Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

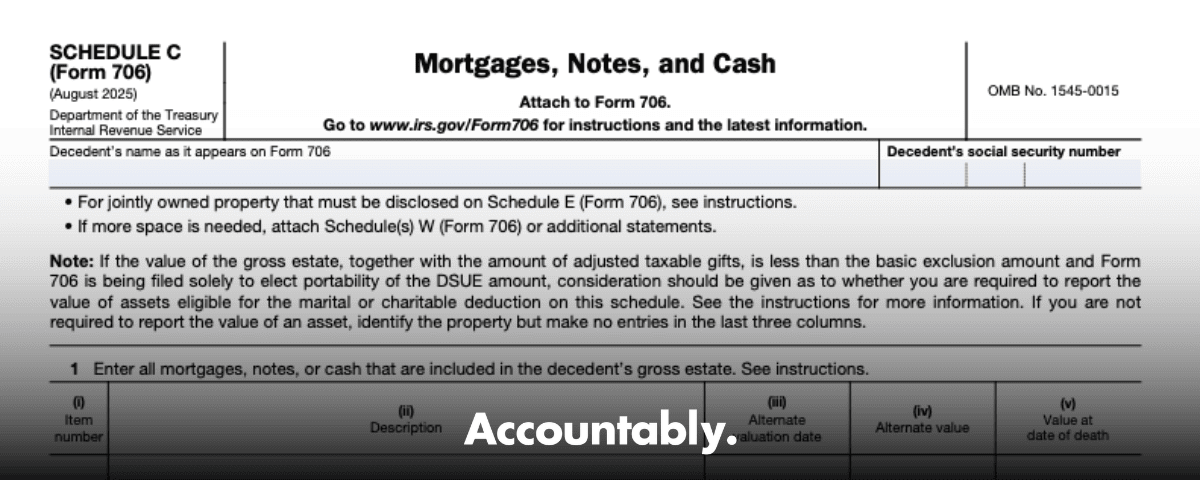

You will use Form 706 Schedule C to report receivables owed to the decedent, think mortgages, promissory notes, land‑sale contracts, plus cash and bank balances as of the date of death. Schedule C does not record the decedent’s debts. It captures what others owed the decedent and the cash the decedent held.

That clarity matters because these items drive liquidity, valuation, and, in many estates, the timeline for distributions. The IRS instructions confirm that Schedule C includes mortgages, notes payable to the decedent, and cash on hand or in financial organizations.

Key Takeaways

- Schedule C reports receivables owed to the decedent and cash, not the decedent’s liabilities. List mortgages and notes payable to the decedent and cash on hand or in banks.

- For each note or mortgage, capture face value, unpaid principal at death, instrument and maturity dates, maker, property securing the debt, interest rate, and the interest accrual date. Include interest accrued through the date of death.

- For land‑sale contracts, include purchaser, contract date, property description, total price, down payment, installments, interest terms, and unpaid principal at death.

- Cash in possession is a single line. Bank and similar accounts are itemized by institution, account number, account type, date‑of‑death balance, and accrued interest to death. Keep the bank statements for inspection.

- File Form 706 within 9 months of death. If you need time, apply for a 6‑month extension using Form 4768 by the original due date. Portability elections also hinge on timely filing or a specific relief procedure.

What Schedule C Covers, In Plain English

Schedule C tells the story of money owed to the decedent and the cash that was theirs at death.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

You will list, one by one, the receivables where someone else promised to pay the decedent. That includes traditional mortgages the decedent held, personal or business notes, and any installment contract to sell land. Then you will report cash, both physical cash and balances held in checking, savings, and time deposits. The IRS instructions explicitly call for these categories and explain the level of detail expected on the schedule.

A quick caution about portability-only filings

If you are filing a 706 only to elect portability for a surviving spouse, the regulations allow a special rule. For certain property eligible for the marital or charitable deduction, you estimate values and do not enter amounts in the last three columns of the underlying schedules, including Schedule C, then you carry a table amount on the Recapitulation. The instructions reference Regulations section 20.2010‑2(a)(7)(ii) and tell you exactly how to handle those estimates. Keep this in mind so you do not overbuild support you do not need.

When You Must File and How Deadlines Really Work

Here is the timing, stated simply. You file Form 706 within 9 months after the date of death. If you need more time to prepare the return, you can request an automatic 6‑month filing extension by submitting Form 4768 by that original 9‑month deadline. The 4768 instructions also discuss a later “for cause” extension if you missed the automatic window, and they list where to mail the extension request. Remember, an extension to file does not extend time to pay.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallPortability deserves a special note. To transfer the DSUE amount to a surviving spouse, the executor must file a timely Form 706, within 9 months or, if extended, within the 6‑month extension. If no filing was required and you missed that window, Rev. Proc. 2022‑32 gives many estates up to the fifth anniversary of death to file solely to elect portability, with a clear statement at the top of the return. The 2025 instructions restate this relief.

What You Will Need Before You Start

- Copies of every note, mortgage, and land‑sale contract that was outstanding at death.

- Current payoff or account statements from makers and servicers, plus any default or modification notices.

- For bank and brokerage cash, written confirmations showing the date‑of‑death balance and unpaid interest through that date. The IRS tells you to keep these statements for inspection.

- A simple reconciliation for checking accounts to identify outstanding checks at death. This is practitioner best practice to support the real date‑of‑death balance.

- A working list that maps each Schedule C item to other places it appears on the return, so your trail is obvious during review.

A quick word on filing method and addresses

Form 706 is a paper‑filed return. The IRS does not offer e‑file for 706 as of 2025, although it accepts electronic or digital signatures on certain paper‑filed forms, including 706. Original 706 returns are mailed to Kansas City, Missouri, and the instructions list a separate address for private delivery services. If you later file a supplemental or amended return, that goes to the Florence, Kentucky address. Always confirm current addresses on the IRS site before you ship.

How To Build a Clean Schedule C, Step by Step

We will use the What, How, Wow approach. What belongs, how to document it, and a few tips that save hours in review.

Mortgages, notes, and promissory notes payable to the decedent

What to capture for each instrument:

- Face amount and unpaid principal as of death.

- Instrument date and maturity date.

- Maker’s legal name and contact details.

- Property description if the note is secured.

- Interest rate and the date through which interest is accrued on the figure you present.

How to substantiate:

- Attach, or keep ready, the signed note, any recorded security instrument, payoff or borrower statement, and evidence of recent payments.

- Confirm whether the note is current or in default, and note any modifications that change the economics.

- Use the same item label on Schedule C and in your workpapers, so anyone can trace the value in minutes.

Wow tip from the field:

- If you inherit a messy file, rebuild an amortization schedule from the instrument date through the date of death, then tie to the borrower’s statement. You will spot misposted payments or fee add‑ons that do not belong in principal.

Contracts to sell land, what the IRS expects you to show

When you list a land‑sale contract on Schedule C, you are presenting it like a note secured by real property. The IRS instructions call out specific details to include, such as the purchaser’s name, contract date, property description, total price, down payment, installment amounts, unpaid principal at death, and the interest rate.

Practical steps:

- Verify the purchaser’s legal name and the exact contract date from the executed agreement, not a recording date unless the contract says otherwise.

- Tie the property description to the contract, then to any escrow or title statements.

- Reconcile the unpaid principal to the most recent amortization or servicer statement.

- Add accrued interest through the date of death. If interest was past due, make that clear in your notes and flag collectability risk for the reviewer.

Cash in possession versus cash in financial accounts

Keep these buckets separate on the schedule and in your workpapers.

- Cash in possession, report a single line for physical cash held at death. Keep a short memo noting where cash was found and who counted it. The instructions ask you to list cash on hand separately from bank deposits.

- Cash in financial organizations, itemize by institution name and address, account number, type of account, amount in each account, and unpaid interest accrued from the last interest payment to the date of death. Retain the statements.

Best practice for checking accounts:

- Prepare a date‑of‑death bank reconciliation. Start with the bank’s balance at close of business, add deposits in transit, and subtract outstanding checks issued before death. This gives reviewers confidence that the number really reflects what was available at death.

Data Points You Should Not Miss

Required fields by asset type

| Field | Mortgage or Note | Land‑Sale Contract | Cash in Bank | Cash in Possession |

| Face amount | Yes | Contract price | N/A | N/A |

| Unpaid principal at death | Yes | Yes | N/A | Amount counted |

| Instrument or contract date | Yes | Yes | Account opening date optional | N/A |

| Maturity or balloon date | Yes | Yes | CD maturity if relevant | N/A |

| Maker or purchaser name | Yes | Yes | Institution name and address | N/A |

| Property description or collateral | If secured | Yes | N/A | N/A |

| Interest rate and accrual through DOD | Yes | Yes | Accrued interest through DOD | N/A |

| Account number or serial | If applicable | Contract number optional | Yes | N/A |

Note, DOD means date of death.

Documentation Checklist You Can Hand to the Team

- Fully executed notes, mortgages, and land‑sale contracts.

- Servicer or borrower confirmations of principal and accrued interest at death.

- Bank letters or statements showing date‑of‑death balances and accrued interest, kept for IRS inspection per the instructions.

- Amortization schedules that bridge from face to unpaid principal.

- Proof of collateral, such as recorded deeds of trust.

- Reconciliations for checking accounts with outstanding checks listed.

- Any default notices, modifications, or assignments that affect value or collectability.

Sample entry, filled the way reviewers prefer

| Schedule C Line | Asset Description | Maker or Purchaser | Instrument or Contract Date | Maturity | Face Amount | Unpaid Principal at Death | Interest Rate | Accrued Interest to DOD |

| C‑3 | Note receivable, secured by 123 Oak St | L. Carter, individual | 03‑15‑2021 | 03‑15‑2031 | 200,000 | 168,445 | 5.00% simple | 1,112 |

Reviewer notes, collateral recorded 03‑20‑2021, borrower current, no modification. Interest accrual verified with borrower ledger and independent amortization schedule.

Special Rules When Filing Only To Elect Portability

If your only reason to file Form 706 is the DSUE election, the 2025 instructions restate the special rule. You still list the property on the appropriate schedules, including Schedule C, yet you do not enter values in the last three columns for assets that qualify under the rule. You estimate those values and report a table amount on the Part V Recapitulation, Items 10 and 23, exactly as the instructions describe. This saves time and still keeps you compliant.

Quick memory hook, list the asset for traceability, estimate for the Recap, keep the support in your file.

Accountably tip, used sparingly because this is not a sales page, if your firm struggles to gather bank confirmations, interest accruals, and contract details during peak season, a disciplined offshore review lane that follows your SOPs can prep the workpapers and tie‑outs so your seniors focus on conclusions, not chasing statements. Keep ownership of workflow and quality controls inside your firm.

Filing Mechanics, Addresses, Signatures, and Common Pitfalls

Where to file in 2025:

- Original Form 706, mail to Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999. If you use a private delivery service, ship to Internal Revenue Submission Processing Center, 333 W. Pershing Road, Kansas City, MO 64108. The IRS instructions list different addresses for supplemental or amended filings.

- If you need an extension to file, submit Form 4768 by the original due date. The 4768 instructions include the Florence, Kentucky address for extension requests and confirm the automatic 6‑month extension option.

Electronic filing status:

Form 706 is not available for IRS e‑file as of 2025. The IRS explicitly allows electronic or digital signatures on certain paper‑filed forms, including 706, which is a strong indicator that the return itself remains paper only.

Signatures and co‑executors:

If there are co‑executors, it is sufficient for only one to sign the return, a point confirmed in the Internal Revenue Manual that governs IRS processing. Still list all executors on page 1.

Five mistakes we see most often

- Using the wrong date for a land‑sale contract. Use the executed contract date, then cross‑check with payment history for reasonableness.

- Forgetting accrued interest through the date of death on bank accounts, notes, and CDs. The instructions ask for unpaid interest accrued to the date of death.

- Mixing cash in possession with bank balances. Keep a single line for physical cash and itemize each financial account separately.

- Omitting documentation. The IRS tells you to keep statements for inspection. Borrower and bank confirmations save audits.

- Missing the portability timeline. Timely filing is required to transfer DSUE, and there is specific relief if no filing was originally required and you missed the window.

A Simple Workflow You Can Reuse

- Intake, request every note, mortgage, and contract, plus bank letters that show date‑of‑death balances and accrued interest.

- Build tie‑outs, amortization schedules through date of death, and reconciliations for checking.

- Prepare Schedule C with consistent item labels and clear reviewer notes on default status or collectability.

- Quality review, map each Schedule C line to its workpaper and to Part V Recapitulation.

- Finalize and file, confirm addresses and signers, and calendar Form 8971 if your estate needs consistent basis reporting.

FAQs

Who needs to file Form 706?

For decedents who died in 2025, file if the gross estate, plus adjusted taxable gifts and specific exemption, exceeds the filing threshold, or if you are electing DSUE portability. The instructions list the threshold and explain portability basics.

Who needs to complete Schedule C?

Complete Schedule C if the estate includes mortgages or notes payable to the decedent, or any cash the decedent had at death. That includes cash in banks and similar institutions, itemized by account with accrued interest to the date of death.

Can an estate have a Schedule C if there is no tax due?

Yes. Schedule C is part of the asset detail in the gross estate. Even if no estate tax is due, you still report receivables and cash when Form 706 is required, or when you file solely to elect portability under the special rule.

Where do I mail Form 706, and can I e‑file it?

Mail original returns to Kansas City, Missouri, and use the Kansas City Pershing Road address for private delivery services. Form 706 is not available for e‑file as of 2025, though the IRS accepts electronic signatures on certain paper‑filed forms, including 706.

Closing Thoughts

You can work through Schedule C with confidence. List every receivable with exact dates, rates, and unpaid principal. Separate cash in possession from bank accounts and support each account with a date‑of‑death confirmation and interest detail. File on time, use Form 4768 if needed, and document everything so your return stands up to review. The IRS instructions back you up on the what and the how, so your job is to make the file clear and complete.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk