Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

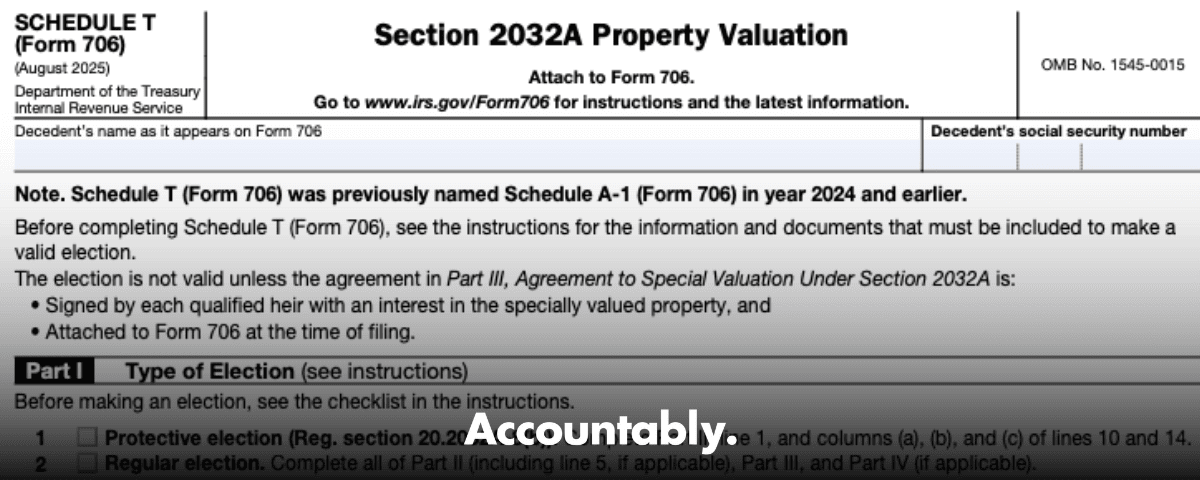

Quick clarity for 2025. Schedule T on Form 706 is now the section 2032A special‑use valuation schedule, formerly Schedule A‑1. You still compute GST on direct skips at death on Schedules R and R‑1, and Schedule T comes into play when special‑use property exists, because you must also show the GST tax savings for any skip person who receives specially valued property. You complete Schedules R and R‑1 using special‑use values, then build a second set of worksheets at fair market value to show the savings. That is how Schedule T and GST connect in 2025.

Key takeaways

- In 2025, Schedule T on Form 706 supports the section 2032A special‑use valuation election and includes a GST “tax savings” requirement for skip persons who receive specially valued property. GST on direct skips at death is still computed on Schedules R and R‑1.

- The estate return is due in nine months, and you can request a six‑month filing extension on Form 4768. The tax remains due at nine months, and interest runs on unpaid estate and GST.

- The top GST rate equals the top estate rate, which is 40 percent, and the 2025 basic exclusion amount is $13,990,000. The annual gift exclusion for 2025 is $19,000.

- Use Schedules R and R‑1 to identify direct skips, allocate the decedent’s GST exemption, and apply the trustee aggregation rule. For non‑ordinary trust payors, you aggregate by payor and use the $250,000 threshold to determine whether items stay on Schedule R or move to R‑1.

- Trustees file Form 706‑GS(T) for taxable terminations, and distributees file Form 706‑GS(D) for taxable distributions, both generally due April 15 following the calendar year of the event.

What Schedule T is in 2025, and why it still matters for GST

Here is the short version. You elect special‑use valuation on the main return, then you complete Schedule T to support that election. Because a reduced special‑use value can also reduce the GST burden on property going to a skip person, the IRS requires you to show the GST tax savings for each skip person who receives any specially valued property. You do that by preparing two Schedules R as worksheets, one using special‑use values and one using fair market values, and you compare the tax. That comparison is the GST savings you must disclose for each affected skip person.

If a grandchild receives specially valued real property, you must show the GST tax on Schedules R and R‑1 using special‑use values, then recompute the same items at fair market value and disclose the difference as the GST tax savings for that grandchild.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

This is where teams get tripped up. If you treat Schedule T like a GST calculator, you will chase your tail. Treat Schedule T as the special‑use home base, then let Schedules R and R‑1 do the GST math. Your job is to keep the values, allocations, and notices consistent across all three.

When you must file, who pays, and where the money comes from

At death, a direct skip is reportable on Form 706, Schedule R. If the direct skip is made from a trust, and the trust property is includible in the gross estate, you use Schedule R‑1 to notify the trustee and to pass the liability to the trustee when the aggregation rules say so. As a default, the GST is charged to the property that makes the transfer unless the will or trust says otherwise. This is why the Part II versus Part III split on Schedule R matters, it tells you whether the property itself bears the GST or another fund pays it.

The well known trustee aggregation rule controls which schedule you must use. For ordinary trusts, direct skips are shown on R‑1, except when the executor is also a trustee, then they stay on Schedule R. For non‑ordinary trust payors, such as life insurance companies and annuity payors, you aggregate tentative maximum direct skips per payor. If the total is $250,000 or more, you report on Schedule R‑1 and the payor or trustee pays. If less than $250,000, you report on Schedule R and the estate pays, with a right to recover as allowed.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallBefore we go deeper on mechanics, let me call out one more calendar item that saves pain. File Form 4768 by the original due date to extend filing by six months, but plan payments by month nine. Extensions do not extend time to pay, interest applies to unpaid estate and GST amounts, and penalties can stack if the extended filing window is missed.

Core GST terms you will use on Schedules R and R‑1

You will use three building blocks across the estate and trust filings.

- Direct skip, a transfer to a skip person, two or more generations below the transferor, of an interest in property that is subject to estate or gift tax. This is what you report at death on Schedules R and R‑1 of Form 706.

- Taxable termination, the moment a non‑skip interest in a trust ends and only skip persons remain. The trustee files Form 706‑GS(T) and pays the GST. Due April 15 following the calendar year of the event, with Form 7004 available to extend filing.

- Taxable distribution, a distribution from a trust to a skip person that is not a direct skip or a taxable termination. The distributee files Form 706‑GS(D) and pays the GST, the trustee issues Form 706‑GS(D‑1). Due April 15 following the calendar year of the distribution.

The direct skip at death, where to file it and how to allocate exemption

For the estate, everything starts with Schedules A through I, because only property includible in the gross estate can be subject to GST on the estate return. Once values are set, you identify skip persons and use Schedules R and R‑1 to compute GST, charge it to the right bucket, and allocate any remaining GST exemption. The deemed allocation rules at death under section 2632 apply if you do not affirmatively allocate, so be deliberate.

Who files which form

Here is the quick map you can share with a reviewer or client.

| Item | Who pays | Filing form |

| Direct skip during life | Transferor | Form 709 |

| Direct skip at death, not from a trust or below threshold | Estate, on Schedule R | Form 706, Schedule R |

| Direct skip at death, from a trust or payor at or above threshold | Trustee or payor, notified via R‑1 | Form 706, Schedule R‑1 |

| Taxable termination | Trustee | Form 706‑GS(T) |

| Taxable distribution | Distributee, trustee issues D‑1 | Form 706‑GS(D) |

Use April 15 for the trust returns, nine months after death for Form 706 and any GST reported there, and extend the estate filing with Form 4768 if needed.

Special‑use valuation property and the GST “tax savings” disclosure

If you elect special‑use valuation, your Schedule T requires extra GST work. For each skip person who receives specially valued property, you must compute GST twice, once with special‑use values and once at fair market value, and disclose the difference as GST tax savings. Prepare those as Schedule R worksheets, not as additional R‑1s. This is a 2025 nuance that many teams miss.

Trustee aggregation, per‑insurer rules, and when to use R‑1

When direct skips occur from a trust that is includible in the gross estate, Schedules R and R‑1 divide the work. For ordinary trusts, direct skips go on R‑1 unless the executor is also a trustee, then they stay on R. For non‑ordinary trust payors, such as insurance companies and annuity payors, aggregate tentative maximum direct skips per payor. If the total reaches $250,000, use R‑1 and the trustee or payor bears the tax. If the total is below $250,000, report on R and the estate pays.

Insurance and annuity items follow the same per‑company or per‑entity aggregation logic. If life insurance proceeds are included in the gross estate and are payable to a skip person, you treat the transfer as a direct skip from a trust that is not an ordinary trust. At or above $250,000 with that insurer, use R‑1, otherwise use R. The same idea applies to includible annuities with survivor benefits to skip persons.

Pro tip, create a one‑line roll‑up per insurer and annuity payor early in the engagement, then you will know whether you are in R or R‑1 territory before you start building the schedules.

Finally, watch the special case where any executor is also a trustee. In that event, all direct skips for that trust stay on Schedule R, even if they would otherwise fall on R‑1. This is an easy one to miss when you inherit a file mid‑season.

Gathering data you need before touching Schedules R, R‑1, or T

If you start the forms without a clean inventory, you will chase corrections for weeks. Build your packet first, then complete the schedules in one pass.

Asset and value checklist

- Date‑of‑death fair market values for assets that can pass to skip persons, including insurance proceeds payable to grandchildren.

- Any special‑use property you plan to elect under section 2032A. You will need both the special‑use value and the fair market value because the GST “tax savings” comparison flows through Schedule T.

- Trust principal balances, beneficiary classes, and whether any trust interests are includible in the gross estate.

Create a one‑pager that ties each potential skip transfer back to a Form 706 schedule, for example “Grandchild specific bequest, 706 Schedule B, item 12.”

Beneficiary mapping and skip status

- Confirm each beneficiary’s relationship to the decedent.

- Mark skip persons, for example grandchildren, great‑grandchildren, or a trust whose beneficiaries are all skip persons.

- Note any predeceased child exceptions and whether a parent is deceased, because that can change the generation assignment.

A five‑minute call with the family can prevent hours of recalculation later.

Trusts, payors, and thresholds

- Obtain the trust instruments, creation dates, trustee names, and whether the executor is also a trustee.

- Identify non‑ordinary payors, such as insurers or annuity companies, and list them by legal name.

- Build an aggregation line per trustee or payor so you know whether you are above or below the threshold that flips items between Schedule R and Schedule R‑1.

Lifetime history and prior allocations

- Pull prior Forms 709, look for lifetime direct skips, prior GST exemption allocations, and any inclusion ratios that carry into the estate return.

- Note automatic or affirmative allocations under section 2632 so you do not over‑allocate on the estate return.

Good practice, keep a running “inclusion ratio” worksheet per trust. Even a two‑column sheet with value and protected value will save your reviewer from hunting inside the form.

Completing Schedules R and R‑1, then using Schedule T for special‑use GST savings

Think of this as a three‑step loop, values first, GST computation second, then the special‑use comparison.

- Set values. Place assets on Schedules A through I of Form 706, set any special‑use election, and confirm which items are includible in the gross estate.

- Compute GST on direct skips at death. Use Schedule R to list direct skips and allocate the decedent’s remaining GST exemption. If a direct skip is made from a trust or a payor subject to aggregation, use Schedule R‑1 when the rules shift liability to the trustee or payor. If the executor is also a trustee, those trust items remain on Schedule R.

- If you elected special‑use valuation, prepare two Schedule R worksheets for skip recipients of specially valued property. One uses special‑use values, the other uses fair market values. The difference is the GST “tax savings” you must disclose on Schedule T for each affected skip person.

Inclusion ratio, the quick way to keep it straight

- Protected value is the portion covered by the GST exemption you allocate.

- Unprotected value is the portion that exceeds the exemption or is not covered due to prior allocations.

- Inclusion ratio equals unprotected value divided by total value. It ranges from 0 to 1.

- Multiply the inclusion ratio by the GST rate to get the effective rate for that transfer.

Record the inclusion ratio next to each trust or transfer so you can audit the math in minutes.

Who pays and how to reflect it on the schedules

- If property itself bears the GST, show it that way on Schedule R and reduce the amount passing by the GST charge.

- If another fund pays the GST, mark it accordingly so the property amount is not reduced.

- When Schedule R‑1 applies, complete the notice and timing requirements for the trustee or payor, and keep a copy in your workpapers.

Timeline, extensions, and task sequencing that keep you on track

- Anchor everything to the Form 706 due date, nine months after death.

- If needed, file Form 4768 to extend filing by six months. The tax is still due at nine months.

- Build your calendar backwards. Aim to finish valuations and beneficiary mapping by week four, GST allocations by week six, Schedule R‑1 notices by week seven, and final sign‑off by week eight.

- For taxable terminations and distributions that arise after death, track those on their own calendar. Trustees handle Form 706‑GS(T), distributees handle Form 706‑GS(D), generally due April 15 following the year of the event.

A simple spreadsheet with columns for “Item, Form, Who Pays, Due Date, Status” keeps the whole engagement visible and reduces last‑minute surprises.

Special rules, trustee aggregation, and per‑insurer calculations

This is where most review notes come from. Slow down and get the structure right.

Trustee aggregation for trusts includible in the estate

- Aggregate direct‑skip property by trustee or payor, not by beneficiary.

- For ordinary trusts, direct skips typically appear on Schedule R‑1 and the trustee pays. If the executor is also a trustee, keep those items on Schedule R and the estate pays.

- For non‑ordinary payors, such as insurance and annuity companies, total the tentative maximum direct skips by each payor. At or above the threshold, file R‑1 and shift liability to the payor or trustee. Below the threshold, keep the item on Schedule R and the estate pays with recovery rights.

Keep a cover sheet per trustee or payor, attach your roll‑up, and staple the related R‑1 if it applies. You will thank yourself later.

Insurance and annuity nuances

- Confirm whether the policy or contract is includible in the gross estate. Incidents of ownership and beneficiary designations matter.

- If includible, and the proceeds are payable to a skip person, treat it like a direct skip from a non‑ordinary trust.

- Apply the per‑insurer aggregation. One company, all includible skip‑bound proceeds on a single tally. Decide R versus R‑1 from that tally.

A one‑line summary in the file, “Insurer ABC, total tentative maximum direct skips, amount, R or R‑1,” keeps your reviewer aligned.

Elections and documentation that make your allocations stick

Your allocation only works if it is timely and well documented.

- Make any section 2632 allocations on a timely filed return. Late filings complicate the binding effect of elections.

- Cross‑reference the allocation on Schedule R to a simple worksheet that shows available exemption, prior lifetime use, and current allocation by transfer.

- If you elect special‑use valuation, include the two‑step GST comparison in your Schedule T packet, one set at special‑use values and one at fair market values, clearly labeled for each skip recipient of specially valued property.

- If the governing instrument charges GST to a different fund, include a copy of that clause in your workpapers and note it next to the item on Schedule R.

Clear labels beat clever formulas. Name your files “R worksheet, special‑use values” and “R worksheet, FMV values” so anyone on the team can follow the trail.

Workflow tips that cut review time in half

- Standardize file names, for example “R‑Item‑03_Grandchild‑Bequest_706‑B‑12.pdf.”

- Use short preparer notes at the top of each schedule explaining what changed since the draft.

- Build a short QC checklist, for example “skip status checked, threshold tested, R‑1 issued or N/A, allocation reconciled to exemption roll‑forward.”

- Save one page at the end of the packet that lists all open questions for the partner, with your recommendation next to each one.

If you lead a firm where delivery gets stuck in review loops, consider assigning a single reviewer for all GST items across files during peak season. Consistency speeds everything up.

Common errors and how to avoid them

You can avoid 80 percent of GST problems by watching for these traps.

Misclassifying the transfer

Calling a taxable distribution a direct skip, or vice versa, will throw every form off. Confirm whether the transfer is immediate to a skip person, whether any non‑skip interests remain, and whether a trust interest actually ended. That tells you which form to use and who pays.

Ignoring prior allocations

If you miss prior lifetime allocations on Form 709, you will over‑allocate on the estate return or compute the wrong inclusion ratio. Build a simple exemption roll‑forward with three rows, lifetime used, remaining at death, allocated at death.

Missing the executor‑as‑trustee exception

If the executor is also a trustee, the direct skips for that trust typically stay on Schedule R. Teams often prepare an R‑1 out of habit and then have to unwind it.

Forgetting the special‑use GST comparison

When you elect special‑use valuation and a skip person receives any of that property, you must show the GST effect at special‑use values and again at fair market value and disclose the savings. Skipping the comparison invites questions you do not want.

Letting deadlines drift

Form 4768 extends filing, not payment. Put “payment plan” in week six, not week eight. Interest and penalties chew up goodwill with families fast.

Best practices that build clean, audit‑ready files

- Tie every taxable amount on Schedules R and R‑1 back to the correct Form 706 schedule. Add a note like “ties to 706‑B‑12.”

- Keep inclusion ratio math visible, not buried. A one‑line note, “ratio 0.40 = 100,000 unprotected / 250,000 total,” makes your reviewer’s life easy.

- Issue Schedule R‑1 promptly and keep proof of delivery. Note the due date for any trustee or payor responses.

- Store beneficiary confirmations and skip status in a single PDF so anyone on the team can verify relationships without digging through emails.

- Maintain a living SOP for GST tasks. Even a two‑page playbook lowers training time for new staff and reduces errors.

Where Accountably helps without adding noise

If your firm’s bottleneck is delivery, not sales, the fix is structure and capacity at the same time. This is where a disciplined offshore delivery model helps. When we support firms on estate and GST work, we plug into your systems, use your templates, and keep the review loop tight with SOP‑driven workpapers, a multi‑layer review, and clear R and R‑1 packets. You keep control, you gain predictable turnaround, and you protect quality while your partners focus on client strategy. Mentioning this once here is enough, since the job is to help you finish accurate returns on time, not to pitch you.

FAQs

What is the quick difference between Schedules R, R‑1, and T on Form 706?

- Schedule R computes GST on direct skips at death and lets you allocate the decedent’s GST exemption.

- Schedule R‑1 is the notice and reporting for trustees or other payors that must pay GST on certain direct skips.

- Schedule T supports the special‑use valuation election and, when skip persons receive specially valued property, it includes the GST “tax savings” disclosure based on comparing special‑use values with fair market values.

Who files and pays GST at death?

The estate reports and pays GST on Schedule R, unless the rules shift the liability to a trustee or other payor, in which case you notify them using Schedule R‑1. Trustees pay GST for taxable terminations on Form 706‑GS(T), and distributees pay GST for taxable distributions on Form 706‑GS(D).

Do I have to allocate GST exemption on every direct skip?

No. You can choose to allocate or not, but if you do nothing, deemed allocation rules can apply. Most practitioners build a simple worksheet showing the remaining exemption and how much, if any, to apply to each transfer, then attach that to the file.

How do insurance proceeds to a grandchild show up?

If the policy is includible in the gross estate and the proceeds are payable to a skip person, treat it as a direct skip associated with a non‑ordinary payor. Aggregate by insurer to decide whether it belongs on Schedule R or R‑1, and then follow the notice rules if R‑1 applies.

Can I extend time to file the estate return and the GST schedules?

Yes. File Form 4768 by the original due date to get a six‑month filing extension. Remember that tax is still due at the nine‑month mark, and interest applies to unpaid amounts.

What workpapers should I include for a clean review?

Include your inclusion ratio math, exemption roll‑forward, trustee or payor aggregation roll‑ups, R‑1 copies if issued, and a short note for each item that explains who pays the tax and why you used R or R‑1.

Conclusion and a practical next step

You now have a clear runway. Start with values and relationships, decide which transfers are direct skips, compute GST on Schedules R and R‑1, and, if you elected special‑use valuation, show the required GST “tax savings” for any skip recipient on Schedule T. Keep your inclusion ratios visible, allocate exemption deliberately, and issue R‑1 notices early so there is no scramble near the finish line.

If you want an experienced team to standardize your GST packets and cut review time without losing control of your workflow, our team at Accountably can help. We work in your systems, follow your templates, and keep the files audit‑ready. If that would save your season, reach out, and we will show you the delivery model that firms use when they cannot risk misses on deadlines or quality.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk