Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Once we filed a complete Form 706‑NA with clean valuations and a short treaty note, the process moved again. If you are staring at a frozen U.S. brokerage account or a transfer agent that will not budge, you are not alone, and there is a path through it.

Your job is to prove what the estate owns in the United States, show how you valued it, file on time, and attach any treaty statement so custodians can release assets after IRS review.

Key Takeaways

- Form 706‑NA is the U.S. estate and GST tax return for a nonresident, noncitizen who owned U.S.‑situated assets.

- You must file when U.S.‑situs assets, plus adjusted taxable gifts and any 1976 specific exemption, total at least 60,000 at the date of death.

- The return is due 9 months after death. File Form 4768 by that date to get an automatic 6‑month filing extension, time to file only, not time to pay.

- Many transfer agents will not release U.S. securities until IRS clearance is issued, often after the Service reviews the 706‑NA and confirms tax is paid or provided for.

- If you claim treaty relief, attach a clear treaty statement that cites the article and explains how it applies.

- Mail 706‑NA to IRS, Kansas City, MO 64999, or use the IRS‑approved Private Delivery Service street address in Kansas City. Keep delivery proof.

- Estate Tax Closing Letter requests are made through Pay.gov. As of May 21, 2025, the user fee is 56. The IRS asks you to wait about 9 months after filing before you request it.

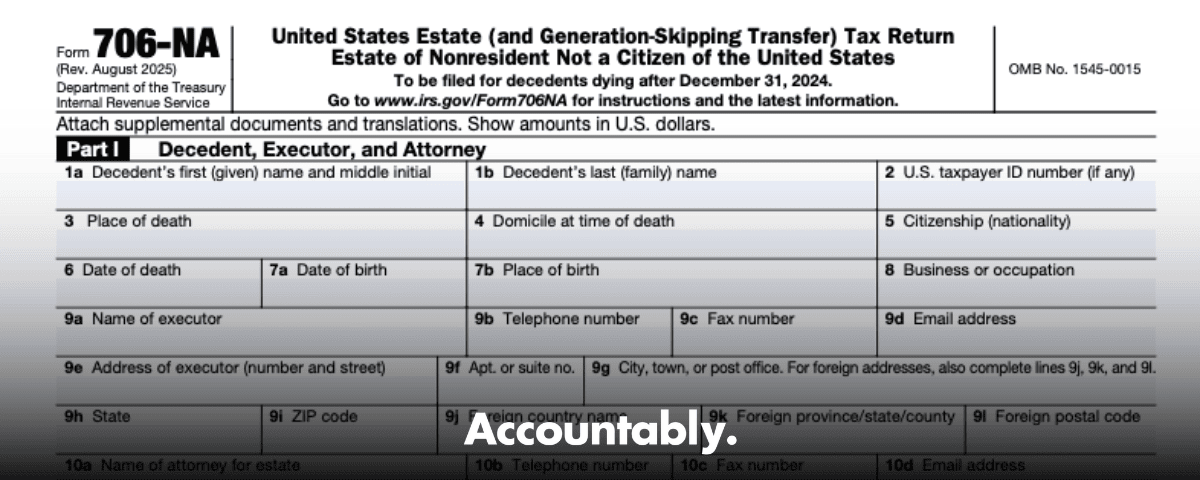

What Form 706‑NA Is And Why It Matters

Form 706‑NA is the federal estate and generation‑skipping transfer tax return for a decedent who was neither a U.S. citizen nor domiciled in the United States. You use it to compute any U.S. estate or GST tax on U.S.‑situated property. If the combined date‑of‑death value of those U.S.‑situs assets, plus required gift adjustments, reaches 60,000, the executor must file.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

It matters for two reasons. First, it determines whether U.S. estate tax is due and documents deductions, credits, and treaty positions. Second, it unlocks administration. Many U.S. transfer agents will not retitle or release securities until the IRS finishes its review and, when needed, issues a federal transfer certificate. Filing a complete, organized 706‑NA starts that process and prevents months of back‑and‑forth.

How This Guide Helps You

You will get a practical map for each step, threshold testing, residency and domicile checks, what counts as U.S.‑situs property, how to value and document it, what deductions you can claim, how to handle treaty relief, and how to plan for deadlines, penalties, and clearance. If you are an executor, you will learn how to move assets while you wait. If you are a CPA or private client attorney, you will find a repeatable workflow you can standardize.

Think order, not speed. List assets, support values, disclose treaty facts, file on time, and keep calm while the IRS reviews your return.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhat “Nonresident, Noncitizen” Means For Estate Tax

Estate‑tax residency is not the income‑tax day‑count test you may know. It turns on domicile, a permanent home and intent to remain. A person can spend long periods in the United States and still be domiciled elsewhere if the facts point to a home outside the country. Evidence can include housing, visa status, where family lives, business ties, community affiliations, voter registration, driver’s license, and even statements in a will.

If the decedent was a nonresident, noncitizen at death and the filing threshold is met, the executor files 706‑NA, not the resident Form 706. If you plan to use a treaty article that narrows U.S. taxing rights or expands credits, you still file 706‑NA and attach a treaty statement.

The 60,000 Filing Trigger

The filing trigger is precise. Add the date‑of‑death value of all U.S.‑situated assets to adjusted taxable gifts and any 1976 specific exemption. If the total is 60,000 or more, you must file. Even if no tax is ultimately due after deductions or treaty relief, filing supports clearance with transfer agents and gives you a clean paper trail for the estate.

Common edge case, the estate holds less than 60,000 in U.S. assets but crosses the threshold once prior U.S.‑situs gifts are added. Build a one‑page threshold worksheet that shows your math and references the documents behind each number. It will save time later and gives reviewers immediate context.

What Counts As U.S.‑Situated Property

When you build the gross U.S. estate, focus on situs rules that the Form 706‑NA instructions lay out.

-

U.S. real property

-

-

- Land and buildings in the United States, valued at the date of death, or the 6‑month alternate valuation date if elected.

-

-

Tangible personal property located in the U.S.

-

-

- Artwork, jewelry, vehicles, furnishings, and similar items physically in the United States at death.

-

-

Stock and certain securities of U.S. corporations

-

-

- Treated as U.S.‑situs regardless of where certificates or the account sit. Custodians sometimes hold certificates abroad, the situs rule still points to the issuer.

-

-

U.S. debt obligations

-

- Bonds and notes of U.S. persons and entities, with narrow exceptions defined in guidance.

Three habits keep you safe. Document situs clearly, inventory everything before you set values, and tie each value to appraisals, market data, or statements that will stand up in review.

Valuation, Deductions, Credits, And The Unified Credit

Start with values. Use the date of death or elect the alternate valuation date if it reduces both the gross estate and the estate tax. Keep appraisal reports for real estate and closely held assets, and keep full broker statements for marketable securities. If there is a dispute, aim for support you would be comfortable defending in an audit, comparable sales, methodology, assumptions, and signatures.

Then apply deductions. On 706‑NA you generally use Form 706 schedules to document allowable deductions, and some amounts are prorated to the U.S. fraction. Typical deductions include,

- Funeral and administration expenses, professional fees, court costs, and necessary compliance costs.

- Enforceable debts and mortgages.

- Losses during administration that meet the rules.

- Qualified charitable transfers, with care if foreign charities are involved.

Marital deduction, this is narrow. For a noncitizen surviving spouse, the standard marital deduction is unavailable unless the assets pass to a qualified domestic trust, a QDOT, or a treaty provides relief. Confirm the QDOT trustee, corpus rules, and election timing before you promise a result.

Unified credit, for nonresident decedents the credit is limited compared to U.S. residents. You compute tentative tax using the unified rate schedule for the decedent’s year of death, then apply the nonresident unified credit, generally 13,000, subject to special rules and treaties. The unified rate schedule’s top marginal rate is 40 percent.

Basis consistency, some estates must file Form 8971 to report values to beneficiaries soon after filing the estate tax return. Check whether Form 8971 applies and calendar the 30‑day window so you are not scrambling later.

Work in this order, confirm U.S. assets, pick your valuation date and back it with evidence, then claim only deductions you can prove.

Treaties, When And How To Claim Relief

Estate tax treaties can reduce double taxation, raise a credit, or limit U.S. taxation to U.S.‑situs property. If you rely on a treaty article, disclose it. Attach a simple treaty statement that,

- Cites the treaty, the article, and the date of entry into force that matches the facts.

- Explains the decedent’s domicile and why that treaty covers the estate.

- Shows how the article applies to the assets you reported.

Include residency certificates, foreign registrations, and translations if needed. Treaties are powerful, but only when they are documented. No statement, no relief.

What Executors Must Do In Week One

- Get a certified death certificate, plus court letters that show your authority.

- Freeze the list, inventory U.S.‑situs assets and their likely values.

- Calendar the 9‑month due date, create a 4768 reminder 30 days before, and set monthly check‑ins.

- Start valuation orders early, appraisers and brokers get busy.

- Notify custodians and transfer agents that a 706‑NA filing is coming, ask for their document list now so there are no surprises later.

The earlier you start valuation and custodian outreach, the more control you have over deadlines and cash flow.

Deadlines, Extensions, And Payment Strategy

You must file within 9 months of the date of death. If the return will not be ready, submit Form 4768 by the original due date to secure an automatic 6‑month filing extension. That extension covers the time to file only. Interest on any unpaid estate tax runs from the original 9‑month due date. If you expect tax, include a payment with Form 4768 to control interest.

Extra time to file or to pay

- Filing time, automatic 6 months with Form 4768 filed by the original due date.

- Executor out of the country, you may request additional filing time on 4768 with an explanation.

- Time to pay, separate and discretionary, request under section 6161 on 4768, explain why, and be ready for security or a bond if asked.

Simple payment plan for executors

- Forecast cash needs and sources, U.S. accounts may be frozen during clearance, so look to non‑U.S. cash first.

- If tax is likely, overpay a bit with the extension to reduce interest, then true‑up with the final return.

- Keep proof of payments with your file, screenshots and bank confirmations included.

Penalties, Interest, And Reasonable Cause

Penalties and interest add up quickly if you miss the original due date and tax is due.

- Late filing and late payment penalties generally apply from the original 9‑month due date.

- Accuracy‑related penalties can apply to substantial valuation understatements.

- Civil fraud penalties apply only in willful cases, avoid them by staying honest and complete.

If events outside your control caused a delay, request penalty abatement for reasonable cause. Write a short, factual statement, add documents, and show that you acted promptly once you could.

Protect the estate’s value. Meet the 9‑month date, pay what you reasonably estimate, and document every judgment call.

Step‑By‑Step Filing Process

Step 1, confirm the filing trigger

- Build a threshold worksheet, total U.S.‑situs assets at date‑of‑death values, add adjusted taxable gifts and the 1976 specific exemption, and note the 60,000 result.

Step 2, assemble your evidence

- Authority, certified death certificate, foreign passport or ID, court letters.

- Assets, appraisals for real estate and closely held interests, broker statements for securities, inventories for tangibles.

- Deductions, invoices, contracts, receipts, proofs of payment.

- Gifts, prior U.S. gift returns and credit use.

- Treaty, a one‑page statement with domicile evidence if you rely on a treaty.

Step 3, draft, sign, and file

- Use the 706‑NA edition that matches the date of death.

- Attach the relevant Form 706 schedules the 706‑NA instructions require.

- Sign, keep a full copy, and mail by the deadline, or file 4768 on time if you need more runway.

Step 4, pay and track

- Pay any expected tax by the 9‑month date to avoid extra interest.

- Keep delivery tracking and payment confirmations.

- Create a simple status log with dates, who you spoke with, and what was sent.

Required Documents, A Handy Table

| Document | Why it matters | Good evidence looks like |

| Death certificate and court letters | Proves authority to act | Certified copy, clear court seal |

| Asset proof and values | Supports the gross estate | Appraisals, full broker statements, inventories with photos |

| Deduction support | Lowers tax legally | Invoices, receipts, contracts, proof of payment |

| Gift records | Adjusted taxable gifts and credits | Prior 709 filings, schedules, payment proofs |

| Treaty statement | Secures treaty relief | One page citing article, plus residency and domicile evidence |

Transfer Certificates, Form 5173, And Clearance

Most transfer agents will not release or retitle U.S. securities until the IRS confirms that estate tax is paid, provided for, or not due. That confirmation is the federal transfer certificate, frequently referred to as Form 5173 in practice. You usually start this process after you file 706‑NA, since the IRS needs the return on record before it can review clearance.

A simple clearance timeline

- File 706‑NA, clean and complete, within 9 months, or extend and then file.

- Pay any tax or provide for it to the IRS’s satisfaction.

- After a reasonable processing period, request an Estate Tax Closing Letter through Pay.gov to evidence progress.

- When eligible, ask the IRS to issue the transfer certificate so the transfer agent can release the shares.

What slows clearance

- Missing or thin valuations, fix with full appraisals and complete statements.

- Omitted treaty statements, if you rely on a treaty, put it in writing.

- Wrong form year or missing schedules, always use the edition that matches the date of death.

- Unapplied or suspense‑posted payments, keep proof and follow up until the IRS credits the account correctly.

Handling U.S. Financial Assets During The Wait

Expect a holding pattern once you file. Many agents will not move U.S. securities until the IRS issues a transfer certificate or a closing letter. That can limit estate liquidity.

| Action | Detail |

| Notify transfer agents | Send letters of administration, certified death certificate, and a copy of the filed 706‑NA to each custodian. |

| Monitor status | Calendar 60 to 90 day check‑ins, keep a contact log with names, dates, and outcomes. |

| Stabilize assets | Confirm dividend handling, corporate actions, and address changes so nothing goes missing. |

| Plan cash | Cover expenses from non‑U.S. accounts when possible so you are not forced to sell blocked U.S. assets. |

If you keep transfer agents in the loop and maintain a tidy log, you avoid inactivity and reduce the risk of escheat or missed corporate actions.

Special Notes On Canadian‑Held U.S. Shares And Medallion Guarantees

Many Canadian estates hold U.S. shares that also require a medallion signature guarantee. That small green stamp carries big weight, it confirms identity and authority, and the guarantor accepts liability if the signature is invalid. It is separate from IRS clearance.

Medallion basics

- Call ahead, not every bank or broker stamps, and many only stamp for clients.

- Bring government ID, a certified death certificate, court letters, and the agent’s transfer forms.

- Ask what “level” of stamp is required, stamp limits can block high‑value transfers.

- Run medallion steps in parallel with IRS steps to avoid months of delay.

Canadian transfer flow, a quick table

| Step | Responsible party | Key check |

| Inventory U.S.‑situs shares | Executor | Confirm situs and date‑of‑death values |

| File 706‑NA and pay or provide for tax | Executor | Correct schedules, signatures, and attachments |

| Seek clearance | IRS | ETCL request timing and, when eligible, transfer certificate |

| Transfer shares | Transfer agent | Medallion accepted, forms complete, no gaps |

Common pitfalls

- Waiting on the medallion until after clearance, start both tracks together.

- Inconsistent values, fix with appraisals that a reviewer will accept.

- Missing treaty statements, attach the article you rely on with a one‑page explanation.

Where To File, Private Delivery Service Options, And Fees

Mail Form 706‑NA to, Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999. If you use an IRS‑designated Private Delivery Service, send it to the street address, Internal Revenue Submission Processing Center, 333 W. Pershing, Kansas City, MO 64108. Always confirm the current address in the form instructions before you ship, rules change. Keep a full copy of what you mailed and delivery tracking in your file.

Estate Tax Closing Letters are requested through Pay.gov. As of May 21, 2025, the ETCL user fee is 56. The IRS asks you to wait about 9 months after filing before requesting a closing letter or transcript so the return is in the system.

Quick mailing checklist, correct‑year form, correct address, delivery tracking, payment proof, and a calendar reminder for the ETCL window.

Practical Tips, Common Pitfalls, And Best Practices

- Build a threshold worksheet on day one. Add U.S.‑situs assets at date‑of‑death values, then add adjusted taxable gifts and the 1976 specific exemption. You will know, in writing, whether you must file.

- Use the 706‑NA edition that matches the date of death. Attachment lists, addresses, and small rules can change year to year.

- Disclose treaty positions. A one‑page statement that cites the article and explains how it applies is usually enough. Keep residency and domicile proofs handy.

- Control the calendar. File within 9 months, or extend with Form 4768 by the original date, and pay what you reasonably estimate to limit interest.

- Plan clearance early. Read the transfer agent’s document list now, not later, and set 60 to 90 day check‑ins so nothing goes cold.

- Keep basis consistent. If Form 8971 applies, calendar the 30‑day window and send beneficiary statements on time.

- Document every dollar. Clean workpapers cut review time and reduce questions.

For CPA, EA, And Private Client Teams

If your firm handles 706‑NA cases during peak season, you know the common bottlenecks, threshold worksheets are missing, valuations trickle in late, and treaty statements get rushed. Some firms add disciplined offshore execution to keep production steady without giving up control. When used well, you get SOP‑driven workpapers, layered reviews that protect partners’ time, and predictable turnaround. Accountably offers that kind of U.S.‑led offshore support to stabilize compliance work, mentioned here only as a practical option if you need capacity without chaos.

FAQs

What is Form 706‑NA

It is the U.S. estate and GST tax return for a nonresident, noncitizen decedent with U.S.‑situs assets. You file when those assets, plus adjusted taxable gifts and any 1976 specific exemption, reach 60,000, even if tax later nets to zero after deductions or treaty relief.

When is Form 706‑NA due, and can I extend

It is due 9 months after the date of death. File Form 4768 by the original due date to obtain an automatic 6‑month extension to file. The extension does not extend time to pay, so include a payment if tax is likely.

What is the top estate tax rate, and how does the nonresident credit work

You compute tax using the unified rate schedule for the decedent’s year of death. The top marginal rate is 40 percent. The nonresident unified credit is generally 13,000, unless modified by treaty or special rules for certain territories.

How long does IRS clearance take

The IRS asks you to wait about 9 months after filing before requesting an Estate Tax Closing Letter. Transfer certificates often arrive after the Service completes review and confirms tax is paid or provided for. Timelines extend if the return is examined or documents are incomplete.

A Simple, Repeatable Playbook

Use this playbook to keep control, even when emotions run high.

- Threshold first, list U.S.‑situs assets and values, add adjusted taxable gifts and the 1976 specific exemption, and test 60,000.

- Valuation next, order appraisals and pull complete statements early, then pick the valuation date that fits.

- Deductions with proof, only claim what you can show with invoices, contracts, and receipts.

- Treaty if helpful, attach a one‑page statement that cites the article and explains how it applies.

- File clean, use the correct 706‑NA edition, sign, make payment if tax is due, and keep delivery proofs.

- Plan clearance, keep transfer agents updated, log every contact, and schedule your ETCL request through Pay.gov at the right time.

Do the simple things well, clarity beats speed, and steady follow‑through beats last‑minute sprints.

Conclusion

You now have a clear route through Form 706‑NA. Decide if the 60,000 trigger applies, confirm nonresident status, build a complete U.S.‑situs inventory with defensible values, and file on time. If you need more time to file, use Form 4768 by the original deadline, and include a good‑faith payment if tax is likely. While you wait for IRS review, keep transfer agents in the loop and keep a tidy log so nothing stalls.

If you are a practice leader, standardize this process. A simple pack, threshold worksheet, valuation evidence folder, treaty memo, filing checklist, and clearance tracker, will turn one‑off stress into a predictable workflow your team can run in season and out.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk