Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

TAS is independent inside the IRS, it coordinates with operating units, can request a collection hold, and helps move a stuck case. You can submit Form 911 by email, fax, or mail, and if you do not hear back within 30 days, TAS instructs you to follow up. Email submissions are accepted for speed, however TAS warns that email and attachments are not encrypted, and TAS will respond by phone or letter, not by email. All details below were re‑verified on October 27, 2025.

Key Takeaways

- Use Form 911 when IRS actions or delays cause, or are likely to cause, economic harm, for example levy, wage garnishment, loss of housing, utility shutoff, or when an IRS process is not working and the delay extends more than 30 days past normal processing.

- TAS is independent inside the IRS, it can coordinate with IRS functions and request holds on collection, but it does not give legal advice and it cannot reverse tax court or Appeals decisions. If you need representation, contact a CPA, EA, tax attorney, or a Low Income Taxpayer Clinic.

- Submit Form 911 by email, fax, or mail. Current intake, email , fax 855‑828‑2723, mail Taxpayer Advocate Service, 7490 Kentucky Dr., Stop MS 11‑G, Florence, KY 41042.

- If you do not hear back within 30 days, call the TAS office that received your form or the national line at 877‑777‑4778. Many taxpayers hear sooner, plan follow up around the 30‑day guidance.

- For fast relief on lien or levy issues, consider CAP or CDP. CAP aims for swift Appeals review of collection actions, while a timely CDP request, Form 12153, generally pauses collection and preserves court review.

What Form 911 is, and how TAS helps

Form 911 is your request for TAS assistance when normal contacts have failed and you face economic harm or a systemic breakdown. Economic harm means essentials are at risk, housing, food, utilities, transportation, or your income dropped sharply because of a levy. Systemic issues include long delays beyond normal timelines, multiple interim letters with no progress, missed promised dates, or procedures that did not work as intended. Make your facts obvious, dates, notice numbers, timeframes, and the specific relief you need.

Once TAS accepts your case, a case advocate becomes your point person. They coordinate with the IRS function, can request a hold on collection while your plan is set, and track milestones with you. TAS is independent, however it is not your lawyer. TAS will not draft a Tax Court petition and generally steps back once you have petitioned. If you need legal advice or representation, hire a qualified professional or contact a Low Income Taxpayer Clinic.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Quick tip, answer unknown numbers for a couple of weeks after you file. TAS often calls before mailing a letter, and missed calls can stretch timelines.

When you should use Form 911

Use Form 911 the moment IRS actions or delays threaten essentials, or when normal channels have failed and you are well past expected timelines. Classic triggers include a wage levy that makes rent impossible, a bank levy that wiped out your funds, an eviction risk tied to IRS action, or a return that has sat far beyond normal processing, usually more than 30 days, with missed promised dates. You can file even if you have not exhausted every call when harm is immediate. Otherwise, try normal paths first, then elevate with Form 911 and attach proof so TAS can act quickly.

Situations that do not qualify

Do not use Form 911 to get legal advice, to ask TAS to prepare returns, or to overturn an Appeals or court decision. TAS is federal only, it will not handle state tax issues. If you need court review on a collection matter, a timely CDP request is the correct path, not Form 911.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallDisclosure, this guide is for general information. It is not legal, tax, or accounting advice. For legal strategy, speak with your tax professional or an attorney.

Understand TAS criteria, economic harm and systemic issues

TAS uses two acceptance gateways. Knowing which one fits your facts makes your submission clearer and faster to process.

- Economic harm, your basic living costs are at risk because of an IRS action or a long delay. Examples, eviction risk, utility shutoff, loss of transportation to work, or a levy that chops your take‑home pay so much that you cannot cover essentials. If the answer is yes to these questions, TAS may be able to help.

- Systemic issue, an IRS process failed. You are more than 30 days past normal processing, the IRS missed a promised date, or you received repeated interim letters with no real movement. Show exactly how long you have been waiting beyond published norms.

Micro‑story, a sole proprietor’s refund sat for months with three interim letters and no action. We filed Form 911, listed the letters and dates in bullets, attached identity proof, and TAS prodded the IRS function to resolve the freeze. This is a clean systemic‑issue example.

How to document harm in minutes

Make it easy for a case advocate to see the problem in one pass.

- Identify the IRS action and date, for example CP504 dated July 10 or LT11 dated August 2.

- Connect it to the harm, wage levy cut take‑home by 42 percent, utilities past due 327, rent due November1.

- List your attempts, calls on July 25 and August 19, a promised response by September 5 that never came.

- Ask for narrow relief, place a 30‑day collection hold, release wage levy while I submit Form 433 and an installment proposal.

If you are past the 30‑day delay threshold without a crisis, you can still qualify under systemic issues. Be specific about delay length, missed promises, and which unit has the file.

Pick the right path, TAS vs CAP vs CDP

Form 911 is powerful for coordination and for pausing collections while a plan is set. Sometimes a formal appeal is the faster or more protective option.

- CAP, Collection Appeals Program, is built for quick Appeals review of lien, levy, seizure, or certain installment agreement actions. The IRM confirms there is no Tax Court review of a CAP decision. CAP can be used before or after a collection action, and it is often fast. Use it when speed on a discrete collection action matters most.

- CDP, Collection Due Process, preserves rights. File Form 12153 by the date on your notice, a timely CDP request generally pauses collection while Appeals reviews your case and preserves the right to petition Tax Court if you disagree with the determination. If you miss the deadline, you can request an Equivalent Hearing within one year, however you lose Tax Court review.

If a levy is about to hit, CAP or a timely CDP request can be faster than waiting for TAS intake. You can still file Form 911 if you meet TAS criteria. The right choice depends on urgency, need for court rights, and the exact collection action you are fighting.

When TAS is the best first move

Choose Form 911 first when you need cross‑unit coordination, when harm stems from a stalled process, when you need a collection hold while proposing a plan, or when multiple IRS functions are involved. TAS is built to cut through fractured workflows and hold dates accountable.

Common mistakes that slow TAS intake

- Vague 12a narratives, no form number, no tax period, no dates, no harm quantified.

- Asking TAS to overturn Appeals or court, TAS cannot do that, and it will delay acceptance.

- Emailing full SSNs and bank images without thinking through privacy, remember email is not encrypted. If privacy is critical, use fax or mail.

- Missing signatures, including the spouse on a joint issue, or missing Form 2848 when you check representative boxes.

- Submitting before trying normal channels when there is no immediate harm, TAS expects you to try those steps unless the situation is urgent.

Short plan you can copy, Day 0 submit Form 911 with attachments, Day 7 to 14 answer calls, Day 30 call 877‑777‑4778 if no contact yet.

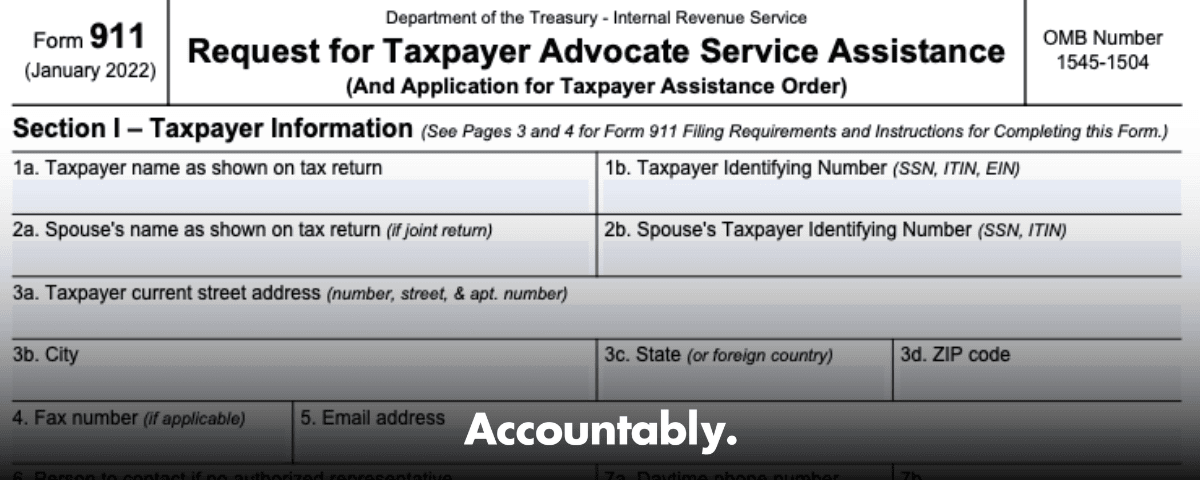

How to complete Form 911, step by step

You will sign under penalty of perjury, so accuracy matters. Work section by section, then add attachments that tell the story clearly.

- taxpayer details

- Full legal name, SSN or EIN, spouse details for joint cases, address, and best phone number.

- For businesses, include the responsible party on the account.

- Ensure your address matches what the IRS has, it helps mail reach you.

- Line 12a, describe the problem

- Identify the form and tax period, 1040 for 2023, 941 for Q2 2025, or similar.

- State the IRS actions and dates, for example CP504 on July 10, ACS calls on July 25 and August 19, promised response by September 5 that never came.

- Quantify harm or delay, pay cut of 42 percent due to levy, eviction notice dated October 28, unprocessed refund 90 days past normal time.

- Line 12b, state the relief you want

- Ask for narrow, practical relief, stop levy, place a 30‑day hold, expedite processing, correct a misapplied payment, or release a lien if documentation supports it.

- If proposing an installment agreement or currently not collectible status, note the monthly amount or the hardship basis, and reference an attached Form 433.

- Sign and date

- You sign and date, both spouses sign for joint issues.

- If represented, complete Section II and attach a signed Form 2848 or 8821.

- Attach documents

- Notices, transcripts, proof of harm, for example pay stubs showing levy, eviction or disconnect notices, a short call log with dates and names.

TAS emphasizes complete forms for faster intake. Clear facts and focused relief shorten back and forth and help a case advocate act quickly.

One‑page prep table you can copy

| Section | What to enter | Evidence to attach | Reviewer tip |

| I | Names, SSN or EIN, spouse if joint, address, phones | Prior IRS notice with matching address | Check for address consistency |

| 12a | Form, period, action, dates, harm or delay | Notices, letters, call notes | Use bullets with dates for skimming |

| 12b | Specific relief and short rationale | Budget snapshot, 433, bank proof | Ask for time‑boxed relief |

| Rep auth | Section II and Form 2848 or 8821 | Signed POA, CAF number | Confirm fax permissions if used |

Sample 12a and 12b language

Example 12a, the problem 1040, TY 2023. Wage levy started 9‑20 after CP504 issued 7‑10. I called ACS 7‑25 and 8‑19, was told to expect a response by 9‑5, none received. Levy reduced take‑home by 42 percent. Rent due 11‑1, utilities past due 327.

Example 12b, the relief Request a 30‑day collection hold and release of wage levy while I submit Form 433‑A and an installment proposal of 200 per month. If needed, assign field to verify income and expenses.

Where and how to submit Form 911

Pick the channel that fits your speed and privacy needs. TAS accepts email, fax, and mail. Email is quickest, however it is not encrypted, TAS will respond by phone or letter, not by email. If you prefer more privacy, use fax or mail to the Kentucky intake address.

| Method | How to send | Speed | Privacy | Notes |

| Fast | Lowest | TAS will not reply by email. Expect a call or letter. | ||

| Fax | 855‑828‑2723 | Fast | Better | Keep a fax confirmation sheet for your records. |

| TAS, 7490 Kentucky Dr., Stop MS 11‑G, Florence, KY 41042 | Slower | Better | Use tracking to confirm delivery. | |

| Time zones outside CONUS | Puerto Rico or Hawaii TAS offices | Varies | Better | TAS lists dedicated PR and HI fax numbers and addresses for certain GMT ranges. |

If 30 days pass with no contact, call 877‑777‑4778 or your local TAS office and reference your submission date.

Security tip, if you email due to urgency, consider redacting full SSNs on nonessential attachments, then provide full documents to your case advocate through a secure channel once assigned. TAS explicitly warns that email submissions are not encrypted.

What to expect after you file Form 911

Plan around a 30‑day follow‑up window. TAS indicates you should hear back within 30 days about your case. In many files, the first contact comes sooner by phone. If TAS cannot reach you by phone, they will mail a letter with next steps. Keep your voicemail available and your mailing address current.

- Initial contact, phone first, letter if they miss you.

- If 30 days pass with no contact, call 877‑777‑4778 or your local TAS office to check status.

- Accepted cases are assigned to a case advocate who coordinates with the IRS function and updates you on timelines.

If your situation is urgent

Tell TAS if you face eviction, utility shutoff, or a levy that threatens essentials. TAS can request immediate action, including a collection hold. If a collection action is already moving, you may need a formal appeal in parallel.

- CAP, built for speed on lien, levy, seizure, or certain installment agreement actions. There is no Tax Court review for CAP decisions, however Appeals aims to resolve these quickly. Use it when a discrete collection action needs an immediate decision.

- CDP, file Form 12153 by the deadline on your notice. A timely CDP request generally pauses collection while Appeals reviews the case and preserves the right to petition Tax Court after the determination. If late, you can request an Equivalent Hearing within one year, but you lose court review.

Alternatives to Form 911 and how they interact

| Option | Best for | Speed target | What you get | Court review |

| TAS, Form 911 | Economic harm or systemic delay, cross‑unit coordination | Follow up at 30 days if no contact | Case advocate, coordination, potential collection holds | No court review via TAS. |

| CAP | Fast review of a collection action | Typically faster than letters alone, designed for quick Appeals action | Appeals decision on the action, often within days | No Tax Court review of CAP decisions. |

| CDP, Form 12153 | Stop collection and preserve rights | Must file by the notice deadline | Appeals hearing, levy generally paused | Yes, you can petition Tax Court after the determination. |

Important, if you withdraw a timely CDP to switch to CAP, you usually give up Tax Court review and some related protections. Withdrawals remove the hold on levy and stop the extension of the collection statute. Read the withdrawal letter carefully before you sign.

For firm leaders and busy tax teams

If you run a CPA, EA, or bookkeeping firm, a repeatable Form 911 workflow protects clients and reduces partner time in review. Build an intake checklist, standard examples for Lines 12a and 12b by issue type, and a decision tree for TAS vs CAP vs CDP. Keep transcripts, notices, and proof of harm in a consistent folder structure so a case advocate can see the story at a glance. That discipline trims days off intake.

Accountably appears here only where it helps your workflow, not as a pitch. If your firm uses Accountably’s SOP‑driven workpaper structure, standardized naming, and layered review, the supporting documents TAS expects, notices, dates, call logs, and proposed relief, are already organized. That means less scramble, faster TAS acceptance, and less partner time stuck in review. Use whatever system you prefer, the point is consistency and visibility.

FAQs

What is IRS Form 911 in plain terms

Form 911 is the request you file when IRS actions or delays are causing, or are likely to cause, economic harm, or when an IRS process is not functioning and you are well past normal timelines. TAS is independent inside the IRS, and a case advocate can coordinate with the operating unit and request collection holds when appropriate.

Do Taxpayer Advocates really help

Yes, when your facts fit TAS criteria. Expect a phone call or letter, often before the 30‑day follow‑up window. If 30 days pass with no contact, call 877‑777‑4778 or your local TAS office and confirm your contact details.

Can TAS give legal advice or prepare a Tax Court petition

No. TAS does not provide legal advice and does not prepare Tax Court petitions. Once you petition, your case generally moves to IRS Counsel or the Department of Justice. Hire a qualified professional or contact a Low Income Taxpayer Clinic if you need representation.

Is email safe for Form 911

Email is accepted for speed, however TAS warns that email submissions are not encrypted. TAS will not reply by email, expect a phone call or a letter. If privacy is a concern, use fax or mail.

What should I do if a levy is happening right now

If a levy is imminent or already in place, consider CAP for a fast Appeals decision on the specific action, or file a timely CDP request with Form 12153 to generally pause collection and preserve Tax Court rights. You can also file Form 911 if you meet TAS criteria, the best choice depends on urgency and whether you need court review.

Final checklist before you hit send

- You meet TAS criteria, economic harm or a systemic delay more than 30 days past normal processing or a missed promised date.

- Line 12a lists form, period, actions, dates, and the clear harm or delay.

- Line 12b asks for focused relief, hold, release levy, expedite processing, correct account, or similar.

- Notices, transcripts, and proof of harm are attached, plus a short contact timeline.

- You chose the right channel, email for speed, fax or mail for privacy, and you set a 30‑day follow‑up reminder.

Short resources and freshness note

- Submit a request for assistance, current email, fax, and Kentucky address, and the email security notice, verified October 27, 2025.

- TAS contact page, 30‑day follow‑up guidance and national line, 877‑777‑4778.

- Appeals and CDP basics, Form 12153 requirement and right to petition Tax Court after a timely CDP determination. Page reviewed in 2025.

- CAP program scope and no Tax Court review for CAP decisions.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk