Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

If CP08 landed in your mailbox, the IRS thinks you might be due money. It just needs proof, clean and fast.

Key takeaways

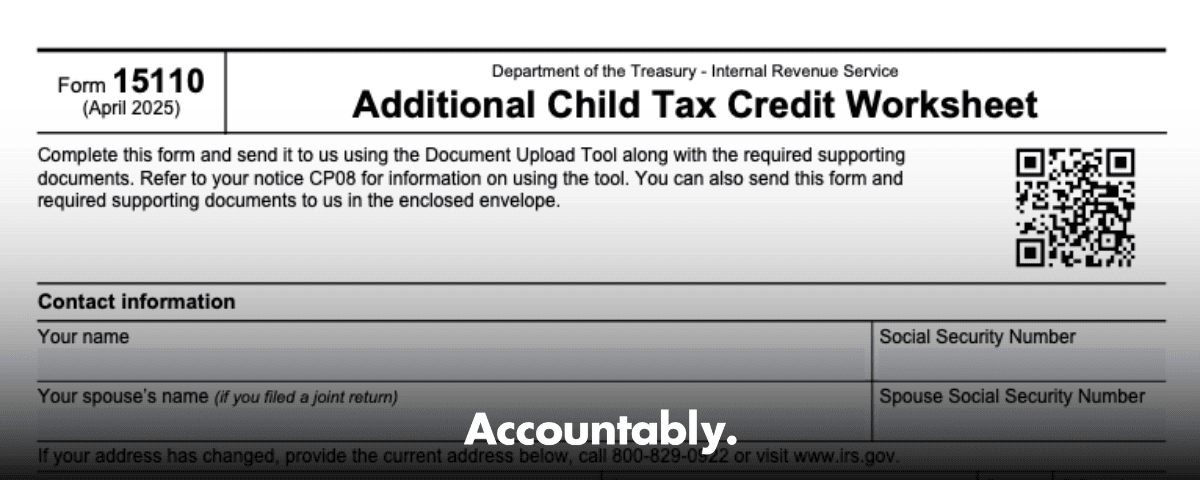

- Form 15110 is the one‑page worksheet the IRS asks for after CP08 to verify your eligibility for the refundable Additional Child Tax Credit. Return it within 30 days.

- List only children from your original return who had valid Social Security numbers issued by the return’s due date. If a child’s number was not issued by then, that child does not qualify for CTC or ACTC for that year.

- If at least one child qualifies, complete Schedule 8812 to calculate your credit for the year.

- You can mail your response using the address on the top left of CP08, or upload it through the IRS Documentation Upload Tool with your access code.

- Typical timeline is 8 to 10 weeks from IRS receipt to a decision or refund, and you can call 800‑829‑1954 if you have not heard back after that window.

What Form 15110 actually does

Form 15110 confirms facts about each child you already claimed on your original return, including full name, Social Security number, relationship to you, age test, and U.S. status. If your answers show at least one qualifying child, the IRS asks you to attach Schedule 8812 to compute the credit. This is not a second chance to add new dependents, it is a verification of what you already filed. If you need to add a dependent you did not include originally, amend your return instead of using Form 15110.

Why you got CP08 in the first place

CP08 fires when the IRS’s systems see signs you might be eligible for the refundable Additional Child Tax Credit but did not claim it. The agency will not pay the refund without your confirmation, so it prompts you to complete Form 15110 and, if a child qualifies, Schedule 8812. Respond within 30 days by mail or with the secure upload link and access code listed in your notice.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

The 2025 numbers you should know

For 2025 tax returns, the maximum Child Tax Credit is up to 2,200 per qualifying child, and the refundable Additional Child Tax Credit is up to 1,700 per child, subject to income limits. As in prior years, the refundable portion is calculated on Schedule 8812. The familiar phaseout thresholds of 200,000 single, 400,000 married filing jointly still apply unless the IRS publishes a change. Always use the instructions for the specific tax year you are filing.

Note for accuracy and timing

- Each qualifying child must have an SSN that is valid for employment and issued by the due date of your original return, including extensions. If the SSN was issued after the due date, that child does not qualify for CTC or ACTC for that year.

What, how, wow

- What: Form 15110 verifies your qualifying children for the refundable credit after CP08.

- How: Fill the child details exactly as filed, confirm the three tests, then complete Schedule 8812 if at least one child qualifies, and return everything in 30 days by mail or upload.

- Wow: Two small updates help in 2025, the maximum CTC increases to 2,200, and Internal Revenue Manual guidance confirms there is no signature requirement on Form 15110 for tax years 2022 and later, which removes a common processing snag.

Who this guide is for

- Parents and caregivers who received CP08 and want a clean, fast response.

- Tax pros who need a tight checklist to keep refunds moving.

- Firm owners who want consistent handling across teams, especially during peak season when CP08 letters stack up.

In our work supporting busy accounting teams, the biggest slowdowns are simple, missing SSN issue dates, sending the wrong year’s worksheet, or skipping Schedule 8812 when a child does qualify. A few minutes of structure up front saves weeks of back and forth later.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallStep by step, completing Form 15110

Start with exact taxpayer info

- Enter your legal name and SSN exactly as they appear on your original Form 1040.

- If you filed jointly, include your spouse’s name and SSN exactly as filed.

- Use the same mailing address you used on the return, or submit an address change before responding if you have moved.

- Include a daytime phone number in case the IRS needs a quick clarification.

- Per current IRS procedures, Form 15110 does not require a signature for tax years 2022 and later, which helps prevent a common reject.

List children and confirm SSN rules

- List only the children you claimed on your original return.

- Enter each child’s full name and SSN, and confirm that the SSN was valid for employment and issued by the due date of your original return, including extensions.

- Children with only ITINs do not qualify for CTC or ACTC, though they may qualify for the Credit for Other Dependents, which is separate from this process.

Pro tip for speed If you are uploading, include a clear scan of each child’s Social Security card as supporting proof. The CP08 page does not list required documents, but practitioners routinely include this to avoid a second request. Use legible PDFs.

Apply the qualifying child tests

For each child, answer these three, and all must be yes.

- Relationship, your son, daughter, stepchild, eligible foster child, sibling, or a descendant of any of these.

- Age, under 17 at the end of the tax year.

- Status and residency, U.S. citizen, U.S. national, or U.S. resident alien, who lived with you for more than half the year. Also confirm the SSN rule above.

Shared custody notes

- Keep school or medical records handy to document days lived with you.

- For temporary absences, like college or medical care, count them as time lived with you if the child would have lived with you otherwise. See the Schedule 8812 instructions for details by year.

When to complete Schedule 8812

If at least one child qualifies on Form 15110, complete Schedule 8812 to compute both the nonrefundable CTC and any refundable ACTC. For 2025 returns, the maximum CTC is up to 2,200 per child, with up to 1,700 refundable, subject to income limits and earned income thresholds. If you or your spouse file Form 2555, you cannot claim the ACTC. Follow the line‑by‑line instructions for the correct year.

If you need to add a dependent

Form 15110 is verification, not an amendment. If you must add a dependent you did not claim on the original return, file Form 1040‑X for the year in question, then follow the CP08 directions. The CP08 help page focuses on verification, so handle amendments separately to prevent delays.

How and where to submit

You have two options, mail or the IRS Documentation Upload Tool. Use only the address shown on the top left of your CP08 if you mail it. If you upload, use the secure link and access code from your notice, or scan the QR code, both route your response to the proper IRS unit.

Mail vs. upload, quick comparison

| Method | Best for | What to include | Speed and tracking |

| Mail to the address on CP08 | If you prefer paper or cannot scan documents | Form 15110, Schedule 8812 if required, copy of CP08, copies of SSN proof | Delivery time varies, no on‑screen confirmation, keep postal receipt |

| Documentation Upload Tool | If you want faster routing and an on‑screen confirmation | Form 15110 PDF, Schedule 8812 PDF, copy of CP08, supporting proof in PDF, JPG, or PNG | Immediate upload confirmation, routes directly to IRS correspondence systems via your access code |

Use one method, not both, within 30 days. Multiple submissions can slow processing.

Light ops note for firms If your team handles multiple CP08s at once, save a stamped checklist, it should show the CP08 notice number, access code, taxpayer name and SSN masked, forms included, and who uploaded or mailed the packet. This kind of basic workflow discipline prevents misses during peak weeks.

Timelines, refunds, and status checks

Once the IRS receives your Form 15110 and Schedule 8812, it reviews your entries and either approves the credit or sends a letter explaining why it was denied. If no other balances are due, you should see a refund in roughly 8 to 10 weeks. If you have not heard back after that window, call 800‑829‑1954 with your CP08 and access code handy.

Helpful habits

- Save a full PDF of what you submitted, including the CP08 notice and upload confirmation page if you used the tool.

- If you mailed your response and lost the original envelope, use any envelope but only the address printed on the top left of your CP08. Using a different address can delay processing.

Common mistakes that slow refunds

- Listing a child who was not on the original return. Form 15110 verifies, it does not add dependents.

- Missing or invalid SSN, or an SSN issued after the return due date for that tax year. The child does not qualify for that year if the SSN was issued late.

- Skipping Schedule 8812 when at least one child qualifies. The IRS cannot compute your refund without it.

- Using the wrong year’s worksheet or instructions. Always match the tax year on CP08 and Schedule 8812.

- Forgetting that Form 15110 does not need a signature for tax years 2022 and later, which avoids a back‑and‑forth.

Practical examples

- Example 1, SSN timing: You filed your 2024 return on April 10, 2025. Your younger child’s SSN was issued on May 5, 2025. That child does not qualify for 2024 CTC or ACTC because the SSN was not issued by the 2024 return due date, including extensions.

- Example 2, 2025 amounts: You have two qualifying children on your 2025 return. Your CTC can be up to 2,200 per child, and if your tax is reduced to zero, your refundable ACTC can be up to 1,700 per child, subject to earned income and limits on Schedule 8812.

- Example 3, Form 2555: You worked abroad in 2025 and file Form 2555. You cannot claim the Additional Child Tax Credit, even if you have qualifying children.

For CPA firms and tax teams, keep delivery disciplined

When CP08 responses pile up, bottlenecks come from inconsistent workpapers, unclear review steps, and missing documentation. A tight delivery system fixes that.

- Use a standard CP08 response packet with a cover sheet listing the notice number, access code, tax year, and what is enclosed.

- Keep structured naming, like “YYYY‑Taxpayer‑CP08‑15110‑Schedule8812.pdf” for every upload.

- Build a multi‑layer review, preparer checks SSN and tests, reviewer verifies Schedule 8812 math, final reviewer confirms the right IRS address or the correct upload link and code.

- Track SLAs, intake to send date, send date to IRS receipt, receipt to decision.

Where Accountably fits, lightly If your firm is short on capacity during peak season, Accountably can deploy trained offshore teams inside your workflow to assemble CP08 packets, standardize workpapers, and close review loops without slowing partners. We integrate to your systems, follow your templates, and work under your review protections so you keep control of quality and timing. Use us when you want structured help, not resumes.

FAQs

What is Form 15110 in plain English?

It is the worksheet the IRS asks you to complete after a CP08 letter to confirm that the children you claimed meet the rules for the refundable Additional Child Tax Credit. If at least one child qualifies, attach Schedule 8812 and return both within 30 days by mail or through the IRS upload link with your access code.

What is the Child Tax Credit amount for 2025?

For 2025 returns, the maximum Child Tax Credit is up to 2,200 per qualifying child. The refundable portion, the Additional Child Tax Credit, is up to 1,700 per child, calculated on Schedule 8812, and subject to income limits. Always use the instructions for the correct tax year when you prepare the form.

How fast will I get my refund after I respond?

Most decisions or refunds are issued within 8 to 10 weeks after the IRS receives your response. If you have not heard anything by then, call 800‑829‑1954 with your CP08 notice nearby.

Do I have to sign Form 15110?

The Internal Revenue Manual notes no signature requirement for Form 15110 for tax years 2022 and later. That said, complete every field accurately and include Schedule 8812 when a child qualifies.

Can I upload my response instead of mailing it?

Yes. Use the Documentation Upload Tool link and your unique access code shown on CP08, or scan the QR code on the notice. Uploading routes your response directly to the IRS correspondence system and gives you an on‑screen confirmation.

My child’s SSN was issued after I filed. Can I still get the credit?

No for that year. For CTC or ACTC, the child must have an SSN that is valid for employment and issued by the tax return due date, including extensions. If the SSN came later, the child may qualify in a future year if all other tests are met.

What if I need to add a child I forgot to claim?

Do not use Form 15110 to add dependents. File Form 1040‑X to amend your return, then follow the CP08 instructions. Using the wrong process can slow your case.

Who should not claim the Additional Child Tax Credit?

If you, or your spouse on a joint return, file Form 2555, you cannot claim the Additional Child Tax Credit, even if you have qualifying children. Check the year‑specific Schedule 8812 instructions before filing.

Final checklist before you send

- Form 15110 completed for the correct tax year, names and SSNs match your original return.

- SSNs valid for employment and issued by the return due date for that year.

- Schedule 8812 attached when at least one child qualifies, using the year’s limits and instructions.

- Packet sent within 30 days, by mail to the CP08 address on the notice, or uploaded with your access code.

Compliance and currency note Tax rules, amounts, and forms vary by year. The citations above link to current IRS pages and the Internal Revenue Bulletin as of November 1, 2025. Always match your response to the tax year on your CP08 and the latest IRS instructions.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk