Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

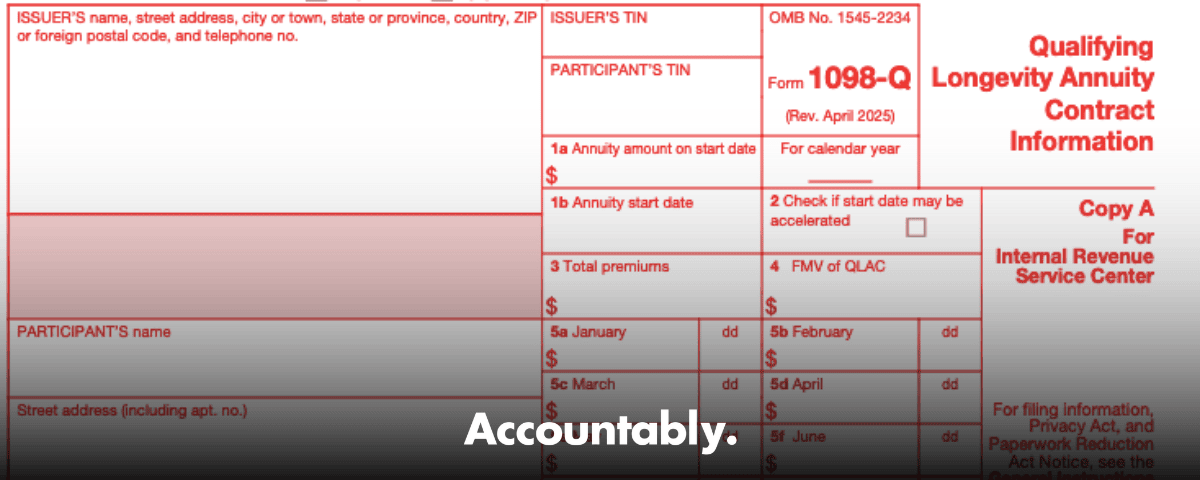

Form 1098‑Q is the issuer’s information return for a Qualifying Longevity Annuity Contract, and it supports RMD treatment by documenting QLAC status before payouts begin.

Key Takeaways

- Form 1098‑Q reports the purchase and annual status of a QLAC, including the annuity start date, the annuity amount at that date, cumulative premiums, December 31 FMV, and a month‑by‑month premium schedule.

- You must furnish the participant statement by January 31 and file with the IRS each year, beginning with the first premium year and continuing until death or age 85.

- For 2025, the QLAC premium cap is $200,000, with future increases indexed and rounded in $10,000 steps. The prior 25% rule was repealed for post‑December 28, 2022 premiums.

- If you file 10 or more information returns in aggregate, you must e‑file. IRIS and FIRE both support the 1098 series.

- Penalties are tiered under IRC 6721 and 6722. For 2025 filings, common per‑form tiers are $60, $130, and $330, with higher amounts for intentional disregard.

What Is Form 1098‑Q

Form 1098‑Q is the IRS return an insurer files when a contract is intended to be a QLAC funded from qualified plans or IRAs other than Roth IRAs. Filing begins in the first premium year and continues annually until the year before the participant dies or reaches age 85. This annual reporting helps confirm that QLAC value is excluded from the RMD base prior to annuitization.

The Boxes That Matter Most

- Box 1a, Annuity Amount on Start Date, shows the periodic payment due at the scheduled start if payments have not yet begun.

- Box 1b, Annuity Start Date, lists when payments are set to start.

- Box 2, check if the start date may be accelerated.

- Box 3, Total Premiums, is the cumulative amount through year end.

- Box 4, FMV of QLAC, is the December 31 value.

- Boxes 5a–5l, Monthly Premiums and Dates, list each premium with its date, and must reconcile to Box 3.

Quick win, reconcile Boxes 5a–5l to Box 3 first. If they do not tie, reviews drag and deadlines slip.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Who Must File Form 1098‑Q

If you issue a contract intended to be a QLAC under sections 401(a), 403(a), 403(b), 408 other than Roth IRA, or an eligible governmental 457(b) plan, you must file Form 1098‑Q and furnish the participant statement each year. The duty starts in the first premium year and ends in the year before death or age 85. If the employee dies and the sole beneficiary is the spouse, furnishing continues to the spouse until their distributions begin, or until the spouse dies.

Practical Implications For Issuers

- The insurer files, not the plan.

- Use distinct account numbers when a participant holds multiple QLACs with you.

- You may truncate a participant’s TIN on Copy B, never on Copy A filed with the IRS.

Deadlines, Formats, And The 10‑Return Rule

Here are the key timing rules for the calendar year following the premium year.

| Action | Due date | Notes |

| Furnish Copy B to participant | January 31 | Truncate TIN allowed on participant copy only. |

| File Copy A, paper | February 28 | Next business day if weekend or holiday. |

| File Copy A, electronic | March 31 | Next business day if weekend or holiday. |

| E‑file mandate | 10 or more information returns in aggregate | IRIS and FIRE support the 1098 series. |

Snapshot, furnish by January 31, paper file by February 28, e‑file by March 31. If you file 10 or more information returns, you must e‑file.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallHow SECURE 2.0 Changed The QLAC Limits

The new regime is now integrated into the current instructions. For 2025, the QLAC premium cap is $200,000. Beginning with calendar years starting on or after January 1, 2025, the cap is indexed for inflation, rounded down to the next $10,000. If you added premiums after December 28, 2022, those additions follow the new cap, provided earlier premiums met prior rules.

Why this matters, Box 3 must reflect a total that respects the cap for the year. Overfunding risks failure of QLAC status unless the excess is treated correctly under the rules.

RMD Treatment

Before payouts begin, the QLAC value is excluded from the RMD base. This is one of the key reasons the form exists, it gives administrators and taxpayers the data to apply the exclusion correctly. Final 401(a)(9) regulations apply starting with distribution calendar years beginning January 1, 2025.

Box‑By‑Box Prep, With Reviewer Notes

You can finish Form 1098‑Q preparation quickly if you collect the right fields up front and run two simple tie‑outs.

Identification And Plan Fields

- Issuer name, address, TIN, and a phone line that reaches a knowledgeable person.

- Participant name, address, and TIN, observing truncation rules for participant statements.

- If purchased under a plan, include plan name, plan number, and plan sponsor EIN.

Core QLAC Entries

- Box 1a, periodic annuity amount payable at the start date.

- Box 1b, scheduled annuity start date.

- Box 2, check if the start date may be accelerated.

- Box 3, cumulative premiums through year end.

- Box 4, December 31 FMV.

- Boxes 5a–5l, each month’s premium and payment date.

Reviewer Notes That Prevent Rework

- Reconcile Boxes 5a–5l to Box 3 before review.

- Confirm Box 3 does not exceed the year’s cap, $200,000 for 2025.

- Verify the scheduled start date meets the latest permissible start, the first day of the month after the 85th birthday.

- Assign a unique account number when a participant holds multiple QLACs with you.

E‑File Workflow That Actually Sticks

Electronic filing is straightforward once your data is clean and your account access is set. The two common failure points are formatting and waiting too long to test.

Three‑Step E‑File Plan

- Prepare complete data, issuer EIN, participant TIN, account numbers, plan identifiers if applicable, and proper box formats. Validate before you transmit.

- Transmit through IRIS or FIRE. Both support the 1098 series in processing year 2025.

- Monitor acknowledgements and cure rejections quickly. If March 31 is close, push same‑day corrections to avoid moving into a higher penalty tier.

Remember, the e‑file mandate applies once your total information returns reach 10 or more across types.

Penalties In 2025, Plain Language

Information return penalties share the same tiered structure across most forms. For returns due in 2025, common per‑form amounts are $60 if corrected within 30 days, $130 if corrected by August 1, and $330 after August 1 or not filed, with higher penalties for intentional disregard and different annual maximums by filer size.

Penalty Snapshot Table

| Scenario | Per‑form penalty | Notes |

| Correct within 30 days | $60 | Lower annual cap applies. |

| Correct after 30 days, by Aug 1 | $130 | Higher cap applies. |

| After Aug 1 or never | $330 | Highest standard tier. |

| Intentional disregard | $660+ | No maximum, special rules apply. |

For 2026 returns, the standard tiers rise to $60, $130, and $340 per form, with a $680 intentional disregard amount, and updated annual maximums. Always confirm the table for your year.

A Real‑World Example You Can Model

Maria buys a QLAC from her IRA in March 2025 for $50,000, then adds $50,000 in November 2025. On the 1098‑Q for 2025, you will show $100,000 in Box 3, list $50,000 in Boxes 5c and 5k with their dates, record the planned start date in Box 1b, and enter the periodic annuity amount for Box 1a if payments have not started. Box 4 displays the December 31 FMV. Since her total is below the 2025 cap of $200,000, there is no limit issue. If the contract allows acceleration, check Box 2.

If your monthly entries do not roll to Box 3, reviewers will flag it, you will spend extra hours, and March 31 will creep up fast. Build that tie‑out into prep.

Operations Playbook, From First Premium To Furnishing

Here is the practical flow I use with issuers so this filing never turns into a fire drill.

Intake And Setup

- Tag the contract as intended to be a QLAC at issuance.

- Capture participant TIN, address, date of birth, and plan identifiers if relevant.

- Enter the scheduled annuity start date and confirm it meets the age‑85 latest start requirement.

During The Year

- Log each premium with the exact receipt date.

- Reconcile a year‑to‑date premium total monthly.

- Track the December 31 FMV for Box 4.

Year‑End Close And Statement Prep

- Confirm Box 3 is within the year’s cap, $200,000 for 2025.

- Verify Box 1a and Box 1b agree with contract terms.

- Tie Boxes 5a–5l to Box 3, and Box 3 to cash received.

- Assign unique account numbers when a participant holds multiple QLACs.

Furnish And File

- Furnish Copy B by January 31.

- File Copy A by February 28 on paper or by March 31 electronically, shifting to the next business day when a date falls on a weekend or federal holiday.

- If you file 10 or more information returns across types, e‑file is mandatory. Choose IRIS or FIRE and test your access well before March.

Controls That Keep You Out Of Penalty Trouble

- Box‑level validation rules for dates, positive amounts, and formats.

- A premium limit check by participant across all contracts.

- A monthly to annual premium reconciliation with sign‑off.

- TIN truncation rules applied to participant statements only, never to IRS files.

- A deadline calendar with assigned owners for January 31, February 28, and March 31 tasks.

- An exception log for over‑funding and corrections, including procedures to return excess to the non‑QLAC portion when applicable.

Small process wins usually save more time than new tools. A simple tie‑out and a named owner for each date beat last‑minute heroics every time.

Frequently Asked Questions

Do I enter Form 1098‑Q on my tax return?

No. Participants keep it for records. Actual taxable annuity payments, when they begin, are reported on Form 1099‑R.

Who files Form 1098‑Q?

The issuer of the contract, generally the insurance company, must file with the IRS and furnish the participant statement annually, starting with the first premium year and ending in the year before death or age 85.

What is the difference between 1098‑Q and 1099‑R?

Form 1098‑Q shows QLAC information, including premiums, start date, and FMV. Form 1099‑R reports distributions when annuity payments begin.

Does a QLAC reduce RMDs?

Yes. Before annuity payments start, QLAC value is excluded from the RMD base, subject to the final 401(a)(9) rules that apply beginning January 1, 2025 distribution years.

What is the QLAC premium limit now?

For 2025, the cap is $200,000, indexed for inflation for calendar years beginning on or after January 1, 2025, in $10,000 steps.

Quick Compliance Table

| Topic | 2025 rule | Source |

| QLAC premium cap | $200,000, indexed from 2025 in $10,000 steps | |

| Latest regs effective | Distribution calendar years starting 01‑01‑2025 | |

| Furnish deadline | January 31 | |

| IRS filing deadline, paper | February 28 | |

| IRS filing deadline, e‑file | March 31 | |

| E‑file threshold | 10 or more information returns in aggregate | |

| E‑file systems | IRIS and FIRE support the 1098 series |

Troubleshooting Common Issues

Box 3 Does Not Match Monthly Totals

Root cause is usually a missing month or a date keyed outside the calendar year. Run a month‑end tie‑out and a December 31 cutoff check before review.

Missing Account Numbers For Multiple Contracts

Assign a distinct account number per QLAC when a participant has more than one contract. It speeds participant support and reduces matching errors.

Annuitization Date Incorrect

Validate Box 1b against the contract and confirm it meets the age‑85 latest start rule. If acceleration is allowed, check Box 2.

E‑File Rejection Near March 31

Fix formatting errors, retransmit the same day, and keep proof. Once you hit 10 or more information returns in aggregate, paper is no longer an option without a waiver.

Where Accountably Fits, Briefly

Most 1098‑Q problems are not technical, they are delivery problems. If your team runs lean during peak season, a disciplined model prevents review bottlenecks, missed January 31 mailings, and last‑minute e‑file scrambles. Our approach is simple, work inside your systems, keep monthly premium posting clean, standardize workpapers for Boxes 1a–5l, run the cap and tie‑out checks early, and file on time. Use us when you want capacity with control and keep ownership of your process and quality.

Real‑World Checklist You Can Paste Into Your SOP

- Confirm QLAC intent at issuance and capture participant and plan identifiers.

- Record each premium with exact payment dates and reconcile monthly.

- Validate the scheduled start date and the age‑85 rule.

- Compute December 31 FMV and confirm Box 3 is within the year’s cap, $200,000 for 2025.

- Prepare and furnish Copy B by January 31.

- E‑file via IRIS or FIRE by March 31, or paper file by February 28 if eligible and under the threshold. If you file 10+ information returns in aggregate, e‑file is required.

- Monitor acknowledgements, correct errors promptly, and retain delivery evidence.

Compliance And Trust Signals

- The April 2025 instructions reflect SECURE 2.0 changes and indexing mechanics for the cap. Update your SOPs if they still reference the 25% rule.

- The e‑file threshold is now 10 returns in aggregate across types. Plan IRIS or FIRE access and testing early.

- Penalty tiers for 2025 are $60, $130, and $330 per form, with special rules for intentional disregard and different annual maximums by filer size. Confirm the table for your filing year.

Key Terms, Made Simple

- QLAC, a Qualifying Longevity Annuity Contract purchased from an insurer under qualified arrangements that meets specific requirements, including a latest permissible start by the first day of the month after age 85.

- Annuity Start Date, the scheduled date the QLAC begins paying, reported in Box 1b.

- FMV, fair market value as of December 31, reported in Box 4.

- IRIS, the Information Returns Intake System that supports e‑filing of the 1098 series.

- FIRE, the Filing Information Returns Electronically system that continues to accept the 1098 series via approved software.

Quick Answers For Stakeholders

For Finance Leaders

Ask for a Box 3 limit check and a Boxes 5a–5l tie‑out report as part of monthly close. This keeps year‑end surprises off your plate.

For Compliance

Confirm your SOP references the April 2025 instructions and the 10‑return e‑file mandate. Add a control that reviews TIN truncation on participant statements versus IRS files.

For IT

Validate your file generator outputs acceptable formats for IRIS or FIRE and test acknowledgements early, not on March 30.

Wrap‑Up

When 1098‑Q goes smoothly, nobody notices. When it does not, everyone does. Keep your process simple, track premiums monthly, tie the totals to Box 3, confirm the start date and the annuity amount, and hit January 31 and March 31 without drama. With the April 2025 instructions now in force and the e‑file threshold set at 10 returns, you have clear guardrails and modern systems to help you deliver on time.

This guide is general information. For your facts and year, follow the current IRS instructions and information return guidance, and keep documentation for every deadline and correction.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk