Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

I have watched coordinators scramble in that moment, phones ringing, volunteers waiting, clients confused. One small update on Form 13715 could have prevented a very human headache.

Key idea, when your site details are right on Form 13715, taxpayers actually find you, arrive at the right time, and get served faster.

Key Takeaways

- Form 13715 is the Volunteer Site Information Sheet the IRS uses to power the VITA Site Locator and toll‑free assistance. Fill it accurately, then submit it to your local IRS contact.

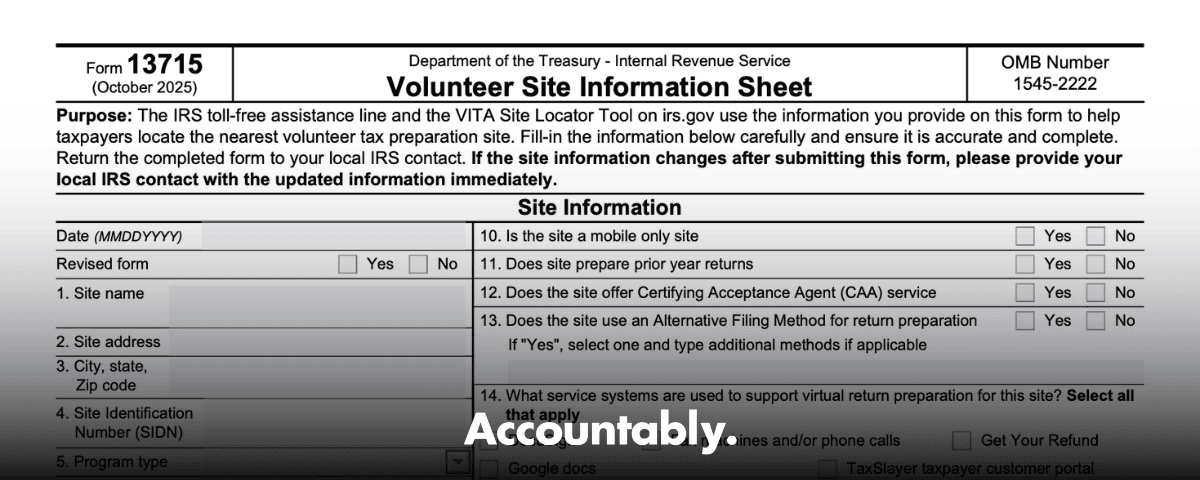

- The latest version is Form 13715, Rev. 10‑2025, OMB 1545‑2222. Download the official PDF from IRS.gov, or submit details through the IRS online wizard. Always check the footer and revision date.

- You must enter essentials, site name, full address, operating dates and hours, public or appointment status, languages, services, and coordinator contact. The form now also captures virtual workflows and security planning.

- After you submit, IRS SPEC staff input your data into SPECTRM, the internal system that feeds the public locator. Keep your Relationship Manager updated whenever details change.

- If you need paper copies or accessibility support, the IRS provides mail fulfillment and Alternative Media options, and you can call 800‑829‑3676 during listed hours.

What is IRS Form 13715

Form 13715 is the one‑page Volunteer Site Information Sheet that tells the IRS, and therefore the public, exactly how to find and use your VITA/TCE site. The IRS uses what you submit to update the VITA Site Locator and to brief phone agents, so accuracy here directly affects real families trying to reach you.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

As of October 22, 2025, the current edition is Rev. 10‑2025 with OMB control number 1545‑2222. You can download the PDF or submit details via the IRS web form wizard. If you already have processes for updates, still check the footer on the file you circulate, it should read “Form 13715 (Rev. 10‑2025).”

Who Should Use Form 13715

You should complete Form 13715 if you coordinate any public‑facing VITA or TCE site, whether hosted by a library, community center, faith group, college, or nonprofit. New sites use it to register, returning sites use it to confirm and update details each season and any time something changes, for example moving rooms, switching to appointment‑only days, or adding Saturday hours. Your SPEC Relationship Manager relies on this form to validate what goes into SPECTRM, the system that powers the IRS locator.

Where To Get the Latest Form

- Download the official PDF, “Form 13715 (Rev. 10‑2025),” from IRS.gov. This is the version referenced in the IRS Forms and Publications index and displayed as the October 2025 revision.

- Prefer a guided experience, use the IRS online wizard that lets you enter details, review, submit electronically, and download a copy for your records.

If you need printed copies or accessible formats, the IRS offers mail order and Alternative Media support. Call 800‑829‑3676 during posted hours to request help, or see the IRS pages covering accessible products.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhat the 2025 Revision Captures

The 2025 form keeps the familiar one‑page layout and expands clarity around virtual preparation and security readiness. In addition to site name, address, dates, hours, and languages, you will record whether you are public or appointment‑only, mobile only, whether you prepare prior‑year returns, whether you operate as a CAA, what virtual systems you use, for example DocuSign, GetYourRefund, TaxSlayer portals, Zoom, and whether you submitted a VITA/TCE Security Plan, Form 15272, to your Territory Office.

Quick check, if you offer virtual intake, drop‑off, or hybrid options, list the exact tools you use and any limits on service hours. The IRS wants taxpayers to have real expectations, not guesses.

How To Complete Form 13715, Step by Step

Start simple, fill the date first in MMDDYYYY. This helps coordinators track which copy is the latest if multiple versions circulate. Then work top to bottom without skipping fields.

Step‑By‑Step Fields You Will See

1. Site Information

- Site name, write the public name taxpayers will see.

- Site address, include city, state, and ZIP. If you are inside a campus or multi‑building complex, add clear location notes in your outreach materials too.

- Site Identification Number (SIDN), enter the S plus eight digits.

- Program type, VITA, VITA Grant, Military, AARP, TCE.

- Operating dates, first day open and last day open for the season.

- Languages offered, list every language you can support reliably.

- Public or appointment status, mark Yes or No for public, then Yes or No for appointment‑only and give the appointment contact if applicable.

- Mobile only, mark if your site is a mobile pop‑up.

- Prior‑year returns, indicate if you prepare them.

- CAA service, mark if you offer Certifying Acceptance Agent support.

- Alternative filing method and virtual systems, select the options that match your intake and preparation model, for example DocuSign, GetYourRefund, TaxSlayer portals, Zoom, or write in another system.

- Financial education and asset building, mark if offered, then your RM completes Form 14099 as required.

- Nonresident returns, indicate if you prepare returns for foreign students or scholars.

- Security plan, confirm whether Form 15272 was submitted.

- e‑file, mark Federal and State status.

- Site Operating Hours

- List hours for each day you open, including comments for holiday closures or seasonal variations. Precision saves taxpayers wasted trips.

- Site Coordinator or Contact

- Enter the coordinator’s name, mailing address, phone, best time to call, and email. Use a monitored inbox, not a personal account that might go unattended during breaks.

Compact Field Reference

| Field group | Required entries | Practical tip |

| Date and status | MMDDYYYY, revised yes/no | Date every update so your team knows the latest copy |

| Site identity | Name, full address, SIDN, program type | Use the exact public‑facing name used on signage |

| Season window | First and last day open | Match outreach and locator timing |

| Access model | Public, appointment‑only, mobile only | Give a working phone or URL for scheduling |

| Services & scope | Prior‑year returns, CAA, e‑file | Spell out limits early, for example no self‑employment |

| Virtual workflow | Alternative methods and systems | Check every platform you actually use |

| People & safety | Languages, security plan, nonresident returns | Confirm Form 15272 status with your RM |

| Hours | Mon–Sun open and close times, comments | Add holiday notes to prevent lineups |

| Coordinator | Name, address, phone, email, best call time | Use a shared mailbox your team can access |

Pro tip, complete a draft in your internal template, then copy clean data into the IRS wizard or PDF to reduce typos. Keep your local naming conventions consistent across your flyer, website, and the form.

Operating Hours and Services, Getting Specific

Your hours are a promise. If you open 10 a.m. to 2 p.m. on Wednesdays only, write exactly that. If you add two Saturday clinics in March, include those dates in comments and update the form once they are confirmed. Clear hours keep clients from showing up frustrated and help SPEC present accurate guidance.

In Services, list what you actually provide this season, for example basic returns, e‑file, EITC screening, ITIN help, CAA. If you support virtual intake or preparation, check the systems you use and note any appointment limits for virtual days. Then, document language access, including ASL interpreters or Over‑the‑Phone Interpreter options available through your program’s channels.

Accessibility and Language Access

- Record the languages your volunteers can cover with confidence.

- If your venue is wheelchair accessible or offers curbside drop‑off, add that in comments.

- For accessible materials or alternate formats, the IRS Alternative Media Center provides multiple options, and callers can use 800‑829‑3676 to request help.

Simple rule, promise only what you can deliver consistently, then keep your RM in the loop when anything changes mid‑season.

How To Submit and Confirm Your Listing

You have two reliable paths, use the IRS web wizard to submit electronically and download your PDF for records, or complete the PDF and send it to your local IRS contact by the approved channel, email, fax, mail, or hand delivery. Ask your Relationship Manager which method they prefer for your territory.

After you submit, SPEC staff use your input to update SPECTRM, the internal system that feeds the IRS VITA Site Locator and informs phone agents. If your hours, location, or appointment policy change, send your RM an updated Form 13715 right away and date it so they know they have the newest version.

Quick verification habit, check the public locator the week you open, and again after any change, to confirm your listing reflects the latest update.

What Your Relationship Manager Does With Your Form

- Receives your Form 13715 or equivalent document.

- Inputs your data into SPECTRM correctly.

- Secures territory approval and tracks copies by season.

- Updates SPECTRM mid‑season when you send an updated, dated form.

Quality, Security, and Documentation Practices

Form 13715 itself does not collect taxpayer SSNs, but your internal packets might. Treat anything that contains PII with care. If you bundle coordinator rosters or screenshots with contact details for your submission, apply true PDF redaction to remove sensitive data, then export a flattened file and test that the text is no longer searchable or selectable.

Secure Sharing Options That Fit VITA Programs

- Encrypted email to your RM’s official address.

- Secure portal upload if your territory supports it.

- Time‑limited links with role‑based access in your document platform.

- Fax, if requested by your territory office. Keep your confirmation page.

Keep one unredacted master in encrypted storage with access logs and follow your VITA/TCE security plan, Form 15272. If you have not filed that plan yet, coordinate with your RM promptly to complete it, since the 2025 Form 13715 asks you to confirm its status.

Common Mistakes And How To Avoid Them

- Wrong revision, you circulated the 2022 PDF. Fix it by downloading Rev. 10‑2025 and replacing all local copies.

- Incomplete hours, you listed weekdays but forgot March Saturday clinics. Add them in comments and send an updated, dated form.

- Appointment confusion, you marked appointment‑only but did not include the phone or URL. Re‑submit with the contact method so taxpayers can actually schedule.

- Unclear service scope, you did not indicate prior‑year returns or nonresident returns. Mark those correctly to reduce surprises at intake.

- No security plan status, you left Form 15272 unanswered. Confirm the plan with your territory office and update your 13715.

Coordinator Resources You Should Bookmark

- Site Coordinator Corner, the IRS hub with handbooks, quality tools, and volunteer standards.

- IRS Forms and Publications index, to confirm the latest revision date before you distribute forms to volunteers.

- Mail and accessibility support, for hours and the 800‑829‑3676 line when you need paper copies or Alternative Media.

Keep a short SOP, who updates the form, who reviews it, who sends it to the RM, and who checks the public listing. One page, shared with every coordinator and shift lead.

Version History And What Changed In 2025

Form 13715 has been around for years, and you may still have a copy labeled Rev. 10‑2022 in your folders. The IRS released a new revision in October 2025, now the benchmark for the 2026 filing season. The 2025 edition preserves the one‑page layout and clarifies fields for virtual preparation methods, service systems like DocuSign or GetYourRefund, and security plan confirmation. If you support mobile or hybrid sites, these updates make your listing clearer to taxpayers.

Bottom line, confirm the footer reads “Form 13715 (Rev. 10‑2025)” before you onboard volunteers or publish outreach. It takes thirty seconds and prevents a month of confusion.

FAQs About Form 13715

Who fills out Form 13715 and where do I send it

The site coordinator or program lead completes the form and submits it to the local IRS SPEC contact, usually your Relationship Manager or Territory Office channel. Ask your RM which submission method they prefer, electronic wizard, email with PDF, fax, mail, or hand delivery.

How fast do updates show on the IRS locator

Your RM updates SPECTRM after receiving your revised, dated form, and the locator reflects changes after IRS processing. If you change hours mid‑season, send the update immediately, then check the public listing within a few days to confirm.

What if my site runs pop‑ups at different addresses

Mark “mobile only” if that fits your model and use the operating dates and comments fields to show when and where you will be open. Coordinate with your RM for the best way to display rotating locations in the locator.

Is there a way to submit online instead of emailing a PDF

Yes. The IRS Form 13715 online wizard lets you enter details, review, submit electronically, and download a PDF for your records. Many coordinators prefer it to reduce typos and ensure all required fields are complete.

Where do I get help or paper copies if I cannot print

Use IRS Forms and Publications by mail and the Alternative Media resources. You can call 800‑829‑3676, Monday through Friday during posted hours, to request assistance or mailed forms.

When Accountably Can Help

If your firm supports a community VITA clinic alongside client work, you already know that operations can make or break the season. Accountably’s strength is building clear SOPs, naming conventions, and review checklists that keep deadlines on track. If you want help turning Form 13715 updates into a simple recurring workflow your team can run, we are happy to share the templates we use with partner firms.

Wrap‑Up And Next Steps

- Download the current Form 13715, Rev. 10‑2025.

- Fill it completely, date it, and use the IRS wizard or your territory’s preferred submission channel.

- Tell your RM about any change, even small ones, and confirm your locator listing after updates.

- Keep a dated copy in a shared folder and include the update step in your coordinator SOP.

Your site runs smoother when the basics are buttoned up. Form 13715 is one page, but it is the front door for the families you serve.

Disclosure

Key facts, the current IRS revision and resources cited above, were verified against IRS.gov.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk