Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

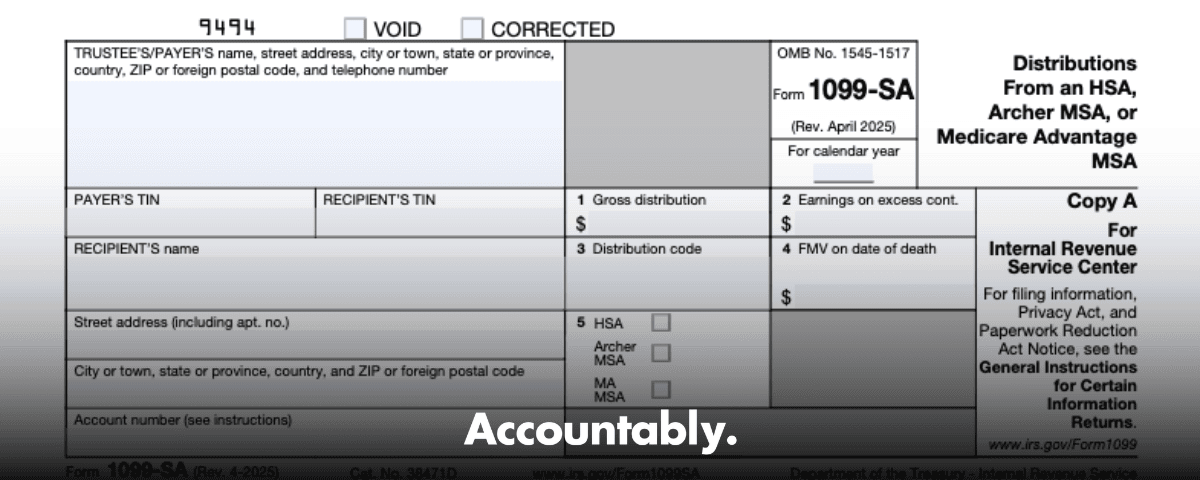

Quick truth, Form 1099-SA confirms you withdrew money from a tax-advantaged medical account, and it gives you the numbers you need to finish Form 8889 for HSAs or Form 8853 for Archer MSAs.

Your HSA or MSA trustee, usually a bank or insurer, must send you Copy B and send Copy A to the IRS. For the 1099 family of forms, the usual timetable is copies to you by January 31 of the year after the withdrawal, paper filing with the IRS by February 28, and e-filing by March 31. Always check the current IRS schedule before filing, since the IRS updates its general instructions and may add reminders each season.

Key takeaways

- Form 1099-SA reports distributions from HSAs, Archer MSAs, or Medicare Advantage MSAs for the tax year, and you use it to complete Form 8889 or Form 8853.

- Box 1 shows your total distribution, Box 3 shows a code that signals tax treatment, for example normal, excess contribution, disability, or death-related distribution.

- If you used HSA money for qualified medical expenses, the amount is generally not taxable. Amounts not used for qualified medical expenses are taxable and can trigger an additional 20% tax unless an exception applies.

- Trustees must furnish recipient copies by about January 31, and file with the IRS by February 28 if on paper or March 31 if e-filed, see the current IRS schedule.

- Trustee-to-trustee transfers are not reported as distributions on 1099-SA, while rollovers follow specific rules.

What Form 1099-SA reports and when it applies

When Form 1099-SA lands in your inbox or mailbox, it means you took a distribution from one of three accounts, an HSA, an Archer MSA, or a Medicare Advantage MSA, during the year. Box 1 lists the total that left the account. Box 3 lists a distribution code that tells you and the IRS what kind of distribution it was. You will carry these details into your tax return, usually on Form 8889 for HSAs or Form 8853 for Archer MSAs.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

The trustee is responsible for issuing the form and for filing with the IRS. The IRS allows electronic furnishing of recipient statements with proper consent, and it requires most filers that issue 10 or more information returns to e-file. If a trustee uses electronic delivery, they must meet the IRS timing and access rules so recipients can retrieve statements through October.

A quick highlight on due dates

For information returns like 1099-SA, the IRS schedule most taxpayers rely on is copies to recipients by January 31, paper filing by February 28, and e-filing by March 31. The IRS posts a running table and seasonal notices each year, so if a date falls on a weekend or holiday, the due date usually shifts to the next business day. Use those official tables to confirm the exact year’s dates you care about.

Who issues the form and how it is delivered

Your HSA or MSA trustee, think bank, credit union, or insurer, prepares the form. They include their name, their TIN, your TIN, your address, and the account number. You receive Copy B for your records and for completing your return, while Copy A goes to the IRS. Electronic delivery is permitted if the trustee follows the IRS rules for consent and online access.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhy you might not receive a 1099-SA

If you did not withdraw any money, there is nothing to report, so no 1099-SA arrives. Trustee-to-trustee transfers are not reportable distributions either, so they will not generate a 1099-SA. If you expected a form and it is missing by early February, contact your trustee to request a copy or a correction.

The boxes that matter

Here is how to read the key fields on your 1099-SA and what they mean for your return.

Box 1, gross distribution

This is the total amount that left your account during the year. You will start with Box 1 to reconcile on Form 8889 for HSAs, or Form 8853 for Archer MSAs.

Box 2, distribution code

Box 2 tells you the type of distribution, which drives tax treatment. for example normal distributions, excess contributions, disability, prohibited transactions, and death-related codes. You will reference these when deciding if any part is taxable or subject to the 20% additional tax.

Box 3, fair market value on date of death

If the account holder died, Box 4 may show the account’s value on the date of death. This helps determine how beneficiaries report distributions, and it changes how the additional tax applies.

Tax free versus taxable, and how the 20% additional tax really works

If you used HSA money for qualified medical expenses for you, your spouse, or your dependents, distributions are generally not taxable. If any part was not for qualified medical expenses, that portion is taxable. For HSAs, a taxable amount can also trigger an additional 20% tax unless an exception applies. You claim the exceptions if the distribution occurred after you reached age 65, after you became disabled, or after death of the account holder.

Box 3 distribution codes at a glance

Use your code from Box 3 to understand what you are reporting.

| Code | What it means | Typical notes |

| 1 | Normal distribution | Default code for regular withdrawals or payments to providers |

| 2 | Excess contributions | Used when returning excess HSA or Archer MSA contributions, earnings on excesses appear in Box 2 |

| 3 | Disability | Distribution after the account holder is disabled under section 72(m)(7) |

| 4 | Death distribution, not code 6 | Payments to an estate in the year of death, or to an estate after the year of death |

| 5 | Prohibited transaction | See sections 220(e)(2) and 223(e)(2) |

| 6 | Death distribution after year of death to a nonspouse beneficiary | Use only for nonspouse beneficiaries, not estates, after the year of death |

| Source, IRS Instructions for Forms 1099‑SA and 5498‑SA. |

Transfers, rollovers, and mistaken distributions

- Trustee-to-trustee transfers are not reported as distributions and do not create tax. For example, moving funds from one HSA custodian to another via direct transfer does not generate a 1099-SA.

- Rollovers are different from transfers. Archer MSA rollovers to another Archer MSA or to an HSA are generally tax free if completed within 60 days, and you will track them on Form 8853 or Form 8889. HSAs can only accept one rollover per 1 year period.

- If you took an HSA distribution by mistake, the IRS allows repayment by the due date of the return for the year you knew, or should have known, of the mistake. Ask your trustee about their mistaken distribution process, then keep proof with your records.

How to use the codes when you file

For HSAs, report distributions on Form 8889. If your Box 3 code is 1 and you used the funds for qualified medical expenses, the taxable amount is generally zero. If any portion was not for qualified medical expenses, include that amount in income and compute the 20% additional tax unless an exception applies. For Archer MSAs, report on Form 8853 and follow the same qualified versus nonqualified logic.

The 20% additional tax exceptions, made simple

The additional 20% tax does not apply to amounts included in income if the distribution occurred after you turned age 65, after you became disabled, or after the account beneficiary died. When you complete Form 8889, you will check the exception box if it applies, then only apply 20% to the portion not covered by an exception. Keep dates with your receipts, for example the date you turned 65, so you can support the exception if asked.

Beneficiaries and Box 4

If a spouse is the designated beneficiary of an HSA, the HSA becomes the spouse’s HSA and is treated as if the spouse were the original account holder. If a nonspouse beneficiary inherits, the account stops being an HSA, and the fair market value on the date of death is generally taxable to the beneficiary, reduced by qualified medical expenses the decedent incurred and were paid within 1 year after death. The 1099-SA codes differ for payments in the year of death versus after the year of death, which is why Box 3 and Box 4 matter here.

Step by step, how to use Form 1099-SA on your return

- Match the basics Check your name, TIN, and account number, then confirm Box 1 and the Box 3 code. If anything looks off, ask the trustee for a corrected form before you file.

- Map the form

- HSAs go to Form 8889, Archer MSAs go to Form 8853. Medicare Advantage MSA distributions are handled under the same 1099-SA framework, but follow the instructions that apply to your account type.

- Prove the purpose Line up receipts for qualified medical expenses. If all distributions were qualified, your taxable amount is generally zero. If not, calculate the taxable portion and the additional 20% tax if you do not meet an exception.

- Watch the exceptions If you reached age 65 during the year, split pre‑65 and post‑65 distributions, then apply the exception only to the post‑65 amounts that were not for qualified medical expenses. The instructions show examples, and the lines on Form 8889 walk you through the math.

Timelines, missing forms, and corrections

Deadlines you should know

- Recipient copies, usually due by about January 31 for the prior tax year.

- IRS filing, February 28 if paper, March 31 if e-filed, unless the IRS posts a special date.

- If a date falls on a weekend or holiday, it typically moves to the next business day. Trustees must also follow IRS rules if they furnish statements electronically, including posting by January 31 and keeping access available through October 15.

Missing or incorrect 1099-SA

If you expected a 1099-SA and it has not arrived by early February, contact your trustee and ask for a copy or a correction. You usually do not mail the form with your return, you keep Copy B and use the numbers to complete your filing. The trustee files Copy A with the IRS.

Common real world scenarios

- You withdrew 2,200 for an ER visit, and Box 3 shows code 1. You keep the hospital and pharmacy receipts, enter the numbers on Form 8889, and you owe no income tax or additional tax.

- You spent 500 on a nonmedical purchase. That portion is taxable, and if no exception applies, you also compute 20% of 500 as additional tax on Form 8889.

- You moved an HSA from Bank A to Bank B through a trustee-to-trustee transfer. There is no 1099-SA, and there is no tax.

- You returned an HSA withdrawal that was clearly a mistake, for example the provider reversed a charge and you immediately sent the funds back. Ask your trustee about their mistaken distribution process, then document the repayment by the deadline in the IRS rules.

Quick reference tables

How 1099-SA flows to your return

| Step | What you do | Where it goes |

| 1 | Confirm name, TIN, account number | Keep Copy B, fix errors with trustee |

| 2 | Read Box 1 total distribution | Form 8889 for HSAs, Form 8853 for Archer MSAs |

| 3 | Use Box 3 code to set tax treatment | Form 8889 or 8853 instructions |

| 4 | Calculate taxable amount, if any | Form 8889 Part II or Form 8853 Part II |

| 5 | Apply 20% additional tax or exceptions | Form 8889 exception checkbox, then line for additional tax |

| Sources, IRS Instructions for Form 8889 and Form 8853. |

Filing due dates, big picture

| What | Recipient copy due | IRS paper due | IRS e-file due |

| Most 1099s, including 1099‑SA | Around Jan 31 | Feb 28 | Mar 31 |

| Source, IRS guide to information returns and seasonal reminders. |

FAQs

What is Form 1099-SA used for?

It reports withdrawals from HSAs, Archer MSAs, and Medicare Advantage MSAs. You use it to complete Form 8889 for HSAs or Form 8853 for Archer MSAs, then carry any taxable amount to your Form 1040.

Do I have to enter Form 1099-SA on my tax return?

Yes. HSAs reconcile on Form 8889, MSAs on Form 8853. If all distributions were for qualified medical expenses, your taxable amount is usually zero. If not, include the nonqualified portion in income, and compute any additional 20% tax if no exception applies.

I did not receive a 1099-SA, now what?

If you did not take a distribution, none is due. If you did and it is missing by early February, ask your trustee for a copy. Transfers between trustees do not produce a 1099-SA.

How do rollovers and transfers show up?

Direct trustee-to-trustee transfers are not reported as distributions. Rollovers have their own timing and once-per-year limits for HSAs and Archer MSAs, so follow Form 8853 and 8889 instructions and keep proof.

What are the distribution codes on 1099-SA?

Codes run from 1 to 6 and cover normal, excess contribution returns, disability, death-related distributions, and prohibited transactions. The code you see drives how you report the amount and whether the additional 20% tax can apply.

A brief note for firm leaders

If you run an accounting firm and need consistent, on-time HSA and MSA reporting support at scale, structure beats staffing every time. Accountably integrates trained offshore teams inside your workflow with SOP-driven execution, standardized workpapers, and defined SLAs, so partner review time drops and deadlines stop slipping. Use it when you need capacity without chaos, and keep control of quality and security. (Mentioned sparingly since this page is educational first.)

Sources and year checks

- IRS Instructions for Forms 1099‑SA and 5498‑SA, updated for 2025, including distribution codes, death rules, transfers, and mistaken distributions.

- IRS Instructions for Form 8889, 2024 revision, for HSA taxability and the 20% additional tax exceptions.

- IRS Instructions for Form 8853, 2024 revision, for Archer MSA distributions and rollovers.

- IRS Guide to Information Returns and seasonal due date reminders for recipient and IRS filing deadlines.

Note, this content is educational, not tax advice. If your situation involves unique facts, file with a qualified tax professional, and always confirm live-year dates on IRS.gov before you submit.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk