Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

We caught it in time by setting the 8971 date the same day we set the 706 plan, and by keeping proof of delivery in the file. You can do the same.

Quick truth, the earlier of rule runs the show for both filing and furnishing. Put it on your calendar the day you decide your Form 706 timeline.

Key Takeaways

- Form 8971 reports estate tax values from Form 706 and requires you to furnish each beneficiary a separate Schedule A, not the whole form.

- Deadline, file Form 8971 and furnish all Schedules A within 30 days of the Form 706 due date, including extensions, or within 30 days after you actually file Form 706, whichever is earlier.

- Exceptions, no Form 8971 when Form 706 is filed solely to elect portability or solely for GST allocation.

- Use the IRS Florence, KY address, Internal Revenue Service, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042. The IRS specifically warns not to use older addresses.

- Many assets are excepted from the consistent basis rules, including wholly deductible marital or charitable property and interests in retirement plans expressed in U.S. dollars, so you generally do not furnish Schedule A for those items.

- The final regulations, T.D. 9991, removed the “zero basis” rule and clarified what counts as included property and when you must supplement, which reduces harsh outcomes.

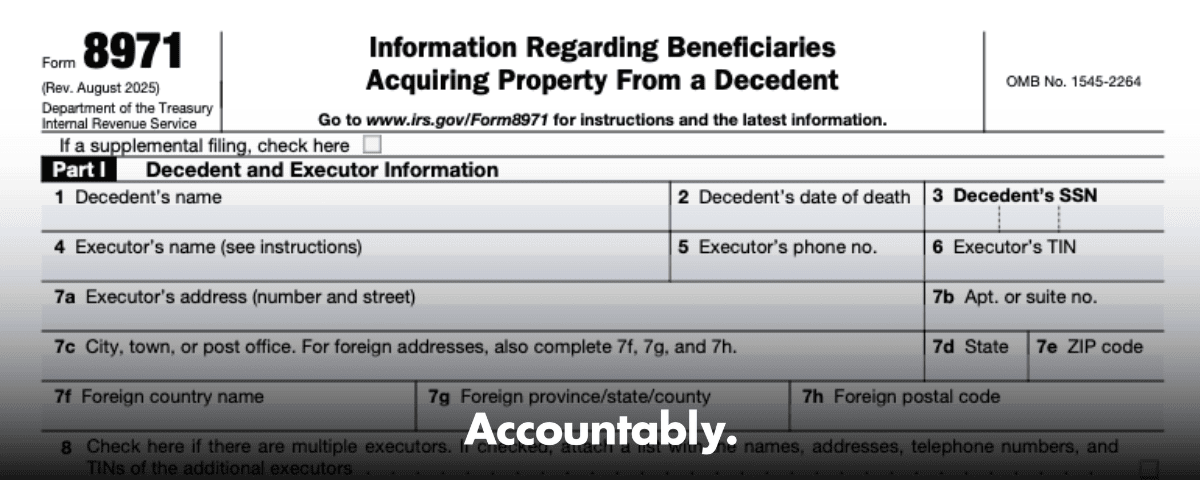

What Form 8971 does, and why it matters

Form 8971 identifies who received property from the estate and gives each person a Schedule A with the estate tax value. It supports basis consistency, the rule that a beneficiary’s initial basis cannot exceed the estate’s reported or final value for assets that actually increased estate tax. You file Form 8971 with copies of all Schedules A and you furnish only the relevant Schedule A to each beneficiary. Keep proof of delivery and record the date you furnished each Schedule A on the form.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

This is both a tax issue and a workflow issue. You need clean allocations, timely handoffs, and records that back you up. A simple master sheet for names, TINs, assets, percentages, and dates cuts review time and lowers penalty risk.

Who must file, and the big exceptions

If the estate must file Form 706 or 706‑NA, you must file Form 8971 and furnish Schedules A. Clear exceptions apply, you generally do not file Form 8971 when the estate tax return is filed solely to elect portability or solely for GST allocation. Confirm this on day one so you do not trigger a sprint you do not need.

What about marital, charitable, and retirement assets

The consistent basis rules focus on property that increases estate tax. Wholly deductible marital or charitable property is excepted. Interests in retirement plans and IRAs that are expressed entirely in U.S. dollars are also excepted. In practice, you generally do not furnish Schedule A for those excepted items, even if you still must file the Form 8971 itself because the estate was required to file Form 706.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallTiming, the 30 day window, and how to prove delivery

Your deadline for both steps, filing Form 8971 with copies of all Schedules A and furnishing each beneficiary’s Schedule A, is the earlier of 30 days after the Form 706 due date, including extensions, or 30 days after the actual Form 706 filing date. You may furnish in person, by mail, by approved private delivery service, or by email. Enter the exact delivery date in Part II and keep proof, mail receipts, tracking, portal logs, or email confirmations.

When a beneficiary acquires property after the 706 due date, the regulations give you a helpful option, furnish a supplemental Schedule A by January 31 of the year after the beneficiary acquires the property, and attach that to a supplemental Form 8971. Put this date on your year end checklist.

Note, this article is educational, not legal or tax advice. Always verify the latest instructions and regulations for your facts.

Filing requirements and purpose, in plain language

You file Form 8971 when the estate is required to file Form 706 after July 31, 2015. The form transmits valuations to the IRS and, via separate Schedules A, to each beneficiary who receives property subject to the consistent basis rules. You furnish only the Schedule A to that beneficiary, not the entire Form 8971. You still must file the Form 8971 even if no Schedules A are furnished because all property is excepted.

What to include on each Schedule A

Each Schedule A lists the specific property the beneficiary received or will receive, the value reported on the estate tax return, whether the item increased estate tax, and any other required details. If you later correct values or allocations, file a supplemental Form 8971 and furnish supplemental Schedules A. Check the “Supplemental Filing” box and include only the changes.

Deadlines, delivery, and penalties

The earlier of 30 days rule controls both filing and furnishing. You can furnish by email with consent, through a secure portal, by mail, by private delivery service, or in person. Record the date furnished on the form and keep proof. Late filing or failures to furnish can draw information return penalties. Reasonable cause relief exists, but plan to avoid needing it.

Filing timeline rules you can copy

- Set your Form 8971 due date the same day you set your Form 706 plan.

- File Form 8971 and furnish all Schedules A by the earlier of 30 days after the 706 due date, including extensions, or 30 days after the actual 706 filing date.

- Use the January 31 rule when a beneficiary acquires property after the 706 due date.

History note, early transition relief in 2016 moved filing to March 31, 2016 for certain returns, which no longer applies today. You follow the current 30 day rules.

Beneficiary delivery methods that hold up

- In person, get a signed receipt.

- Mail or private delivery, keep tracking.

- Email or portal, get consent and retain confirmations.

- For trusts or estates with multiple fiduciaries, giving Schedule A to one trustee or executor is sufficient.

Penalty exposure, the practical view

Information return penalties can apply for late, missing, or incorrect filings and for failing to furnish correct statements to beneficiaries. The Internal Revenue Manual restates the exceptions, including portability only and GST only, and confirms the earlier of 30 days rule. Build a five minute pre‑filing check that confirms the date math, beneficiary identifiers, totals, and delivery proof. It prevents most notices.

Where to file in 2025

Mail Form 8971, including all Schedules A, to the IRS Florence, KY address, Internal Revenue Service, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042. The IRS has a standing notice that says do not use the address printed on older instruction PDFs. Use tracked mail or an approved private delivery service.

Quick reference table

| Situation | Do you file Form 8971 | Do you furnish Schedule A | Why |

| Required Form 706 filed | Yes | Yes, for non‑excepted property | Basis consistency applies to property that increased estate tax |

| Portability only Form 706 | No | No | Explicit exception |

| GST allocation only Form 706 | No | No | Explicit exception |

| All property is excepted | Yes | Generally no | You still file 8971 on time, but do not furnish Schedules A for excepted items |

Sources, IRS instructions and IRM.

Beneficiaries, allocations, and what not to include

Start with a clean roster, names, TINs, addresses, and fiduciary details for trust or estate beneficiaries. If a TIN is missing, send a written request, report “requested” as allowed, and plan to supplement when you receive it. Furnish only the relevant Schedule A to each beneficiary, then record the delivery date in Part II and keep proof.

Who should not receive a Schedule A

- Wholly deductible marital or charitable property, excepted from consistent basis.

- Interests in retirement plans and IRAs expressed in U.S. dollars, also excepted.

- Certain property sold by the estate before distribution in a taxable transaction, when described by the regulations.

Keep one subtle point in mind. Even if all property is excepted, the executor still files Form 8971 on time, you just do not furnish Schedules A for those items. The instructions say this directly.

Precision on allocations

If one person gets an asset, reflect that one to one on Schedule A. If multiple beneficiaries share an item, define exact percentages that total 100.0000 and mirror those on every Schedule A. Indicate whether each item increased estate tax. Values and percentages on the Schedules A must reconcile to the Form 8971 you file.

Single‑beneficiary steps

- Create the beneficiary record.

- Assign that beneficiary to the asset.

- Prepare and furnish the Schedule A, then record the delivery date on Form 8971.

- Keep proof of delivery with the file.

Multi‑beneficiary steps

- Build the list of beneficiaries and define exact percentages that total 100.0000.

- Assign the ratio to the asset and generate per‑recipient Schedules A.

- Confirm totals and values match across every Schedule A and Form 8971.

- Verify no Schedule A is furnished for excepted property like wholly deductible marital or charitable items.

Practical furnishing, paper or electronic

You can furnish by hand, mail, private delivery, or email. For email or portals, get consent in your engagement documents, use encryption or a secure portal, and retain confirmations. Enter the correct date in Part II. If you cannot locate a beneficiary by the deadline, report your efforts and supplement when you do locate them.

Save yourself a headache, keep a one page “furnishing log” that lists the beneficiary, method, date, tracking or confirmation, and initials of the person who sent it. Five minutes now saves hours later.

A note on spouse, QTIP, and charity

Clients often ask whether to list a surviving spouse or QTIP trust. If the property is wholly deductible for marital or charitable deduction purposes, it is excepted from the consistent basis rules, so you generally do not furnish Schedule A for those assets. If deductions are partial and estate tax is still due, the property may be subject to consistent basis, so include it. The regulation examples are helpful when you are on the fence.

Final regulations you should know, and what changed

In 2024, Treasury and the IRS finalized the consistent basis and reporting regulations, T.D. 9991. Two changes matter most in daily work. First, the “zero basis” rule in the older proposals was removed, which avoids punitive results for beneficiaries when property is discovered or corrected later. Second, the rules clarified what counts as included property, how to determine final value, and when to supplement. Effective date is September 17, 2024, so your 2025 filings use these final rules.

The regulations also confirm how initial basis works before there is a final value, how adjustments under other Code provisions fit with consistency, and how penalties apply if someone claims a basis above final value. If you sell before final value is set, you can rely on the reported value on the beneficiary Statement, then adjust if the final value later differs, subject to normal statute rules.

AICPA input, and instruction updates

Professional groups pushed for clarity, and the Service has been updating instructions and posting operational notices like the Florence, KY address. Articles from the profession note that many AICPA recommendations made it into the final regulations, including removal of the zero basis rule, clearer treatment for marital and charitable property, retirement accounts, beneficiary loan forgiveness, deferring some reporting until actual distribution, and practical guidance on supplements.

Common edge cases you will see

- Property sold before distribution If the estate sells an item in a taxable transaction before any beneficiary receives it, that item can be excepted from Schedule A. Keep the sale documentation and dates with your file.

- Retirement accounts and IRAs Interests in retirement plans and IRAs expressed in U.S. dollars are excepted property, so you generally do not furnish Schedules A for those interests.

- All assets are excepted, do you still file Yes. The executor still files Form 8971 on time, even when no Schedules A are furnished, because the estate was required to file Form 706.

- Portability or GST‑only filing No Form 8971 is required when Form 706 is filed solely to elect portability or solely for GST allocation. Confirm facts before you rely on the exception.

Quality control, five quick tests before you ship

- Dates match the earlier of rule for both filing and furnishing.

- Every Schedule A ties to the Form 8971 totals and percentages sum to 100.0000.

- Each delivery date is entered in Part II and you have proof on file.

- Items marked as not increasing estate tax are truly wholly deductible marital or charitable property.

- Any item a beneficiary acquires after the 706 due date has a January 31 tickler for the supplemental Schedule A.

Documentation kit I keep on every case

- Master beneficiary sheet with TIN status and contact details

- Asset classification list with citations showing subject to consistency or excepted

- Allocation worksheet for shared items that totals to 100.0000

- Furnishing log with method, date, and confirmation

- Supplement tracker, reasons, and due dates

Where Accountably fits, if you are scaling delivery

If your firm runs multiple estates at once, the challenge is less about tax theory and more about hitting the earlier of rule while keeping reviews tight. In those cases, a disciplined offshore delivery system can help you standardize workpapers, layer reviews, and track every Schedule A through a live workflow, so you hit the 30 day window with clean files and proof of delivery. Use this only if it truly supports your process, since capacity without structure adds risk. This is exactly the kind of controlled offshore delivery our team at Accountably builds for firms that want speed without giving up review protection or security. Keep it pragmatic, adopt only the pieces that remove your bottlenecks.

Practical tips, addresses, and quick answers

Mailing address to use in 2025

File Form 8971 and attached Schedules A at, Internal Revenue Service, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042. The IRS says not to use older addresses that appear in some PDFs. Use tracked mail or an approved private delivery service.

Email delivery, done right

Email is allowed, provided you can prove delivery. Get consent, use encryption or a portal, and keep confirmations. Enter the exact date furnished on the form. For trusts or estates with multiple fiduciaries, giving Schedule A to one trustee or executor is enough.

FAQs

What is the purpose of Form 8971

You use it to identify beneficiaries who received property and to furnish each beneficiary a Schedule A with the estate tax value. This supports basis consistency and links to the Form 706 timeline using the earlier of 30 days rule.

What assets are excluded from Schedule A

Excepted property includes wholly deductible marital or charitable property, interests in retirement plans and IRAs expressed in U.S. dollars, certain cash items, and other categories listed in the regulations. If all property is excepted, you still file Form 8971, but you generally do not furnish Schedules A.

Does everyone have to file an estate tax return

No. You file Form 706 only when required under section 6018 or to make specific elections. Form 8971 rides on that requirement, with explicit exceptions for portability only and GST only submissions.

Do you report an IRA on Form 8971

Usually no. Interests in retirement plans and IRAs expressed in U.S. dollars are excepted from the consistent basis rules, so you generally do not furnish Schedule A for them, even when the account appears on Form 706.

When do I supplement

You supplement when information changes or when a beneficiary acquires property after the Form 706 due date and it was not previously reported on that beneficiary’s Schedule A. Use the January 31 rule for property a beneficiary acquires after the due date. Check the supplemental filing box and report only the changes.

Quick compliance blueprint you can copy

- Decide if Form 8971 is required. Watch the portability and GST exceptions.

- Set the earlier of 30 day deadline the day you set your Form 706 plan.

- Build the beneficiary list and request any missing TINs in writing.

- Classify assets as subject to consistency or excepted, and cite your source.

- Allocate precisely and reconcile totals to Form 8971.

- Furnish each Schedule A, record the date, and keep proof.

- Track supplements and use the January 31 rule for after‑acquired property.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk