Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

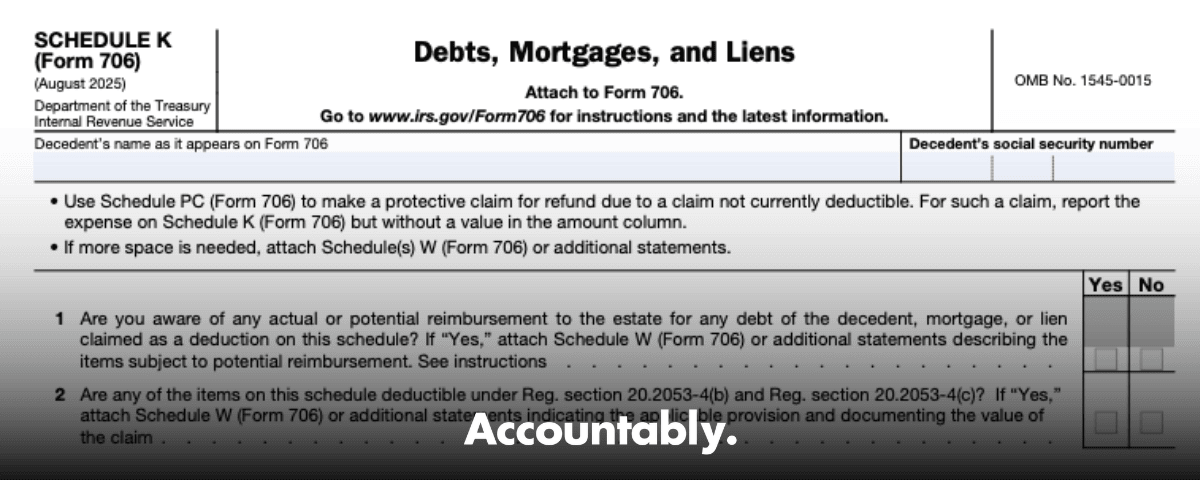

You want a clear, reliable way to decide what belongs on Schedule K, how to document it, and how to coordinate with other schedules without creating duplicate deductions. Below is the plain‑English playbook I wish I had on day one, grounded in the current IRS instructions and built to fit your firm’s workflow.

Key Takeaways

- Schedule K covers two buckets, Part I for the decedent’s deductible unsecured debts and Part II for mortgages and liens on property included in the gross estate at full value when the estate or decedent was personally liable.

- If a mortgage is nonrecourse and the estate is not personally liable, include only the property’s equity in the gross estate and do not deduct the debt on Schedule K.

- Accrued taxes, interest, and certain business expenses at the date of death can be deductible on Schedule K and may also be deductions in respect of the decedent on the estate’s income tax return. Choose the placement intentionally, especially for medical expenses.

- Use Schedule PC for protective claims when a section 2053 deduction will not meet all requirements before the refund claim period expires, and do not enter an amount in the last column for that item.

- Avoid duplication with Schedules J and L, and cross‑reference property schedules when a debt ties to a specific asset.

What Schedule K Actually Does

Think of Schedule K as your estate’s liability ledger on the estate tax return. It tells the IRS exactly which debts reduce the taxable estate and why they are enforceable. You will list each creditor, the nature of the claim, the amount as of the date of death, and the time period it covers. Part I is for unsecured debts of the decedent. Part II is for mortgages and liens that encumber property already included in the gross estate at an unreduced amount when the decedent or estate is personally liable.

Put simply, unsecured claims live in Part I, while any debt tied to an asset with personal liability belongs in Part II. If there is no personal liability, include only the equity in the asset on the property schedule and skip a Schedule K deduction.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Common Part I items include unpaid medical bills, household and vendor invoices incurred before death, enforceable notes or judgments, and the decedent’s share of federal or state income taxes on pre‑death income. For Part II, you will show mortgages and other liens on property that you reported in the gross estate at full value because the estate or decedent was liable on the debt. You will also identify where that property appears, by schedule and item number.

How Schedule K Fits With The Rest Of Form 706

- Schedule J handles funeral and administration expenses for property subject to claims. If a potential section 2053 expense is not currently deductible, you can file a protective claim on Schedule PC and put zero in the last column until it becomes fixed and paid as required.

- Schedule L captures net losses during administration and expenses for property not subject to claims. That is a different bucket from Schedule K and should not contain the same items.

- Schedule PC preserves a future refund for section 2053 amounts that are not yet deductible before the section 6511 refund window closes. Each claim gets its own Schedule PC, and you will later notify the IRS when the claim is resolved.

When you coordinate these schedules correctly, you prevent double counting, keep the return defensible, and speed up review. If your firm tracks these connections in the workpapers, reviewers can confirm placement in minutes rather than hours.

What, How, Wow

- What: Schedule K reduces the taxable estate by valid debts of the decedent and by certain mortgages and liens tied to property reported at full value when personal liability exists.

- How: Identify enforceable claims as of death, separate unsecured from secured, place mortgages with personal liability in Part II, attach documentation, and map each item to the related property or schedule to avoid duplication.

- Wow: Use protective claims and the current section 2053 framework to time deductions right, then design your firm’s SOPs so Schedule K is a fast, low‑risk step rather than a bottleneck.

A Quick Word On Medical Expenses And Income Tax Coordination

Medical expenses are a choice point. If you deduct the decedent’s medical expenses on the estate tax return, they can be fully deductible as claims against the estate. If you instead claim them on the decedent’s final income tax return under section 213(c), you cannot also deduct them on the estate tax return, and you cannot bring over amounts that were not deductible on the income tax return due to percentage limits. Decide the path that creates the best overall tax result, document it in the file, and keep the choice consistent.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallIdentifying Deductible Unsecured Debts

Your filter for Part I is simple. Was the debt valid and enforceable under local law, and did it exist on the date of death, whether or not it had matured? If yes, and it is not tied to collateral that you are reporting in the gross estate at full value with personal liability, it likely belongs in Part I. Include vendor invoices and household expenses incurred before death, unpaid professional fees for pre‑death services, the decedent’s share of income taxes on pre‑death income, and enforceable notes or judgments. Keep original statements and show the dates of service or accrual.

Inclusion‑Exclusion Snapshot

- Include in Part I, unpaid medical bills incurred before death with dates of service, enforceable unsecured notes, judgments, and taxes on income received during life.

- Do not include in Part I, debts that are secured by a mortgage or lien on property you reported at full value with personal liability, those belong in Part II.

- Do not include nonrecourse mortgages here, you will report only equity for the asset on the property schedule and no Schedule K deduction.

Evidence Checklist For Part I

| Item | Deductible on K? | Proof to keep in file | Key note |

| Medical bills for pre‑death care | Yes | Itemized statements with service dates and balance at death | Coordinate with decision on income vs estate tax deduction. |

| Household or vendor invoices incurred before death | Yes | Invoices, contracts, or statements | Show period covered and amount outstanding at death. |

| Unsecured promissory note | Yes | Signed note, payment history, interest rate, balance at death | If joint liability exists, explain co‑obligor responsibility. |

| Property taxes accrued before death | Yes | Tax bill showing period and accrual | Only pre‑death accrual qualifies. |

| Income taxes on pre‑death income | Yes | Return, assessment, or billing | Post‑death income taxes are not deductible. |

Mortgages And Liens, When Part II Applies

Part II of Schedule K covers debts that are secured by mortgages or other liens on property included in the gross estate at full value or at a value not reduced for the debt, and for which the decedent or the estate is personally liable. You will include the creditor, the description, the amount at death, and, critically, the schedule and item number where the related property is reported.

- If the estate is personally liable, report the asset at full value on the relevant property schedule, then deduct the mortgage or lien on Schedule K, Part II.

- If the estate is not personally liable, include only the equity of redemption in the gross estate and do not deduct the indebtedness on Schedule K.

- Debts secured by collateral like stocks or bonds also belong in Part II, since they are obligations secured by a lien on property in the gross estate.

Examples You Can Use In Review Meetings

- Nonrecourse real estate loan, decedent not personally liable. You include the property in the gross estate only at its equity value and take no Schedule K deduction for the loan. Reviewers should see the equity computation in the workpapers and a clear note that no K deduction is taken.

- Home mortgage with personal liability. You include the home at fair market value on Schedule A and deduct the unpaid mortgage principal and accrued interest to the date of death on Schedule K, Part II, with the Schedule A cross‑reference in the description.

- Portfolio loan secured by brokerage collateral. Include the securities at full value on Schedule B, then list the note under Part II with a description referencing the Schedule B item number.

Income vs Estate Tax Deduction, The Coordination Rule

Taxes, interest, and business expenses that accrued at the date of death can be deducted on Schedule K and may also qualify as deductions in respect of the decedent on the estate’s income tax return. Medical expenses require a choice. If you take them on the final Form 1040 under section 213(c), you cannot also deduct them for estate tax, and you cannot move over amounts that were disallowed on the income tax return because of percentage limitations. Make the election that gives the better bottom line and document it.

Practical Tip

Keep a one‑page “placement memo” in the file that states which expenses you are taking on Schedule K, which you are taking on Schedule J or L, and which medical expenses, if any, you are electing to take on the income tax side. That single page saves time during review and if the IRS asks for support later.

Documentation That Survives Audit

Schedule K entries live or die by documentation. For each claim, name the creditor exactly, describe the claim, show the dates covered, and state the outstanding amount as of the date of death. Tie every number to source records and keep copies in a labeled workpaper tab.

Creditor Identification Details

- Use the creditor’s legal name and full mailing address as shown on the documents.

- Show the exact outstanding amount at death, including the interest cutoff date. If interest accrues daily, show the calculation to the date of death.

- List the origination date and terms of any note, including rate, compounding, maturity, and whether there is collateral. If collateral exists and personal liability applies, plan to place the claim in Part II with a cross‑reference to the related asset schedule.

- Attach support, invoices, account statements, the signed note, judgments, tax assessments, or court filings for disputed items. If a claim is contingent or under litigation and you need to preserve a deduction later, use Schedule PC for a protective claim and omit the amount in the last column until it becomes deductible.

Amount And Time Period

You must report the dollar amount as of the date of death and the period the liability covers. For recurring bills, prorate the pre‑death portion and show the billing cycle. For notes, include the unpaid principal and accrued interest through the date of death, with payment history to show legitimacy. For taxes, show the tax type and tax period and include an assessment, bill, or return.

Avoiding Duplication Across Schedules

Duplicate deductions are an easy exam adjustment. Keep these rules front and center.

- Do not take the same expense on Schedule J and Schedule K.

- If you include an asset at equity only because the debt is nonrecourse, do not also deduct that debt on Schedule K. The equity reporting already accounts for it.

- For property not subject to claims, use Schedule L and do not migrate those items to Schedule K.

- If you file a Schedule PC protective claim, note it on Schedule K with zero in the last column until it becomes deductible. Track each claim with its own PC.

A Quick Mini‑Case

An estate had a rental property with a nonrecourse loan. The preparer listed the full property value on Schedule A, then deducted the loan on Schedule K. That overstated deductions and triggered a notice. The fix was to report only the equity on Schedule A and remove the Schedule K deduction entirely. A single cross‑reference in the description field would have prevented the mismatch.

Common Pitfalls We See

- Misclassifying secured debts in Part I rather than Part II, or deducting nonrecourse loans on Schedule K at all.

- Missing the medical expense election coordination, then trying to claim amounts both on the final Form 1040 and on Schedule K.

- Vague descriptions like “utilities” without a period covered or an amount at death.

- Skipping the property schedule and item number in Part II descriptions, which slows review and invites questions.

Operations That Make Schedule K Easy

If you run a CPA or EA firm, a little workflow discipline turns Schedule K from a headache into a quick pass.

- Use SOPs for creditor naming conventions, file naming, and interest cutoff calculations.

- Standardize a one‑page placement memo that maps each liability to Schedule K, J, L, or a protective claim on Schedule PC, with cross‑references to property schedules.

- Build a two‑step review, preparer to senior, that checks only three things first, enforceability, placement, and duplication. Everything else follows.

On Accountably’s side, we focus on these same controls inside your systems so your team is not stuck in review loops. That means structured workpapers, a mortgage and lien cross‑reference for Part II, and a standing check for nonrecourse items that should be handled as equity, not deductions. Mentioning this once here is enough. The real win is fewer revision cycles and faster approvals for your clients.

Tight SOPs, clear cross‑references, and a simple placement memo are the three quickest ways to cut Schedule K review time in half.

Step‑By‑Step, Completing Schedule K

- Build your liability list. Pull vendor statements, medical invoices, notes, judgments, tax bills, and any mortgages or liens connected to property in the gross estate. Split the list into unsecured versus secured.

- Decide medical expense placement. Run the numbers to choose between the estate tax deduction on Schedule K or the income tax deduction on the decedent’s final Form 1040 under section 213(c). Document the choice in the file.

- Place unsecured debts in Part I. Enter the creditor name and address, nature of claim, amount at death, and period covered. Attach support.

- Place mortgages and liens with personal liability in Part II. Identify the related property, point to the schedule and item number, and confirm the estate’s or decedent’s personal liability. If there is no personal liability, include only equity on the property schedule and do not deduct the debt on Schedule K.

- Separate principal and accrued interest. Deduct interest only through the date of death unless the instructions allow more in a specific context, and show the calculation.

- Use Schedule PC when needed. For section 2053 items that will not be deductible before the refund claim period closes, file a protective claim with zero in the last column, one Schedule PC per item, and track resolution to notify the IRS within the required timeline.

- Final cross‑check. Confirm that no item appears on both Schedule K and Schedule J or L, and that Part II descriptions include the correct property schedule and item numbers.

Timing, Protective Claims, And Statutes You Should Track

A protective claim preserves a potential refund when a section 2053 deduction is not yet fixed or paid before the limitations period in section 6511 closes. File Schedule PC with the original Form 706, and later notify the IRS when the claim is resolved, either by filing a supplemental 706 with an updated Schedule PC or by filing Form 843 as notification. Each expense requires its own Schedule PC. The IRS will acknowledge receipt, but that is not a determination on validity. Keep dates, support, and contact information current.

FAQs

What is Schedule K on Form 706?

Schedule K reports deductible debts of the decedent and, when personal liability exists, mortgages and liens on property included at full value in the gross estate. You will list the creditor, the nature of the claim, the amount at death, and the period covered, and you will cross‑reference property schedules for Part II items.

Should I deduct medical expenses on Schedule K or on the final Form 1040?

You can choose. If you deduct them on the estate tax return, they can be fully deductible as claims against the estate. If you take them on the decedent’s final income tax return under section 213(c), you cannot also claim them on the estate tax return, and you cannot bring over amounts disallowed on the income tax return due to percentage limits.

Where do nonrecourse mortgages go?

They are not deducted on Schedule K. Report the property in the gross estate at equity only, then skip the Schedule K deduction for the debt because the estate is not personally liable.

When do I use Schedule PC?

Use Schedule PC to file a protective claim for a section 2053 deduction that will not meet all requirements before the refund claim window closes. Enter the item on Schedule K with zero in the last column, file one Schedule PC per item, and later notify the IRS when the claim is resolved.

Compliance Note And Trusted Sources

This guide reflects the IRS Instructions for Form 706 current as of September 2025, including the rules for Schedule K, mortgages and liens, and Schedule PC protective claims. Always confirm the latest instructions before filing, especially if your decedent’s date of death or filing date pushes into a new revision year.

Light Touch Support From Accountably

If your team wants extra hands for estate work during peak season, the smart move is structure before capacity. Our teams work inside your systems, follow your SOPs, and keep Schedule K clean, from enforceability checks to property cross‑references. That way, partners spend time on client strategy, not on chasing duplicate deductions.

Final Thoughts

Schedule K is not hard, but it is exact. Identify enforceable claims as of death, split unsecured from secured, put mortgages with personal liability in Part II, and show your work. Use protective claims when timing is uncertain. Keep a one‑page placement memo, and you will cut review time while making your return easier to defend.

This article is general information, not legal or tax advice. For a specific estate, consult your tax advisor and confirm the current IRS instructions before filing.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk