Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Quick clarity before we go any further:

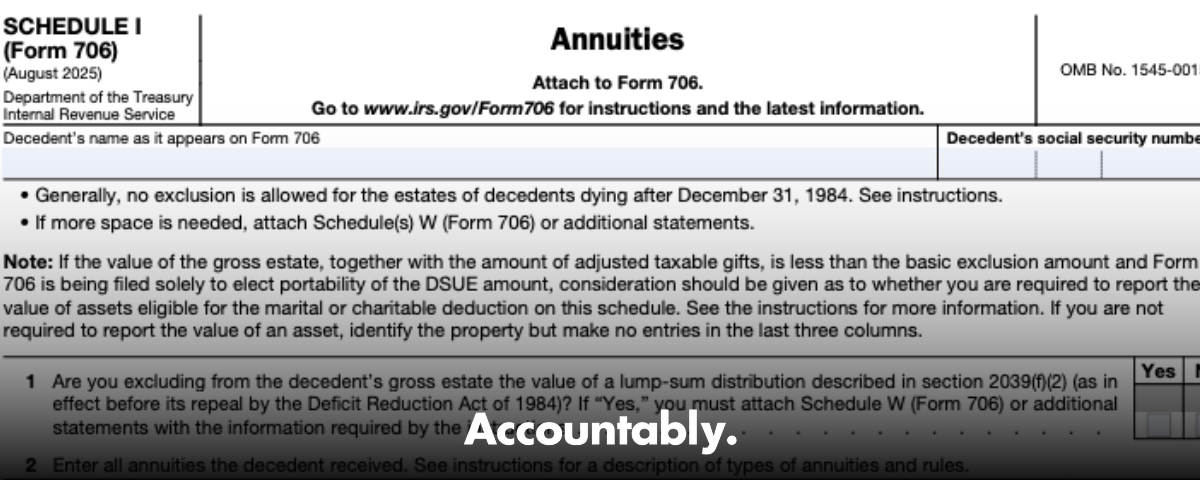

- On Form 706, Schedule I is for annuities that may be includible under IRC section 2039. It is not the GST schedule.

- Generation‑skipping transfer tax at death is reported on Schedule R and Schedule R‑1, not on Schedule I.

This guide gives you a clean, human, field‑tested way to complete Schedule I, then walks you through GST at death on Schedules R and R‑1 so your filing is accurate, defensible, and on time.

Note on compliance and dates

- File Form 706 within 9 months of the date of death, or apply for a 6‑month extension with Form 4768. Interest still runs on unpaid tax.

- For 2025 decedents, the estate and GST basic exclusion amount is 13,990,000 per person. For 2024 decedents, it was 13,610,000. The annual gift exclusion is 19,000 for 2025.

- Portability late election relief now runs to the fifth anniversary of death for estates not otherwise required to file. Use Rev. Proc. 2022‑32 language at the top of the return.

Key takeaways

- Schedule I is about annuities includible in the gross estate. GST at death belongs on Schedule R and R‑1.

- File Form 706 in 9 months, or get a 6‑month extension on filing with Form 4768. Payment due dates do not move without a separate approved extension to pay.

- The 2025 basic exclusion amount is 13,990,000, which also sets the GST exemption for that calendar year under IRC 2631(c).

- If you missed a portability election and the estate had no filing requirement, you can often fix it within five years under Rev. Proc. 2022‑32.

- The GST inclusion ratio is 1 minus the applicable fraction, and GST tax on direct skips at death is computed and reported using Schedules R and R‑1. Top statutory rate is typically 40%.

Pro tip: If a survivor benefit from an annuity on Schedule I goes to a skip person, that transfer can be a direct skip and may trigger reporting on Schedule R‑1 when the payer’s combined tentative maximum direct skips hit the threshold. Keep these schedules talking to each other.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

What Schedule I actually covers

The purpose of Schedule I

Schedule I collects every annuity that may be includible in the decedent’s gross estate. Think employer pensions, IRAs with annuity features, purchased commercial annuities, and private annuities. You include items that are wholly, partially, or not includible, because the IRS wants visibility and support for the inclusion decision.

When an annuity is includible

In general, all or part of an annuity is includible if:

- It pays to someone because they survived the decedent,

- The agreement is post‑March 3, 1931,

- The decedent had the right to receive payments for life or a period tied to death, and

- It is not a life insurance policy.

If the decedent paid only part of the purchase price, you include that proportion of the survivor’s annuity value. Employer contributions tied to employment are treated as if contributed by the decedent for this test.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallSpecial situations you will see

- Approved plans and exclusions, including historic plans such as section 401(a), 403(b), certain IRAs, and older arrangements, have specific exclusion mechanics and a possible 100,000 cap in narrow legacy cases. Read the plan terms and the instructions.

- Social Security benefits do not fall on Schedule I, even if a spouse continues receiving benefits.

- Joint and survivor pensions that benefited the decedent during life often trigger partial inclusion. For QTIP interactions on joint and survivor annuities, cross‑reference Schedule M.

A quick Schedule I checklist

- Pull all employer plan statements, IRA contracts, and annuity policy pages.

- Confirm who receives post‑death payments, the survivor percentage, and payment start dates.

- Document who funded the contract, what portion was employee versus employer, and any employee after‑tax amounts.

- Compute the includible share based on the decedent’s contribution ratio, then tie that value back to Schedules A through I totals.

Where GST at death actually lives

GST at death is a separate exercise from Schedule I. You use Schedule R for direct skips that the estate pays, and Schedule R‑1 when the trustee pays the GST on direct skips from certain trusts, such as marital trusts that are includible in the estate. The instructions walk you through which schedule to use, how to assign generations, and how to value property for GST.

We will dive into GST allocations, inclusion ratios, reverse QTIP elections, and timing on Schedule R and R‑1 in the next section. For now, the key point is simple. Keep annuity inclusion decisions on Schedule I, and compute GST on R or R‑1. Your review notes, your workpapers, and your peace of mind will thank you.

Completing Schedule I with confidence

How to value what is includible

- Start with the survivor benefit that is payable because of death, then apply the decedent’s contribution ratio. If the survivor’s annuity value is 200,000 and the decedent funded 60%, you include 120,000. Keep your actuarial support or provider valuation on file.

- If the annuity is under an approved plan with no decedent contribution, the survivor’s benefit can be excludable within the specific rules, so list it and show why it is out.

Field note: We often prepare a one‑page “Annuity Inclusion Summary” for reviewers. It lists the contract, payer, survivor, decedent contribution percentage, includible value, and where it ties out on the return. That single page cuts review time, and it prevents back‑and‑forth the week before filing.

Documentation to keep ready

- Plan documents, payout elections, beneficiary designations, contribution histories, and any employer confirmations about who funded what portion.

- Valuation statements showing the survivor annuity present value, if provided by the plan or insurer.

- Notes on whether any part is payable to the executor, since that portion is usually includible.

How Schedule I interacts with GST schedules

A survivor annuity that is includible on Schedule I and payable to a skip person can create a direct skip reportable on Schedule R‑1 when the payer’s combined tentative maximum direct skips cross the threshold. This is easy to miss if your annuity team and your GST team sit in different lanes. Build a handoff checklist between the two.

GST at death, the right way on Schedules R and R‑1

The five steps we use on real files

- Identify property includible in the gross estate, since GST at death only applies to property already in the estate. That means Schedules A through I must be set first.

- Assign generations, then confirm who is a skip person. Watch for the predeceased parent rule and the 90‑day rule for testamentary transfers.

- Decide which lines go to Schedule R versus Schedule R‑1. Remember, direct skips paid by a trustee from a trust that is includible in the estate typically belong on R‑1.

- Allocate the decedent’s GST exemption on the schedules. You can make partial or full allocations, and any unallocated amount is subject to the deemed allocation rule under section 2632(e).

- Compute tax at the applicable rate. The instructions’ draft forms show a 40% rate applied to post‑allocation amounts for direct skips at death. (omb.report)

Inclusion ratio, in plain English

The inclusion ratio converts your exemption allocation into a decimal that tells you how much of a transfer is still exposed to GST. It is 1 minus the applicable fraction, and the applicable fraction is your allocated GST exemption over the value of the property. Round the applicable fraction to the nearest 0.001.

- Law anchor: IRC §2642 and the regulations under 26 C.F.R. §26.2642‑1 drive this computation.

A quick numeric example

- Facts: The estate funds a new skip trust with 2,000,000 at death. You allocate 1,200,000 of GST exemption to this trust.

- Applicable fraction = 1,200,000 ÷ 2,000,000 = 0.600

- Inclusion ratio = 1 − 0.600 = 0.400

- If a 500,000 direct skip distribution occurs later from this trust and the top estate rate is 40%, the tentative GST is 500,000 × 0.400 × 40% = 80,000. This aligns with the instructions’ structure for computing post‑allocation GST on direct skips.

Reverse QTIP and marital planning

When a QTIP trust is included in the decedent’s estate, you may elect reverse QTIP under section 2652(a)(3). The effect is that, for GST, the decedent is treated as the transferor, which lets you allocate the decedent’s GST exemption to that trust. Document the election clearly on the return and attach the statement as the instructions require.

Automatic and specific allocations

You can rely on deemed allocations under section 2632(e) in some situations, or make specific allocations by dollar amount or fraction. For clarity in audits, we like simple formula language that targets a zero inclusion ratio where intended. See the regulatory guidance for valid formula allocation language and timing, especially if you are allocating during an ETIP.

Expert tip: Keep separate inclusion ratio workpapers by trust, with date‑stamped valuation support and a running ledger of exemption remaining. Future you will be grateful.

Timelines, elections, and portability, without the panic

Filing deadlines to calendar

- File Form 706 by 9 months after death. If needed, file Form 4768 by the original due date for an automatic 6‑month filing extension. An extension to file does not extend time to pay. Interest continues to accrue on unpaid amounts.

- If you are filing purely to elect portability and you had no filing requirement, you can often file by the fifth anniversary of death under Rev. Proc. 2022‑32. Use the precise legend at the top of the return.

Portability and GST do not move together

Portability transfers the decedent’s DSUE to a surviving spouse for estate and gift tax. It does not transfer GST exemption. For GST, you must allocate the decedent’s own exemption on Schedules R and R‑1, and any unallocated amount is handled by the deemed allocation rules. See IRC 2631(c) for the link between the year’s basic exclusion amount and the GST exemption.

2024 and 2025 numbers to anchor your planning

- 2024 basic exclusion amount, and therefore 2024 GST exemption, is 13,610,000.

- 2025 basic exclusion amount, and therefore 2025 GST exemption, is 13,990,000.

- The 2025 annual gift exclusion is 19,000. These are IRS‑published figures.

Avoid the common traps

- Treating GST as a Schedule I item. It is not. Park GST at death on R and R‑1.

- Missing the executor‑as‑trustee rule. If an executor is also a trustee of the trust making a direct skip, you typically report that direct skip on Schedule R, not R‑1.

- Forgetting the predeceased parent rule and the 90‑day rule for death of a parent soon after the transfer. These change generation assignments and can rescue or trigger GST.

- Relying on outdated portability relief. The simplified late election relief is now five years, superseding Rev. Proc. 2017‑34.

Side‑by‑side comparison, what goes where

| Item | Where it is reported | What you include | Who pays the tax | Notes |

| Annuities includible in the gross estate | Schedule I | Contracts, survivor benefits, contribution ratio, includible value | Estate tax as part of gross estate | Use plan terms and contribution history to compute portion includible. |

| Direct skip to an individual at death | Schedule R | Beneficiary, property description, estate tax value, GST exemption allocated | Estate | Values must tie to Schedules A through I. |

| Direct skip from a trust includible in the estate | Schedule R‑1 | Trust information, property description, estate tax value, GST exemption allocated | Trustee | Executor notifies trustee, watch 250,000 threshold mechanics and exceptions. |

| Reverse QTIP election | Schedule R, statement | Election under 2652(a)(3), trust details | N/A | Allows the decedent’s GST exemption to be allocated to a marital QTIP trust includible in the estate. |

Documentation and workpaper flow that stands up in review

Build your file like an auditor will read it

- A master index that links Schedule I items to plan statements and valuation support.

- A GST binder with generation assignments, direct skip identification, inclusion ratio worksheets, and exemption ledgers by trust.

- Copies of all election statements, including any reverse QTIP statements and clear language for specific or formula allocations.

What to say in your election statements

- Identify each trust or transfer, the dollar or fractional allocation of GST exemption, and the resulting inclusion ratio if you are computing one now.

- State whether the allocation is tied to a reverse QTIP or a qualified severance and attach support. Keep signed copies with calculations.

Reviewer hint: We include a one‑paragraph narrative at the top of the GST section that tells the story. Who are the skip persons, which transfers are direct skips, how much exemption did we allocate, and what is left. It is simple, and it is gold during an IRS inquiry.

FAQs, straight answers in two to four sentences

Does Schedule I compute DSUE or GST?

No. Schedule I lists annuities for estate inclusion purposes. The DSUE computation appears in the main tax computation and portability sections of Form 706, and GST at death is reported and computed on Schedules R and R‑1.

What is the 2025 GST exemption?

Your GST exemption equals the year’s basic exclusion amount under section 2010(c). For 2025, that figure is 13,990,000 per person according to the IRS.

Can I fix a late portability election?

Often yes, if the estate was not required to file and you are within five years of death. Use the exact legend from Rev. Proc. 2022‑32 at the top of the return and follow the procedure.

When does GST go on Schedule R‑1 instead of Schedule R?

When the trust pays the GST on a direct skip and that trust is includible in the estate, use R‑1 to notify the trustee. If an executor is also the trustee, you generally use Schedule R instead.

Where do the inclusion ratio rules come from?

They live in IRC §2642 and its regulations. The inclusion ratio equals 1 minus the applicable fraction, which is the allocated exemption over the property value, rounded to the nearest 0.001.

Put it into practice, a short step‑by‑step

- Finish your Schedule I annuity analysis first, including the includible portion and documentation.

- Map every transfer that could be a direct skip and decide whether it belongs on R or R‑1.

- Allocate the decedent’s GST exemption where it matters most, document any reverse QTIP elections, and show your math for inclusion ratios.

- Check deadlines. File Form 706 within 9 months or secure the Form 4768 extension. For portability only returns with no filing requirement, remember the five‑year relief.

- Cross‑foot, reconcile to Schedules A through I, and keep a copy of every election statement and appraisal.

Where Accountably fits, only if you need it

If you have more complex estates or seasonal spikes, Accountably can slot disciplined workpaper prep into your workflow with named preparers and reviewers who follow your templates. That means your Schedule I documentation lands cleanly, and your R and R‑1 allocations arrive with inclusion ratio worksheets and a running exemption ledger. Use us to stabilize production, not to override your technical judgment.

Closing thought

You do not need heroics to finish these returns, you need clarity and a calm, repeatable process. Treat Schedule I as the home for annuities, then move to Schedules R and R‑1 for GST. Allocate exemption with purpose, keep your election statements crisp, and file on time. Your reviewers will breathe easier, your clients will feel the certainty of a well‑run process, and you will have a file that stands tall if anyone takes a closer look.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk