Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

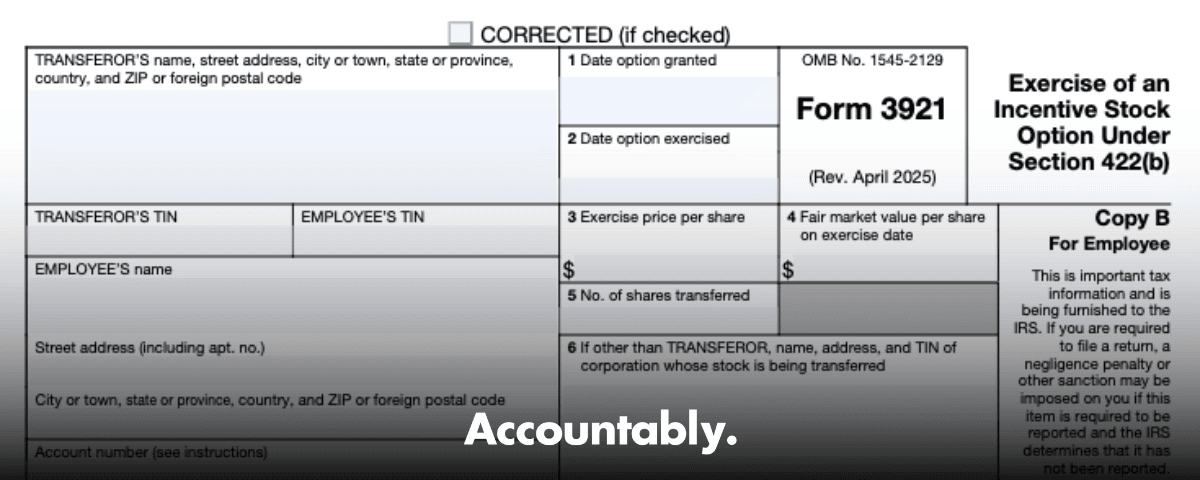

Form 3921 is the information return the IRS expects you to file for each Incentive Stock Option exercise under IRC §422(b). It captures the grant date, the exercise date, the exercise price, the fair market value on the exercise date, the number of shares, and both issuer and employee identifiers. In short, it records the exact economics of the exercise so employees and tax preparers can compute AMT adjustments and future basis with confidence.

Key takeaways

- You must prepare one Form 3921 for each ISO exercise event in the calendar year. It is not one per person, it is one per exercise.

- Furnish Copy B to the employee by January 31 for prior year exercises, then file Copy A with the IRS by February 28 if filing on paper, or by March 31 if filing electronically.

- If you have 10 or more information returns in total for the year, electronic filing is required, and the 10 count is aggregated across return types.

- Penalties for late or incorrect filing are tiered and inflation adjusted. Amounts increase the later you correct, and intentional disregard removes caps.

- Form 3921 data drives AMT calculations on Form 6251 and helps confirm holding periods and basis when the stock is sold.

What Form 3921 is and why it matters

Form 3921 is the IRS information return that reports each transfer of stock to an employee when they exercise an Incentive Stock Option, as defined in section 422(b). It is purely informational for regular tax at exercise, however it is essential for the employee’s AMT computation and for setting the right basis figures later. Expect to complete the grant date, the exercise date, the exercise price per share, the fair market value per share on the exercise date, the number of shares, and both parties’ names, addresses, and TINs.

Why you should care if you are in finance, payroll, or equity admin. The form underpins three jobs. First, employees need the AMT adjustment, which equals fair market value at exercise minus the option price, times the shares. Second, basis for regular tax and AMT can differ, and Form 3921 is your audit‑ready paper trail. Third, accurate and on time filing avoids penalties and late nights in February.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Who must file and who receives the form

If your company transfers stock to a person because they exercised an ISO, you must file a separate Form 3921 for each exercise in that calendar year. That includes exercises by former employees if the transfer happened while you were their employer. You file Copy A with the IRS and furnish Copy B to the person who exercised. Keep Copy C with your records. There is an exception for some nonresident aliens who were not required to receive a Form W‑2 during the relevant period.

A quick way to confirm responsibility. Check your plan logs for any ISO exercises with share delivery. If the answer is yes, you have a 3921 obligation. Confirm addresses and TINs early, because failed TIN matching is a common reason for rework and penalties. The required data points are specific, so lock them down before you generate any statements.

Information you need to complete Form 3921

Work from reliable source documents. Gather the corporation’s legal name, address, and EIN, the employee’s legal name, address, and TIN, the ISO grant date, the exercise date, the number of shares and their class, the exercise price per share, and the fair market value per share on the exercise date. Cross check share counts and prices against your cap table and brokerage confirmations.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallA tip that saves reviews. Tie the fair market value used on Form 3921 to the 409A or other defensible appraisal as of the exercise date. Keep a short note in the file that cites the report date, the valuation firm, and the share class. This small step avoids back and forth during AMT questions later and keeps your basis numbers consistent with what appears on the employee’s return workpapers.

Filing deadlines and furnishing requirements, without surprises

Here is the simple calendar you and your auditors expect to see. Furnish Copy B to each person who exercised an ISO by January 31 of the year after exercise. File Copy A with the IRS by February 28 if paper filing, or by March 31 if e‑filing. For 2024 exercises, those dates were January 31, 2025 and March 31, 2025 for electronic filers. If you need more time to file with the IRS, submit Form 8809 by the original due date to request a 30 day extension for the IRS copy.

Employee furnishing deadline

Focus first on the January 31 furnishing date. Build a recipient list from your cap table or equity platform, verify addresses, and send Copy B by the deadline. If you furnish late, Section 6722 penalties apply on a per statement basis, with amounts that increase the later you correct.

IRS filing timelines

Treat the IRS deadlines as fixed. Paper filings are due by the last business day in February, electronic filings by March 31. If you cross the electronic filing threshold, you must e‑file. The current rules count almost all information return types together, so if your total is 10 or more, you need to transmit electronically. Plan on this being the norm for most employers once W‑2, 1099, and other returns are included.

Quick reference table

| Item | What to do | Due date |

| Copy B to employee | Furnish statements for prior year ISO exercises | January 31 |

| Copy A to IRS, paper | File if permitted to paper file | February 28 |

| Copy A to IRS, electronic | File via approved IRS e‑file system | March 31 |

| Extension for IRS filing | File Form 8809 for a 30 day extension | By the original due date |

Electronic versus paper filing, what to use in 2025

If you have 10 or more information returns in total, you must e‑file. The 10 count is aggregated across return types, not by form. Many filers easily cross the threshold once W‑2 and 1099 volumes are added to 3921 counts. Register early for the IRS system you will use and confirm technical specs before you transmit.

Where to file electronically. The IRS supports information return e‑filing through its electronic systems. Confirm the system that supports your form, obtain credentials, and test early. If you transmit through FIRE, follow Publication 1220 file layouts and error codes. If you use the newer system, follow its user guide and schemas.

When paper still applies. If you are below the 10 return threshold, you may paper file, however Copy A must be machine scannable in the official red dropout ink format or an approved substitute that matches IRS measurements. Order or produce compliant forms to avoid rejections and processing delays.

Penalties for late or incorrect filing, and how to avoid them

The IRS assesses penalties under Sections 6721 and 6722 if you file late, furnish late, or submit incorrect information. The per return amounts are tiered, generally lowest if corrected within 30 days, higher if corrected by August 1, and highest after that. Intentional disregard removes caps and results in steeper amounts per return. Check current year figures before filing season, then build those thresholds into your risk review.

A practical checklist that keeps you out of trouble

- One form per exercise, no combining across events.

- Validate TINs and EINs before you print or transmit.

- Anchor fair market value to a documented appraisal as of the exercise date.

- Use IRS compliant red ink paper if you mail Copy A, or transmit through the approved e‑file system if required to e‑file.

- Calendar the January 31, February 28, and March 31 milestones and file Form 8809 if you need a filing extension for the IRS copy.

AMT implications of ISO exercises, where Form 3921 shows its value

Exercising an ISO usually does not create regular taxable income, however it often creates an AMT adjustment. The adjustment equals the fair market value per share on the exercise date minus the exercise price per share, multiplied by the number of shares. You report that adjustment on Form 6251 for the year of exercise. Form 3921 provides the exercise date, exercise price, and exercise day fair market value, so you can compute the adjustment accurately.

When basis differs. For regular tax, basis starts at the exercise price, while AMT basis starts at fair market value on the exercise date if you recognized an AMT adjustment at exercise. Keep both sets of numbers, because the AMT basis can reduce future AMT in a later sale and can affect the AMT credit. This is a common reconciliation during year end reviews, so document it while the exercise details are fresh.

What about disqualifying dispositions. If you sell ISO stock before meeting both holding period tests, part of your gain becomes ordinary income and the AMT adjustment may reverse in that year. If you exercise and sell in the same calendar year, there is no AMT adjustment from the exercise. Track these cases carefully so your W‑2 and 1099‑B tie to the return.

Using Form 3921 data when you sell stock

When the shares are sold, start with facts you already have. Pull the exercise price per share, the exercise date, and the fair market value per share on the exercise date from Form 3921. For regular tax basis, multiply the exercise price by the number of shares. For AMT basis, multiply the fair market value at exercise by the number of shares if you included an AMT adjustment. Reconcile these to the amounts reported on the employee’s 1099‑B and any W‑2 ordinary income for disqualifying dispositions.

Determine the correct cost basis

- Regular basis equals exercise price times shares.

- AMT basis equals fair market value at exercise times shares, if you recognized an AMT adjustment.

- For disqualifying sales, ordinary income is generally the lesser of fair market value minus exercise price, or sales proceeds minus exercise price.

- Keep Copy B with the return workpapers to support Schedule D and Form 8949.

Verify holding period dates

To qualify for ISO long term treatment, you need at least two years from the grant date and at least one year from the exercise date. Use Form 3921 boxes for grant and exercise dates to confirm both tests. If the sale happens in the same calendar year as the exercise, you have a disqualifying disposition, so expect ordinary income reporting on the W‑2 for the appropriate amount.

Recordkeeping and data security, practical controls that stand up in audits

Treat every copy and every data point on Form 3921 as sensitive tax data. Retain Copy C and supporting evidence, including the plan document, grant notice, exercise confirmation, and valuation report. Maintain encryption for storage and transmission, enforce role based access, and preserve audit logs that show who viewed, exported, or changed records. These are table stakes for strong internal controls and they make penalty abatement far more credible if you ever need it.

A note on paper forms. If you mail Copy A, confirm your forms meet the IRS scannable standards, including red dropout ink, exact layouts, and margin specifications. Substitutes must be exact replicas for Copy A. Mismatched measurements and ink are common reasons for processing failures.

Coordinating Form 3921 with 409A valuations

Form 3921 hinges on the fair market value per share on the exercise date, so tie the value to a specific 409A appraisal or other defensible valuation in effect on that date. In your files, note the valuation date, report version, valuation firm, and the share class used, then confirm that the cap table and any post money adjustments line up with what you put on the form. This avoids disputes later and matches the box‑by‑box approach you are expected to follow.

Simple coordination checklist

- Match the FMV per share on Form 3921 to the valuation that covered the exercise date.

- Record the report date, share class, and any preferences that affect price per share.

- Reconcile the AMT adjustment to Form 6251 workpapers.

- Update your filing calendar so valuations are ready before the January 31 furnish date and March 31 e‑file date.

Step by step filing workflow you can reuse every year

Gather required details

Build a complete dataset for each exercise. Capture the corporation’s legal name, address, and EIN, the employee’s name, address, and TIN, the grant date, the exercise date, the number and class of shares, the exercise price per share, and the fair market value per share on the exercise date. Generate one Form 3921 per exercise and label Copies A, B, and C. Keep the source evidence that ties each box to a document.

Choose your filing method

Map form counts and deadlines to the rules. If you have 10 or more information returns in aggregate, e‑file is mandatory. Register early for the IRS e‑file system you will use, then follow the right technical specs. If you are below the threshold and choose paper, use IRS scannable Copy A with the required red ink and measurements. Either way, furnish Copy B by January 31, file Copy A by the correct IRS date, and retain Copy C.

| Criterion | Decision guide |

| Total information returns for the year | 10 or more, e‑file is required |

| System to use | Use the IRS system that supports your forms |

| Setup lead time | Transmitter setup and testing can take several weeks |

| Deadlines | January 31 furnish, February 28 paper, March 31 electronic |

Meet key deadlines

Anchor your calendar to three milestones. Furnish Copy B to each ISO exerciser by January 31. File Copy A with the IRS by February 28 if on paper or by March 31 if electronic. Initiate your transmitter setup well in advance, since credentialing and testing can add time. If needed, file Form 8809 to request a 30 day extension for the IRS filing.

Operating at scale, without burning out your team

If your firm is handling dozens or hundreds of ISO exercises across multiple entities and states, the work can quickly bottleneck, especially in January. The failure pattern is predictable, missing SOPs, unstructured workpapers, unclear review loops, and last minute firefighting. The fix is a disciplined delivery model, clear procedures, standard files, and a layered review that protects partner time. This is where a purpose built offshore delivery system, not resume based staffing, can keep 3921 work on schedule while preserving quality and security.

A light note on how some firms handle it. Accountably integrates trained offshore teams into your workflow, inside your systems and templates, with SOP driven execution, standardized workpapers, and multi layer reviews so reviewers spend time on judgment, not format. Capacity planning and live tracking keep deadlines on target, which matters when January 31 and March 31 arrive at the same moment as W‑2 and 1099 responsibilities. Mentioned here because it is practical, not because you must outsource to do this well.

Common errors and how to avoid them

Small 3921 mistakes tend to snowball, so fix the highest risk steps first.

- Issuing one form per person instead of one per exercise. Always create a separate form for each exercise event.

- Missing or incorrect TINs. Use TIN validation and keep addresses current before you furnish Copy B.

- Using the wrong fair market value. The exercise date FMV is the only value that belongs in Box 4. Tie it to the valuation that covered that date.

- Paper forms that are not scannable. Use red dropout ink and exact measurements for Copy A, or e‑file.

- Missing deadlines. Calendar January 31, February 28, and March 31, and use Form 8809 if you need more time for the IRS copy.

FAQs

Do I file Form 3921 if the employee is a nonresident alien who never received a W‑2 from us during the relevant period?

In general, no. There is an exception for a nonresident alien employee who was not required to receive a Form W‑2 during the time from the grant year through the exercise year. Confirm facts with counsel if uncertain.

Can I furnish Copy B electronically?

Yes, with the employee’s consent that meets IRS rules. Maintain records of consent, deliver on or before January 31, and allow employees to access and print their statements securely. Truncate TINs on payee statements when permitted.

Is e‑file mandatory for Form 3921 in 2025?

It depends on your total count of information returns. If you file 10 or more in the year, you must e‑file and you must aggregate across return types to test the threshold. Select the IRS system that supports your forms and follow its technical specifications.

Where do AMT amounts from ISO exercises show up on the return?

Employees compute the ISO adjustment on Form 6251 in the year of exercise. The numbers on Form 3921, mainly exercise date, exercise price, and exercise date fair market value, feed that calculation. Keep both regular basis and AMT basis in your files for the later sale.

What are the penalties if I file late or report incorrect data?

Penalty amounts are indexed annually and tiered. The lowest penalty applies if you correct within 30 days, a higher amount applies if you correct by August 1, and the highest tier applies after that. Intentional disregard removes caps and increases the per return amount. Check the current year schedule each filing season.

Does the newer IRS e‑file system handle Form 3921, or do I need the legacy system?

The IRS offers electronic filing through its systems. Confirm the system that currently supports Form 3921, register, and test early. Many filers continue to use the legacy channel, while others adopt the newer interface as it expands coverage.

Can I print Copy A myself on plain paper?

No. Copy A must be machine scannable and printed in the required red dropout ink format or an approved substitute that exactly matches layout and measurements. Use approved vendors or IRS supplied forms to avoid rejections.

Quick action plan you can use this week

- Build your ISO exerciser list for last year, reconcile shares, and confirm addresses and TINs.

- Tie fair market value per share to the valuation that covered each exercise date and note the report details in your files.

- Decide now whether you must e‑file based on the 10 return aggregation rule, then line up system credentials and test files.

- Order compliant red ink paper forms if you are below the threshold and plan to file on paper, or validate your e‑file test transmissions.

- Calendar January 31 for furnishing and March 31 for e‑file submission, then add a reminder for Form 8809 in case you need a filing extension for the IRS copy.

Templates and checklists you can copy into your SOPs

Pre‑January 31 furnishing checklist

- Run ISO exercise reports and reconcile by person and by event.

- Validate recipient names, addresses, and TINs.

- Prepare Copy B and obtain electronic consent if furnishing electronically.

- Retain a proof file, sent emails, mail receipts, or portal logs.

March filing checklist

- Confirm whether the 10 return rule requires e‑file for your organization this year.

- Transmit using the IRS system that supports your forms, then monitor acknowledgments and error codes.

- If filing on paper, verify red ink forms, margins, and page counts match IRS specs, and include Form 1096 as required.

- File Form 8809 by the original due date if you need a 30 day extension for the IRS filing.

Where to check the rules, straight from the IRS

- Instructions for Forms 3921 and 3922, including who must file and box by box details.

- General Instructions for Certain Information Returns, including e‑file options, electronic furnishing, and penalties.

- Current guidance on the 10 return aggregation rule for mandatory e‑file.

- Annual penalty amounts and caps for the current filing year.

- Instructions for Form 6251 showing where the ISO adjustment appears.

Final tip from the trenches

You do not need a hero sprint in late January. You need good files, a repeatable checklist, and early systems setup. If you are short on hands during peak season, consider structured help that works inside your systems, follows your SOPs, and protects review time. That way, Form 3921 becomes a predictable task on your calendar, not a fire drill.

Note: This article is for general information, not tax advice. Always check the current IRS instructions and your facts before filing. Dates in this guide reflect the 2025 calendar as of November 1, 2025.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk