Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The IRS requires VITA/TCE sites to use this intake and interview sheet so preparers can confirm who you are, choose the right filing status, capture dependents, and make sure every income item is on the table for credits and deductions. When this form is complete and consistent, your appointment is shorter, your return is cleaner, and your refund, if any, is less likely to be delayed.

Key Takeaways

- Form 13614-C is the official IRS intake and quality review sheet used at VITA/TCE sites. Bring a completed copy to start your 2024 return quickly and accurately.

- Nonresident aliens use Form 13614-NR instead of 13614-C. If you are a citizen or resident alien, 13614-C is your form.

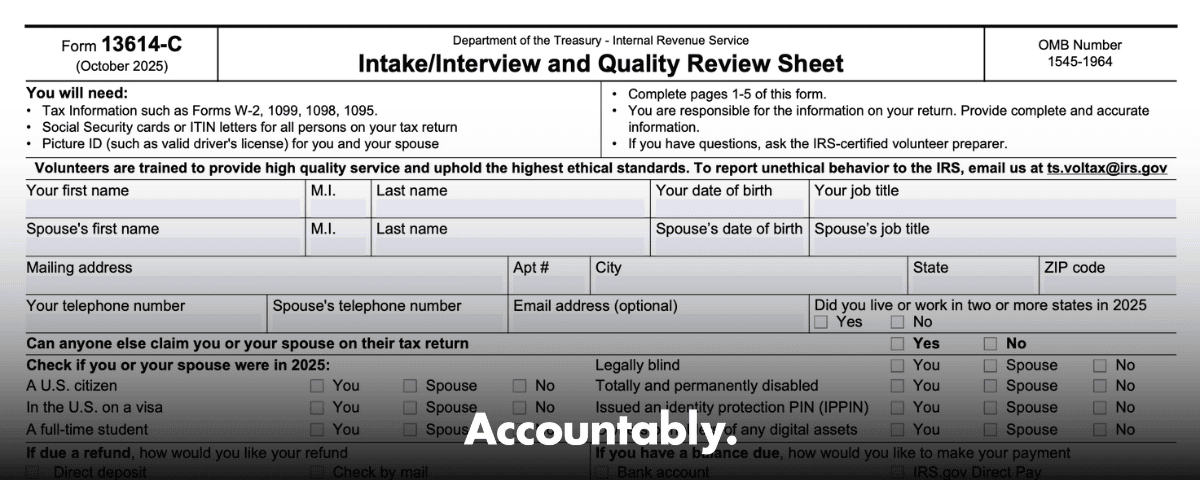

- The latest Form 13614-C has an October 2025 revision date. Use the newest fillable PDF or your site’s preferred version.

- The form is available in many languages, including Spanish, Arabic, Chinese, French, German, Gujarati, Haitian Creole, Italian, Japanese, Khmer, Korean, Persian, Polish, Portuguese, Punjabi, Russian, Somali, Tagalog, Urdu, and Vietnamese. Choose the language you read best.

- Always bring photo ID, Social Security cards or ITIN letters for everyone on the return, and all income forms. These are verified against your intake responses during quality review.

What Form 13614-C Is and Why It Matters

Think of Form 13614-C as the backbone of your appointment. It guides the interview, keeps your information consistent, and powers the quality review that every VITA/TCE site must perform before your return is filed. Sites use it to confirm identity with photo ID, match names to SSN or ITIN documentation, and ensure income and life events are reflected correctly in your return. If you answer “Unsure” to a question, your reviewer must resolve it before the return can move forward, which is why complete answers save time.

What you write on this sheet matters. It drives filing status, dependent eligibility, credit screening, and scope checks. For example, if you indicate self employment, investment sales, or foreign income, the volunteer can tell you what is in scope for the site and what documents are needed to prepare your return correctly. Form 13614-C does not show SSNs on its face, so the site verifies names and numbers using your Social Security cards or ITIN letters during the review.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

What changed and what to expect in 2025

You may notice the intake looks cleaner and prompts for more complete answers. The IRS posted a new revision of Form 13614-C in October 2025. Most sites prefer that you complete the latest fillable PDF before you arrive, since typed entries are easier to read and review, but paper is usually accepted if your location still uses it. Always follow your site’s instructions and use the version they provide or recommend.

Language access is better too. If English is not your preferred language, you can complete Form 13614-C in many languages, including Spanish, Arabic, Chinese Simplified and Traditional, French, German, Gujarati, Haitian Creole, Italian, Japanese, Khmer, Korean, Persian, Polish, Portuguese, Punjabi, Russian, Somali, Tagalog, Urdu, and Vietnamese. Choose the version you understand best so your answers match your documents and reduce corrections in the interview.

The right form, 13614-C vs. 13614-NR

Use 13614-C if you are a U.S. citizen or a resident alien for tax purposes. If you are a nonresident alien, use 13614-NR, the nonresident intake sheet. Not sure which you are. Residency is decided by either the Green Card test or the Substantial Presence Test, which counts days in the U.S. over a three year window with a 183 day rule. If you do not pass either test, you are a nonresident and should use 13614-NR.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick residency checkpoint

- Green Card during the year, you are generally a resident.

- No Green Card, apply the Substantial Presence Test. It requires at least 31 days in the current year and 183 weighted days over three years. Certain days, such as many student or teacher visa days, may not count. When in doubt, ask the site to help apply the rules.

Bring the intake form completed, bring IDs and SSN or ITIN documents, and bring every 2024 income form. That one habit can cut your appointment time dramatically.

Language options and accessibility

Completing your intake in the language you read best prevents mistakes and speeds up the review. IRS provides Form 13614-C in a wide range of languages, so you can complete it in Spanish or in another supported language. If you will be using 13614-NR as a nonresident, most sites handle it in English, and if you need help, you can request an interpreter at many locations.

Table, examples of Form 13614-C language versions

- Arabic, Chinese Simplified, Chinese Traditional, French, German, Gujarati, Haitian Creole, Italian, Japanese, Khmer, Korean, Persian, Polish, Portuguese, Punjabi, Russian, Somali, Spanish, Tagalog, Urdu, Vietnamese.

Tip, use the exact language version for the form you will bring to the site, keep your answers consistent with your IDs and tax documents, and print or save a copy so you can reference what you reported.

How to complete the fillable PDF the right way

You can fill the latest IRS PDF on your computer or phone with a reliable reader, then print it for your appointment. Follow these steps for a smooth intake.

1) Open the newest Form 13614-C PDF and confirm the revision date on page 1. As of today, the current revision is October 2025.

2) Work in one session if you can, or save a copy with a clear file name so you do not lose your place. Use consistent date formats, for example MM/DD/YYYY.

3) Complete personal info and contact details, then filing status and dependent sections. If you are separated or divorced, include dates. Answer every question with Yes or No, avoid Unsure, because quality reviewers must clear every uncertainty before filing.

4) List all 2024 income items. Bring W 2, 1099 series forms, and any 1095 for health coverage. If you received Social Security, pensions, unemployment, or other benefits, include the forms you received.

5) Prepare your identity and tax number documents. Bring government photo ID, plus Social Security cards or ITIN letters for everyone on the return. Sites verify these against your intake responses during quality review.

6) If you may qualify for credits, such as education credits, child or dependent care, or Earned Income Credit, note those life events on the intake so the volunteer knows which documents to review first.

What to bring, quick checklist

- Identity and tax numbers, government photo ID, SSN cards or ITIN letters for everyone listed.

- Income, all 2024 W 2, 1099 INT, 1099 DIV, 1099 B, 1099 NEC or 1099 MISC, 1099 G, 1099 R, W 2G, 1042 S if applicable.

- Prior year, your 2023 return and, if you made estimated payments during 2024, a record of those amounts.

- Bank info, a voided check for direct deposit or your routing and account numbers.

- Education, 1098 T and fee bills if you paid qualified tuition and related expenses in 2024.

Students and education credits, get your 1098‑T right

If you, your spouse, or your dependent attended college in 2024, gather every Form 1098 T, along with fee bills and receipts for required books and supplies you paid out of pocket. The American Opportunity Credit and Lifetime Learning Credit use your actual qualified expenses, not only the amounts shown on 1098 T, and the form helps your preparer see timing, scholarships, and adjustments. You can use 2024 payments for academic periods beginning in the first three months of 2025 when figuring 2024 credits, so bring December payments for spring term.

If you did not receive a 1098‑T, you may still claim an education credit in limited situations, for example when the school is not required to furnish one, but you must show enrollment and prove payment. Ask your site for guidance before filing.

Education documents, mini checklist

- Every 1098 T for 2024.

- Term by term fee bills that show what you paid and any grants or scholarships.

- Receipts for required books and supplies you purchased yourself.

- School EIN, needed on Form 8863 for the American Opportunity Credit.

Itemized deductions and Schedule A, what to track for 2024

Many taxpayers take the standard deduction. If you itemize, bring documentation for medical expenses, mortgage interest, charitable gifts, and state and local taxes. For 2024 returns filed in 2025, the combined deduction for state and local income or sales tax plus property tax was limited to 10,000 in total, or 5,000 if married filing separately. If you claim sales tax, you can use the IRS Sales Tax Deduction Calculator to support your worksheet.

- Medical and dental, bring totals and invoices for unreimbursed expenses. Only amounts above 7.5 percent of AGI can count.

- Mortgage interest, bring Form 1098.

- Charitable contributions, bring receipts for cash and any acknowledgments required by law.

- State and local taxes, gather property tax bills, plus state income tax withheld or estimates. The 10,000 cap applies to the combined total on Schedule A for 2024.

Self employment income and the Schedule C worksheet

If you received 1099 NEC or ran a side business, prepare a simple Schedule C worksheet. List gross receipts by source, including invoices that were paid without a 1099. Reconcile to your bank deposits and keep proof. Then summarize expenses by category, for example advertising, supplies, contract labor, dues and subscriptions, utilities, and business insurance. If you used a vehicle for business, record total miles and business miles for 2024 along with your chosen method, standard mileage or actual. If you use a home office, note square footage for the office and the home, plus direct and indirect costs.

Bring this worksheet to your appointment, along with statements and receipts. It helps the preparer input your data correctly and avoid missed deductions.

Investments, retirement, and other income

List all 2024 investment and other income on your intake and bring the supporting forms.

- Interest, 1099 INT, including tax exempt municipal interest.

- Dividends, 1099 DIV, and note if you have dividend reinvestment.

- Sales through a broker, 1099 B, including basis information. If you received a corrected year end statement, bring the latest version.

- Retirement income, 1099 R for pensions and IRA distributions, and Social Security benefits statements if applicable.

- Unemployment, 1099 G, and any gambling winnings on W 2G.

- Foreign income or 1042 S, bring the form and proof of foreign tax paid so the volunteer can check if a foreign tax credit applies.

Accuracy tips that shorten your appointment

- Group your 1099s by type.

- Flag any corrected forms.

- For sales, include your basis spreadsheets or broker statements that show cost and adjustments.

- If you sold crypto or held digital assets, note that on the intake and bring your year end statement.

Nonresident alien pathway, when 13614-NR is required

If you are not a U.S. citizen and you do not meet the Substantial Presence Test, you are a nonresident for tax purposes and should complete Form 13614-NR. Bring your passport, visa type, and any Form 1042 S. You will also need precise U.S. entry and exit dates for the last three years to support the residency decision at intake. Volunteers use these details to decide filing status, credit eligibility, and which return type applies.

Determining residency, quick guide

- Substantial Presence Test, you are a resident if you were present at least 31 days this year and your weighted three year total is 183 days. Some individuals, like many F 1 or J 1 students and scholars, are “exempt individuals,” which means many of their days do not count toward residency for a limited period.

- Green Card test, if you held lawful permanent resident status at any time during the year, you are generally a resident. Publication 519 explains exceptions, first year choice, and dual status returns if you changed status during the year.

Documenting travel days

Write down each entry and exit date for 2022, 2023, and 2024 if you are determining status for a 2024 return. Count any part of a day in the U.S. as a day present, then apply the 1, 1/3, and 1/6 weighting across the three years. If you think a closer connection exception might apply, bring proof of your foreign tax home as well.

Submitting and bringing your completed forms

Most sites want you to arrive with a printed copy of your completed fillable Form 13614-C, or they will give you a paper copy to complete on site. Either way, the volunteer will verify your photo ID and Social Security or ITIN documentation and compare your answers to the source documents you bring. The quality reviewer will not complete the final review until the intake is complete, every “Unsure” is resolved, and your documents match what is checked on the form.

Pre appointment checklist

- Correct form, 13614-C for citizens and resident aliens, 13614-NR for nonresident aliens.

- IDs, photo ID and SSN cards or ITIN letters for everyone on the return.

- Income, all 2024 W 2, 1099s, 1099 R, 1099 G, and W 2G if any.

- Prior year, your 2023 federal and state returns.

- Banking, routing and account numbers for direct deposit.

- Credits and deductions, education forms, child care provider information, charitable receipts, mortgage interest, and property taxes.

Helpful IRS forms and where to find them

If something comes up during the interview, you may see the volunteer reference these forms and instructions.

- Form 1040 and Instructions, main individual return.

- Schedule A, itemized deductions and its instructions for SALT and other limits.

- Schedule C, self employment income and expenses.

- Schedule B and Schedule D, interest and dividends, capital gains and losses.

- Form 8863, education credits, with instructions that explain 1098 T, payment timing, and school EIN reporting.

Note, IRS pages are updated during filing season. If a form or instruction looks different from last year, use the latest version posted on IRS.gov.

A quick word for firms and coordinators

If you run a community clinic or partner site, you already know intake discipline is what keeps appointments on time and quality reviews smooth. Accountably supports firm grade workflow control, from structured workpapers to review checklists, and can help you standardize intake handling inside your existing tools. Use it where it serves your process, then focus your team on helping taxpayers, not chasing documents.

FAQs

What is the purpose of Form 13614-C?

It gives volunteers a complete picture of your situation so they can prepare an accurate return, then it serves as the checklist for the required quality review. Sites must use it, and the reviewer compares your intake answers and IDs to the forms you bring before the return is filed.

What must the certified volunteer preparer do with my intake form?

They verify your ID and tax numbers, confirm filing status and dependents, resolve any “Unsure” answers, and make sure your documents match what you reported. A certified quality reviewer then completes a final check using the intake as the guide.

How does Form 1095-C affect my refund?

Form 1095 C reports employer coverage. It rarely changes your refund by itself, but it helps confirm that premium tax credit rules were met if you had Marketplace coverage at any point. If something does not match, it can delay processing while the IRS resolves it.

Who needs to file a Schedule C?

If you earned self employment income as a sole proprietor or single member LLC, you file Schedule C. You also file Schedule SE if net earnings are at least 400 for the year. Partnerships and S corporations do not use Schedule C on a personal return.

Do I have to itemize to deduct state and local taxes?

Yes. SALT is part of Schedule A. For 2024 returns, the combined deduction for income or sales tax plus property tax is limited to 10,000, or 5,000 if married filing separately. Your volunteer can help you compare itemizing to taking the standard deduction.

Your next steps, show up ready

- Download and complete the latest Form 13614-C fillable PDF in the language you read best, then print it.

- If you are a nonresident alien, complete Form 13614-NR and bring passport, visa, and travel day records for the last three years.

- Gather your 2024 income forms and credits documentation, including 1098 T and fee bills if you or a dependent were in school.

- Bring photo ID and SSN or ITIN letters for everyone on the return.

A complete intake form is not busywork, it is the fastest path to an accurate return and a smooth quality review.

Note, this page reflects IRS guidance available as of October 22, 2025, including the October 2025 revision of Form 13614-C and current residency and education credit rules. Always follow your VITA/TCE site’s instructions if they provide a specific intake packet or additional forms.

Key sources used for accuracy

- IRS, Form 13614-C, Oct 2025 revision listing. (irs.gov)

- IRS Link & Learn, quality review, identity and SSN/ITIN verification. (apps.irs.gov)

- IRS forms index, language versions of Form 13614-C. (irs.gov)

- IRS, Form 13614-NR listing and use for nonresident intake. (irs.gov)

- IRS, Substantial Presence Test, Publication 519, and related residency guidance. (irs.gov)

- IRS, Instructions for Schedule A 2024 and Topic 503, SALT limit. (irs.gov)

- IRS, Instructions for Form 8863 and Publication 970, education credits and 1098‑T handling. (irs.gov)

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk