Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Quick truth, Form 1099‑LTC reports gross benefits, not what is taxable. Your tax result depends on how the benefits were paid and whether the policy is tax‑qualified.

Key Takeaways

- Form 1099‑LTC reports long term care and accelerated death benefits that were paid in the prior year. You use it to figure out what, if anything, is taxable.

- Box 3 matters. Per diem means a flat daily amount. Reimbursement means benefits tied to actual costs. These paths use different exclusion rules.

- For 2025, the per diem exclusion limit is 420 per day. Amounts above that can be taxable unless your actual qualified costs are high enough to offset them. You calculate it on Form 8853, Section C.

- If the policy is tax‑qualified, shown by Box 4, reimbursement benefits are generally excludable up to actual qualified long term care costs.

- Terminal illness accelerated death benefits are typically fully excludable with proper certification. Keep the certification date with your records.

What Form 1099‑LTC Is And Why You Received It

Form 1099‑LTC is an IRS information return titled Long‑Term Care and Accelerated Death Benefits. Insurers, some government payers, and licensed viatical settlement providers use it to report payments made under long term care insurance or accelerated death benefit riders. You get a copy, and the IRS gets a copy. That is why you cannot ignore it, even when nothing ends up taxable.

You will see two big buckets of amounts:

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- Box 1, gross long term care benefits

- Box 2, gross accelerated death benefits

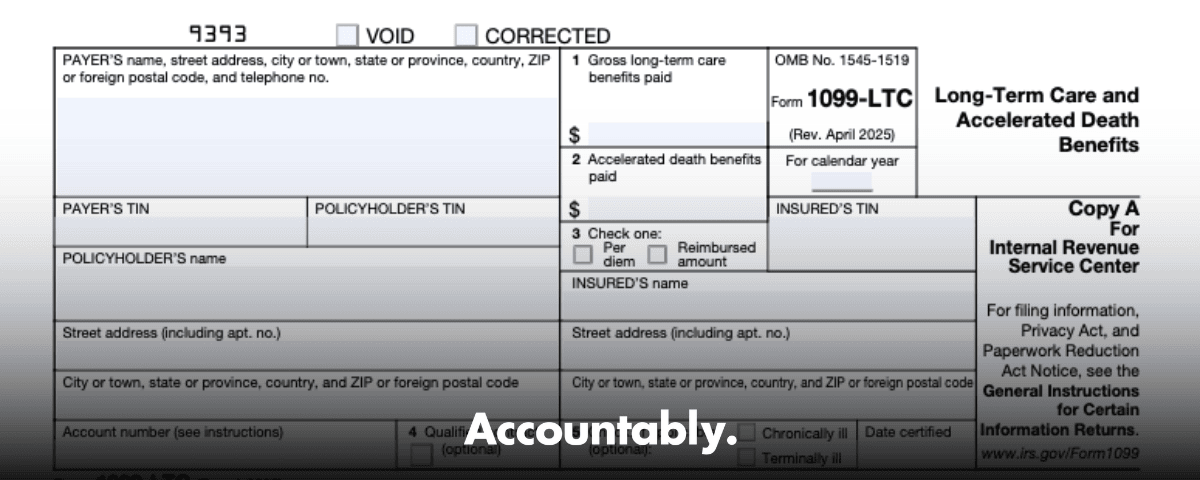

The form also shows whether payments were made as per diem or as reimbursements in Box 3, whether your contract is tax‑qualified in Box 4, and the certification that the insured is chronically ill or terminally ill with the certification date. These fields drive your tax math on Form 8853.

A quick word on 2025 limits

The 2025 per diem exclusion limit is 420 per day. This figure is indexed each year. If you are reading this for a future year, check the current IRS annual revenue procedure for the latest number. For reference, the IRS has already published a 2026 limit of 430 per day.

Who Receives Form 1099‑LTC

You may receive this form if you are the policyholder, the insured, or a third party who actually received benefits. The payer files Copy A with the IRS and sends you a copy in January for the prior calendar year. Always match the payer’s name and EIN, and your SSN or TIN, before you enter anything in your software. A mismatch can trigger notices.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWho sends it

Only certain entities issue Form 1099‑LTC, typically insurance companies, government agencies, and licensed viatical settlement providers that paid the benefits. They must file whether they paid you directly or paid a care provider for you.

How Per Diem And Reimbursement Payments Affect Tax

Think of per diem as a daily allowance and reimbursement as a refund of actual costs.

- Per diem, you can exclude up to the IRS daily cap, 420 per covered day in 2025. Above that, the excess can be taxable unless your facts fit special situations laid out in Form 8853.

- Reimbursement, if Box 4 shows a tax‑qualified contract, amounts that match qualified long term care services are generally excludable. Keep receipts and account statements, because your documentation is what supports the exclusion.

If benefits were paid as accelerated death benefits, terminal illness amounts are generally excludable in full with proper certification. Chronic illness benefits follow the per diem or reimbursement rules, including the per diem cap when paid as a per diem. You still do the math on Form 8853.

Read These Boxes First

Use this box‑by‑box checklist as you open the envelope.

| Box or Field | What to verify | Why it matters |

| Box 1 | Total LTC benefits | Drives per diem or reimbursement math for care benefits. |

| Box 2 | Accelerated death benefits | May be fully excludable for terminal illness with certification. |

| Box 3 | Per diem or reimbursement | Sets the exclusion method on Form 8853. |

| Box 4 | Tax‑qualified contract | Enables broader exclusions for reimbursements. |

| CI or TI plus Date | Certification type and date | Proves eligibility for exclusion and period covered. |

Tip, if Box 3 is blank or seems wrong, request a corrected form from the payer before you file. The payment method controls the math on Form 8853.

A Short Story From The Review Desk

In our work supporting U.S. CPA firms, we often see rush season errors that create notices later. One common one, a per diem policy entered as reimbursement. The return looked fine, but the worksheet never applied the per diem cap, so the IRS read the e‑file and flagged a mismatch. A three minute box check up front would have prevented a letter and an hour of cleanup.

Note on scope, Accountably supports firms with standardized workpapers and Section C tie‑outs, which reduces review time and keeps Box 3 and Box 4 logic consistent. If you run a firm and want fewer review loops and a clean trail for Form 8853, build that discipline into your process, whether you do it in house or with a partner.

What, How, Wow, turning the form into a clean worksheet

- What, Form 1099‑LTC tells you the gross amounts and how they were paid.

- How, you move the numbers to Form 8853, Section C, apply the per diem limit or match reimbursements to qualified costs, then carry any taxable piece to Schedule 1.

- Wow, a few extra lines of documentation, certification date, LTC days, and receipts can turn a messy folder into an airtight file that survives a notice or an exam.

Definitions you will use while you work

- Policyholder, the person who owns the proceeds and reports the income, even if money was assigned to a facility or a family caregiver.

- Per diem payments, fixed amounts paid on a periodic basis without regard to actual costs.

- Qualified LTC insurance contract, generally a contract that meets section 7702B rules, which is often shown by Box 4 checked.

Eligibility And Certification Rules, the gate to exclusion

To exclude LTC or accelerated death benefits, the insured must meet medical criteria and you must have a current certification.

- Chronically ill, a licensed health care practitioner certifies the individual needs substantial assistance with at least two activities of daily living for at least 90 days, or needs substantial supervision due to severe cognitive impairment.

- Terminally ill, a physician certifies a condition that is expected to result in death. Terminal illness benefits are generally fully excludable when paid as accelerated death benefits.

Match the certification type and date on the form to the periods you claim on Form 8853. Keep copies of the certification with your tax file.

Per Diem Versus Reimbursement, which path are you on

Here is a quick comparison you can keep with your return.

| Feature | Per Diem payments | Reimbursement payments |

| What it is | Fixed daily benefit, not tied to bills | Payment that matches actual qualified costs |

| Where shown | Box 1 or 2, with Box 3 checked Per diem | Box 1 or 2, with Box 3 checked Reimbursed amount |

| 2025 exclusion rule | Exclude up to 420 per covered day, do the rest on Form 8853 | Generally excludable under a tax‑qualified contract up to actual qualified LTC costs |

| Documentation | Covered days, certification, and any proof of care | Receipts, statements, and proof of qualified services |

| Common pitfall | Forgetting to apply the per diem cap on Form 8853 | Forgetting that non‑qualified contracts can create taxable income |

What counts as qualified LTC services

Think of services that are necessary for a chronically ill individual, for example nursing care, personal care, and care in a qualified facility. This often overlaps with expenses discussed in IRS Publication 502, which explains medical and long term care costs in plain language. Keep receipts and statements that prove who was paid, for what service, and for which dates.

How To Read The Form, box by box

Start with the identifiers. Confirm the payer name and EIN match your policy. Confirm your SSN or TIN. Then walk the boxes.

- Box 1, total long term care benefits, tie to your explanation of per diem days or reimbursed costs.

- Box 2, accelerated death benefits, note whether the insured is terminally ill or chronically ill.

- Box 3, payment type, circle it on your copy to avoid data entry mistakes.

- Box 4, tax‑qualified contract, if checked, expect broader exclusions when benefits reimburse qualified services.

- Chronic or terminal certification plus date, verify that the period covers the days or costs you are excluding.

Pro move, staple a one page summary to the front of your Form 1099‑LTC. List LTC days, the per diem limit used, total per diem received, total qualified costs, and a photo or scan of the certification. Future you will thank present you.

The Math You Need, Form 8853 Section C

Form 8853, Section C, is where you compute what is excludable and what is taxable. You enter gross benefits, indicate per diem or reimbursement, track LTC days, and list qualified costs. If multiple people received per diem payments for the same insured, you may need to attach an aggregate computation and allocate the per diem limitation across recipients, a rule that trips people up if family members split benefits.

Worked example, per diem in 2025

- Facts, you received a per diem LTC benefit of 460 per day for 120 covered days in 2025. The policy is tax‑qualified, Box 4 is checked.

- Step 1, compute the annual exclusion, 120 days times the 2025 per diem limit of 420 equals 50,400.

- Step 2, compute total per diem received, 460 times 120 equals 55,200.

- Step 3, taxable excess, 55,200 minus 50,400 equals 4,800.

- Step 4, report it, complete Form 8853, Section C, then carry 4,800 to Schedule 1, Other income, with a brief description, for example LTC. Keep your LTC day count and certification with your records.

Worked example, reimbursement in 2025

- Facts, the insurer paid 36,000 directly to a qualified facility, and you paid 4,000 out of pocket. Box 3 shows Reimbursed amount. Box 4 is checked.

- Result, reimbursement benefits under a tax‑qualified contract are generally excludable to the extent of qualified costs. With 40,000 of qualified costs and 36,000 reimbursed, there is no taxable income. You may still complete Form 8853 to document the exclusion if your software requires it.

Accelerated Death Benefits, special rules to know

If the insured was certified as terminally ill, accelerated death benefits are generally fully excludable. If the insured was certified as chronically ill, those benefits follow the same rules as LTC benefits, per diem limit if paid as per diem, reimbursement matching if paid as reimbursements. Form 8853 gives you the exact lines to use, and the instructions include special rules for multiple payees.

Reporting On Your Tax Return

Here is the clean path most filers use.

- Complete Form 8853, Section C, with gross amounts from Form 1099‑LTC and the details for per diem days or qualified costs.

- Review whether any portion is taxable, per diem above the daily limit or reimbursements that exceed qualified costs under a non‑qualified contract.

- Carry any taxable amount to Schedule 1, Other income, and keep your computation with your return.

Using tax software

Many consumer and professional platforms guide you to a 1099‑LTC entry screen that feeds Form 8853. Menu names differ, so search for 1099‑LTC or Form 8853 in your software’s help panel. TaxAct, for example, routes you through Federal, Other Adjustments, Archer MSAs and Long‑Term Care Insurance Contracts to Section C. Paths change, so always follow your software’s current instructions and compare the final Form 8853 to your paper form.

Keep a PDF of your completed Form 8853, the certification, and a day count or expense log in the same folder. If the IRS asks, you can answer in minutes instead of hours.

FAQs

What is the 1099‑LTC form

It is the IRS information return for long term care and accelerated death benefits. You use it to figure out what is excludable and what, if anything, is taxable, mostly using Form 8853, Section C.

Are LTC benefits taxable income

Often no. Per diem benefits are excludable up to the daily cap, 420 per day for 2025. Reimbursements under a tax‑qualified contract are generally excludable up to qualified long term care costs. You do the computation on Form 8853.

Where do I enter a 1099‑LTC in common software

Look for a 1099‑LTC or Form 8853 entry in the income section or in other adjustments. The exact menu labels vary. Always review the produced Form 8853 for accuracy against your paper form.

How do I report a reimbursed amount

Enter the gross benefits and your qualified costs on Form 8853, Section C. Under a tax‑qualified contract, reimbursement benefits are generally excludable up to qualified costs. Any excess or non‑qualified contract amounts can become taxable and flow to Schedule 1.

What if more than one person received per diem payments

When multiple people receive per diem payments for the same insured, you may need an aggregate computation and an allocation of the per diem limit across recipients. The instructions explain how to attach the statement and allocate the limit.

Resources

- IRS Instructions for Form 1099‑LTC, continuous use, updated April 2025. Keep these handy for payer rules, box definitions, and filing guidance.

- IRS Instructions for Form 8853. Section C walks you through definitions, day counts, reimbursement lines, and multiple payee rules.

- IRS Publication 502, Medical and Dental Expenses. Helpful for understanding which services qualify as medical and long term care.

- Annual IRS revenue procedure for inflation updates. For 2025 the per diem limit is 420 per day, and for 2026 it is 430 per day.

Practical Checklist Before You File

- Confirm payer and recipient IDs on the form.

- Circle Box 3, per diem or reimbursement, and Box 4, tax‑qualified status.

- Pull the certification and verify the date covers your LTC period.

- Count LTC days if per diem applies, then apply the 420 per day cap for 2025.

- Gather receipts and statements if reimbursement applies.

- Complete Form 8853, Section C, then carry any taxable amount to Schedule 1.

- Save your computation, certification, and receipts with your return.

For Firm Owners And Reviewers

If you run a CPA or EA firm, standardize your 1099‑LTC intake. Ask for the certification, a simple LTC day log, and copies of facility invoices up front. That reduces review comments and protects your team’s time. Accountably partners with firms that want disciplined, repeatable delivery. Our teams work inside your systems and templates so Section C tie‑outs are consistent, which helps cut review time without risking quality.

Compliance note

This article is for educational purposes only. Tax situations vary. For personalized advice, talk with a qualified tax professional. Always confirm current year limits and instructions on IRS.gov before filing. The 2025 per diem limit used here comes from the IRS’s annual inflation update and the Form 8853 instructions.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk