Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

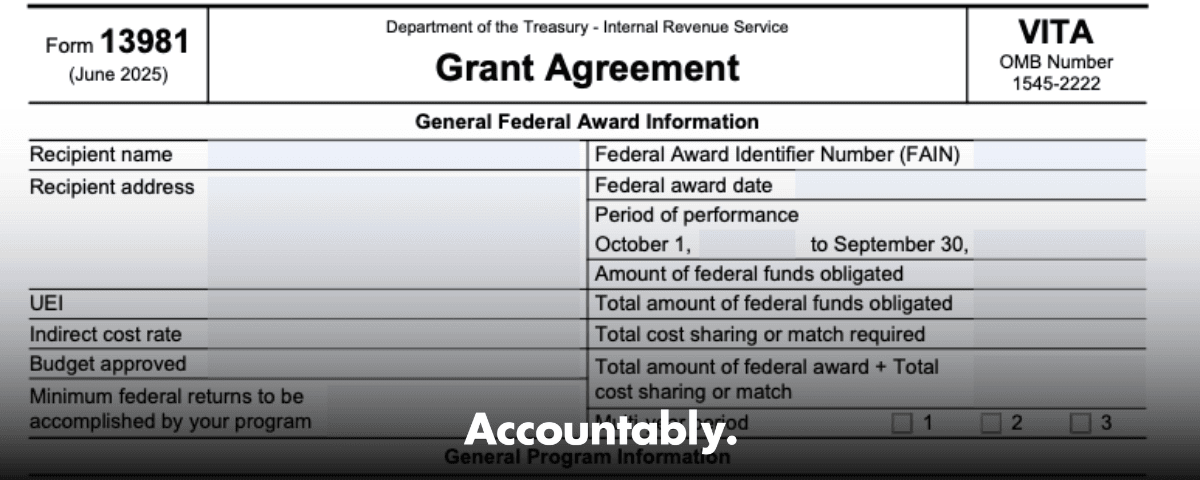

Here is the clarity you need. Form 13981 is the official grant agreement the IRS issues to VITA grantees. It sets your period of performance, the minimum returns expectation, and the terms tied to your award. The current revision shows the period of performance running October 1 through September 30, with signatures from both the IRS and the recipient, and it carries OMB control number 1545‑2222.

What it is not, it is not the form a taxpayer signs to let a preparer see transcripts or talk to the IRS. For that, you need the Third‑Party Designee on the return itself, Form 8821 for tax information authorization, Form 2848 for representation, and Form 8879 for e‑file signature authorization. We will map those choices in a quick table shortly.

If you remember only one thing, remember this, Form 13981 is about your VITA grant award and performance window, not client‑by‑client authorization.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Key Takeaways

- Form 13981 is the IRS VITA Grant Agreement, it defines your award, period of performance, and terms, typically October 1 through September 30.

- It does not authorize transcript access or e‑file actions for individual taxpayers. Use the Third‑Party Designee on the tax return, Form 8821, Form 2848, or Form 8879, depending on what you need.

- The “Third‑Party Designee” on many IRS returns uses a name, phone, and any five‑digit PIN that the designee selects, and it expires automatically, usually one year after the return due date. This is for basic processing questions, not representation.

- If you use the IP PIN program, you can choose continuous enrollment or a one‑time year, and voluntary participants can opt out in their Online Account. Victims of identity theft are generally required to remain in the program. Allow about 72 hours after opting out before e‑filing without an IP PIN.

- VITA grantees have acceptance steps and reporting tied to the grant cycle, including final reporting 120 days after September 30, which lands on January 28. Keep your grant documents, agreements, and performance reports tight.

What Form 13981 Actually Does

Form 13981 memorializes your VITA grant award. It identifies your organization, the Federal Award Identifier Number, award dates, total federal funds, matching expectations, and the performance period. It is signed by both parties, and it references the minimum returns expected under the award. This is the contractual anchor for your VITA funding year.

The IRS maintains a public index that lists Form 13981 as the “VITA Grant Agreement,” with the current revision date shown as June 2025. If you are double‑checking that you have the right PDF for your binder or internal wiki, confirm that label and revision date.

If you are new to VITA grants, also bookmark the IRS VITA Grant Program page and the VITA grant recipient hub. These pages outline application windows, acceptance steps, terms, and final reporting dates, including the January 28 deadline for the final report after the project period ends on September 30.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhat Form 13981 Does Not Do

Here is where most confusion creeps in during busy season.

- It does not let a preparer or site volunteer access taxpayer transcripts. That control lives with the taxpayer through the Third‑Party Designee on a filed return or through an authorization like Form 8821, and for representation through Form 2848.

- It does not authorize e‑file signatures. Use Form 8879 for the 1040 series and follow the identity verification rules your ERO software enforces.

- It is not a way to manage IP PIN participation. IP PIN enrollment and opt out choices now happen through the taxpayer’s Online Account, with continuous and one‑time enrollment options.

Quick Orientation For Busy Leads

When you are onboarding volunteers or coaching new staff, ground them in a simple message. Form 13981 is your grant contract, the VITA “terms and dates” document. If you need to handle taxpayer‑level authorizations, use the right tool for the job, the return’s Third‑Party Designee for basic processing questions, Form 8821 for information access, Form 2848 for representation, and Form 8879 for e‑signature.

In my experience working with teams during January onboarding, the fastest way to reduce errors is to keep a one‑page routing sheet in your shared drive that maps “purpose” to “form,” then link each item to the most current IRS page. It saves hours, reduces rework, and keeps your program audit ready. For the authoritative references, you will find the IRS pages linked in the citations throughout this guide.

Choose The Right Authorization, Every Time

What Each Form Really Covers

Use this table to match your need to the correct IRS mechanism.

| Purpose | Use this | What it allows | Key limits | Where to find it |

| Let a named person answer basic IRS processing questions about a filed return | Third‑Party Designee on the return | IRS may speak to the designee, designee picks any five‑digit PIN | Basic processing help only, expires automatically, typically one year after due date | 1040, 941, 943, 945 instructions explain name, phone, PIN fields |

| Let a firm or person receive tax information or transcripts | Form 8821, Tax Information Authorization | Inspect and receive confidential tax information for listed years and types of tax | No representation rights, consider 120‑day signature rule when not for an IRS matter | IRS “About Form 8821” and instructions |

| Let a qualified individual represent the taxpayer before the IRS | Form 2848, Power of Attorney | Advocate, negotiate, receive information, do actions listed on the form | Representative must be eligible to practice, scope is limited to listed years and matters | IRS “About Form 2848,” IRM on representation |

| Capture taxpayer’s e‑signature for e‑filed 1040 series returns | Form 8879 | Authorizes ERO to enter or generate PIN as signature | Identity verification rules apply, keep signed 8879 per e‑file handbook | IRS “About Form 8879,” e‑file FAQs |

| Document your VITA grant award and performance period | Form 13981, VITA Grant Agreement | Terms, award amounts, period of performance, minimum returns | Not a taxpayer authorization tool | IRS forms index and OMB PDF |

Third‑Party Designee, The Five‑Digit PIN People Ask About

On many returns, the IRS allows a Third‑Party Designee. You enter a specific name, phone number, and any five‑digit PIN that the designee chooses. This PIN is not an IP PIN and not the taxpayer’s e‑file signature PIN. It simply authenticates the designee when calling the IRS about processing questions for that return. The authority expires automatically, usually one year after the return due date, and it does not create representation rights.

When You Actually Need Transcripts Or Account Data

If you need transcripts for a mortgage verification, a cleanup project, or to resolve an account issue, use Form 8821. It authorizes the IRS to share confidential information for specific years and tax types, and it can enable online transcript delivery to the authorized party. Do not use 8821 if you need to advocate or sign agreements, that is Form 2848 territory.

For context on transcript timing, the IRS notes that wage and income transcripts for the current processing year typically post by late March. If you are planning early season work that depends on those files, build that date into your timeline.

E‑Signature Rules That Still Trip People Up

Form 8879 is the e‑file signature authorization. The ERO can enter or generate the taxpayer’s PIN if the taxpayer authorizes it, and identity verification rules apply. If a taxpayer has an IP PIN, that six‑digit number must be included when filing or the return will be rejected or delayed.

IP PIN Enrollment And Opt‑Out, Updated For 2025

The IRS expanded IP PIN options. You can enroll through Online Account and choose continuous enrollment, which keeps you in the program automatically, or a one‑time enrollment that ends at year end. If you voluntarily enrolled and you are not an identity theft victim, you can opt out in your Online Account. After opting out, allow up to about 72 hours before you can e‑file without the IP PIN, and the same wait applies before opting back in.

Identity theft victims are generally auto‑enrolled and will not be permitted to opt out while the IRS still sees risk on the account, which is why the opt‑out gate is not available in those cases. If Online Account is not an option, the IRS still supports alternatives like Form 15227 for eligible incomes or an in‑person TAC appointment to get or maintain an IP PIN.

Practical tip, if a taxpayer insists on leaving the program mid‑season, explain the tradeoff clearly. IP PINs stop a lot of low‑effort fraud. If they opt out, you lose that match check at filing.

Working With Form 13981, From Award To Closeout

Your Timeline, At A Glance

- Period of performance, October 1 to September 30. Keep that window front and center in your internal calendar.

- Acceptance steps, follow the IRS grant recipient resource guide for actions within the initial acceptance window after award notice. Review the Terms and Conditions before signing.

- Final report, due 120 days after the project period ends, January 28. Assign a single owner for this date and back‑plan deliverables with at least two internal checkpoints.

What To Check Before You Sign

- Confirm entity legal name, UEI, address, and banking details match SAM and your internal records.

- Verify the minimum returns expected and your multi‑year status if applicable, the agreement language explicitly references both.

- Read Publication 5247, Terms and Conditions, alongside your grant agreement so your finance and operations leads know what they are signing up to deliver.

Keep Your Grant Files Audit Ready

Create a single digital folder structure, for example 00 Agreement, 01 Budget and Match, 02 Staffing and Training, 03 Reporting, 04 Closeout. Store Form 13981, budget narratives, performance measures, site lists, ethics training logs, and final reports here. If you change site coordinators or add a new sub‑award, update the folder the same day.

From experience, the friction is rarely the work itself, it is hunting for the right version. Good file hygiene saves hours in March.

Common Mistakes And How To Avoid Them

Grant‑Side Mistakes

- Letting the agreement sit unsigned while onboarding volunteers, then crunching compliance at the last minute. Fix it by scheduling a 30‑minute acceptance huddle with your executive and finance leads within 48 hours of the award notice.

- Confusing Form 13981 with client authorizations, which leads to missing 8821 or 2848 when problems arise. Fix it by pinning your “Which form, when” cheat sheet in your shared workspace.

Taxpayer‑Level Mistakes

- Using the five‑digit Third‑Party Designee PIN area on a return as if it creates representation or transcript access. It does not. Fix it by training preparers to use 8821 for information and 2848 for representation.

- Missing the one‑year expiration on Third‑Party Designee authority, then getting blocked on follow‑up calls. Put a simple “expires one year from due date” reminder in your SOP.

- Forgetting the IP PIN on returns for enrolled taxpayers, which causes rejections or delays. Fix it with a software rule that flags missing IP PINs at sign‑off.

Quick Checklists You Can Use Today

VITA Grant Agreement, Pre‑Signature

- Confirm period of performance and multi‑year status.

- Reconcile MRE goal to site capacity plan.

- Review Terms and Conditions with finance and operations.

- Lock file storage, signers, and due dates.

Taxpayer Authorization, By Scenario

- Need to answer simple processing questions on a filed return, use the Third‑Party Designee on the return, enter name, phone, and five‑digit PIN.

- Need transcripts or balances, use Form 8821.

- Need to represent, advocate, or sign agreements, use Form 2848.

- Need e‑file signatures for 1040 series, use Form 8879, follow identity verification rules.

- Managing IP PINs, enroll, retrieve, or opt out through Online Account when eligible, consider the 72‑hour processing window.

Where Accountably Fits, If You Run A Busy Firm

If your firm handles a mix of VITA partnerships, CAS, and tax, the first failure point is almost always delivery discipline, not sales. In practice, we see problems when authorizations and e‑signature steps live in people’s heads rather than in a documented workflow. The fix is simple, write SOPs that map each use case to the right IRS form, standardize file naming, and add a review checklist that blocks transmission if an authorization is missing. This is the kind of controlled delivery structure Accountably builds for firms that want scale without chaos.

Deadlines And Reference Table

| Item | What it is | Key timing or rule | Source |

| Form 13981 | VITA Grant Agreement | Period of performance, October 1 to September 30 | IRS forms index, OMB PDF |

| Final report | Closeout reporting | Due 120 days after project period ends, January 28 | VITA grant recipient page |

| Third‑Party Designee | On many returns | Name, phone, any five‑digit PIN, authority typically expires one year after due date | IRS “Power of Attorney and other authorizations” and return instructions |

| Form 8821 | Tax Information Authorization | Grants information access for listed years and taxes | About Form 8821 |

| Form 2848 | Power of Attorney | Grants representation and information rights within listed scope | About Form 2848, IRM 13.1.23 |

| Form 8879 | e‑file Signature Authorization | Authorizes ERO to enter or generate PIN, identity verification applies | About Form 8879, e‑file FAQs |

| IP PIN program | Identity protection | Continuous or one‑time enrollment, voluntary opt‑out for non‑victims via Online Account, allow about 72 hours to take effect | IP PIN FAQs and IRM |

Frequently Asked Questions

Is Form 13981 required for every VITA site we operate?

Form 13981 is the grant agreement for your organization’s award, not a site‑by‑site authorization. Your sites, targets, and minimum return expectations flow from the award and your application package, and they are reflected in your reporting.

Can we use Form 13981 to let volunteers pull transcripts?

No. Use the Third‑Party Designee on the taxpayer’s return for basic processing questions, or use Form 8821 for transcript and account access for specific years. For representation, use Form 2848.

What is the five‑digit PIN I keep seeing?

It depends on context. On many returns, the Third‑Party Designee chooses any five‑digit PIN that the IRS uses to verify the designee. Separately, taxpayers use a five‑digit PIN as an electronic signature when filing. These are different from the six‑digit IP PIN used for identity protection.

How do we opt a taxpayer out of the IP PIN program?

If the taxpayer voluntarily enrolled and is not a confirmed identity theft victim, they can opt out in their Online Account. The change takes about 72 hours to flow before e‑filing without an IP PIN.

When do wage and income transcripts become available for the current year?

The IRS indicates that current year wage and income transcripts typically become available by late March, which matters if you rely on them for early season cleanup or verification.

We keep getting stuck on e‑file signatures. What should we check?

Confirm your process uses Form 8879 correctly, that your software’s identity checks are enabled, and that IP PINs are entered when required. If an IP PIN is missing on an account that has one, the return will reject or be delayed.

Final Notes And A Simple Way To Stay Clean

If you run VITA work inside a broader firm, your risk is not lack of good people, it is lack of clear guardrails. Keep a one‑page matrix for authorizations, keep your Form 13981 and Terms and Conditions in a shared folder with due dates pinned, and train to the differences between Third‑Party Designee, 8821, 2848, and 8879.

If you want help tightening the delivery side, especially with SOPs, structured workpapers, and review checklists that catch missing authorizations before transmission, our team at Accountably can help you implement a disciplined, low‑friction workflow. We focus on capacity without chaos, workflow discipline, and review protection, so your team can ship on time without burnout.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk