Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

You file Form 8971 and furnish each beneficiary’s Schedule A within 30 days of the Form 706 due date or the actual filing date, whichever is earlier. For later distributions, you file a supplemental package by January 31 of the year after the beneficiary actually acquires the property. That shift matters, and it is now in black and white in the updated IRS instructions.

Key Takeaways

- You file Form 8971 and furnish a separate Schedule A to each beneficiary no later than 30 days after the Form 706 due date, including extensions, or 30 days after Form 706 is filed, whichever is earlier.

- Required Schedules A cover property a beneficiary has actually acquired by that 30‑day point. You may send an optional Schedule A to someone you reasonably believe will acquire the property, then update if the final recipient changes.

- For distributions that occur after the 30‑day window, you must furnish the beneficiary’s Schedule A and file a supplemental Form 8971 by January 31 of the year after the beneficiary acquires the property.

- Portability‑only estates, GST‑only filings, and estates under the basic exclusion amount are generally outside the Form 8971 regime.

- The 2024 final regulations, T.D. 9991, removed the proposed automatic zero‑basis rule and confirmed that basis consistency applies only to “included property,” that is, property whose inclusion increases the federal estate tax.

Quick note, this article is general information, not tax advice. Always check your facts and dates against the current IRS instructions and regulations for your decedent’s year of death.

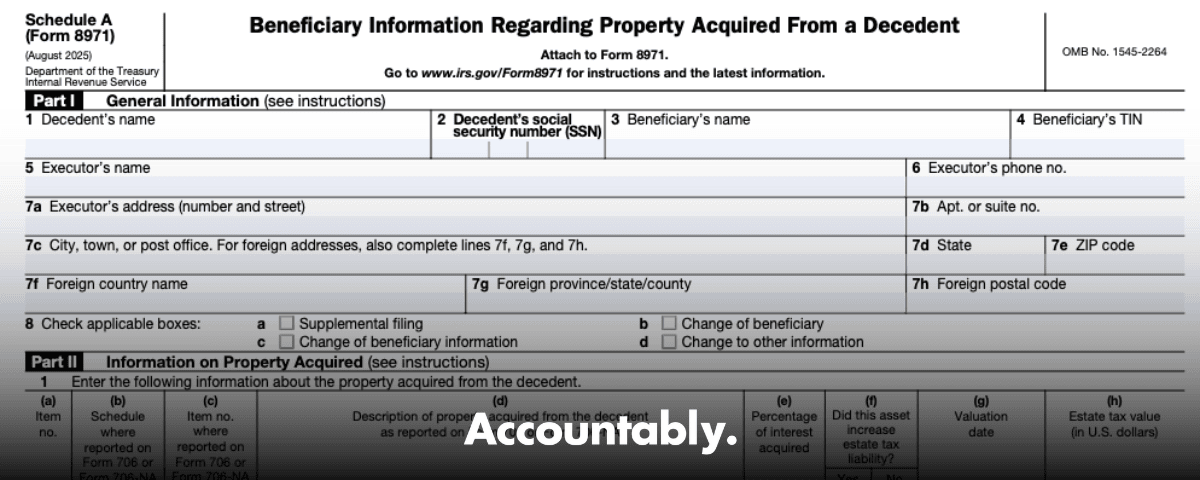

What Form 8971 And Schedule A Do

Form 706 reports the estate tax itself. Form 8971, with beneficiary‑specific Schedules A, transmits the estate‑tax value of particular assets to both the IRS and the recipient so the recipient’s basis stays consistent with the estate’s numbers under sections 6035 and 1014(f). Prepare a separate Schedule A for each beneficiary that has acquired property by the 30‑day mark, list the asset details, and include the value reported on Form 706. Keep proof of when each Schedule A was furnished, because you will certify those dates on the form.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Why The 2024–2025 Changes Matter

Two shifts made compliance more workable:

- You no longer blanket beneficiaries with every possible asset. Required Schedules A cover property actually acquired by the beneficiary at that time, and you can use optional Schedules A when you reasonably expect a beneficiary to receive an item, then update if the recipient changes.

- The proposed zero‑basis presumption for omitted assets is gone. The consistent‑basis cap applies to included property that increased estate tax after credits, not to every item on the return.

Who Must File, And Who Is Out

If you are required to file Form 706, you generally must file Form 8971 and furnish Schedules A. If the estate is below the basic exclusion amount or the return is filed solely to elect portability of DSUE, or solely for a GST election/allocation, Form 8971 does not apply. The Internal Revenue Manual and the updated instructions both confirm this. Keep documentation that supports your decision, especially for portability‑only filings.

At‑A‑Glance Filing Matrix

| Scenario | Form 8971/Schedule A required | What you do |

| Estate must file Form 706, tax could be affected | Yes | File within 30 days, furnish Schedules A to beneficiaries who have acquired property |

| Portability‑only (DSUE), no Form 706 required under 6018 | No | Keep portability workpapers and your DSUE computation |

| GST‑only or protective filing, under threshold | No | Retain records that show limited purpose |

| Trust later distributes property it received from the estate | Yes, trustee duty | Trustee furnishes Schedule A to trust beneficiaries and files supplemental Form 8971 as required |

Sources, IRS instructions and final regs.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallFiling Deadlines You Cannot Miss

- Initial deadline, no later than the earlier of 30 days after the Form 706 due date, including extensions, or 30 days after Form 706 is actually filed.

- Supplemental deadline for property acquired after that window, January 31 of the year following the beneficiary’s acquisition.

- Supplemental deadline for changes triggered by amended 706 filings or audit‑determined final value, generally 30 days after the information becomes available.

Keep your delivery proof, such as email delivery receipts, read confirmations, or certified mail records. The instructions explicitly direct you to certify the date furnished and to retain evidence.

Where And How To File, Plus Delivery Proof That Sticks

You must file Form 8971 with the IRS at the current processing address. As of August 2025, the Service directs you to mail Form 8971 with all required Schedules A to:

Internal Revenue Service, Mail Stop 824G, 7940 Kentucky Drive, Florence, KY 41042.

The IRS also posted a specific “where to file” update in August 2025. If you have a saved PDF of older instructions, do not use the first‑page address on that version. Use the updated Florence, Kentucky address above.

Furnish each Schedule A directly to the beneficiary, to the trustee of a beneficiary trust, or to the executor of a beneficiary estate, and only to that recipient, by email, in person, U.S. mail, or an approved private delivery service. On Form 8971 you certify the date furnished, so keep proofs of delivery in your file.

Delivery Checklist You Can Reuse

- Email, save server‑stamped sent items and any automatic receipts, and a PDF of the Schedule A that was sent.

- Paper, send certified mail, keep the green card or carrier proof, and scan it to the file.

- Multiple fiduciaries, if a trust or another estate is the beneficiary, delivery to one trustee or one executor is sufficient, keep notes on who received it.

Basis Consistency In Plain English

Most inherited assets get a basis set by the estate tax value. Section 1014(f) caps the recipient’s initial basis at the final estate value when, and only when, including the property increased the estate’s federal estate tax after credits. If that value later changes because of an amended 706 or an audit that sets a final value, you update via a supplemental filing. The final regulations, effective September 17, 2024, clarify these mechanics and tie them to the consistent‑basis rules in sections 1014 and 6035.

The cap applies to “included property,” not everything on the return, and the automatic zero‑basis idea for omitted items did not make it into the final rule.

What Changed Versus The Old Proposals

- The zero‑basis presumption for omitted assets is out. Good‑faith omissions no longer default to a basis of $0, though enforcement remains for willful conduct.

- The rules let you defer beneficiary statements for assets not yet acquired, then report later on a fixed January 31 timeline. This reduces the guesswork that used to lead to over‑reporting.

- Beneficiaries who later gift inherited property no longer have a separate basis‑reporting duty. Trustees, however, still have reporting obligations when they distribute property that came from the estate.

Optional Versus Required Schedules A

- Required Schedules A, list property a beneficiary has acquired by the 30‑day deadline, then furnish only to that beneficiary.

- Optional Schedules A, if you reasonably believe a beneficiary will acquire an item later, you may furnish a statement early. If that beneficiary ends up receiving it, you do not need a supplemental 8971 just to record the acquisition. If someone else receives it, you must update the IRS and correct the statements within 30 days of knowing the change.

Practical Example

Say you file Form 706 on April 15. By May 15, a child has already received the brokerage account, so you must include that on the child’s Schedule A. The house is still pending. You may send an optional Schedule A to the residuary trust naming the house. If, by September, the house actually goes to a different child, you have 30 days from that decision to file a supplemental 8971 and furnish corrected Schedules A, or you can wait and use the January 31 rule if the acquisition occurs after the 30‑day window.

Portability‑Only Estates, Below‑Threshold Estates, And Other Exceptions

You skip Form 8971 when the estate is below the basic exclusion amount or the Form 706 is filed solely to elect portability of DSUE or solely for a GST election/allocation. If you rely on an exception, document it. Keep the DSUE computation, asset schedules, and your memo that explains why 6035 does not apply. The IRS instructions and IRM section 4.25.2 both say portability‑only estates are out.

Table, Who Files And When

| You are | Must file 8971? | When to furnish Schedule A |

| Executor required to file 706 under 6018 | Yes | Within 30 days of 706 due date, or 30 days after filing |

| Executor filing 706 solely for DSUE portability | No | Not applicable, keep portability proof |

| Executor filing 706 only for GST allocation, estate under threshold | No | Not applicable, keep GST documentation |

| Trustee who later distributes inherited property | Yes, trustee duty | January 31 of the year after the trust beneficiary acquires the property |

References, IRS instructions and final regs.

Supplemental Reporting And Update Triggers

Your duty to supplement continues until values are final for all included property, or later, until all such property has been acquired. You must supplement when a beneficiary later acquires property not previously covered, when a different person takes property than the one you identified, when you amend Form 706, or when the IRS sets a final value that differs from what you reported.

- Later acquisition, furnish Schedule A and file a supplemental Form 8971 by January 31 of the year after acquisition.

- Change in recipient, generally file within 30 days after the information becomes available that a different beneficiary will acquire the item.

- Amended 706 or final value, supplement within 30 days of filing the amendment or of the date final value is determined.

Trustees, Your Specific Role

If a trust receives property from the estate and later distributes it in kind, the trustee must furnish Schedules A to the trust beneficiaries and file the supplemental 8971 on the same timeline, often the January 31 deadline after the beneficiary’s acquisition. This is distinct from a beneficiary’s gift of inherited property, which no longer triggers a beneficiary reporting duty under the final regs.

A Simple Trustee Workflow

- Track the date the trust actually distributes each asset.

- Tie every asset to the estate tax value from the filed Form 706.

- Furnish each Schedule A to the recipient, file the supplemental 8971 by January 31, and keep delivery proof with the trust’s administrative file.

Penalties And Reasonable Cause

The IRS applies information return penalties for late, missing, or incorrect filings, as well as for late or incorrect beneficiary statements. Reasonable cause relief is available when the failure was beyond your control and you acted responsibly before and after the issue. The instructions also describe a de minimis safe harbor for small dollar errors on Schedules A if other conditions are met. Count your exposure carefully, fix errors promptly, and document your efforts.

Keep a single “8971 file,” store delivery proofs, transmission logs, correspondence, and contemporaneous notes. It is the best defense you can have if the IRS questions timing or accuracy.

Step‑By‑Step, Getting Schedules A Right

Single‑Beneficiary Allocation

- Create the beneficiary record first, confirm they are not the surviving spouse or a QTIP beneficiary when that would be excepted from reporting.

- Assign the asset to that beneficiary at 100% so the Schedule A matches the estate value you reported on Form 706.

- Generate the Schedule A, furnish it within 30 days, and store proof of delivery.

Multi‑Beneficiary Allocation

- Create separate records for each beneficiary with exact percentages, for example four at 25.0000 each, and validate that the total is 100.0000%.

- Produce separate Schedules A that show each beneficiary’s percentage of the estate tax value.

- If the split changes later, file a supplemental 8971 and furnish corrected Schedules A on the right timeline.

Practical Tips That Save Time

- Use calendar holds that map the 30‑day clock from the 706 due date and from the 706 filing date, whichever is earlier, then add a January 31 reminder for any items scheduled to distribute later.

- Tag assets in your workflow tool with “included property” status, which helps reviewers confirm that basis consistency actually applies.

- When you must send an optional Schedule A, add a flag to revisit the recipient within 60 to 90 days. If the recipient changes, track the 30‑day supplement rule.

Sample Language For Your File

On October 10, we furnished Schedule A for Account 1234 to Beneficiary A by certified mail. The asset is included property. Proof of delivery scanned to the 8971 file. If the residuary shift occurs as expected in December, revisit recipient and file a supplemental by January 31 if Beneficiary B acquires the property.

FAQs

What is a Schedule A of Form 8971?

It is a beneficiary statement listing the item a beneficiary acquired, its description and item number, and the estate tax value used to set initial basis. You rely on it for basis and to avoid disputes, and the executor must keep proof of when it was furnished.

What is IRS Form 8971 used for?

Form 8971 identifies beneficiaries who must receive basis information and sends copies of the furnished Schedules A to the IRS. It enforces basis consistency and creates the paper trail that ties Form 706 values to the recipient’s basis.

Who needs to furnish a Schedule A?

Executors furnish Schedules A to beneficiaries who have acquired property by the 30‑day deadline. Trustees furnish Schedules A when they later distribute property the trust received from the estate.

What are the due dates?

The earlier of 30 days after the Form 706 due date, including extensions, or 30 days after filing Form 706. Later acquisitions use the January 31 rule for the following year. Changes from amended returns or final value are generally due within 30 days of when the information becomes available.

Closing Thought, Then A Light Next Step

You can make Form 8971 predictable by anchoring your process to three beats, the 30‑day initial window, optional statements only when you are confident, and the January 31 sweep for everything that happened later. That rhythm will keep your basis consistent and your files clean.

If you lead a CPA or EA firm and you want help standardizing workpapers, reviewer protection, and verifiable 8971 delivery inside your own systems, our team at Accountably can integrate disciplined offshore capacity without sacrificing control. Ask for a quick workflow audit, and we will show you where the 30‑day and January 31 steps can be automated securely.

- IRS, Instructions for Form 8971, updated August 29, 2025.

- IRS, address update for Form 8971, posted August 7, 2025.

- Final regulations, T.D. 9991, effective September 17, 2024.

- Practitioner summaries of T.D. 9991, KPMG TaxNewsFlash and Journal of Accountancy.

Notes, This guide is general information for U.S. federal tax purposes as of October 29, 2025, and is not tax or legal advice. Always check current IRS instructions for your facts and deadlines.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk