Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

“We have time, right?” We did, but only because we got the basics right, fast. The recipient, not the trustee, had to file Form 706-GS(D) and pay any GST tax by the April 15 deadline, or file a valid extension. California also wanted a complete copy of the federal return mailed to the State Controller. That is where many otherwise careful firms stumble, especially in peak season.

Key Takeaways

- You file Form 706-GS(D) when you, as a skip person, receive a taxable distribution from a trust and need to compute and pay GST tax. The trustee files Form 706-GS(D-1), not the tax return.

- The filing window runs from January 1 to April 15 of the year after the distribution. If needed, request an automatic 6‑month extension with Form 7004, then pay by the original due date to limit interest and penalties.

- California piggybacks on the federal regime. If you file federally, you must mail a California GST(D) with a complete copy of your federal return to the State Controller, P.O. Box 942850, Sacramento, CA 94250‑5880. Do not mail to the Franchise Tax Board.

- Trustees must send Form 706‑GS(D‑1) to the skip distributee and file Copy A with the IRS by April 15 following the year of the distribution.

- The inclusion ratio, shown on Form 706‑GS(D‑1), drives how much of a distribution is taxed. An inclusion ratio of 0 means no GST tax on that distribution.

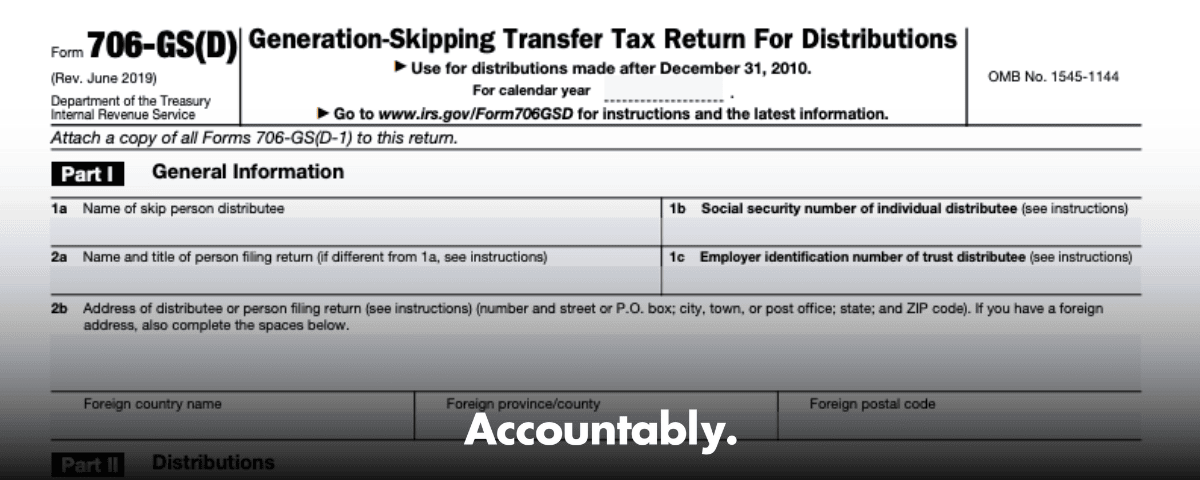

What is Form 706‑GS(D)

Form 706‑GS(D) is the IRS return a skip person uses to calculate and report generation‑skipping transfer tax on taxable distributions from a trust. The return is organized in three parts, general information, the distribution detail, and the GST tax computation. The trustee’s companion form, 706‑GS(D‑1), supplies you with the data needed to prepare the return.

If you received a 706‑GS(D‑1) and every listed distribution shows an inclusion ratio of 0, you typically do not need to file Form 706‑GS(D). Keep the notice with your records.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

In estate planning, this filing keeps GST compliance clean. It confirms who received what, on which date, at what value, and how the tax was computed, so the IRS and any state agency can reconcile the distribution trail.

Who Must File and When

You file Form 706‑GS(D) if you are a skip person distributee who received a taxable distribution during the calendar year. The return is due on a calendar year basis. File on or after January 1 and not later than April 15 of the year following the distribution year.

If you cannot file by April 15, request a 6‑month automatic extension with Form 7004. The IRS confirms that Form 706‑GS(D) is eligible for a 7004 extension, and as of June 30, 2025, its e‑file page lists 706‑GS(D) among the returns you can extend electronically. If e‑file is unavailable in your situation, submit a paper 7004 by the regular due date. Either way, pay your best estimate by the original due date to limit interest and penalties.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallCoordinating With California

If you file Form 706‑GS(D) or 706‑GS(T) federally, California requires you to file its companion return, GST(D) or GST(T), and attach a complete copy of your federal return with all schedules. Mail the California package to the State Controller, Local Government Programs and Services Division, Tax Administration Section, P.O. Box 942850, Sacramento, CA 94250‑5880. California sets the same April 15 deadline and references federal interest rules for underpayments and overpayments.

California At A Glance

| Topic | California Rule |

| Trigger | Federal filing requires a California filing with a full federal copy attached. |

| Due date | April 15 after the calendar year of the distribution or termination. |

| Where to mail | State Controller, LGPSD, Tax Administration Section, P.O. Box 942850, Sacramento, CA 94250‑5880. |

| Interest on underpay | Daily compounding, at the IRC section 6621(a)(2) rate, per RTC section 16760. |

| Interest on overpay | Interest follows IRC sections 6621(a)(1) and 6622, per RTC section 16870. |

California’s own site also summarizes these rules and reminds filers not to mail GST returns to the Franchise Tax Board. Save proof of mailing.

Key Terms You Actually Use, Skip Person, Inclusion Ratio, GST Rate

- Skip person, a beneficiary at least two generations below the transferor, for example a grandchild, or an unrelated person more than 37 and a half years younger. For filing, focus on whether you, the recipient, meet the skip person definition on the date you received the distribution.

- Inclusion ratio, the portion of a distribution that bears GST tax. In practice, you will see the inclusion ratio on the trustee’s Form 706‑GS(D‑1), Column d. An inclusion ratio of 0 means no GST tax on that distribution. An inclusion ratio of 1 means the full distribution amount is exposed to GST tax.

- GST rate, for distributions after December 31, 2012, the maximum rate table points to 40 percent, the same as the top estate tax rate for those years.

A quick example

Say you receive two distributions in the same year. The trustee’s 706‑GS(D‑1) shows 50,000 with an inclusion ratio of 0.40, and 20,000 with an inclusion ratio of 0. The taxable base is 50,000 times 0.40, or 20,000. Apply the 40 percent rate in effect for transfers after 2012, which yields 8,000 of GST tax, before any allowable expenses reported on Part III. Keep both 706‑GS(D‑1) notices with your records.

Required Information and Documentation

Build your package so the IRS and California can follow the math without calling you.

- Identification, your legal name, SSN, and current address, the trust’s name and EIN, contact information.

- Distribution detail, dates, property descriptions, and fair market values on distribution dates, for cash and noncash items. Tie to trustee schedules.

- Inclusion ratio and tax rate, use the trustee’s 706‑GS(D‑1) for inclusion ratio, then apply the applicable rate table.

- Support for noncash items, appraisals for closely held equity, real estate, art, collectibles, life insurance, and digital assets, plus method notes and appraisal dates.

- California copy, a complete federal copy must be attached to California GST(D) or GST(T), then mailed to the State Controller at the address above.

Practical tip, keep a single PDF binder or a paper folder with the 706‑GS(D), every 706‑GS(D‑1), valuation support, and your interest and payment confirmations. California wants the full federal copy attached.

Completing Parts I–III of Form 706‑GS(D)

Work in order. It keeps names, dates, and numbers aligned.

- Part I, enter your name, SSN, mailing address, the trust’s legal name and EIN, and the calendar year. Confirm that IDs match the trustee notice and trust records.

- Part II, list each taxable distribution. Include the distribution date, property description, and fair market value on that date. If you received noncash property, describe it clearly, for example units, share classes, CUSIPs, policy numbers. Keep the trustee’s values and your support aligned.

- Part III, compute the tax. Total the taxable distributions, apply the inclusion ratio that applies to each, then multiply the exposed amounts by the applicable GST rate. The instructions include the rate table and explain where to place the final number, and how to prepare a payment to the United States Treasury.

Work sequentially, tie identifiers across all three parts, and reconcile your totals to the trustee’s accounting and the 706‑GS(D‑1) notices. It saves review time and avoids most IRS questions.

Review checklist before you sign

- Names and ID numbers match on Part I and the 706‑GS(D‑1).

- Noncash property values have support, for example a qualified appraisal, pricing source, or method note.

- Inclusion ratio for each line agrees to 706‑GS(D‑1), Column d, or your own documented calculation if the trustee’s notice was incomplete.

- Payment voucher details are correct, payee is United States Treasury, and your SSN and “Form 706‑GS(D)” are on the check if you mail a payment.

Extensions and Form 7004

You can secure an automatic 6‑month extension of time to file by submitting Form 7004 on or before April 15. As of June 30, 2025, the IRS e‑file page lists Form 706‑GS(D) among returns for which you may e‑file Form 7004. If e‑file is not available in your case, file 7004 on paper by the due date using the address the IRS provides for 706‑GS(D). An extension to file does not extend time to pay, so estimate the GST tax and pay by April 15 to reduce interest and penalties. Keep confirmation of timely submission.

If you prefer belt and suspenders, print your 7004, mail it certified, and keep the USPS receipt with your records. If you later need penalty relief, a clean paper trail helps.

Trustee Notifications and Form 706‑GS(D‑1)

Trustees use Form 706‑GS(D‑1) to report taxable distributions from a GST trust and to provide the skip distributee with the information needed to figure the tax. Copy A goes to the IRS, and Copy B goes to the distributee. The trustee must file Copy A and send Copy B by April 15 of the year after the calendar year when the distribution occurred.

What must the trustee include

- Trust EIN, distributee ID, date of distribution, and a description of each item distributed.

- Valuation detail that allows the IRS and recipient to compute GST exposure, for example units, share classes, CUSIPs, policy numbers, or wallet addresses for digital assets.

- The inclusion ratio for each distribution, Column d, which the recipient uses on Form 706‑GS(D).

Fast, clear trustee notices protect the distributee’s filing window and prevent last‑minute scrambles in March and April.

Common Errors and How to Avoid Them

- Missing or mismatched IDs, the distributee’s SSN or the trust’s EIN is blank or incorrect. Confirm IDs in Part I before you do any math.

- Wrong inclusion ratio or no ratio at all, which leads to incorrect tax. Use the trustee’s 706‑GS(D‑1) and confirm Column d for every line.

- Filing late without paying, you get the extension to file and still owe interest starting the original due date. Pay the best estimate by April 15.

- Skipping California, if you file federally, California wants its GST(D) with a full federal copy attached, mailed to the State Controller, not the Franchise Tax Board.

- Leaving out support for noncash distributions, the IRS expects valuation support consistent with the type of asset. A short summary is not enough for closely held interests or unique property.

A quick pre‑filing huddle

- Confirm the distribution dates and values against trustee accounting.

- Reconcile every line in Part II to a 706‑GS(D‑1) or your own documentation.

- Draft California GST(D) and assemble the federal copy now, then set a calendar reminder to mail both with tracking.

Payment, Interest, and Penalties

Interest applies if you pay after the original due date, even when you filed a valid extension. The IRS charges interest under section 6621, and penalties may apply under section 6651 unless you show reasonable cause. California assesses interest on underpayments with daily compounding at the same rate per year as IRC section 6621(a)(2), and pays interest on overpayments consistent with IRC sections 6621(a)(1) and 6622. Pay early, stop the meter, and document your payment method.

Mailing Addresses, Filing Methods, and Recordkeeping

- IRS filings, Form 706‑GS(D) is processed in Kansas City for returns filed after June 30, 2019. If you use a private delivery service, follow the IRS street address guidance for those carriers.

- California filings, mail GST(D) with the complete federal copy to the State Controller, Local Government Programs and Services Division, Tax Administration Section, P.O. Box 942850, Sacramento, CA 94250‑5880. Keep proof of mailing.

- Retention, keep your filed return, trustee notices, appraisals, interest and payment confirmations, extension proof, and your reconciliation workpapers in one place. If the IRS or California asks a question, you will have everything ready.

Where Accountably Helps, When It Actually Matters

If your firm handles even a handful of GST distributions each year, the work often lands in late winter when your team is already stretched. That is where disciplined delivery beats heroics. Accountably integrates trained offshore teams into your workflow, uses SOP‑driven execution, standardized workpapers, and layered review, so 706‑GS(D) filings move from intake to review to mailing without drama. Use us for seasonal GST workload or for a white‑label delivery team that follows your templates and checklists. Brief the work once, get consistent files back, and keep partner time on strategy. This is delivery support, not resume farming.

FAQs

Do I always have to file if I received a 706‑GS(D‑1)?

Not always. If every distribution on the trustee notice shows an inclusion ratio of 0, you generally do not need to file Form 706‑GS(D). Keep the notice with your records. If any line shows a nonzero inclusion ratio, file the return and compute the tax.

Can I e‑file Form 7004 for 706‑GS(D)?

As of June 30, 2025, the IRS e‑file page lists 706‑GS(D) among returns eligible for an e‑filed Form 7004. If e‑file is not available to you, file 7004 on paper by the original due date. Either way, pay by April 15.

Where do I mail California GST(D)?

Mail to the State Controller, Local Government Programs and Services Division, Tax Administration Section, P.O. Box 942850, Sacramento, CA 94250‑5880. Include a complete copy of the federal return with all schedules, and do not mail to the Franchise Tax Board.

What GST rate do I use?

For distributions after December 31, 2012, the table in the instructions points to 40 percent. Check the IRS rate table in the instructions for the year of transfer if you are dealing with older distributions.

What if I missed April 15?

File and pay as soon as possible. Interest starts from the original due date. If you have reasonable cause for the delay, document it and request penalty relief. California interest follows federal rates and compounds daily.

Final Wrap Up and Next Steps

You are ready to get this done. Confirm that you, the recipient, are the filer. Gather trustee notices, values, and appraisals. Complete Parts I through III in order, compute the tax using the inclusion ratio and applicable rate, and pay by April 15 or extend and pay. If California is triggered, assemble the complete federal copy and mail your California GST(D) with tracking. If you are juggling multiple returns and need disciplined help, we can plug in a review‑protected workflow so you meet every deadline with clean, standard files.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk