Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

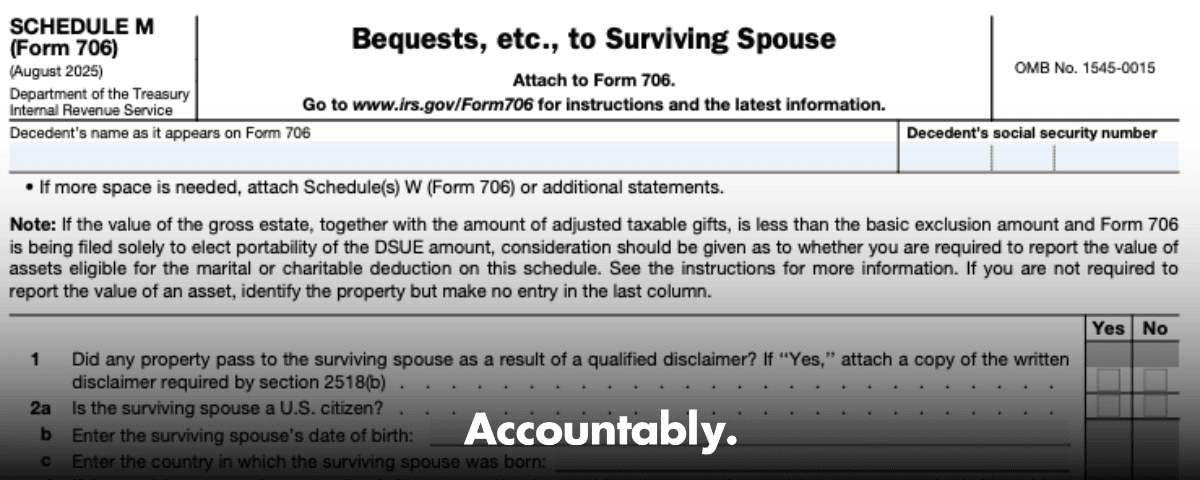

If you prepare estates, you feel the squeeze. Files arrive late, beneficiary forms are inconsistent, and everyone is riding the nine month clock. Schedule M asks you to slow down and prove, line by line, which assets truly qualify for the marital deduction and, when needed, where you are making a QTIP election. That clarity protects the credit shelter share, the DSUE plan, and your reputation with the reviewing agent.

Before we dive in, one quick number you must set correctly. For deaths in calendar year 2025, the basic exclusion amount is 13,990,000 per person, indexed by the IRS. That figure matters when you weigh elections, portability, and whether Rev. Proc. 2016‑49 relief is even on the table.

Key Takeaways

- Schedule M exists to claim the federal estate tax marital deduction for property that actually passes to the surviving spouse and meets IRC §2056 rules. You show the legal path for each item and, when relevant, you elect QTIP.

- List only qualifying interests, then reduce values for mortgages, liens, and related taxes or expenses you report elsewhere on Form 706. Use net values, not gross.

- QTIP elections are affirmative and irrevocable. If you list a qualifying terminable interest and do not exclude part of it, you are presumed to have elected QTIP. That choice brings the property into the survivor’s estate under §2044 later.

- For a non‑U.S. citizen spouse, you usually need a QDOT that meets §2056A and related regulations, including a U.S. trustee with withholding authority on principal distributions.

- Deadlines matter. Form 706 is due 9 months after death, and Form 4768 gives a 6‑month automatic extension if filed on time. Portability late relief is available for certain estates for up to 5 years under Rev. Proc. 2022‑32.

What Schedule M Does, And Why It Sits At The Center Of The Return

Schedule M is narrow by design. Your job is to pinpoint which assets pass to the spouse in a form that qualifies for the deduction and to document the authority that makes each item deductible. That means tying every line to a clause in the will or trust, a beneficiary designation, a community property rule, or a statute. It also means showing the right net value after debt and death taxes borne by that property. Done well, Schedule M prevents accidental erosion of the credit shelter share and keeps your DSUE and QTIP strategy intact.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Quick rule of thumb: if the spouse does not get all income for life and no one else can touch principal during the spouse’s lifetime, you likely need an explicit QTIP election to claim the marital deduction, unless the interest already fits a different qualifying path like a general power of appointment trust.

Property That Belongs On Schedule M

Common Qualifying Items

- Outright bequests to the spouse under the will or revocable trust.

- The decedent’s interest in jointly held property with the spouse, credited in line with inclusion rules.

- The decedent’s half of community property that passes to the spouse.

- Life insurance, annuities, and retirement assets payable to the spouse, when included in the gross estate.

- Qualifying trusts, for example, a general power of appointment trust, or a terminable interest that meets QTIP rules when you elect on Schedule M.

Make sure values on Schedule M reflect any mortgages, state death taxes, or federal estate and GST taxes that are charged to the very property you are deducting. The instructions require you to back those out. If an item is payable from a group of assets, reduce the value by any assets in that group that would be nondeductible terminable interests.

Property You Should Keep Off Schedule M

Items That Usually Do Not Qualify

- Terminable interests that end at a date or event, unless they fit a statutory exception or you make a valid QTIP election.

- Property directed to be converted after death into a terminable interest for the spouse.

- Transfers to a noncitizen spouse that are not in a QDOT by the filing date.

- Interests that fail income‑for‑life or sole‑benefit standards for the spouse.

If you see “everything to my spouse, then to the kids,” stop and read the trust mechanics. Many “simple” marital trusts are not actually deductible without QTIP treatment. Also, remember the special rule for certain joint and survivor annuities, where the law can create an automatic QTIP election unless you affirmatively elect out on Schedule M, line 3. That one checkbox can drive a lot of downstream estate math.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick Reference, What Qualifies And What Does Not

| Item type | Usually qualifies for marital deduction | Notes you should document |

| Outright bequest to spouse | Yes | Cite the clause, attach probate order if available, show net of debt and taxes borne by the property. |

| Joint and survivor annuity | Often, yes | Special automatic QTIP rule can apply. Elect out on line 3 if you do not want QTIP, then it is not deductible on Schedule M. |

| General power of appointment trust | Yes | Confirm spouse’s testamentary GPOA, all income to spouse, and no other current beneficiaries. |

| QTIP trust | Yes, if elected | List on line 4. Election is irrevocable. Future inclusion under §2044 in survivor’s estate. |

| Community property share | Yes, if passing to spouse | Confirm state law and dispositive clause, then list the decedent’s one‑half interest. |

| Assets to noncitizen spouse | Not without QDOT | The trust must meet §2056A rules, including U.S. trustee and withholding rights. |

| Terminable interests without exception | No | Unless you elect QTIP and the trust meets income‑for‑life requirements. |

Pro move: mirror the Schedule M line item to the source schedule and the paragraph or section in the governing document. That cross‑reference cuts review time and reduces follow‑up from the estate and gift unit.

QTIP Elections On Schedule M, How To Get Them Right

A QTIP election is simple on paper, you list the trust on line 4 and include its value, and it is powerful in practice. The election is affirmative and irrevocable, and unless you clearly exclude a portion, the IRS presumes you elected on the entire item you listed. That choice converts what would otherwise be a nondeductible terminable interest into a marital deduction, and it sets up inclusion in the survivor’s estate later under §2044. Treat that as a modeling decision, not a checkbox.

Here is how I approach it on real files:

- Draft a one page trust inventory that shows income rights, principal standards, invasion powers, and any powers of appointment.

- Model the survivor’s estate with and without QTIP property, then test GST and basis tradeoffs.

- Decide whether to elect fully, elect partially, or elect out, and write a short memo to the file with the reasons.

- On Schedule M, describe the legal basis, the trust section references, and, if a partial election, the fraction that is elected.

When You Wish You Hadn’t Elected, Relief Boundaries

There is limited relief when a QTIP election was not needed to reduce the first decedent’s estate tax to zero. The IRS first provided relief in Rev. Proc. 2001‑38 and later updated the rules in Rev. Proc. 2016‑49. The current position, estates that make a portability election generally cannot have an unnecessary QTIP election treated as a nullity. In other words, if you elected portability, do not expect the IRS to unwind a QTIP choice later under this relief.

When relief does apply, the revenue procedure explains how to position the request, including a clear statement on the return that it is filed pursuant to Rev. Proc. 2016‑49 and evidence that portability was not elected. Use this sparingly. I treat it as a safety valve for honest over‑inclusion, not a planning tool.

Avoiding The Classic Pitfalls

Misreporting QTIP Assets

Do not park bypass assets on Schedule M. Map the estate plan, test the trust mechanics, and list only the property that truly qualifies or that you are choosing to treat as QTIP. An inadvertent QTIP election is still an election, and it will pull the property into the survivor’s estate.

Overstating The Marital Deduction

Yes, the marital deduction can shelter a lot, yet listing everything undercuts the bypass trust and can waste exclusion. Tie each line to specific bequests and funding clauses. Match titles and beneficiary designations to what the plan intended, then adjust for mortgages and liens, since you can only deduct the decedent’s equity in property on Schedule M.

Noncitizen Spouses And QDOT, What You Must Prove

If the surviving spouse is not a U.S. citizen, the unlimited marital deduction usually requires a Qualified Domestic Trust, QDOT. The trust must be administered under U.S. law, have at least one U.S. trustee, and no principal distribution can be made unless that U.S. trustee can withhold the §2056A tax. Larger QDOTs can trigger extra security requirements in the regulations to protect collection. List the QDOT on Schedule M, and make the election on the return.

Timing matters. If property passes outright to a noncitizen spouse, you can still qualify by transferring or irrevocably assigning that property to a compliant QDOT before the Form 706 due date, including extensions, and by making the election on the return. If the spouse later becomes a U.S. citizen before any principal distributions and meets the regulatory rules, you can reassess whether QDOT administration remains necessary.

QDOT Mechanics You Should Check Line By Line

- U.S. trustee or domestic corporate trustee is in place, with authority to withhold.

- The instrument meets §2056A, and, for trusts over the regulatory threshold, additional security provisions are satisfied.

- The trust limits principal distributions, or ensures withholding on any principal paid.

- Administration records are available, and you have EINs and trust accounting to support the filing.

Field note: when facts are tight, attach a short trustee statement on the withholding mechanics and reference the governing sections. That small attachment often prevents a back‑and‑forth later.

Deadlines, Extensions, And Portability, The Dates That Keep You Safe

- Form 706 is due 9 months after death.

- An automatic 6‑month extension is available if you file Form 4768 by the original due date.

- The extension to file does not extend time to pay. Interest runs from the original due date.

- Portability late election relief allows certain estates with no filing requirement to file a complete Form 706 within 5 years of death, with a specific legend at the top of the return.

Keep your calendar tight. I include the extension receipt in the binder and note the new filing date at the top of every worksheet. It sounds basic, yet I have seen great technical work dinged by a missed date stamp.

Documentation That Survives Review

Strong Schedule M files tend to look the same. They include:

- The will, trust agreement, and any amendments with tabs to the relevant clauses.

- Beneficiary designations for insurance and retirement assets.

- Appraisals that meet FMV standards and show valuation dates.

- A Schedule M index that cross‑references each line to the governing language and the asset schedule.

- A one page memo explaining every election, including QTIP and QDOT, and the expected §2044 effect.

When you elect portability or rely on late portability relief, add the correct legend at the top of the return. The IRB guidance explains the exact wording. Missing that line can cost you hours later.

A Step‑By‑Step Workflow You Can Reuse

- Read the dispositive documents before you touch the forms. Flag the marital share mechanics, the bypass funding clause, and any terminable interest language.

- Build an asset‑title matrix, who owns what, where it is listed on Schedules A through I, and who gets it under the plan or by beneficiary form.

- Identify the marital‑eligible items. If a trust is involved, test income rights, principal access, and powers of appointment.

- Decide whether a QTIP election is needed, optional, or harmful. Model the survivor’s estate and GST, then choose full, partial, or no election.

- For noncitizen spouses, confirm QDOT mechanics well before the filing date. If assets passed outright, prepare the assignment into QDOT and the election.

- Reduce values for debt and death taxes that burden the item, then prepare Schedule M with detailed descriptions and cross‑references.

- Write a short memo summarizing elections and attach any statements the instructions expect, for example, probate orders, disclaimers, or annuity details.

Common Edge Cases

- Joint and survivor annuities, review line 3 and decide whether to elect out of QTIP. List on Schedule M only if you are not electing out.

- Formula clauses that pour into a marital trust and a bypass trust, allocate with care and show your math.

- Property that can be satisfied from a group of assets, reduce the listed value for any assets in that group that would be nondeductible terminable interests.

Relief, When And How To Use It

If you made an unnecessary QTIP election in an estate that did not need it to reduce tax to zero, Rev. Proc. 2016‑49 explains how to have that election treated as void. Remember the big guardrail, this route is not available where the estate elected portability, even if the DSUE amount is zero. Follow the revenue procedure’s filing instructions, including the specific notation on the return and a clear explanation of facts.

For portability itself, Rev. Proc. 2022‑32 gives a simplified method for certain late elections for up to five years after death. Use the exact legend it provides, and confirm that the estate truly had no filing requirement. If a later determination shows a filing requirement existed, the relief can be void from the start.

FAQs

What is Schedule M used for?

You use Schedule M to list property that passes to the surviving spouse and qualifies for the marital deduction, including QTIP property you elect. It is the proof section for why each item is deductible and how it meets the statute.

Who must file Form 706?

File Form 706 if the gross estate plus adjusted taxable gifts exceeds the basic exclusion amount for the year of death, for example 13,990,000 for deaths in 2025. Many estates that are under the threshold still file to elect portability.

How long do I have to file, and how do I extend?

The return is due 9 months after death. File Form 4768 by that original due date for an automatic 6‑month extension. Interest on tax runs from the original due date.

When is a QDOT required?

When the surviving spouse is not a U.S. citizen and you want the marital deduction. The trust must meet §2056A and regulatory requirements, including a U.S. trustee with authority to withhold tax on principal. You must make the election on the return.

Can I fix an unnecessary QTIP election?

Sometimes. Rev. Proc. 2016‑49 allows relief if the QTIP was not needed to reduce tax to zero and you did not elect portability. Follow the procedure and include the required statements.

Where Disciplined Offshore Execution Helps Firms Get Schedule M Right

When firms stall on delivery, it is not because partners cannot win work, it is because files bottleneck in production and review. Schedule M is one of those pressure points. If your team is buried, you need stable capacity that follows your SOPs, your templates, and your timelines, not a stack of resumes. This is where a structured, U.S. led offshore model helps, consistent checklists, standardized workpapers, and layered review protect the marital deduction and keep partners out of endless review loops.

If your firm works with Accountably, you get trained preparers who work inside your systems, across tax suites and workflow tools, and who understand how to document a QTIP, record a QDOT, and tie every Schedule M line back to governing language. The value is simple, predictable turnaround, clear visibility, and fewer revision cycles on one of the most sensitive parts of the return. Mentioning it here is enough, no pitch needed. Focus on quality work, on time.

Compliance Notes, Sources, And A Final Word

Two reminders as you publish or share this guide with your team:

- Check the year of death and confirm the basic exclusion amount for that year. For 2025, it is 13,990,000. Laws can change, so verify for later years.

- Read the current Form 706 and Schedule M instructions for line‑by‑line rules, QTIP presumptions, and QDOT election details. Those pages answer most gray areas and are updated with each revision.

I will leave you with this. Schedule M is not a “fill it in last” schedule. It is the story of how the marital deduction works in this estate, with names, clauses, and math that hold up in review. If you slow down here, you protect the bypass plan, you avoid §2044 surprises, and you make the survivor’s future return a lot easier to manage.

Mini Checklist You Can Copy

- Confirm who gets what under the plan, then build the asset‑title matrix.

- Identify qualifying marital items, then reduce for debt and taxes they bear.

- Decide on QTIP, full, partial, or none, and memo your reasoning.

- For noncitizen spouses, confirm QDOT mechanics and elect by the filing date.

- File on time, or extend with Form 4768. Note portability decisions and legends.

Legal and tax disclaimer, this guide is for general information. It reflects IRS guidance as of October 25, 2025. Always confirm the latest IRS instructions, revenue procedures, and regulations for your facts.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk