Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

You are likely juggling deadlines, multiple entities, and fast‑moving facts. Schedule O can be simple when the gift is a fixed dollar amount. It gets tricky once you are allocating residuary shares after federal estate tax, GST tax, and any other death taxes that the will or local law charges to the residue. The IRS allows the charitable deduction only for the amount actually available for charitable use, which is why clean documentation and after‑tax math matter so much.

Key Takeaways

- Schedule O is where you claim the estate’s charitable deduction on Form 706, and you must file it if you enter a deduction on Part V, item 22. List each organization and the exact dollar amount or the precise fractional share that it receives.

- The deduction is limited to what the charity actually receives. If federal estate tax, federal GST tax, or other death taxes are paid from a charitable bequest or from the residue that feeds that bequest, you must reduce the deduction accordingly. Attach your computation.

- For residuary gifts, compute each share after you determine the post‑tax residue. Do not guess. Document the reduction for taxes and show your allocation schedule in the workpapers you attach.

- Include each charity’s full legal name, mailing address, and enough detail to verify status. If a qualified disclaimer pushes property to charity, check line 2 and attach the written disclaimer.

- Align Schedule O with Schedules M, P, Q, R, and the recapitulation. Credits like foreign death taxes or tax on prior transfers affect the overall estate tax, which changes the residue that funds charitable shares. Keep your cross‑schedule math synchronized.

Pro tip: If a will charges taxes to the residue, run the tax, update the residue, then recalc charitable shares. Loop until the numbers settle. The IRS expects to see the computation that proves what the charity will actually receive.

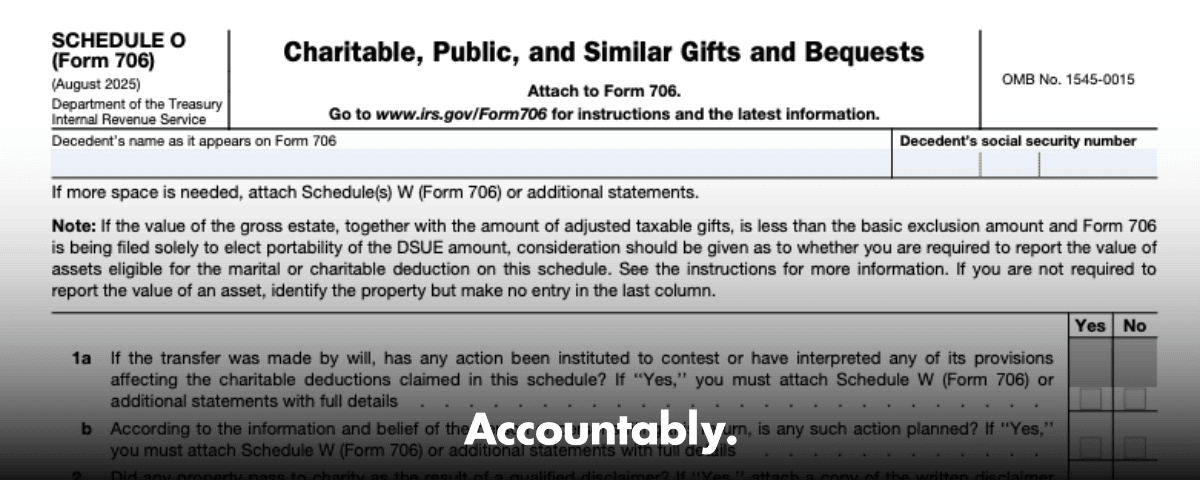

What Schedule O does, and when you must file it

Schedule O documents every charitable, public, or similar transfer that you include in the gross estate and for which you claim a deduction under section 2055. You must complete and file Schedule O if you claim a deduction on Form 706, Part V, item 22. The organizations that qualify include U.S. and state governments for public purposes, charities that operate exclusively for exempt purposes, and certain other qualifying entities noted in the instructions.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Here is the part that often gets missed. The deduction is not whatever the will says in percentages. It is what the charity receives after taxes that the governing documents or local law allocate to that bequest or the residue. If interest on deferred estate tax will be paid from charitable property, you must reduce the deduction by the expected interest as well. When the deduction is based on the residue, attach the computation that shows the reduction for these taxes.

If property passes to charity because someone made a qualified disclaimer, check line 2, answer Yes, and attach the written disclaimer under section 2518. The IRS instructions call this out explicitly.

Who this guide is for

- You manage estate tax filings for a CPA, EA, or law‑firm practice and want fewer review loops.

- You prepare 706 returns and need a clear way to support residuary charitable allocations.

- You review files and want to see clean workpapers that match the IRS instructions updated September 2025.

I will use plain language and practical steps. We will map your data, calculate the after‑tax residue, and show how to present Schedule O so it stands up to scrutiny and saves partner review time.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallThe information to gather before you touch Schedule O

- The controlling instrument, for example, the will and any codicils, trust agreements, and any court orders. If the charitable transfer is by will, the IRS wants a certified copy of the order admitting the will to probate, along with the will.

- For each charity, the full legal name, mailing address, and, if you maintain it, the EIN and a contact person for verification. Keep the description of the bequest exact, for example, specific dollar amount, or x percent of residue.

- A tax apportionment summary that shows whether federal estate tax, federal GST tax, and any state or other death taxes are charged to the bequest or to the residue. This determines the reduction to the charitable amount.

- A credits snapshot. Credits, such as the credit for foreign death taxes on Schedule P or the credit for tax on prior transfers on Schedule Q, change the estate tax and therefore the residue that funds charitable gifts. Track these in a worksheet so your residual math and your schedules agree.

- Valuation dates consistent with the gross estate, either date of death or alternate valuation date, since the same dates apply on Schedule O.

Brief note on tools and workflow. If you model these calculations in your tax software, make sure the Schedule O computation reflects the after‑tax residue and that your attached statement matches the software output. Reviewers and exam teams look for that tie out.

Soft, relevant note on help. If your team is buried in 706 season and review time is the choke point, Accountably can integrate disciplined offshore teams that work inside your templates and follow your review structure without changing your control of the file. Mentioned here because clean Schedule O work relies on process, not heroics. Only engage if a delivery system would help you scale, not as a short‑term patch.

How to report organizations and allocate amounts or percentages

Here is a simple, repeatable way to complete Form 706 Schedule O without second guessing yourself on review day.

1. Identify the bequest type

- Specific dollar amount, for example 50,000 to Charity A.

- Specific asset, for example 1,000 shares of ABC stock.

- Fraction of the gross or net estate, for example 5 percent of the net estate.

- Residuary interest, for example 20 percent of the residue after expenses and taxes.

- Gather each charity’s details

- Full legal name, mailing address, and, if available, EIN and a primary contact.

- Copy the controlling clause, including any conditions or directions about taxes, management, or timing.

- Decide the valuation date

- Use date of death or alternate valuation date consistently with the rest of the return. Note it in your workpapers.

- Model tax apportionment

- Read the will and state law. Confirm which taxes are charged to the bequest or the residue. This tells you whether the charitable deduction must be reduced.

- Compute the post tax residue

- Run the estate tax. Subtract expenses and taxes that the document or law charges to the residue. The balance is the residue that funds the charitable shares.

- Allocate shares

- For specific bequests, enter the exact amount or asset value.

- For residuary bequests, multiply each percentage by the post tax residue to get each charity’s dollar amount.

- Prepare your attachments

- A statement that shows the reduction for taxes and the math behind the residuary allocations.

- Copies of the will, codicils, and trust excerpts that control the charitable gifts. Include any court orders or disclaimers if those changed who receives what.

- Enter Schedule O

- List each organization exactly as it appears in the instrument. Enter the exact amount or the precise fractional share. Describe any conditions, for example restricted use or timing.

Specific bequests versus residuary bequests

Specific bequests are usually straightforward. You report the charity and the exact dollar amount or the fair market value of the specified asset on the chosen valuation date. The deduction is the entry you show, unless the clause charges taxes to the bequest.

Residuary bequests take more work. The deduction is limited to what the charity actually receives from the residue after you reduce the residue for taxes and charges that apply. This is where a Residual Interests worksheet earns its keep. You show the starting residue, subtract taxes and charges that apply, then allocate the balance by the stated percentages.

A quick numeric example you can copy

- Facts. The will leaves the residue 60 percent to Charity A and 40 percent to Charity B. The document charges federal estate tax and GST tax to the residue. After paying specific bequests and expenses, the pre tax residue is 1,000,000. The combined federal estate and GST taxes, after credits, are 200,000, and they are charged to the residue.

- Steps. Reduce the residue by the 200,000 tax. The post tax residue is 800,000.

- Allocation. Charity A receives 480,000, Charity B receives 320,000.

- Schedule O. You list each charity and report the exact amounts, 480,000 and 320,000, not 60 percent and 40 percent of 1,000,000. Attach the worksheet that shows your math.

If a clause says a charity receives a fraction of the gross estate or the net estate rather than a share of the residue, follow the instrument. Document the base you used and show the tax effects that the instrument or law assigns to that gift.

What to include in your documentation packet

- A one page summary of each charitable bequest that shows type of gift, valuation date, tax apportionment, and the final deductible amount.

- A clear worksheet that bridges from the gross or pre tax residue down to the post tax residue, then to each charity’s dollar share.

- Copies of controlling clauses, beneficiary designations if relevant, and any qualified disclaimers.

- A cross reference list that shows where each item ties to other schedules on the return.

Coordinate Schedule O with the rest of the return

Your goal is to make the math tell one clean story from start to finish. These are the cross checks I use before a partner review.

The quick tie out map

| Schedule or Part | What to verify | Why it matters |

| Part 5, item 22 | Total charitable deduction equals the sum of Schedule O entries | Prevents mismatches that trigger questions |

| Schedule M | If any charitable bequests also qualify for marital deduction, confirm you did not double count | The deduction cannot be claimed twice |

| Schedule P and Q | Credits reduce the estate tax, which changes the residue that funds charitable shares | Wrong credits mean wrong residue and wrong deduction |

| Schedule R and R‑1 | GST tax that is charged to the residue also reduces charitable shares | Missing GST effect overstates the deduction |

| Recapitulation | Valuation date and property descriptions match the charitable entries | Keeps the return consistent across schedules |

| Attachments index | Your computation of post tax residue is listed and easy to find | Helps examiners follow your logic without follow up |

Software and workflow tips that save review time

- Keep a single source worksheet for the residue math, then feed numbers into your software from that one place.

- Lock the worksheet when a reviewer signs off, then version any later changes.

- Label every figure with the schedule and line number where it appears. This turns your worksheet into a map, so anyone on the team can trace the numbers in minutes, not hours.

Short process note. If your team struggles with turnarounds and version control during peak filing, the fix is structure, not heroics. Accountably can supply disciplined offshore teams that sit inside your systems, follow your SOPs, and protect review time with layered QC. Use this only if a repeatable delivery model would remove your bottleneck. No quick fixes, no resume dumps, only accountable execution.

Common filing pitfalls and how to fix them

Small misses create big review loops. Use this list during prep and again right before filing.

| Pitfall | What goes wrong | The simple fix |

| Missing charities | One or more donees from the will or trust never show up on Schedule O | Enumerate all recipients from the governing documents, then tick and tie each name to an entry |

| Vague percentages | Entries say “various” or only list 60 percent or 40 percent without a dollar figure | State the precise fraction and the final dollar amount after tax. Attach the worksheet that shows your math |

| Ignored GST impact | GST that is charged to the residue never reduces the charitable shares | Rerun the residue with GST included, then recalc the charitable amounts and replace the Schedule O numbers |

| Off schedule entries | Gifts appear in narratives or on Schedule M but not on Schedule O | Reconcile all charitable items to Schedule O totals and to Part V, item 22 |

| Thin documentation | No computation attached for a residuary bequest | Attach a clear, one page computation that starts at the pre tax residue, subtracts taxes and charges, and allocates the post tax residue |

| Wrong valuation date | Values on Schedule O do not match the date used across the return | Confirm date of death or alternate valuation date, then sync values and footnotes |

| Tax apportionment guesswork | Team applies default tax sharing, not the document or state law | Read the tax clause, then apply that rule. If silent, apply the state apportionment statute, and disclose assumptions in your workpapers |

| Duplicate deductions | An item shows on Schedule M and also inflates Schedule O | Choose the correct schedule based on the clause. Do not double count |

| Unclear restrictions | Conditional or restricted gifts are listed without context | Add a short description of the condition and attach the clause or order that explains it |

Quick checklist for a clean Form 706 Schedule O

- Confirm that a charitable deduction is claimed on Part V, item 22.

- List every charity by full legal name and mailing address, and keep EINs in your file.

- Identify the bequest type for each entry, specific amount, specific asset, fraction, or residuary share.

- Select the valuation date and use it consistently across the return.

- Read the tax apportionment clause and the applicable state statute, then document which taxes reduce the charitable amount.

- Compute the pre tax residue, subtract taxes and charges that apply, then allocate the post tax residue to each charity.

- Prepare a one page computation attachment for residuary bequests.

- Cross check totals to Schedules M, P, Q, R, and the Recap page.

- Index your attachments so a reviewer or examiner can follow the trail quickly.

- Final spot check, compare the governing documents to your Schedule O entries, then lock the version.

Documentation pack you can reuse

- Governing documents, will, codicils, trust excerpts, plus the probate order if applicable.

- Qualified disclaimers that resulted in property passing to charity.

- Residue calculation worksheet with version control and sign off lines.

- A table that maps each charity to the clause, schedule, and final dollar amount.

- A short cover memo that explains tax apportionment, assumptions, and any timing notes.

Frequently asked questions

Who needs to file Schedule O

File Schedule O when you claim a charitable deduction on Form 706. List each organization and either the exact dollar amount or the precise fractional share it receives. If a disclaimer pushes property to charity, include that in your packet and note it on the schedule.

Who needs to file IRS Form 706

File Form 706 when the gross estate plus adjusted taxable gifts and specific exemptions meets the filing threshold for the year of death, or when you elect portability for the surviving spouse. The due date is nine months after death, with a six month extension available on Form 4768. Check your state’s rules for any separate filings.

What exactly is Schedule O

Schedule O is where you support the estate tax charitable deduction under section 2055. You identify each qualified organization and show the exact amount it will receive. For residuary gifts, you attach a computation that proves the amounts are after tax, not before tax.

Do I need to report a sale of inherited property

Yes. If you, as a beneficiary, sell inherited property, report it on your individual return using Form 8949 and Schedule D. Use the step up in basis, generally the fair market value at the date of death, subject to any adjustments. If the estate sold the property, review Form 1041, the K 1, and any 1099 S.

How do disclaimers affect Schedule O

A qualified disclaimer can change who receives property and can increase or create a charitable gift. Keep the written disclaimer in your file, reflect the new recipient on Schedule O, and make sure your allocation math reflects the post disclaimer plan.

What about split interest transfers

If the gift is a split interest, for example a charitable remainder trust, make sure you record the correct interest and that you have the valuation to support the deduction. Coordinate with the schedules that handle split interests, and do not double count on Schedule O.

When to bring in extra hands

If your firm’s bottleneck is delivery, not sales, the fix is a stable production system with clear SOPs, versioned workpapers, and layered reviews. Schedule O is a perfect example, it rewards structure. If capacity and review protection would help, Accountably can integrate trained offshore professionals who work inside your systems, follow your templates, and reduce partner time in review through a multi layer QC process. Use this when you want predictable turnaround and consistent workpapers, not as a short term band aid.

Conclusion and next steps

Schedule O is straightforward once you commit to two habits, exact entries and after tax math. Gather clean inputs, apply the governing tax clause, compute the post tax residue, then allocate with precision. Attach a one page computation, cross check totals to the rest of the return, and keep your packet easy to follow. That is how you protect the charitable deduction, speed up reviews, and keep the file exam ready.

If you want a ready to use packet, create a template that includes the residue worksheet, a mapping table, and a cover memo. Use it on every estate. If you are facing heavy volume or complex apportionment this season and need disciplined help that works your way, our team at Accountably can support your Schedule O process inside your systems with built in QC and version control.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk