Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Plain talk, not promises, wins with the IRS. Solid documentation, consistent compliance, and an offer that matches your true ability to pay are what move an OIC forward.

Key Takeaways

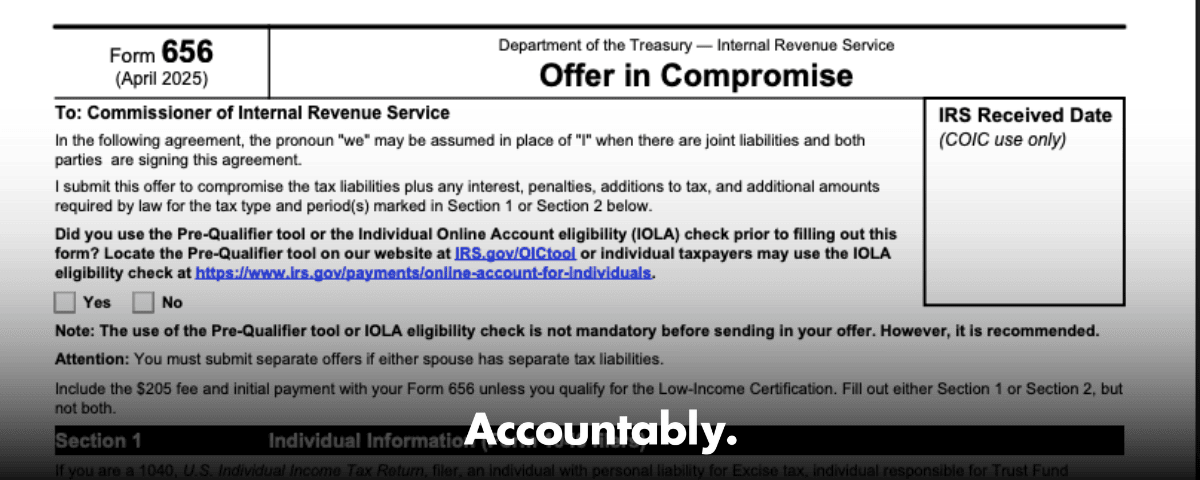

- Form 656 is the official application for an Offer in Compromise. You include Form 433‑A(OIC) or 433‑B(OIC), a $205 fee, and an initial payment unless you qualify for Low‑Income Certification, which waives both and pauses required monthly payments during review.

- Eligibility, you must have all required returns filed, be out of bankruptcy, and, if you have employees, have made current and the past two quarters of federal tax deposits before you apply.

- Two bases, Doubt as to Collectibility when your reasonable collection potential is less than the debt, or Effective Tax Administration for exceptional hardship cases even when you appear able to pay.

- Filing, individuals can now use an IRS Online Account to check eligibility, make payments, and file an offer online. Paper filing remains available and the Form 656‑B booklet controls mailing details.

- Reality check, acceptance rates have tightened in recent years, so accuracy and documentation matter.

- After acceptance, you must stay current on filing and paying for five years or the IRS can default the agreement.

Note, details are current as of October 28, 2025. This is general information, not tax or legal advice.

What Is IRS Form 656, And When Should You Use It

Form 656 is the application you submit to propose a settlement for less than the full amount when full collection is unlikely or would cause economic hardship. Your package includes financials on Form 433‑A(OIC) for individuals or 433‑B(OIC) for businesses, plus the $205 fee and an initial payment unless you qualify for Low‑Income Certification. The IRS looks at four pillars, your ability to pay, your income, your necessary living expenses, and your asset equity. In practice, the IRS generally accepts an offer only when it represents the most it could expect to collect in a reasonable period.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- Pick a payment path, Lump Sum Cash requires 20% with the application and up to five remaining payments after acceptance, Periodic Payment requires the first monthly payment with the application and monthly payments during review unless Low‑Income Certification applies.

- Be complete and consistent, if the IRS cannot process your offer, it returns your package and the fee. If it processes and later rejects, the fee stays with the IRS and your payments are applied.

A quick note about “pennies on the dollar” promises

Be cautious with aggressive ads that guarantee outcomes. If you hire help, choose a licensed EA or CPA and expect a real calculation of your reasonable collection potential, not hype. A good practitioner will calculate your numbers, organize workpapers, and protect your compliance timeline.

The Two Main Paths To An OIC

You generally file Form 656 under one of two bases.

Doubt As To Collectibility, the math must support your offer

Use this when your total of realizable asset equity plus projected disposable income is less than the tax you owe. The IRS will compare your offer to this reasonable collection potential and usually accepts only if your offer meets or exceeds that number. Include full 433‑A/B(OIC) support, bank statements, pay stubs, loan statements, and proof for any expenses above national or local standards.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call| Requirement | What the IRS expects | Risk if missing |

| Offer amount vs RCP | Offer equals or exceeds your reasonable collection potential | Rejection |

| Form 433‑A/B(OIC) | Complete and consistent with attachments | Return or rejection |

| Fee and initial payment | $205 fee plus 20% or first installment, unless Low‑Income Certification applies | Return |

| Filing compliance | All required returns filed and current‑year estimates paid | Return or rejection |

Source, use the current IRS Form 656‑B booklet and OIC instructions.

Effective Tax Administration, when full payment would create real hardship

If your numbers suggest you could pay but full collection would jeopardize basic living needs or be inequitable, you can request an offer on Effective Tax Administration grounds. Write a clear hardship statement and attach proof such as medical bills or caregiver documentation. Review is discretionary, so documentation quality is critical.

Eligibility, Pre‑Qualification, And Staying Compliant

Confirm you meet the baseline rules before you apply. You must have filed all required returns, made current estimated payments, not be in open bankruptcy, and, if you are an employer, have made federal tax deposits for the current and past two quarters. That compliance check happens early, and the IRS returns ineligible packages without a decision. Use the Offer in Compromise Pre‑Qualifier to screen your situation, then build your offer with the Form 656‑B booklet.

Individuals can now use an IRS Online Account to check eligibility, make payments, and file an OIC online, which streamlines submission and tracking. Paper filing is still allowed, and the booklet controls addresses and instructions.

- If you have an open audit, an innocent spouse claim, or another special circumstance, consider professional help before you file.

- If you are asserting hardship, craft a concise, fact‑driven narrative and support it with documents.

Acceptance has tightened

If you have seen older acceptance rates near one third, adjust your expectations. Build a reality‑based offer with clean workpapers. From experience, inconsistent financials slow cases the most. If your bank statements do not match the budget on Form 433, expect questions and potential disallowance of expenses above standard amounts unless you justify them. A labeled, indexed workpaper set makes a reviewer’s job easier.

Fees, Low‑Income Certification, And Initial Payments

Most applicants include a $205 nonrefundable application fee and an initial payment for each Form 656. If you meet the Low‑Income Certification guidelines, you do not send the fee or the initial payment, and you do not make monthly payments during review. The latest Form 656‑B explains the thresholds and documentation.

If the IRS cannot process your offer, it returns your package and the fee, and it applies any payment you sent to your balance. If the IRS processes and later rejects your offer, it keeps the fee and your initial payments are applied, not refunded.

Choosing the right payment option

| Option | What you send with Form 656 | How you pay the rest | Practical notes |

| Lump Sum Cash | 20% of your total offer | Up to 5 remaining payments after acceptance | Faster finish if accepted, 20% is nonrefundable unless the offer is returned as not processable. |

| Periodic Payment | First monthly installment | Keep paying monthly during review unless Low‑Income Certification applies | Missing a required monthly payment can trigger a return without appeal rights, payments already sent are applied. |

Tip, use separate checks or money orders for the fee and the initial payment, label them, and keep copies. If you pay electronically, select the specific OIC options so payments are applied correctly, Offer in Compromise or Offer in Compromise, Subsequent Periodic Payment.

Completing The Form 656 Package, Sections 1–4

Treat Form 656 as the contract cover sheet and 433‑A/B(OIC) as the engine behind it. Move through Sections 1–4 carefully and align every number to documentation.

- Section 1, list your legal name, SSN, mailing address, and every tax period included. Check Low‑Income Certification if you qualify.

- Section 2, business filers add entity details, individuals skip.

- Section 3, choose Doubt as to Collectibility or Effective Tax Administration. Attach a short explanation and include any hardship statement.

- Section 4, choose Lump Sum Cash or Periodic Payment. Remember, periodic offers require monthly payments during review unless Low‑Income Certification applies.

Sections 5–9, payments, sources, terms, and signatures

- Designate your fee and initial payment correctly. List each source of funds and attach proof, for example bank statements, sale contracts, or loan approvals.

- Read the binding offer terms, including the five‑year stay‑current requirement after acceptance.

- Sign and date everywhere required, and match names and taxpayer IDs across forms.

Quick quality check, reconcile totals on Form 656 to your 433‑A/B(OIC), label PDFs clearly, and use a simple index. That makes a reviewer’s job easier and can shorten requests for more information.

How To File, Online Or By Mail, And Where It Goes

Filing routes have expanded, which created some confusion. Here is the current, practical approach.

- Individuals can use an IRS Online Account to check eligibility, make payments, and file the offer online. This is the simplest path for many taxpayers.

- Paper filing is still allowed. The Form 656‑B booklet controls the mailing addresses and the state assignment between the two Centralized Offer in Compromise, COIC, sites. The IRS has referenced designated email submission in prior guidance, while newer internal guidance emphasizes Online Account for electronic submissions and uses street addresses for overnight mail. Always follow the latest booklet on your filing day.

If you must overnight a paper package, the Internal Revenue Manual lists street addresses for the COIC sites. Confirm current addresses in the latest Form 656‑B before you ship to avoid delays.

Where to send periodic payments during review

If you filed a periodic payment offer, the IRS sends Form 656‑PPV, a payment voucher, and directs payments to the site that is handling your case. You can also pay through EFTPS, Direct Pay, or an IRS Online Account using the specific Offer in Compromise options so funds post correctly.

What To Expect After Submission

Most offers are logged within weeks. Then a specialist compares your forms and documentation to expense standards and asset values.

- If the IRS cannot process the offer, for example because of a missing signature, it returns your package with the fee and applies any initial payment to your balance.

- If the IRS processes the offer and later rejects it, the fee stays with the IRS and initial payments are applied.

- If your offer is accepted, you must complete the payment plan and stay current on filing and paying for five years. The IRS releases liens after you satisfy the offer terms.

While your offer is under consideration, the IRS can file or maintain a federal tax lien, suspend other enforced collection, and extend collection timeframes. If the IRS does not make a determination within two years of the receipt date, the offer is accepted by operation of law. Appeal time does not count toward the two years.

Accepted, rejected, or returned, what each means

- Accepted, you complete payments and stay current for five years. Monitoring applies to most accepted offers, Doubt as to Liability offers are handled differently.

- Rejected, you can appeal within 30 days using Form 13711. Review the Income and Expense and Asset and Equity tables that came with the rejection to target issues.

- Returned, usually for ineligibility or missing information. Fix the issue and resubmit. If you miss a required monthly payment on a periodic offer during review, the IRS can return it without appeal rights.

Practical timing, a well documented offer takes months, not weeks. Build a payment plan that assumes follow up document requests and stay responsive.

Common Pitfalls And How To Avoid Them

- Expenses above national or local standards without proof, expect those to be trimmed. Attach receipts and a short reason for each exception you need.

- Unclear asset equity, show current value and payoff on vehicles or real estate, and explain any negative equity.

- Missing compliance, unfiled returns or missing current year estimates often trigger a return letter.

- Wrong payment labels, if you pay online, use the Offer in Compromise options so funds post to the right place.

Step‑By‑Step, Building A Strong OIC Package

Here is a simple framework you can follow, and for firm readers, it doubles as a staff checklist.

- Confirm eligibility Make sure all required returns are filed, your current estimated payments are made, you are not in bankruptcy, and, for employers, your last two quarters of federal tax deposits are current.

- Map your numbers Draft Form 433‑A/B(OIC) and reconcile every total to bank statements, pay stubs, and loan statements. Flag any expenses above the standards and gather proof now.

- Choose your offer type and amount Calculate your reasonable collection potential and set an offer at or above that figure for collectibility cases. Pick Lump Sum Cash, 20% down with up to five payments if accepted, or Periodic Payment, first installment with the offer and monthly payments during review unless Low‑Income Certification applies.

- Complete Form 656 Fill Sections 1–9 carefully. Use separate instruments for the $205 fee and the initial payment unless Low‑Income Certification applies. If filing online through your IRS Online Account, upload clean, labeled PDFs.

- Assemble exhibits Create a simple index, include identification, bank and investment statements, pay stubs, property records, loan statements, vehicle values, and any hardship proof.

- Submit and track File online for individual cases when possible, or follow the Form 656‑B booklet for mailing. For overnight, use the latest street addresses in the IRS guidance and keep tracking records.

For firm readers, a quick process control note

If your firm handles OIC work, disciplined workpapers and layered review cut rework and speed approvals. Standard operating procedures for 433 documentation, payment labeling, and a two layer review checklist protect quality and partner time. When you are ready to scale compliance capacity without chaos, Accountably can plug trained offshore staff into your workflow inside your systems, with SOPs, review protection, and clear SLAs. Use this to stabilize delivery and keep deadlines, not as a shortcut for judgment.

Special Situations You Should Know

- Doubt as to Liability uses Form 656‑L, not the standard Form 656, and follows different procedures, including no TIPRA payments with the application.

- Public inspection files, for one year after acceptance the IRS keeps a limited public record of accepted offers, Form 7249, which you can request if needed.

- Lien releases occur after you satisfy offer terms, and timing can vary by how you pay. Watch your acceptance letter instructions closely.

People Also Ask, Quick Answers

What is IRS Form 656

It is the application for an Offer in Compromise to settle your federal tax debt for less than the full amount when full collection is unlikely or would cause hardship. You include 433‑A/B(OIC), pay the $205 fee and an initial payment unless Low‑Income Certification applies, and then you wait for a written decision.

Who qualifies for “Fresh Start” options

“Fresh Start” covers several tools. For OIC, you must be compliant, not in bankruptcy, and your offer must reflect your true ability to pay. Many installment plans can be set up online. Check the latest IRS guidance before you choose a path.

How much is the Form 656 fee

The application fee is $205. Low‑Income Certification can waive both the fee and the initial payment.

Can I combine personal and business debts in one submission

You can send one package, but you must include separate Forms 656 for individual and business liabilities. Follow the booklet instructions for combined submissions.

If You Do Not Qualify, Practical Alternatives

- Installment Agreement, set a monthly payment that fits your cash flow and keep penalties and interest from snowballing, many plans can be set up online.

- Currently Not Collectible, if you cannot pay anything now and your situation meets hardship criteria, CNC status pauses enforced collection.

- Effective Tax Administration OIC, if full payment creates genuine hardship even though you appear able to pay, consider ETA with strong documentation.

- Appeal a rejection, you have 30 days to appeal with Form 13711, and you should review the tables included with the rejection to target disagreements.

If you feel stuck, the Taxpayer Advocate Service can help with delays or hardship. They do not file an OIC for you, but they can help you move a stalled process.

What‑How‑Wow, Make Your Offer Stand Out

- What, your goal is an enforceable settlement that reflects your true ability to pay.

- How, build a clean 433‑A/B(OIC), match every line to a document, choose the right payment option, and set an offer that aligns with your reasonable collection potential.

- Wow, include a one page summary that ties documents to your offer amount and explains any exceptions to national standards in plain language. Reviewers are human, clarity helps.

A short story to close

A single member LLC owner came to us after two rejections. The issue was not eligibility, it was structure. We rebuilt the 433‑A, tied every bank line to the budget, trimmed non‑allowable expenses, and changed to a periodic plan that fit cash flow. The offer was accepted months later. Same taxpayer, same facts, better execution.

Final Checklist Before You Submit

- All required returns filed and current estimates paid

- 433‑A/B(OIC) totals match your attachments

- Offer amount equals or exceeds your RCP, or your hardship statement is specific and documented

- Separate instruments for the $205 fee and the initial payment, unless Low‑Income Certification applies

- Correct submission channel, Online Account for individuals, or mail using the most current Form 656‑B booklet rules, with street addresses for overnight if needed

- Clear index, labeled PDFs, and every required signature in place

Light‑Touch Help For Firms

If you run an accounting firm, delivery is everything. Standardized workpapers and layered reviews cut rework and reduce partner time in review. When you are ready to scale compliance work like OICs without losing control, Accountably can integrate trained offshore teams into your workflow, inside your systems and templates, with SOPs, review protection, and clear SLAs. Use this to stabilize output and meet deadlines with confidence.

Sources, Freshness, And A Simple CTA

This guide reflects IRS rules and forms as of October 28, 2025. Always confirm addresses, submission methods, and thresholds in the latest Form 656‑B booklet before you file, because the IRS updates processes periodically.

- If you are a taxpayer, gather bank statements, pay stubs, and a list of necessary expenses, then use your IRS Online Account to check eligibility and consider filing online.

- If you lead a firm and want to standardize OIC delivery without burning out reviewers, reach out to discuss disciplined capacity that protects quality and turnaround.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk