Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

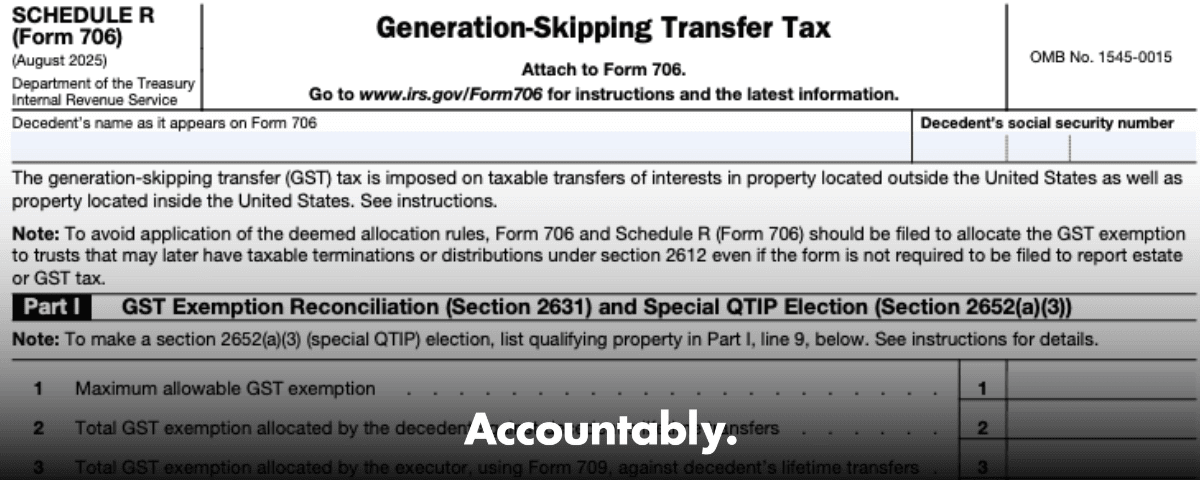

You use Schedule R on Form 706 to report direct‑skip GST at death, compute any estate‑payable GST tax, and allocate the decedent’s GST exemption to trusts. Schedule R‑1 exists to notify trustees when the trust must pay the GST, and it becomes part of your Form 706 filing package.

If you are reading this on Accountably.com, you already care about clean delivery, clear review notes, and fewer late‑night reworks. I will focus on the decisions that trip teams up, give you a field‑tested workflow, and show you the exact Lacerte screens that control whether Schedule R shows up and calculates correctly.

Key Takeaways

- Schedule R covers direct skips at death and figures estate‑payable GST, while Schedule R‑1 is the executor’s notice to a trustee when the trust must pay GST under section 2603(a)(2).

- Part 1 is where you reconcile and allocate the decedent’s GST exemption, including Line 9, Columns C and D, and, if you choose, the trust inclusion ratio in Column E. Unused exemption that you do not allocate on time will be deemed allocated by law.

- Use the executor‑as‑trustee rule first. If the executor is a trustee, report that trust’s direct skips on Schedule R, not R‑1, even if other trustees serve.

- For ordinary, explicit trusts, use Schedule R‑1 unless the executor is also a trustee. For non‑ordinary trust arrangements, life insurance, and annuities, apply the $250,000 entity threshold to decide between R and R‑1.

- In Lacerte, Schedule R will not generate unless at least one beneficiary is marked as a skip person on Screen 2, Part 1 has required entries, and, if you want Part 3, you also check the Part 3 box on Screen 34.

What Schedule R Does, in Simple Terms

Schedule R works alongside your estate schedules, not apart from them. First, finish the gross estate work so you know what is includible. Then identify skip persons, then decide if each transfer is a direct skip, and finally decide whether to report the skip on Schedule R or on Schedule R‑1. The GST on Form 706 is only for direct skips at death. That is why you start by asking three questions for each transfer: is it subject to estate tax, is it an interest in property, and is it to a skip person. Only when all three are yes do you have a direct skip for Form 706.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Inside Part 1 of Schedule R, you allocate the decedent’s GST exemption. You will list trusts on Line 9, show prior allocations in Column C, any new allocation in Column D, and, if you wish to help the trustee for future years, you can compute and note the inclusion ratio in Column E using the worksheet in the instructions. The allocation you make on a timely filed return is irrevocable. Any exemption you do not allocate gets swept up by the deemed allocation rules at death, which move remaining exemption first to direct skips, then to trusts.

Tip for reviewers, think of Line 9 as your control panel. If you do not list a trust there, the law can move the decedent’s unused exemption to that trust automatically, which may not match your plan.

What Changed for 2025 That You Should Note

For decedents dying in 2025, the basic exclusion amount is 13,990,000 and several indexed values updated. You still complete Schedules R and R‑1 using estate tax values, including alternate valuation under section 2032 and special‑use valuation under section 2032A if elected. These changes do not alter the R versus R‑1 decision rules, but they do affect the estate’s broader tax picture.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallI recommend adding a short reviewer note in your file: “2025 Form 706, indexed amounts confirmed per 09‑2025 IRS instructions,” then paste the confirmation citation. Your future self will thank you during any exam or quality review.

The What‑How‑Wow Framework

- What, Schedule R is the part of Form 706 where you report direct skips at death, compute estate‑level GST on those skips, and allocate the decedent’s GST exemption to trusts.

- How, follow a five‑step sequence, complete the gross estate schedules, identify skip persons, determine which transfers are direct skips, divide direct skips between Schedule R and R‑1, then complete both schedules, allocating exemption in Part 1 and computing tax in Parts 2 and 3.

- Wow, avoid needless rework by applying two control rules up front, the executor‑as‑trustee rule and the $250,000 entity threshold for non‑ordinary trust arrangements, insurance, and annuities. These two decisions drive almost every Schedule R versus R‑1 call you will make.

Schedule R vs. R‑1, Make the Right Call Every Time

When teams get stuck, it is usually because they started with dollar amounts instead of roles. Start with who controls the trust and what kind of arrangement it is, then look at the dollar test when it applies.

Rule 1, Executor‑as‑Trustee Controls

If any executor of the estate is a trustee of the trust, put every direct skip from that trust on Schedule R, not Schedule R‑1. It does not matter that other trustees serve. It does not matter that section 2603 would otherwise make the trustee responsible for the tax. The reporting rule turns on the executor’s role as trustee, so keep those skips on Schedule R.

Quick memory hook, executor on the trust, report on R. Always.

Rule 2, Ordinary, Explicit Trusts Use R‑1

An ordinary, explicit trust, a classic will or inter vivos trust with trustees holding title, is reported on Schedule R‑1 when it makes a direct skip and is includible in the decedent’s gross estate. The purpose of R‑1 is to notify the trustee, who is the liable party for GST on a direct skip from a trust under section 2603(a)(2). Exception, if the executor is also a trustee, go back to Rule 1 and report on Schedule R.

Rule 3, The $250,000 Entity Threshold

For direct skips from arrangements that are trusts for GST purposes but are not ordinary trusts, and for life insurance and annuity payors, aggregate tentative maximum direct skips at the entity level. If the total for that entity reaches 250,000 or more, report on Schedule R‑1. If it is below 250,000, report on Schedule R. Liquidating trusts fall in this non‑ordinary bucket and are subject to the threshold test.

Table, Which Schedule Do You Use

| Trigger | Where it belongs | Why it belongs there |

| Executor is a trustee of the trust | Schedule R | Executor‑as‑trustee rule overrides, report on R even if others are trustees. |

| Ordinary, explicit trust, includible, executor is not a trustee | Schedule R‑1 | Trustee is liable for GST on direct skips from a trust, R‑1 functions as notice. |

| Non‑ordinary trust arrangement, tentative maximum direct skips across the entity under 250,000 | Schedule R | Below threshold, keep it on R. |

| Non‑ordinary trust arrangement, tentative maximum direct skips across the entity 250,000 or more | Schedule R‑1 | Crosses threshold, report on R‑1. |

| Life insurance proceeds includible, payable to a skip person, aggregate under 250,000 per insurer | Schedule R | Below threshold, keep on R. |

| Life insurance proceeds includible, payable to a skip person, aggregate 250,000 or more per insurer | Schedule R‑1 | Crosses threshold, report on R‑1. |

| Annuity includible, survivor benefits to a skip person, aggregate under 250,000 per payor | Schedule R | Below threshold, keep on R. |

| Annuity includible, survivor benefits to a skip person, aggregate 250,000 or more per payor | Schedule R‑1 | Crosses threshold, report on R‑1. |

A Word on Definitions

The ordinary trust definition comes from Treasury regulations. A trust for GST purposes can include other arrangements with substantially the same effect, including insurance and annuity contracts. Keep this in mind when you apply the threshold, you are aggregating at the payor or entity level, not just one policy.

Practical Field Example

- Facts, the decedent owned two policies issued by the same insurer, both includible, each payable outright to a grandchild.

- Action, compute the insurer’s aggregate tentative maximum direct skips, the figure that would land on Line 5 of R‑1 if you filed it.

- Result, if the combined tentative maximum hits 250,000 or more, report on R‑1, if not, keep them on R. Keep a short workpaper showing the aggregation by entity and your threshold result.

Many review notes get solved by writing one sentence, “Executor is also trustee of Trust A, therefore trust direct skips reported on R, not R‑1.” Clip that to your file.

Roles, Responsibilities, and the Form Stack

Here is the clean way to assign work and avoid crossed wires between the estate and the trustee.

- Executor, reports direct skips at death on Schedule R and allocates the decedent’s GST exemption in Part 1, unless a trust skip is properly reportable on Schedule R‑1 or the executor is also a trustee, in which case it stays on R.

- Trustee, pays the GST on a direct skip from a trust under section 2603(a)(2), files Form 706‑GS(T) for taxable terminations, and relies on the executor’s R‑1 when applicable.

- Beneficiary, pays GST on taxable distributions using Form 706‑GS(D). Lifetime direct skips still go on Form 709 with any exemption allocation made by the transferor.

The simplest test, who pays, in a direct skip from a trust, the trustee pays, everyone else, look back to the executor and the estate return.

Direct Skips at Death, Tie Each One to the Right Form

- Use Schedule R for estate‑payable direct skips at death.

- Use Schedule R‑1 when the skip comes from a trust that is includible, since the trustee is the liable party, unless the executor is also a trustee, then keep it on R.

- For insurance and annuities, apply the entity threshold test to decide between R and R‑1.

If you elected alternate valuation under section 2032 or special‑use valuation under section 2032A, you must carry those estate values into Schedules R and R‑1. This is a frequent foot fault during reviews, so add a short tick mark that says “2032 applied on R and R‑1.”

Finish the Tax, Then Allocate Exemption With Intention

Complete Parts 2 and 3 and any R‑1s that belong in the file, then allocate the decedent’s GST exemption in Part 1. Use Line 9 to list every trust you want to receive prior or new allocation. If you leave Line 9 blank for a trust, the deemed allocation rules can move remaining exemption there automatically at the filing due date.

Software Workflow, Lacerte Steps That Matter

Lacerte will not generate Schedule R unless the software sees a skip person. Mark at least one beneficiary as a skip person on Screen 2. Next, go to Screen 31, choose Part 1, and enter the trust name, EIN, prior allocations for Column C, new allocation for Column D, and, if you computed it, the inclusion ratio for Column E. If you want Part 3, check the Part 3 box on Screen 34. If the form will not appear, regenerate after edits.

On stubborn files, run a quick user checklist, Screens 2, 31.1, 31.2, 34, then regenerate. Most “it will not print” issues die right there.

Where Accountably Fits, Only When It Helps

If your firm is buried in compliance work and you keep punting Schedule R reviews to late nights, a structured offshore delivery team can stabilize the workload. Accountably integrates trained staff into your workflow, including QuickBooks, Xero, and the common tax suites, so your reviewers get standardized workpapers and predictable turnaround. Use this only if you need it, your team can absolutely follow this guide and succeed on its own.

Allocating GST Exemption and Computing Inclusion Ratios

Part 1 is where you turn policy into math. The instructions let you allocate exemption right on the return, and once you do, it is irrevocable, so slow down for five minutes and document your intent.

Line 9, Columns C, D, and E

- Column C, prior allocations tied to direct skips reported in Parts 2 and 3 or on any R‑1 you attached.

- Column D, fresh allocation from Line 8 that you are assigning to one or more trusts, including inter vivos trusts that are not otherwise on the estate return, valued at date of death. You should also notify the trustee of the total exemption you allocated to that trust.

- Column E, optional inclusion ratio, you are not required to compute it, but completing the worksheet now saves the trustee time later.

If you skip Column E, at least record the total exemption you allocated to each trust. Trustees need that figure to compute GST on later distributions and terminations.

Inclusion Ratio, How to Compute It

Use the worksheet from the instructions. Start with the total estate and gift tax value passing to the trust. Subtract estate and state death taxes and other charges actually recovered from the trust, plus any GST tax recovered from the trust. The result is the trust’s net tax base. Then add Columns C and D from Line 9, divide by the net base to get the applicable fraction, and subtract from 1.000 to get the inclusion ratio. Use a separate worksheet per trust.

To check your logic, cross‑reference how trustees compute inclusion ratios on Form 706‑GS(T). The concept is the same, the inclusion ratio equals 1 minus the applicable fraction, where the numerator is allocated exemption and the denominator is the value transferred net of taxes recovered and charitable items.

Quick Example With Round Numbers

- Value to Trust Beta at death, 2,000,000.

- Taxes recovered from the trust and related charges, 50,000.

- Net trust base, 1,950,000.

- Total exemption you allocated on Line 9, C plus D, 1,950,000.

- Applicable fraction, 1,950,000 divided by 1,950,000 equals 1.000.

- Inclusion ratio, 1.000 minus 1.000 equals 0.

- Result, Trust Beta is fully exempt.

Document that in your memo so the trustee has a clean starting point.

Deemed Allocation, The Safety Net You Still Want to Control

If you do not allocate all unused exemption by the due date for filing Form 706, the regulations will allocate it automatically, first to direct skips, then to trusts, based on values as finally determined for chapter 11 purposes. Since that allocation is irrevocable, make your choices in Part 1 early, then confirm they stick in the final.

Special‑Use and Alternate Valuation

If you elected alternate valuation under section 2032 or special‑use valuation under section 2032A, you must carry those values onto Schedules R and R‑1. When special‑use property goes to a skip person, the instructions require extra worksheets to measure any GST tax savings for that skip person, comparing special‑use to fair market value. Attach the required calculations.

Reviewer Callouts That Save Time

- Bold the names and EINs for all trusts you list on Line 9.

- Add a one‑line reason for any allocation that does not bring a trust to a zero inclusion ratio.

- If you add allocation to a trust that was also listed on an R‑1, note that your Line 9, Column D entry is in addition to any R‑1 Line 7 notice.

Lacerte, Getting Schedule R to Generate Without Drama

You can have the estate work perfect and still not see Schedule R if the software does not see a skip person. Here is the fast path.

The Four‑Screen Checklist

- Screen 2, mark at least one beneficiary as a skip person.

- Screen 31.1, enter a decedent lifetime transfer.

- Screen 31.2, add each trust, enter name and EIN, Column C and D amounts, and, if you choose, Column E. Use Add to create more lines, numeric entries only.

- Screen 34, check the box to include Part 3. Then regenerate.

If you are stuck, open Screen 31, pick Part 1 from the left menu, and build Line 9 entries right there. That single step resolves most “Line 9 is blank” issues.

Common Reasons Schedule R Fails to Print

- No one is marked as a skip person on Screen 2.

- Screen 31.1 or 31.2 entries are missing.

- You expect Part 3, but you did not check the Part 3 box on Screen 34.

- You typed text in a numeric field on Screen 31.2. Fix, enter figures, not notes.

Navigation Tips

- Build your trust list in Screen 31, Part 1.

- Keep a running total of Line 8 allocation and match it to Column D across trusts.

- Use Lacerte’s diagnostics after you regenerate to confirm flow to Line 9.

FAQs

What is Schedule R‑1 for Form 706, in plain English

Schedule R‑1 is the executor’s notice to a trustee when a trust that is includible in the decedent’s estate makes a direct skip and the trustee is liable for the GST under section 2603(a)(2). You attach one copy to Form 706, and you send a copy to the fiduciary before the Form 706 due date.

Who must file Schedule R

You include Schedule R with Form 706 when there are direct skips at death to report or when you are allocating the decedent’s GST exemption. If there are no skip persons, there is nothing to report, but you may still file to allocate exemption intentionally and avoid a deemed allocation you did not want.

Do I use Schedule R or R‑1 for a QTIP trust that moves to a grandchild at the second death

If the QTIP is includible in the surviving spouse’s gross estate and, by reason of that death, passes to a skip person, report the direct skip on Schedule R‑1, the trustee is liable. If the executor is also a trustee, report on Schedule R instead.

What numbers changed for 2025 that might affect my estate return

For decedents dying in 2025, the basic exclusion amount is 13,990,000, with other indexed estate values updated in the instructions. These figures do not change the Schedule R versus R‑1 rules, but they do matter for the overall filing and planning context.

Wrap‑Up and Next Steps

You now have a simple way to win with Schedule R, start with roles, not dollar amounts, apply the executor‑as‑trustee rule first, then use the 250,000 entity test when it applies, finish Parts 2 and 3, then allocate exemption in Part 1 on Line 9 with intention. If you follow the Lacerte checklist, your form will generate, your math will tie out, and your reviewer will move on without red lines.

If your team needs extra hands for peak season, Accountably can plug in trained staff who work inside your systems with standardized workpapers and review protection. If you are good to go, save this guide to your procedures and keep filing strong.

Compliance note, this article reflects IRS instructions and code sections available as of October 25, 2025. Always confirm the latest Form 706 instructions before you file.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk