Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Form CT‑2 is a procedural print control inside New York corporate workflows for Connecticut wage reporting. You use it when the return is set to paper filing and state e‑file is disabled. It does not compute tax, credits, or adjustments, it only controls whether the attachment prints. If you are filing a combined New York State return, the combined rules override the print control, so CT‑2 will not generate. Below, you will get the what, the how, and the extra checks that keep your review cycle clean.

Key Takeaways

- Form CT‑2 is a print attachment control tied to New York corporate return workflows, it only prints when you set paper filing and disable state e‑file.

- You enable it on the New York General worksheet, Section 1, Line 21, then recalculate, the recalc is what refreshes wage totals and output.

- Combined New York State returns override the forcing control, so CT‑2 will not print for combined filings.

- Wage reporting must respect Connecticut’s unemployment taxable wage base and your assigned rate. For 2025 the taxable wage base is 26,100 per employee, up from 25,000 in 2024, with the new employer rate at 2.2% for 2025.

- Quarterly unemployment reports are generally due Apr 30, Jul 31, Oct 31, and Jan 31, so align your wage data with those cutoffs before you print.

Quick clarification so you do not chase the wrong form

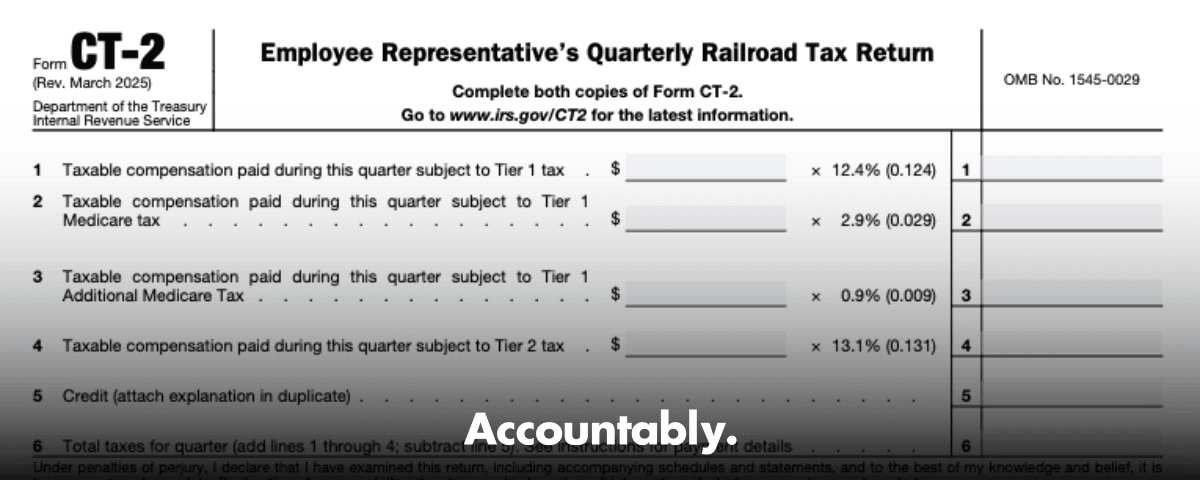

- In this guide, “Form CT‑2” refers to the print control you trigger inside a New York corporate return workflow to include a Connecticut wage‑report attachment. It is not the federal IRS “Form CT‑2” that railroad employers file, and it is not a substitute for your Connecticut unemployment return, which is filed with the Connecticut Department of Labor. Keep your software workflow terms separate from state agency forms to avoid mix ups.

Purpose and scope of Form CT‑2

Think of CT‑2 as a switch that decides when the Connecticut wage attachment shows up in a New York return package you intend to print. You use it for paper workflows only. If you leave electronic filing enabled at the state level, your software protects the e‑file integrity and will not print CT‑2. Scope is tight by design, combined New York State returns do not honor the forcing option, so CT‑2 will not generate for combined groups.

How to turn it on, open the New York taxing authority, go to the General worksheet, Section 1, Basic Data, set Line 21 to the CT‑2 print option that fits your need, then calculate the return. That sequence produces consistent, auditable output.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Tip I give every reviewer, change a print control, then immediately recalc, then preview output. If you skip the recalc step, you end up chasing phantom issues that vanish once totals refresh.

Who must print it, and the filing conditions that matter

You print CT‑2 when all three are true, your corporation has Connecticut nexus, the New York state filing method in your software is set to paper, and state e‑file is disabled. If any of those conditions fail, CT‑2 will not appear. Entities inside a New York combined group cannot force CT‑2, the combined file rules override the control.

Entities required to print

Although CT‑2 is not a taxpayer‑facing return, it must print for specific paper‑filed Connecticut corporate workflows. That includes Connecticut C corporations or S corporations where your software is set to force this printout as part of a New York package. If the New York state return is e‑filed, CT‑2 will not generate, even if you try to force it in the worksheet.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call| Requirement | Action | Outcome |

| Entity type | CT C corp or S corp | Eligible for CT‑2 print control |

| Filing method | Paper filing selected | CT‑2 prints when forced |

| NY combined return | Yes | Option overridden, no CT‑2 |

| Software setting | Line 21 forced | CT‑2 included after recalc |

Income thresholds

Income thresholds do not trigger CT‑2. This form is purely procedural. It prints only when you disable state e‑file, set the CT‑2 print option on the New York General worksheet, Section 1, Line 21, mark the return as paper, and recalc. If any of those are missing, the income level is irrelevant.

Filing timelines you should actually care about

There are two clocks to watch. First, your corporation’s annual return timeline, which controls when the overall package is due. Second, the unemployment calendar quarters, which control when wage data must be final if you are reflecting Connecticut unemployment wages in your documentation.

Annual filing timeline, Connecticut corporate returns

Connecticut corporate business tax returns are due on the fifteenth day of the month following the federal corporate due date. For calendar year filers, that puts the CT‑1120 due date on May 15, not April 15. Connecticut requires electronic filing for corporation business tax returns through myconneCT or MeF. Plan your paper‑print attachments for your New York packet with that in mind.

Quarterly unemployment periods

Connecticut unemployment tax returns and payments are generally due by the last day of the month after each quarter ends, Apr 30, Jul 31, Oct 31, Jan 31. If a due date lands on a weekend or holiday, the next business day applies. If you are a reimbursing employer, you typically get an extra 15 days. Use those dates to anchor your wage caps and year‑to‑date checks before you print.

The exact steps to make CT‑2 appear

Most misses happen because one step in the sequence is out of order. Follow this, and you will save yourself a chase.

- In your software, open the New York taxing authority.

- Go to General worksheet, Section 1, Basic Data.

- On Line 21, choose the CT‑2 print option you need.

- Set the New York state filing method to paper, confirm state e‑file is off.

- Recalculate the return to refresh wage totals and output.

- Preview forms to confirm CT‑2 now prints.

- If you switch back to e‑file later, expect CT‑2 to drop from the print set.

Micro‑anecdote, during a year‑end crunch, a reviewer kept toggling Line 21 without turning e‑file off at the state level. CT‑2 never showed, the team assumed a software bug, and opened a ticket. We flipped the e‑file switch off, hit recalc, and CT‑2 printed. Thirty seconds, problem solved.

Wage reporting and the Connecticut taxable wage base

The heart of accurate unemployment reporting is the wage cap per employee. You cap each employee’s wages at the Connecticut taxable wage base, then apply your assigned unemployment tax rate to those capped wages. Connecticut updated the wage base and the new employer rate, which means your prior year templates may now understate the cap if you left them at old numbers.

- For 2025, the taxable wage base is 26,100 per employee.

- For 2024, the taxable wage base was 25,000.

- The new employer rate is 2.2% for 2025.

Here is a quick progression you can save to your workpapers.

| Year | Taxable wage base | New employer rate |

| 2026 | 27,000 | 1.90% |

| 2025 | 26,100 | 2.20% |

| 2024 | 25,000 | 2.50% |

| 2023 | 15,000 | 2.80% |

Apply the cap, then the rate

- Confirm the year’s wage base, update your payroll export mapping, and make sure each employee’s taxable wages stop at the cap.

- Apply your assigned employer contribution rate to the capped wages. If you are a new employer, start with the Connecticut new employer rate for the year, then transition to your experience rate when assigned.

- Once an employee crosses the cap for the year, stop accruing UI tax for that employee until January 1.

Quarterly timing and payments

- Identify taxable wages for the quarter, cap per employee against the annual base, and exclude the excess.

- Multiply capped wages by your assigned rate to compute the quarter’s liability.

- Remit by the due dates, generally Apr 30, Jul 31, Oct 31, and Jan 31, and keep your confirmation pages in the close binder.

Required employer information that trips people up

Complete the employer’s legal name and any DBA exactly as registered. Enter the Connecticut Tax Registration Number, or your FEIN if a Connecticut number is pending. Use the principal business address, and add a separate mailing address if needed. Assign a responsive contact with phone and email, and make it someone who can answer wage and rate questions on short notice.

- Verify identifiers, match legal name and account numbers before you print.

- Confirm addresses, use a deliverable principal location with full ZIP.

- Set communications, pick a real human who replies fast and keeps an eye on quarter closes.

Enter the reporting period, the number of employees or payrolls covered, then sign, date, and include your title. If you revise Line 21 or switch filing modes, remember to recalc before final output, since totals can shift once the software recognizes the change.

Calculating unemployment tax liability, a clean example

Say you have five employees with Q1 wages of 12,000, 8,000, 30,000, 6,000, and 9,000. For 2025 you cap each at 26,100 for the annual limit, which means in Q1 all of those wages are still under the cap. If your assigned rate is 2.2% as a new employer, your Q1 liability is the sum of capped wages times 2.2%, and you remit by April 30. If one employee crosses the annual cap in Q3, your Q4 accrual for that person drops to zero. This keeps your accruals clean and your reconciliation painless.

Adjustments, credits, and overpayments, and where they actually belong

CT‑2 does not compute adjustments, credits, or overpayments. Keep those on the primary corporate return schedules. For New York corporate work, that often means CT‑3 and CT‑3‑A with supporting forms such as CT‑3.1, CT‑3.3, CT‑3.4, and the CT‑600 credit framework when applicable. If you are in a combined New York State group, work through CT‑3‑A and related schedules. Do not expect CT‑2 to carry any computation, it is only a controlled print attachment.

Practical guardrail, make a one‑page “what computes where” map in your binder. Put wage caps and rates in your CT DOL workpapers, keep New York credits on CT‑3 schedules, and reserve CT‑2 for the print control checklist.

How to file, electronic versus paper, and how CT‑2 fits

CT‑2 only appears when you choose paper filing for the New York return and disable state e‑file. That is by design. In your software, open the New York taxing authority, go to General worksheet, Section 1, Basic Data, set Line 21 to your CT‑2 print option, then recalc before printing.

- If your New York return is eligible for e‑file but your workflow requires a printed CT‑2, switch to paper filing, turn off all state e‑file flags, and regenerate.

- After you pick the print option, verify that calculations run again, many teams forget this and end up with stale totals.

- Before final output, confirm CT‑2 actually appears and that state e‑file remains off.

Keep one important distinction in mind. Connecticut requires electronic filing for corporation business tax returns in myconneCT or through MeF. That rule does not stop you from producing a paper CT‑2 as part of a New York package, it only means you should not try to use CT‑2 in place of a Connecticut e‑filed corporate return.

Recordkeeping and documentation

Treat the CT‑2 sequence like any other control. Document the filing method, the date you switched to paper, and the Line 21 selection on the New York General worksheet. Save the recalculation timestamp, the preview, and the printed output. Keep copies of CT‑2 printouts, supporting schedules, and your wage base verification for at least three years from filing or payment. If your firm runs an internal audit, include system logs and screenshots of Section 1, Line 21 along with the e‑file disablement proof.

If your return is part of a combined New York State filing, add a brief note that combined overrides were active, which explains the absence of CT‑2 in the print set.

Common errors and how to avoid them

- Filing mode mismatch, someone expects CT‑2 to print while the state e‑file flag is still on. Turn e‑file off at the state level, then recalc.

- Line 21 set, no recalc, the attachment will not appear until totals refresh.

- Combined return assumption miss, you cannot force CT‑2 for combined New York State returns.

- Wage base stale, the worksheet still uses last year’s cap. Update to 26,100 for 2025, then confirm rates.

Quick win, add a three line checklist above the print button, Filing mode, Line 21 set, Recalc done. That tiny guardrail saves hours in peak season.

Troubleshooting when CT‑2 will not show up

If CT‑2 still will not generate after you set the return to paper file, selected Line 21 in Section 1, recalculated, and disabled state e‑file, run this short diagnostic.

- Confirm the return is not part of a New York combined group. If it is combined, the override blocks CT‑2 by design.

- Recheck the New York General worksheet, Section 1, Basic Data, Line 21 must be set, not blank.

- Verify e‑file is off for the New York return. Some platforms have more than one e‑file toggle, check both the client level and the engagement level.

- Clear cached print settings, then regenerate forms.

- If the attachment still fails, open a vendor ticket. Include logs, diagnostic reports, screenshots of Section 1 and Line 21, and the filing method screens. Mention the exact software build and the date of your last update so support can replicate.

Connecticut unemployment due dates, and why they matter to CT‑2

Even though CT‑2 is a print control, the data on it must align with quarter cutoffs. Plan your quarter close against the real due dates so reviewers do not see mismatched wage totals.

- Q1 due on or before April 30

- Q2 due on or before July 31

- Q3 due on or before October 31

- Q4 due on or before January 31 If a due date falls on a weekend or holiday, the next business day applies. Reimbursing employers typically get an extra 15 days.

2025 updates you should hard‑code into your templates

Connecticut’s unemployment system changed with trust fund solvency reforms. Two numbers to lock in for 2025, the taxable wage base is 26,100, and the new employer rate is 2.2%. If you build validation rules in your workpapers, set upper and lower bounds for rates as published by the Department of Labor so you catch outliers during review.

Save this snippet in your binder “CT UI TWB 2025, 26,100 per employee, new employer rate 2.2 percent, see CT DOL 2025 tax rate notice.”

A short note on Connecticut corporate due dates

For Connecticut corporation business tax, the due date is the fifteenth day of the month after the federal due date. For calendar year filers that is May 15. Connecticut also expects e‑filing for corporate returns through myconneCT or MeF. This matters because some teams still assume a fourth month deadline and plan their print packets too early. Align your internal calendar with the current DRS schedule.

Where Accountably fits, if you are scaling delivery

If you have ever watched CT‑2 disappear because someone flipped e‑file back on, you already know this is not a staffing problem, it is a delivery system problem. When we build disciplined offshore delivery for firms, we fold small controls like CT‑2 into SOPs, with structured workpapers, multi‑layer review, and clear SLAs. That way, reviewers touch fewer returns twice, and quarter close stays predictable. If you run QuickBooks, Xero, UltraTax, CCH Axcess, ProConnect, Lacerte, Drake, Karbon, Canopy, TaxDome, Suralink, or JetPack, your team can work inside your system, your templates, and your client expectations from day one, with documented Line 21 steps and a recalc check baked in.

FAQs

What is Form CT‑2 in this context

It is a software print control that adds a Connecticut wage‑report attachment to a New York corporate return packet. You use it only when the New York return is set to paper filing and state e‑file is disabled. It does not calculate tax, credits, or adjustments.

Can I force CT‑2 for a combined New York State return

No. Combined filer rules override the control, so CT‑2 will not print for combined NYS returns. If you are in a combined group and need Connecticut wage documentation, include it in the group’s standard workpapers rather than relying on CT‑2.

What is the Connecticut unemployment taxable wage base for 2025

The taxable wage base is 26,100 per employee for 2025. It was 25,000 in 2024 and is scheduled to rise again to 27,000 in 2026. Confirm the current year before you finalize quarter close.

What are the due dates for Connecticut unemployment returns

Quarterly returns and payments are generally due on or before April 30, July 31, October 31, and January 31. If a due date falls on a weekend or holiday, file by the next business day. Reimbursing employers usually get 15 extra days.

Does CT‑2 replace my Connecticut corporate or unemployment filings

No. CT‑2 is only a print control within a New York return workflow. Connecticut corporate business tax returns must be e‑filed with DRS, and unemployment returns are filed with the CT Department of Labor.

What is the 2025 new employer unemployment rate in Connecticut

For 2025, the new employer rate is 2.2%, updated as part of statewide UI solvency reforms. Your assigned rate may differ based on experience.

My CT‑2 still will not print, what now

Recheck three items in order, New York filing mode must be paper, Line 21 must be set in Section 1, Basic Data, and you must recalc. If the return is combined, CT‑2 will not print. If all checks pass, open a ticket with your software vendor and attach screenshots, logs, and the software build number.

Conclusion

You now have a clear path to handle Form CT‑2 without the last minute scramble. Set the filing mode to paper, select the Line 21 option, and recalc before you print. Match your wage reporting to the real Connecticut unemployment wage base and the quarter due dates, and keep your documentation tight so reviews fly by. When you need a steady hand on delivery, bring the same discipline to your broader workflow that you just applied to CT‑2. That is how you protect quality, hit deadlines, and give your partners time back for strategy.

Key numbers to lock in for the current season, 26,100 wage base for 2025 and 2.2% new employer rate, plus corporate due dates that place calendar‑year CT returns on May 15. Update your templates now, add a three line pre‑print checklist, and you will feel the relief of a smooth quarter close when the next rush hits.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk