Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

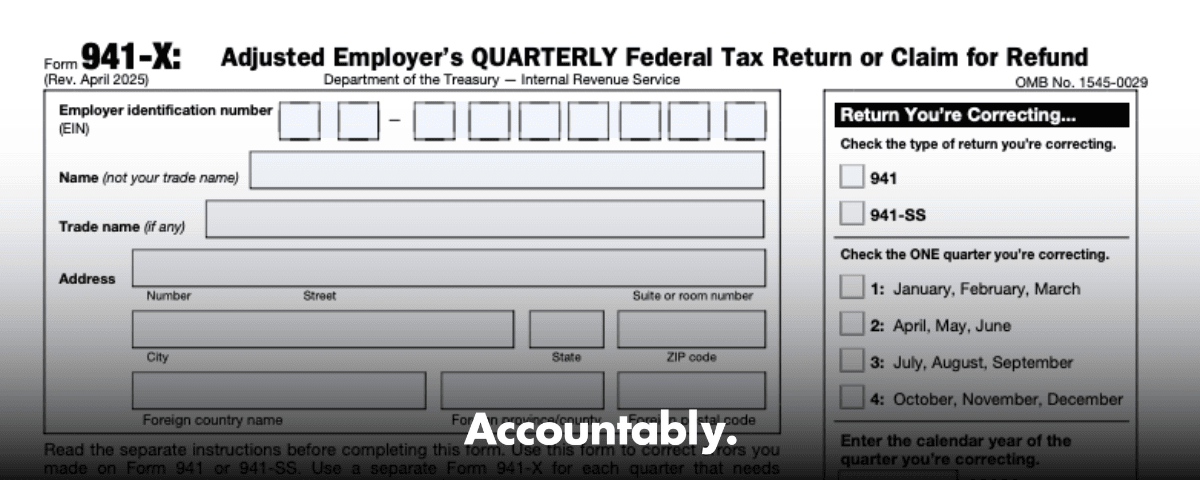

This guide walks you through what Form 941‑X does, when to file it, how to choose between a credit and a refund, and how to write a rock‑solid explanation that reviewers appreciate. I will show you where e‑file now helps, what changed in 2025, and the traps that cause penalties. You will leave with a checklist you can use today.

Before we dig in, two quick notes. First, everything here is educational, not tax advice. If you are unsure, talk to your tax advisor. Second, if your team is already buried, do not feel guilty about getting help. The goal is accurate, timely filings and fewer 2 a.m. fire drills, not heroics.

Key takeaways

- Form 941‑X lets you correct a previously filed Form 941 for a specific quarter, including wages, withholding, Social Security, Medicare, Additional Medicare, and certain credits. File a separate 941‑X for each quarter and include the date you discovered the error.

- You can now e‑file Form 941‑X through IRS Modernized e‑File, which speeds acknowledgments and reduces mailing issues. Confirm your software supports amended 94x e‑file.

- Timing matters. For overpayments, you generally have the later of three years from the original 941 filing or two years from payment. For underpayments, the three‑year window applies. Enter the discovery date and, for interest‑free treatment on underpayments, pay by the due date of the return for the quarter in which you discovered the error.

- Forms 941‑SS and 941‑PR were discontinued after Q4 2023. Employers in U.S. territories now file Form 941 or the Spanish Form 941, sp. Prior 941‑SS or 941‑PR periods are still corrected with the appropriate 941‑X variant.

- Select credit versus refund with care. If you overreported, you may apply a credit forward or file a refund claim. Each path has timing nuances and documentation requirements.

- For research payroll tax credit adjustments, remember the Inflation Reduction Act increased the election cap to 500,000 for tax years beginning after December 31, 2022. That interacts with Form 8974 and your 941, and it can show up in 941‑X corrections.

What Form 941‑X is and when you need it

Think of Form 941‑X as a quarter‑specific repair order. You file it to fix amounts you reported on a previously filed Form 941. Typical drivers include mis‑coded pay items, late tips, bonus true‑ups, group‑term life adjustments, third‑party sick pay, or credit calculations that changed after close. You must file one 941‑X per affected quarter, and you must state the date you discovered the error. That discovery date is not busywork. It matters for interest and penalty relief on underpayments.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

You will usually reach for 941‑X when you need to correct:

- Wages, tips, and other compensation

- Federal income tax withheld

- Social Security wages and tips, Medicare wages and tips, and Additional Medicare tax

- Certain credits, like the qualified small business payroll tax credit for increasing research activities, and time‑limited COVID‑19 credits for the allowed quarters

You will not use 941‑X to change headcounts, fix Schedule B liability timing, or correct non‑941 forms such as 940. You will also avoid it for state unemployment or W‑2 issues that do not change federal 941 amounts.

Quick mental model, if it flows through the 941 math for a specific quarter, and your original 941 is wrong, 941‑X is how you make it right.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallThe 2025 landscape in one glance

A few important updates shape how you file now:

- You can e‑file Form 941‑X using MeF. If your provider supports it, e‑file can cut mailing lag and reduce address mistakes.

- The IRS discontinued Forms 941‑SS and 941‑PR after Q4 2023. Territorial employers now use 941 or 941, sp. Corrections for pre‑2024 941‑SS or 941‑PR still use the matching 941‑X form if the statute is open.

- Several 941‑X lines became “Reserved for future use,” reflecting expired correction windows for older pandemic‑era items. Always work from the current 941‑X instructions, not a bookmarked PDF from two years ago.

- ERC processing remains under heavy scrutiny. Expect longer review cycles and be ready to provide clean workpapers if your 941‑X touches ERC quarters.

Deadlines, statutes, and the discovery date

When you file matters as much as what you file. The law sets firm windows to correct returns and, for underpayments, gives you a way to limit interest if you act on time.

The core timing rules

- Overpayments, refunds and credits You generally have the later of, three years from the original Form 941 filing date, or two years from the date you paid the tax reported on that 941. The later date controls for refunds or credits.

- Underpayments, money you owe You generally have three years from the original Form 941 filing date to correct underreported tax. For interest‑free treatment, file the 941‑X by the due date of the return for the quarter in which you discovered the error, and pay the balance by the time you file. Enter the discovery date.

Here is a quick reference you can save:

| Trigger | Your window | Why it matters |

| Discovery date of an underpayment | File by the due date of the quarter in which you discovered it, and pay with filing, to get interest‑free treatment | Keeps penalties and interest in check if you act on time |

| Original 941 filing date | 3 years | Standard correction window |

| Tax payment date | 2 years | Refunds and credits use the later of 3 years from filing or 2 years from payment |

| Final 90 days of the statute | Claim process required for overpayments | The adjustment process is off the table in the last 90 days |

Tip, do not cut it close. If you want to apply an overpayment as a credit to your current quarter, file your 941‑X early in the quarter so the credit posts before you file your next 941. The instructions even encourage filing in the first two months when you can.

E‑file is now available, and it helps

Modernized e‑File acceptance for 941‑X is a practical change. If your software supports amended employment returns, e‑file can shorten cycle time and reduce address mistakes. Some providers rolled out support during 2024 and expanded it in 2025.

Territorial forms changed in 2024

If you previously filed 941‑SS or 941‑PR, the world shifted in 2024. Those versions were discontinued after Q4 2023. Employers in U.S. territories now use Form 941, and those who prefer Spanish can use Form 941, sp. For corrections, older 941‑SS or 941‑PR quarters still use the matching 941‑X variant where the statute remains open.

Bottom line, file promptly, document your discovery date, and use e‑file where possible. You will save time and avoid avoidable notices.

What you can, and cannot, fix with 941‑X

Yes, you can correct these

- Wages, tips, and other compensation that flow into Social Security and Medicare calculations

- Federal income tax withheld for the quarter

- Social Security, Medicare, and Additional Medicare tax amounts

- Eligible credits for the quarter, including the qualified small business payroll tax credit for increasing research activities, which interacts with Form 8974 and your 941 figures

No, do not use 941‑X for these

- Changing the number of employees on line 1 of the original 941

- Fixing liability timing in Part 2 or Schedule B, those have separate instructions

- Non‑941 forms, such as 940, 943, or 944, use the “‑X” for that form instead

- State unemployment filings or W‑2 issues that do not alter federal 941 amounts

- Claiming COVID‑19 leave credits outside the allowed windows, most employers cannot claim periods after September 30, 2021

If the IRS has examined the period or issued a specific notice or demand, follow the procedures in that notice. Interest‑free treatment may not apply in those cases.

A quick example to make it concrete

Say you discover in July that a box 12 code error underreported Medicare wages in Q1. You have an underpayment. Because you discovered it in Q3, file the Q1 941‑X and pay by October 31 to get interest‑free treatment. Include the discovery date in the header, explain your math in Part 4, and make sure Line 27 is paid when you file.

Choosing between a credit, a refund, or an interest‑free adjustment

When you overreport tax, you have two paths. When you underreport, you have one path that can be interest‑free if you act on time. Here is how to choose without second guessing later.

Overreported tax, two paths

- Adjustment process, apply it forward Check the box to apply a credit to your next 941. File the 941‑X more than 90 days before the statute closes, and preferably in the first two months of the quarter so the credit shows before you file the next 941.

- Claim process, ask for a refund Check the claim box and request a refund or abatement any time before the statute closes. If you are inside the last 90 days of the period of limitations, the claim process is required.

Tip, want the money to hit your cash account, not your next deposit line, go claim. Want to cleanly offset your next quarter’s liability, go adjustment.

Underreported tax, one path with a timing benefit

For underreported tax, file the 941‑X by the due date for the quarter in which you discovered the error, and pay the amount by the time you file. If you do both, you generally avoid failure‑to‑pay and failure‑to‑deposit penalties and interest, which protects your margins. Enter the discovery date, and explain the correction in detail on line 43.

ERC context in 2025

If your correction touches Employee Retention Credit quarters, be patient and precise. The IRS paused new ERC claims in September 2023 and has kept a heavy review posture. Expect longer review cycles and be ready to provide clean workpapers if your 941‑X changes prior ERC math.

Research payroll tax credit corrections

If you are adjusting the qualified small business payroll tax credit for increasing research activities, remember that the cap increased to 500,000 for tax years beginning after December 31, 2022. That interacts with Form 8974 and the order of application, first against the employer Social Security share, then against Medicare for quarters beginning in 2023, with any remainder carried forward. Your 941‑X should include the corrected 8974 and a clear line 43 narrative.

Payment and refund options, in plain English

- If Line 27 on 941‑X is positive, you owe tax. Pay in full when you file. That is how you keep the correction interest‑free if you met the discovery‑quarter due date.

- If Line 27 is negative, you have an overpayment. Choose a refund or apply the credit to your next return in Part 1. If the statute has fewer than 90 days left, use the claim process, not the adjustment process.

- If you file late on an underpayment and you are a semiweekly depositor, attach an amended Schedule B to avoid an averaged failure‑to‑deposit penalty.

Keep proof. Save your submission, acknowledgments, and EFTPS payment confirmations with your 941‑X package. Future you will thank present you.

How to complete Form 941‑X, step by step

Here is a short workflow my team uses so nothing gets missed.

Prep, the five‑minute checklist

- Pull the original 941, the payroll register for the quarter, and any corrected reports.

- Identify exactly which 941 lines change, and why.

- Note the date you discovered the error.

- Decide if you owe or are due money.

- Decide whether you want a credit forward or a refund if overreported.

Fill the form in this order

- Header

- Employer name, EIN, quarter, year, and the discovery date.

- Part 1, select your path

- Overreported, choose adjustment to apply as a credit, or claim to request a refund.

- Underreported, choose the adjustment path and remember to pay when filing.

- Part 3, make the math unambiguous

- For each line you are correcting, complete Column 1 with the corrected amount, Column 2 with the previously reported amount, and Column 3 with the difference.

- For tax lines that require it, compute Column 4, the tax change, using the correct rate. Show your math in your explanation if it is not obvious.

- Part 4, explain your corrections

- Use line 43 to write a clear, specific narrative for each corrected line. Mention the cause, the calculation, and the documents that support it. The regulations require detailed grounds and facts, so avoid vague one‑liners.

- Part 5, sign and date

- Authorized signature and title. E‑filed returns follow your provider’s signature workflow.

- Attachments

- Include a corrected Form 8974 if research payroll credit amounts are affected.

- Add schedules, reconciliations, or a short workpaper that ties payroll detail to the corrected lines.

Use consistent file names. Reviewers love finding “Q2‑2025_941X_Workpapers.xlsx” instead of a mystery spreadsheet.

A sample line 43 structure you can reuse

- Line corrected, for example “Line 5c, Medicare wages and tips.”

- What changed, “Corrected Medicare taxable wages decreased by 2,000 based on payroll register audit, PR Batch 2025‑Q1‑Adj.”

- How you calculated it, “Column 3 difference times 1.45 percent equals 29 decrease in employer Medicare tax, reflected in Column 4.”

- Discovery date, “Discovered July 11, 2025 during quarter‑end reconciliation.”

- Attachments, “See Attachment A for register detail and Attachment B for mapping fix.”

That format answers every question an IRS reviewer will ask and keeps your own team aligned.

Filing methods, addresses, and signatures

You can e‑file or mail. If you e‑file, follow your provider’s steps and keep the acknowledgment. If you mail, use the address in the current 941‑X instructions. As of the April 2025 instructions, the Ogden, Utah addresses handle most paper 941‑X filings and the IRS lists a physical street address for private delivery services. Always confirm the latest instructions before you send.

If your 941‑X is late and you are a semiweekly depositor with an underpayment, remember the amended Schedule B rule to avoid averaged penalties.

Penalties, interest, and practical compliance tips

Penalties hurt more than they should because they are avoidable with a few habits.

- Use the discovery‑quarter rule for underpayments. File by the due date for the quarter in which you discovered the error, and pay when you file to keep the correction interest‑free. Enter the discovery date.

- Write a detailed explanation on line 43. Explain the error, the math, the period, and the documents you used. Vague explanations slow processing and can trigger questions.

- Do not mix processes. If you need both a refund and an underpayment correction, file separate 941‑X forms. Follow the claim process for refunds inside the final 90 days of the statute.

- Keep a clean audit trail. Save PDF copies, e‑file acknowledgments, EFTPS confirmations, and your workpapers together.

The 2025 change log you should know about

- E‑file for 941‑X is available through MeF, and support expanded through 2025.

- Several 941‑X lines are now reserved for future use because the period of limitations has expired for most employers. Work from the April 2025 instructions so your line references match the current layout.

- Territorial forms 941‑SS and 941‑PR ended after 2023, and 941, sp is available if you need Spanish.

- The qualified small business research payroll tax credit cap remains 500,000 for tax years beginning after December 31, 2022.

- ERC risk reviews remain active, which can stretch timelines when refunds intersect ERC quarters.

Real‑world housekeeping to avoid repeat errors

- Lock your quarter. After filing the 941, lock payroll ledgers and require a short change‑control form for any edits.

- Standardize workpapers. Use the same tabs every quarter, for example, wages, tips, credits, deposits, and variances, so reviews move faster.

- Document discovery. If an error clears your threshold, record the date and the root cause in a simple log. That date goes on your 941‑X.

- Train one explainer. Have one person own line 43 narratives. Consistency is your friend.

Where Accountably fits, briefly

If your team is stuck in production and review loops, getting 941‑X right can steal nights and weekends. When we support firms, we plug trained offshore accountants into your workflow, use your systems, and enforce SOPs, naming conventions, and a layered review, preparer, senior, quality, and final review. That structure keeps line 43 narratives crisp, ties numbers to workpapers, and reduces partner time in review. It is not resume farming, it is disciplined delivery with visibility, SLAs, and continuity, so you can scale compliance work without chaos.

Our teams work inside the tools firms already use, QuickBooks, Xero, UltraTax, CCH Axcess, ProConnect, Lacerte, Drake, Karbon, TaxDome, Suralink, and others. If you need a steady 941‑X process that does not burn out your staff, this kind of operational control makes a difference.

FAQs, fast and direct

What is a 941‑X form, in one sentence?

It is the IRS form you use to fix a previously filed quarterly payroll tax return, one quarter per form, including corrections to wages, withholding, Social Security, Medicare, and certain credits, with a required discovery date and a clear explanation on line 43.

How long do I have to file a 941‑X?

For overpayments, you generally have the later of three years from the original 941 filing date or two years from the date you paid that tax. For underpayments, you generally have three years from the original filing. For interest‑free treatment on underpayments, file by the due date of the quarter in which you discovered the error and pay with the filing.

Can I e‑file Form 941‑X?

Yes. The IRS now accepts 941‑X through Modernized e‑File. Check whether your software supports amended 94x e‑file and follow its signature process.

What goes in the line 43 explanation?

Give detailed grounds and facts. State what was wrong, exactly which lines are affected, how you computed the correction, when you discovered it, and what documents support it. Avoid vague statements like “payroll errors.” Attach schedules if you need more room.

Where do I mail a paper 941‑X?

Use the addresses in the current 941‑X instructions. As of April 2025, the IRS directs most paper filings to Ogden, Utah, and lists a street address for private delivery services. Always confirm the latest instructions before mailing.

Does the 941‑SS or 941‑PR change affect me?

Yes if you are in U.S. territories. Starting with Q1 2024, use Form 941 or 941, sp. For older quarters originally filed on 941‑SS or 941‑PR, use the appropriate 941‑X variant if the statute remains open.

What about ERC on a 941‑X in 2025?

Expect longer reviews. The IRS paused new ERC claims in September 2023 and has kept a heavy risk review posture, which can slow refunds when 941‑X changes touch ERC quarters.

How do research credit changes show up on 941‑X?

If you are correcting amounts tied to the qualified small business payroll tax credit for increasing research activities, remember the cap is 500,000 for tax years beginning after December 31, 2022. Attach a corrected Form 8974 and explain the change on line 43.

Step‑by‑step 941‑X checklist you can reuse

- Confirm the quarter, the affected lines, and whether it is an overpayment or underpayment.

- Write down the discovery date.

- Decide credit forward versus refund if you overreported.

- Complete Columns 1 to 3 for each changed line, and Column 4 where required.

- Draft a specific line 43 explanation and list attachments.

- Sign Part 5 and pay Line 27 if you owe.

- E‑file when supported, otherwise use the current mailing address and a trackable delivery.

- Save acknowledgments, proof of mailing, and EFTPS receipts with your workpapers.

If you serve many clients, standardize this checklist as a one‑page PDF and store it with each 941‑X package.

Practical scenarios and templates

Underreported Medicare wages discovered in Q3

- Situation, a benefit code error reduced Medicare wages by 2,000 in Q1.

- Action, file Q1 941‑X during Q3, pay the resulting tax with filing by October 31 for interest‑free treatment, include the discovery date, and explain the math on line 43.

Overreported Social Security due to duplicate bonus import

- Situation, a duplicate import overstated Social Security wages in Q2 by 5,500.

- Action, choose the adjustment process and file the 941‑X in the first two months of Q3 so the credit posts before you file the Q3 941. If the statute has fewer than 90 days left, switch to the claim process.

Research payroll tax credit correction, cap awareness

- Situation, you elected 300,000 on Form 6765 for 2024, but your Form 8974 was prepared off an earlier draft.

- Action, file 941‑X with a corrected 8974, reference the 500,000 cap rules, and explain the sequence of application and carryforward in line 43.

Templates you can copy

Line 43 template, overreported Social Security

Line 8, Social Security wages, overstated by 5,500 due to duplicate bonus import in PR Batch 2025‑Q2‑BON. Corrected wages in Column 1 reflect audited payroll register and GL tie‑out. Column 3 difference of negative 5,500 times 12.4 percent equals negative 682 tax change in Column 4. Error discovered July 8, 2025. Attachments, A, payroll register excerpts, B, import log, C, reconciliation worksheet.

Line 43 template, underreported Additional Medicare

Line 13, taxable wages subject to Additional Medicare, understated by 27,000 due to mapping. Column 3 shows 27,000 difference. Column 4 shows 243 at 0.9 percent. Error discovered September 10, 2025 during quarterly close. Payment of Line 27 included with filing. Attachments, A, corrected register, B, mapping change ticket.

Your next step

- If your issue is small and recent, file now while the discovery‑quarter due date is on your side.

- If you are sorting out multiple quarters, create a short tracker with quarter, discovery date, status, credit versus refund, and mailing or e‑file proof.

- If ERC is involved, expect extra review time and be precise about your worksheets.

If you want a controlled way to push 941‑X work without burning your seniors, an offshore delivery system with SOPs, structured workpapers, and layered review can keep quality high and partner time low. That is the operating model our team uses when we support firms that cannot risk slippage during peak season.

Disclaimer

This guide is for general education. It is not legal, tax, or accounting advice. Always use the current IRS forms and instructions, confirm addresses, and consider your facts and deadlines before filing. For the latest instructions and e‑file information, check the IRS guidance that matches your quarter and your specific facts.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk