Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Your mortgage servicer must send, or make available online, your Form 1098 by January 31, and a separate form is usually issued for each mortgage that hits the $600 reporting threshold.

Key Takeaways

- Form 1098 reports $600 or more of mortgage interest you paid to a lender in a calendar year, along with loan details that help you itemize. Expect a copy for each qualifying mortgage by January 31.

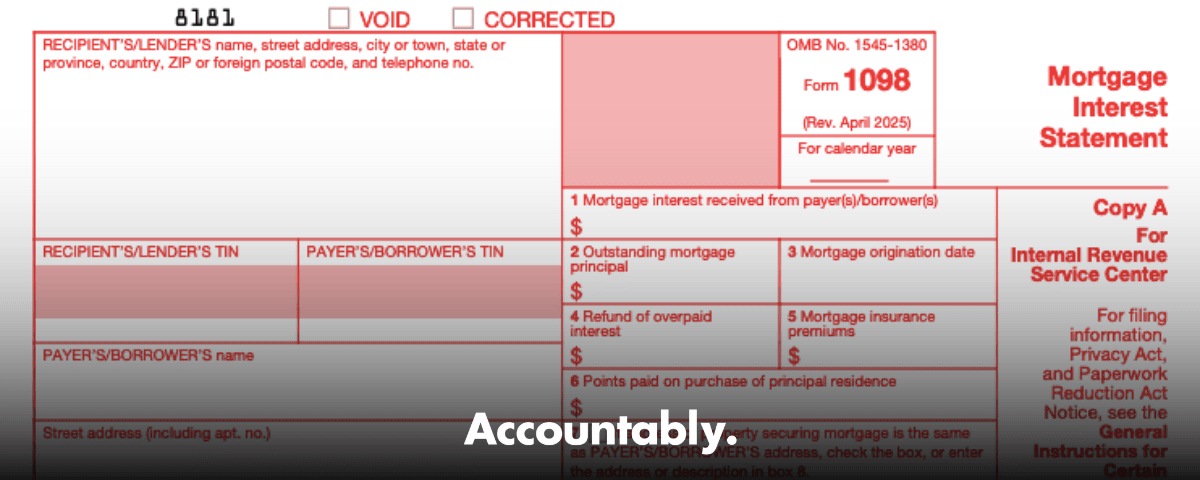

- The boxes changed in recent years. Today, key boxes are: Box 1 interest, Box 2 outstanding principal, Box 3 origination date, Box 4 refund of overpaid interest, Box 5 mortgage insurance premiums, and Box 6 points on a home purchase.

- You only benefit from Form 1098 if you itemize on Schedule A and your loan meets the mortgage interest rules, including the $750,000 acquisition debt cap for loans incurred after December 15, 2017, and the higher cap for older loans.

- Mortgage insurance premiums, shown in Box 5, are generally not deductible for tax years after 2021 unless Congress revives the provision. That is why many Box 5 entries are blank today.

- The current $750,000 cap is scheduled to sunset after December 31, 2025, which would revert the limit to $1,000,000 beginning in 2026, unless Congress acts. Plan ahead if you refinance or buy in 2026.

What is Form 1098?

Form 1098, Mortgage Interest Statement, tells the IRS how much mortgage interest you paid and gives you the data you need to claim an itemized mortgage interest deduction. Lenders file it with the IRS and provide your copy by January 31. The $600 threshold applies per loan, so if you have two mortgages, you may see two forms.

The form is more than a receipt. It lists who you are and who the lender is, your loan’s outstanding principal at year‑end, the mortgage origination date, and whether there was any refund of overpaid interest. It can also show points you paid to buy your principal residence and any mortgage insurance premiums the lender received, even though those premiums are not deductible for post‑2021 tax years unless Congress extends the law.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Who receives Form 1098?

You receive Form 1098 if you are the lender’s payer of record on a mortgage and you paid at least $600 of reportable interest during the year. When there are multiple borrowers, the lender issues one form to the payer of record in its system. If your totals are under $600, the lender is not required to furnish a form, though some do. You will usually get a separate Form 1098 for each qualifying mortgage.

A few common edge cases:

- If you financed directly with a seller or paid interest to an entity that is not in the lending business, a Form 1098 may not be issued. Keep your own records, you can still claim eligible interest if you itemize and the loan is secured by a qualified home.

- If you are a co‑borrower but not listed as the payer of record, the statement may go to the other borrower. You can still allocate the deduction properly on your return based on who actually paid the interest and the IRS rules. Check the lender’s “payer of record” setting if you need the form reissued.

Why some boxes look different than you expect

A lot of older blog posts still say “Box 2 is points” or “Box 4 is mortgage insurance.” That was true years ago. Today’s instructions are clear, and they matter for how you read your form:

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call- Box 1, mortgage interest received

- Box 2, outstanding mortgage principal

- Box 3, mortgage origination date

- Box 4, refund of overpaid interest

- Box 5, mortgage insurance premiums, reportable only when the law allowing a deduction applies

- Box 6, points paid on purchase of your principal residence

Always read the current instructions that ship with the form. They are updated and they control.

Tip, If Box 5 is blank even though you paid PMI or MIP each month, that is normal. The federal deduction expired after 2021, so many servicers do not populate Box 5 for current years. Keep your statements in case the law changes.

What the boxes mean for your return

Let’s translate the fields you will actually use when you prepare Schedule A.

- Box 1, Mortgage interest received, This is the starting point for your itemized mortgage interest deduction. Reconcile it to your year‑end loan statement. If you prepaid December interest in late November, timing can cause small mismatches, so compare the accrual dates too.

- Box 2, Outstanding principal, This helps you monitor the size of your acquisition debt relative to the IRS limits. It does not go on your return, but it matters if you are near the cap.

- Box 3, Mortgage origination date, This date helps you determine which cap applies, $1,000,000 for older acquisition debt and $750,000 for post‑12/15/2017 debt, with a limited binding contract exception for closings by April 1, 2018.

- Box 4, Refund of overpaid interest, If your lender credited you for a prior‑year overpayment, reduce your current deduction accordingly.

- Box 5, Mortgage insurance premiums, Only relevant if Congress extends the deduction. For now, premiums paid after December 31, 2021 are not deductible, which is why you may not see an amount here.

- Box 6, Points, If you bought a principal residence and paid qualifying points, you may deduct them in the year paid. For a refinance, you usually amortize points over the loan term. Keep your closing disclosure and match the label to the IRS definition of points.

Fast box‑by‑box check

- Names, addresses, and TINs match your records.

- Box 1 equals your interest paid for the year, based on accrual, not just payment date.

- Box 2 and Box 3 make sense for your loan history.

- Box 4, if any, is reflected in your deduction.

- Box 5 is blank for most current years, which is expected.

- Box 6 matches your closing disclosure if you bought a home.

When lenders must issue Form 1098

A lender must file Form 1098 with the IRS and furnish your borrower copy when its records show $600 or more of reportable mortgage interest for the year on a single mortgage. Your copy is due to you by January 31. If you have multiple mortgages, the $600 test applies to each loan separately, and you get one form per loan that meets the threshold.

Special reminders lenders follow include who must file, how to report points, how to handle multiple borrowers, and what counts as prepaid interest. These details explain why your form may look different if you refinanced, paid seller‑paid points, or moved mid‑year.

Situations when you might not receive a Form 1098

- Your total interest, points, and reportable items on one loan were under $600 for the year.

- The recipient of your payments is not in the lending business or is not required to file, for example, some seller‑financed notes.

- You are a co‑borrower but not the lender’s payer of record.

- Your servicer delivers statements electronically only, so the form is in your portal.

Good news, Even without a Form 1098, you can still deduct eligible mortgage interest if you itemize and your loan meets IRS rules. Keep statements, amortization schedules, and closing docs as proof.

What to do if the form is missing or wrong

- Check your online mortgage portal. Many servicers post by January 31.

- Compare Box 1 with your annual statement, then look for timing differences, like prepaid or late‑posted interest.

- Ask the servicer for a corrected Form 1098 if the lender name, your TIN, Box 1, Box 4, or Box 6 is wrong.

- Keep a written log of dates, contact names, and responses. If time is tight, file with your own records and attach detailed notes for your files.

How to claim the mortgage interest deduction on Schedule A

Here is a simple path I teach homeowners and new staff each year.

- Confirm you will itemize, Add up mortgage interest, state and local taxes (subject to the cap), charitable gifts, and other deductions. If itemized deductions do not exceed your standard deduction, you will not benefit from entering Form 1098.

- Gather all Forms 1098, one per qualifying mortgage.

- Enter Box 1 amounts, plus any deductible points in Box 6 for purchase loans, on Schedule A.

- If there is an interest refund in Box 4, reduce your deduction.

- Apply the acquisition debt caps described below. Save every statement and your closing disclosure.

The IRS limits your deduction to interest on up to $750,000 of acquisition debt for loans incurred after December 15, 2017, and up to $1,000,000 for older acquisition debt, including a narrow binding‑contract exception for some 2017 purchases that closed by April 1, 2018.

Points and refinances, what to know

- If you bought a principal residence and your points meet the IRS tests, you can usually deduct them in the year paid.

- If you refinanced, you typically amortize points over the new loan’s term, unless part of the refinance paid for home improvements that may qualify for a different treatment.

- Match the description on your closing disclosure to the IRS definition of “points,” not just a generic “fee” label.

Mortgage insurance premiums today

Mortgage insurance premiums, often called PMI or MIP, appeared on Schedule A for years when Congress temporarily allowed the deduction. That deduction expired for premiums paid after December 31, 2021. For recent returns, you usually cannot deduct Box 5, which is why servicers often leave it blank. If Congress revives the deduction, the IRS will update instructions and servicers will resume reporting.

Publication 936 rules that actually affect you

Publication 936 is the IRS playbook for the home mortgage interest deduction. The biggest ideas are:

- Your loan must be a secured debt on a qualified home.

- Interest is deductible only on acquisition debt, money used to buy, build, or substantially improve the home that secures the loan.

- The cap is $750,000 for post‑12/15/2017 acquisition debt, $1,000,000 for older acquisition debt.

- If your average balances exceed those limits, you must prorate the deduction using the IRS worksheet.

Planning note, The current $750,000 limit is scheduled to revert to $1,000,000 on January 1, 2026 unless Congress acts. If you expect to purchase or refinance in 2026, factor that into your assumptions.

Real‑life example

You have two mortgages, both secured by qualified homes. Your Box 1 totals are 12,400 and 3,100. You itemize because your combined deductions beat the standard deduction. Your loans are post‑2017, and your average balances stayed under $750,000 combined. You can deduct the full 15,500 of interest. If the combined balances exceeded $750,000, you would apply the Publication 936 worksheet to limit the deduction proportionally.

Multiple mortgages and how to keep them straight

Treat each loan as its own packet first, then aggregate only the amounts that are actually deductible.

- Track each Form 1098 by loan number and property.

- Sum only the deductible amounts on Schedule A, mainly Box 1 interest and any current‑year deductible points.

- If one loan’s interest is under $600 and no form arrives, you can still claim eligible interest with bank records.

- Keep a simple spreadsheet, including property, lender, loan number, Box 1, Box 4, Box 6, and any notes.

Missing or incorrect Form 1098, quick fix plan

- Contact the servicer, verify your name, address, TIN, and the Box 1 amount, and request a PDF if the paper was lost.

- If the figures are wrong, ask for a “corrected Form 1098,” and confirm when they will also file the correction with the IRS.

- Document every call and message.

- If you must file before a correction arrives, use your statements to compute the deduction and keep your reconciliation in your records.

Form 1098 vs. 1098‑E, 1098‑T, 1098‑C, and 1098‑F

Here is a quick side‑by‑side so you do not mix up similarly named forms.

| Form | What it reports | Who sends it | Threshold | Your next step |

| 1098 | Mortgage interest, points, some loan details | Lender or servicer | $600 per mortgage | Use for Schedule A if you itemize and meet Pub 936 rules |

| 1098‑E | Student loan interest | Loan servicer | $600 | Claim up to $2,500 as an above‑the‑line deduction if you meet MAGI rules |

| 1098‑T | Tuition statement, payments and scholarships | School | Varies by instruction | Use for AOTC or LLC if eligible |

| 1098‑C | Vehicle donation acknowledgment | Charity | Over $500 sale proceeds | Use to substantiate charitable deduction |

| 1098‑F | Fines, penalties, restitution, compliance costs | Government agency | $50,000 aggregate, details vary | Informational for section 162(f) analysis, not a mortgage item |

The IRS sets the $600 threshold for the mortgage Form 1098 and the January 31 recipient due date. The student loan and tuition forms share the same January timeline for recipients.

A closer look at 1098‑F

Form 1098‑F is filed by a government or governmental entity when a suit, order, or agreement requires a payor to pay $50,000 or more in connection with a violation of law, including amounts for restitution or to come into compliance. Agencies also furnish a statement to the payor. In practice, if a dollar amount is not identified, agencies may enter $50,000 and add a code noting the unknown amount, which is why you might see that value even when the final settlement differs. Use 1098‑F as a notice, then analyze section 162(f) deductibility with a tax pro.

Student loan interest, the quick facts you asked about

- Maximum deduction, $2,500, claimed without itemizing.

- For 2024, the deduction phases out between $80,000 and $95,000 MAGI for single filers and $165,000 to $195,000 for joint filers. For 2025, check the latest IRS guidance when you prepare your return, since the IRS sets thresholds annually.

Keep your 1098‑E and your own interest records. If you paid less than $600, you might not receive a form, but you can still claim eligible interest.

For CPA, EA, and firm owners, keeping 1098 work clean at scale

Every January, our team reviews thousands of lender PDFs, and the same issues show up, mismatched Box 1 due to timing, missing corrected forms, and confusion over Box 5. The cure is a simple SOP, name files consistently, reconcile Box 1 to year‑end statements, flag Box 4 refunds, confirm origination dates for the cap rules, and note that Box 5 is usually not deductible after 2021. If your in‑house team is buried in season, a disciplined offshore delivery partner can plug in at the review level without changing your workflow or risking quality.

Accountably’s role here is limited and practical, we integrate trained offshore teams into your existing systems, with SOP‑driven workpapers and layered review that cut partner time in the review loop. That helps you meet the January 31 document checks, keep Schedule A clean, and protect client trust without adding overhead. If you want to compare engagement models or see sample workpapers, reach out when it makes sense.

FAQs

Do I need a Form 1098 to deduct mortgage interest?

No. You can claim eligible mortgage interest if you itemize and your loan meets the rules, even if your lender did not issue a Form 1098. Keep statements, amortization schedules, and your closing disclosure as proof.

Why is Box 5 empty when I pay PMI every month?

The federal deduction for mortgage insurance premiums expired for premiums paid after December 31, 2021. Many servicers do not report Box 5 amounts for current years. If Congress extends the law, the IRS will update instructions and lenders will resume reporting.

What counts toward the $750,000 cap?

Only acquisition debt, money used to buy, build, or substantially improve the home securing the loan. If your balances exceed the cap, use the IRS worksheet in Publication 936 to compute the deductible portion.

I refinanced this year, how do I handle points?

Purchase points that meet the IRS tests are usually deductible in the year paid. Refinance points are generally amortized over the new loan term, with a few exceptions. Match your closing disclosure to the IRS definition of “points.”

I have two mortgages with the same servicer. Will I get one combined 1098?

Expect a separate Form 1098 per loan that meets the $600 threshold. Aggregate only the deductible amounts on Schedule A.

What does 1098‑F have to do with me as an employer?

If you ever receive a 1098‑F from a government agency, it is a heads‑up that section 6050X reporting has been triggered at the $50,000 level for fines, penalties, restitution, or compliance costs. It is informational. Review section 162(f) with your advisor to see what is deductible.

Resources and current revision status

- Instructions for Form 1098, revised April 2025, with box‑by‑box definitions and important notes about points and mortgage insurance reporting.

- Publication 936, 2024 edition, the authoritative rules and worksheets for the mortgage interest deduction.

- Publication 530, 2024 edition, confirms no deduction for mortgage insurance premiums paid after 2021.

- General Instructions for Certain Information Returns, due dates table that shows Form 1098 must be furnished to recipients by January 31.

- Publication 970, 2024, for student loan interest MAGI thresholds and annual updates for 2025.

Updated, October 28, 2025. This guide is general information, not tax advice. For your situation, speak with a qualified tax professional and check the latest IRS instructions for any late‑year changes.

The bottom line

Use Form 1098 as your map, not the destination. Confirm that Box 1 matches your records, understand which cap applies to your loans, ignore Box 5 for now unless the law changes, and keep tidy documentation. If you operate a firm, put a lightweight SOP around January forms and reviews so your team glides into filing season. With a few smart checks, you will turn a pile of PDFs into a clean Schedule A and finish early with less stress.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk