Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Most firms do not stumble because they cannot find work. They stumble when delivery breaks under pressure. If your team is juggling peak close, tax season, and plan certifications, small blocks in a form can snowball into missed deadlines and strained client trust. This guide shows you, step by step, how to file Form 15315 with zero drama, how to document your audit trail, and how to keep reviews fast and clean.

Key Takeaways

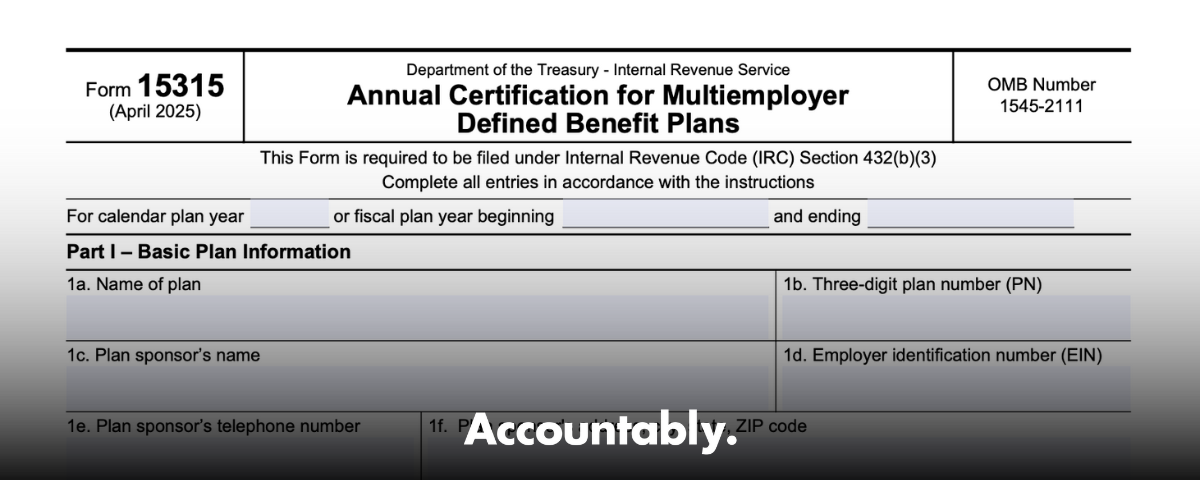

- Form 15315 is the IRS filing that transmits your plan actuary’s annual certification of zone status for a multiemployer defined benefit plan.

- The IRS confirms a Mobile Friendly Forms glitch. If you cannot enter dates beyond December 31, 2025 or a plan number that begins with 0, use mail, fax, or email instead.

- Send only the completed Form 15315. Do not attach actuarial reports or extra letters when you submit.

- Filing deadline is 90 days after the start of the plan year. For a calendar year plan, that is March 31. EPCU does not provide return‑receipt acknowledgments, so keep your own proof.

- For account‑specific questions, contact Employee Plans Customer Account Services at 877‑829‑5500.

Pro tip Use a single clean subject line for email, exactly “Multiemployer Certification,” and attach only the filled Form 15315. This helps automated routing and avoids intake delays.

What Form 15315 does, and who files it

Form 15315 is the IRS’s digital cover for your plan actuary’s annual certification of funding status. You use it to report whether the plan is endangered, critical, or critical and declining, which then drives notices, funding improvement or rehabilitation steps, and other statutory actions for the year. For multiemployer plans, this certification is not optional, it is a yearly requirement tied to MPRA and PPA rules that the IRS has continued to enforce. Filing is due within 90 days after the plan year begins, and for a calendar year plan that means March 31.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

If you are a plan administrator, trustee, fund office leader, or the actuary responsible for the certification, Form 15315 is your official transmission to the IRS. Keep the actuarial report and worksheets in your files, but do not send them with the form unless the IRS asks later.

All accepted filing channels as of October 22, 2025

The IRS supports four submission paths. Use the mobile page when it accepts your entries. If it does not, pivot to one of the paperless or paper options below.

| Channel | Where to submit | What to include | Notes |

| IRS Mobile Friendly Forms | Form 15315 online | Enter form fields only | Use when the page accepts your date and plan number entries. |

| [email protected] | One attachment, the completed Form 15315 | Subject line must read “Multiemployer Certification.” No extra attachments. | |

| Fax | 855‑215‑7122 | The completed form | Keep the transmission report as time‑stamped proof. |

| Department of the Treasury, Employee Plans, CHI‑7602, 25th Floor, 230 S. Dearborn Street, Chicago, IL 60604 | The completed form | Use trackable mail and keep the receipt. |

Fast path if the portal blocks you Email or fax the completed form on the same day, then file your evidence. The IRS has explicitly opened these alternatives while the glitch persists.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallThe filing deadline and what “on time” looks like

- Due date is 90 days after the plan year starts.

- For a calendar year plan, target March 31.

- EPCU does not send return receipts. Your evidence is your time‑stamped email, fax OK page, or mail tracking.

If you need to ask about account status or a specific submission, use the Employee Plans Customer Account Services line at 877‑829‑5500. They can help with account‑level questions and basic information, but they will not provide legal advice.

Quick checklist for proof Save the sent email with timestamp and the attached PDF, or the fax “OK” report with page count and the dialed number, or the postal tracking receipt. File these with your actuarial workpapers for the plan year.

Step‑by‑step, how to file Form 15315 in 2025

You have two paths. Start with the online form. If it blocks a valid date or a leading‑zero plan number, switch to email or fax the same day.

If the Mobile Friendly Forms page works for your plan

- Confirm you are within 90 days of the plan year start.

- Gather plan identifiers, including plan name, EIN, and plan number.

- Validate the certification date and zone status with your actuary.

- Complete Form 15315 online, enter only what the form asks, then submit.

- Download any confirmation screen or capture a screenshot, then file it with your records.

Keep your actuarial report and worksheets in your files. Do not attach them to the IRS submission. The IRS asks for the form only.

If the portal blocks your entries

You may encounter two specific issues, a date field that will not accept entries beyond December 31, 2025, or a plan number that begins with 0. The IRS has acknowledged both, and it allows email, fax, or mail as alternatives.

- Email to [email protected] using the exact subject line “Multiemployer Certification,” attach only the completed Form 15315, then save the sent message and timestamp.

- Fax to 855‑215‑7122, label the cover “Multiemployer Certification,” include plan name, EIN, plan number, contact name and phone, then keep the transmission confirmation.

- Mail to the Chicago Employee Plans address on a trackable service and keep the receipt.

Email specifics that prevent delays

- Use only one attachment, the completed form.

- Do not include letters or exhibits.

- Keep the subject line exactly “Multiemployer Certification,” with no prefixes or extra text.

- Save a PDF of your sent message and the attachment for your records.

Fax checklist

- Destination number 855‑215‑7122.

- Clear cover page that says “Multiemployer Certification,” with plan name, EIN, plan number, contact name, and phone.

- Confirm every page is legible.

- Print or save the “OK” report that shows date, time, page count, and the dialed number. Keep it with the sent pages.

Mail checklist

- Address to Department of the Treasury, Employee Plans, CHI‑7602, 25th Floor, 230 S. Dearborn Street, Chicago, IL 60604.

- Send the completed form only.

- Use a secure envelope, avoid window envelopes, and use a trackable service.

- File the tracking number and a copy of the form with your plan records.

Controls that keep you audit‑ready

A little structure keeps reviews short and stops rework. Here is a simple control set that works for most plans.

| Step | What to check | Your control |

| Pre‑entry | Do your date and plan number meet the portal’s current limits | If not, switch to email or fax immediately, do not burn time on workarounds. |

| Data input | All identifiers and the zone status match the actuary’s certification | Cross‑check against the signed actuarial memo and your plan master data. |

| Submission | Evidence of timely filing is captured | Save the email timestamp and attachment, fax OK page, or mail tracking. |

| Retention | Workpapers reconcile to the filed form | Maintain assumptions, schedules, and notes in your plan’s records. Provide only if the IRS requests. |

Reminder EPCU does not provide return‑receipt acknowledgments. Your trail is your proof. Build it as part of your process, not after the fact.

Due dates and zone status, in plain language

- Due within 90 days after the plan year begins.

- Calendar year plan example, due March 31.

- The actuary certifies status such as endangered, critical, or critical and declining, following MPRA and PPA rules. These statuses guide funding improvement or rehabilitation steps and related notices.

If you need to talk to someone about an account or a submission question, call Employee Plans Customer Account Services at 877‑829‑5500. They can answer account‑specific and procedural items.

FAQs

Who must file Form 15315, and when is it due?

The plan administrator files Form 15315 to transmit the plan actuary’s annual certification for a multiemployer defined benefit plan. File within 90 days after the start of the plan year, for example March 31 for a calendar year plan.

The portal rejected my date or my plan number starts with 0. What now?

This is a known IRS Mobile Friendly Forms issue. Email the completed form to [email protected] with the subject “Multiemployer Certification,” or fax it to 855‑215‑7122, or mail it to the Chicago Employee Plans address. Keep your proof of submission.

Should I include my actuarial report or other support with the submission?

No. Send only the completed Form 15315. Keep your actuarial report, worksheets, and assumptions in your records for possible IRS requests.

Will I get an acknowledgment of receipt?

No. EPCU does not provide return‑receipt acknowledgments for these certifications. Keep your own time‑stamped evidence.

Who do I contact for account‑specific questions?

Use Employee Plans Customer Account Services at 877‑829‑5500. They handle account questions and basic information about retirement plan forms and statuses.

Clean documentation, stronger reviews

Treat your evidence like part of the filing, not an afterthought.

- Email, save the sent message with timestamp and the attached PDF of the form.

- Fax, save the “OK” transmission report with date, time, page count, and dialed number.

- Mail, save the tracking receipt and a copy of what you sent.

- Organize actuarial workpapers, assumptions, and schedules in the plan’s files so they match the filed form.

This simple discipline shortens your internal reviews and gives you confidence if the IRS asks later.

Common pitfalls we see, and how to avoid them

- Letting the portal glitch burn the deadline. If the page rejects a valid date or a leading zero plan number, switch to email or fax the same day.

- Sending extra attachments. The IRS wants the form only. Extra files can trigger handling delays.

- Skipping proof. Since there is no automatic receipt, your file copy and timestamp are your proof of timely filing.

Where Accountably fits, when delivery pressure hits

If delivery bottlenecks are the real risk, not the rulebook, add structure before the next deadline. Accountably builds controlled offshore delivery for CPA and EA firms that need clean workpapers, reliable turnaround, and review protection, especially when compliance work piles up. We work inside your systems, we follow your templates, and we reinforce documentation discipline so filings like Form 15315 do not slip. Use us when your team is buried in production and you need stable capacity without chaos.

Sources, dates, and a quick compliance note

- IRS confirms the Mobile Friendly Forms glitch and accepts Form 15315 by email, fax, or mail, with address, number, and subject line. Checked October 22, 2025.

- Deadline and EPCU acknowledgment policy, “Expanded zone status” guidance, page last reviewed August 26, 2025.

- Employee Plans Customer Account Services contact, page last reviewed August 26, 2025.

This article is for general guidance. Always confirm the latest IRS instructions before you file, since procedures can change.

Final checklist you can copy

- Confirm due date, 90 days after the plan year starts.

- Try the Mobile Friendly Forms page. If blocked by the date or leading zero plan number, move to email or fax that same day.

- Email, subject “Multiemployer Certification,” attach only the completed Form 15315.

- Fax, 855‑215‑7122, clean cover, keep the OK report.

- Mail, Chicago Employee Plans address, track the package.

- Save all proof in the plan’s records with the actuarial certification.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk