Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Every time something felt off, she tapped a checkbox on 6729-C and jotted a one‑line note. Ten minutes later, she had a clean list of fixes, the return was accurate, and the site coordinator could breathe again. That is the real job of Form 6729-C, it keeps you calm, fast, and consistent when everything else is moving.

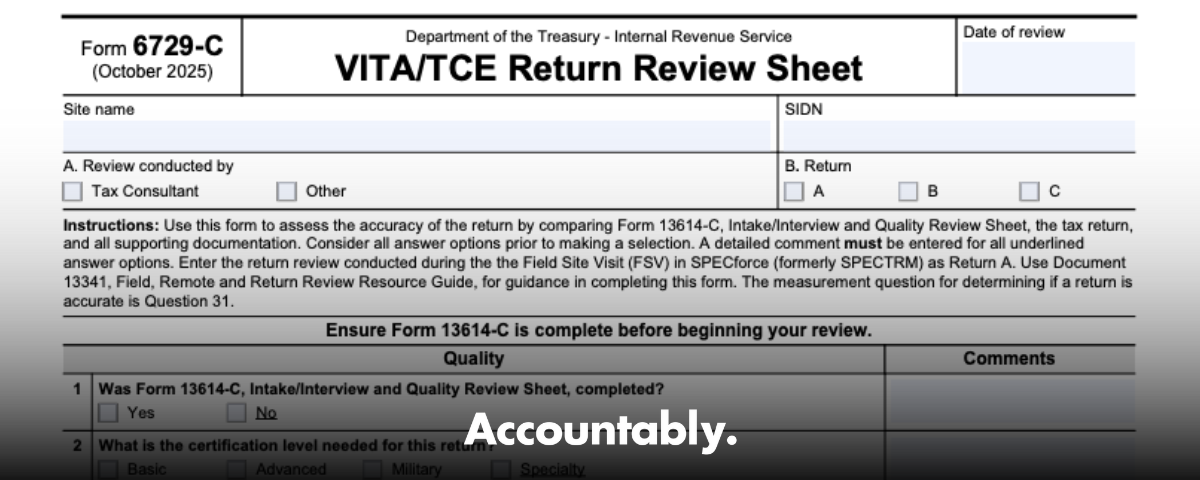

If you review volunteer‑prepared returns, you do not need another lecture, you need a clear, current guide. The IRS updated Form 6729‑C in October 2025. The latest form is three pages with 31 measured questions, and Question 31 is the accuracy decision. Reviews completed during a Field Site Visit are recorded in SPECforce, the IRS’s internal review system that replaced SPECTRM naming, which means this is a quality tool, not something you file with a taxpayer’s return.

Key Takeaways

- The latest 6729‑C is the VITA/TCE Return Review Sheet, revised in October 2025, with 31 questions, not 34. Question 31 is the “accurate return prepared” measurement.

- Use 6729‑C to compare Form 13614‑C, the tax return, and source docs, then document findings and accuracy, especially during Field Site Visits or remote partner reviews. Results are entered in SPECforce by IRS reviewers.

- Partners can also use 6729‑C as an optional review tool, guided by Publication 5140 and anchored to the Quality Site Requirements in Publication 5166.

- This is an internal quality document, you do not attach it to a taxpayer return. Follow VITA/TCE privacy and data‑minimization rules in Publication 4299 when storing any review notes.

- “FSV” on the form means Field Site Visit, not Foreign Service. Out‑of‑scope issues must be flagged and handled per VITA/TCE policy.

What is IRS Form 6729‑C

Form 6729‑C is the IRS VITA/TCE Return Review Sheet. You use it to check a finished volunteer‑prepared return against intake data and source documents, then decide if it is accurate. The October 2025 version opens with instructions to compare Form 13614‑C, the return, and all supporting documentation, and it calls out that the “measurement question” is Question 31.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

The form groups your checks into logical buckets, entity data, filing status, dependents, income, adjustments, tax and credits, payments, and the final accuracy call. It is designed for reviews performed by SPEC during Field Site Visits and Remote Site Reviews, and partners can use it as a structured checklist when they conduct their own internal reviews. Publication 5140 is the official job aid that explains how to answer each question on 6729‑C and 6729‑D.

You will see a specific instruction on page 1 to enter FSV return reviews in SPECforce, formerly SPECTRM, as “Return A.” That detail matters because it confirms 6729‑C is a quality‑control record, not a taxpayer‑facing filing.

What Changed In The 2025 Revision

- The header shows “Form 6729‑C (Rev. 10‑2025).”

- The form references SPECforce and directs FSV reviewers to enter their Return A there.

- The checklist tops out at 31 questions, and the form explicitly names Question 31 as the accuracy measure, so do not reuse older training that talks about 34 checkpoints.

If your site binder still says “34 questions,” update it, point your team to the Site Coordinator Corner page that links the current 6729‑C, and refresh your review scripts.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWho Should Use This Form

- IRS relationship managers and tax consultants during Field Site Visits and Remote Site Reviews use 6729‑C to record return‑level quality outcomes.

- Partner organizations can adopt 6729‑C for internal return reviews, which is encouraged in Publication 5140, paired with 6729‑D for site reviews and anchored to the Quality Site Requirements in Publication 5166.

Remember, your day‑to‑day quality review during preparation still starts with Form 13614‑C and the intake, interview, and quality review process. Link & Learn training reinforces that flow, use the intake sheet to drive the review, then tie every answer back to the return.

6729‑C vs. 13614‑C, When to Use Which

- Use 13614‑C every time you prepare and quality review a return with the taxpayer.

- Use 6729‑C when you are formally reviewing a completed return for accuracy, for example during a Field Site Visit or a partner’s internal QA sweep.

The Sections, What They Cover, And How To Think About Them

Each section lines up with how you scan a 1040. Work in order, it keeps your review tight and less emotional, and it makes Question 31 feel automatic.

| Section | What you confirm | Common proof you check |

| Entity | Names, address, SSN or ITIN are correct | Photo ID, Social Security card or ITIN letter, intake sheet |

| Filing Status | Status on return is supported | 12/31 marital status, dependents, support and living facts |

| Dependents | Who qualifies, who does not | Relationship, residency, age, support tests |

| Income | W‑2, 1099 series, Sch 1 items, Social Security, pensions, capital gains | Source docs, year‑end statements, brokerage 1099‑B support |

| Adjustments | Above‑the‑line items | HSA forms, IRA receipts, SE tax calc, student loan interest |

| Tax and Credits | Standard vs itemized, CTC, education, clean energy credits | Pub 4012 references, worksheets, Schedule A records |

| Payments | Withholding, refundable credits, estimated payments | W‑2 and 1099 withholding, ES payment confirmations |

| Accuracy | Final call, accurate or not | Question 31 decision on page 3 |

Publication 5140 walks through each area and how to evaluate answers on 6729‑C. If you need to tie your review back to site requirements or volunteer roles, Publication 5166 is your north star for QSR.

Pro tip, read the return once for structure, then do a second pass only on differences between the return and Form 13614‑C answers. It is faster, and your notes are cleaner.

How To Complete Form 6729‑C Step By Step

You will move faster when you run the same routine every time. I use a two‑pass method, a quick scan to see the whole return, then a slower pass to answer each checklist question and record proof.

Pass 1, Anchor The File

- Header, fill in reviewer name, review date, site location, and taxpayer names as they appear on the return.

- Pull up the intake sheet, Form 13614‑C, side by side with the tax return.

- Stack source documents, W‑2, 1099 series, Social Security SSA‑1099, brokerage composite, education statements, HSA forms, plus any foreign or state attachments.

- Confirm privacy basics, screens are not visible to others, only necessary data is on the desk, and your storage path is secured.

One minute spent setting the table saves five minutes of rework later.

Pass 2, Work The Checklist In Order

- Identity and entity, match names, SSN or ITIN, and address to ID and intake. Note any name spelling or suffix issues.

- Filing status, tie the status back to year‑end facts, marital status, dependents in the home, and support.

- Dependents, test relationship, age, residency, and support for each person claimed.

- Income, reconcile the return to the W‑2s and 1099s on your desk. If you see prior‑year carryovers, check if they still apply.

- Adjustments, confirm HSA, IRA, student loan interest, self‑employment calculations.

- Deductions and credits, choose standard vs itemized with a simple compare, then validate Child Tax Credit, education credits, and any clean energy credits with their proofs.

- Payments, confirm withholding and estimated tax payments.

- Final call, record notes and make your accuracy decision.

Keep notes short and specific. “1099‑INT from FirstBank missing, $42 interest added, Sch B updated.” Good notes are gold if a coordinator needs to audit your review later.

Quick Reference Checklist

| Step | What you do | What you look at |

| 1 | Verify identity | Photo ID, SSN or ITIN letter, 13614‑C |

| 2 | Confirm filing status | Year‑end facts, dependents, support |

| 3 | Test dependents | Relationship, residency, age, support |

| 4 | Reconcile income | W‑2, 1099‑NEC, 1099‑R, 1099‑B, SSA‑1099 |

| 5 | Validate adjustments | HSA 5498‑SA, IRA 5498, SE calc, tuition receipts |

| 6 | Check deductions and credits | Standard vs Schedule A, CTC, AOTC/LLC |

| 7 | Confirm payments | Withholding, estimated vouchers, prior credit |

| 8 | Decide accuracy | Document notes, sign and date the review |

Required Documentation And Evidence That Speeds Reviews

Think proof first, then entries. When you reach a question, ask yourself, what would I show a coordinator if asked?

- Identity, photo ID, SSN or ITIN letter, and names that match Social Security records.

- Filing status, if there is any doubt, keep a simple fact note, married on 12/31, lived apart from June, child lived with taxpayer all year.

- Dependents, keep a short note that covers relationship, residency months, and support.

- Income, organize statements by type, wages, interest, dividends, self‑employment, retirement, Social Security, brokerage, other income.

- Credits, keep receipts or worksheets for education credits, child care, and clean energy credits.

- Adjustments, IRA and HSA statements, health insurance marketplace forms, and self‑employment worksheets.

- If your site reviews returns with foreign items, keep copies of foreign wage statements and any exclusion worksheets.

Label documents to the return line or schedule they support, add a date stamp, and record where the digital copy is stored. You will thank yourself during site closeout.

Common Errors And Simple Ways To Avoid Them

Even seasoned reviewers miss small things when the room gets loud or the queue gets long. Here are the misses I see most, and the habits that prevent them.

- Identity drift, the return spells the last name differently from the Social Security card. Fix it on the spot.

- Filing status chosen by habit rather than facts. Pause, ask the 12/31 questions, and choose based on living and support details.

- Dependent test shortcuts, a child who stayed with a relative for part of the year needs extra attention on residency and support. Write a two‑line note so the next reviewer understands your decision.

- Unreported small interest or dividends, the $15 1099‑INT left in a wallet can trigger a notice. Scan the intake for “yes” answers about bank interest, then ask again.

- Education credits doubled, the 1098‑T covers the student, not the parent. Confirm who paid and who is eligible, and keep proof of qualified expenses.

- Schedule C mismatches, income on 1099‑NEC is entered, but expenses are estimates. If records are thin, stay conservative, and document the conversation.

- Withholding transposed, $5,140 becomes $5,410, which is a big swing. Re‑key withholding numbers with a second set of eyes.

When in doubt, slow down for sixty seconds. The time you save by rushing is lost three times over in fixes.

A Simple Review Playbook You Can Train In One Meeting

If you coordinate a site or lead a small review team, you can standardize your approach in a single training hour.

The Four Non‑Negotiables

- Every review compares the return to the 13614‑C intake and the source documents.

- Every review has a note for each correction, one line, clear and dated.

- Every review ends with an accuracy decision, not a maybe.

- Every reviewer signs and dates the sheet and stores it where your privacy policy requires.

Smart Tools That Help

- A one‑page reviewer cover sheet that lists all expected documents for the scenario.

- A standard naming convention for digital workpapers, taxpayer name, TY, doc type, date.

- A short script for asking follow‑up questions without creating anxiety for the taxpayer.

- A two‑minute peer check for withholding and routing numbers before you finalize.

If you run an accounting firm and want your production reviews to feel this calm and traceable, this is exactly where disciplined delivery shines. At Accountably, we integrate trained teams into your workflow, we standardize workpapers, and we set clear review gates so partners get time back for advisory. Keep this in your back pocket if you are at the point where reviews are eating your calendar.

Filing Methods And How To Store Your Review

Form 6729‑C is an internal quality document, you do not attach it to a taxpayer’s federal return. Store your completed sheet with your site’s quality records, following VITA/TCE privacy rules and your partner’s retention policy. If you are part of an IRS Field Site Visit team, record the review in the current IRS review system, and keep your notes consistent with what you enter there.

Keep storage simple and safe. Use a secure folder with access limited to those who need it, name files in a standard way, and avoid email for anything that includes personal information. If your site uses a secure portal, upload the completed review sheet with a short note that lists any corrections you made. If your reviewer notes reference sensitive conversations, keep them factual and brief.

Submission And Acknowledgment Basics

- Follow your site’s instructions for capturing and reporting quality reviews.

- If your partner requires periodic uploads, batch them on a set day each week.

- Keep proof of submission, a time stamp, a confirmation screen, or a short log entry.

- If a correction is needed, document the fix and add a line that it was completed.

Good documentation is like a seatbelt. Most days you do not need it, on the day you do, you are grateful it is there.

Related IRS Forms And Resources

You will get more value from 6729‑C when you pair it with the core training set. Here is a quick map you can share with new reviewers.

| Resource | Why it matters |

| Form 13614‑C, Intake, Interview and Quality Review Sheet | Drives the interview and sets the facts you must match in your review |

| Publication 4012, Volunteer Resource Guide | Practical how to steps for most 1040 topics, quick tabbed lookups |

| Publication 4491, VITA/TCE Training Guide | Training content you can use for refreshers during peak season |

| Publication 5166, Quality Site Requirements | The rules your site must follow, useful for reviewer checklists |

| Form 6744, VITA/TCE Test | Keeps skills sharp and helps align review scripts |

| Form 6729‑D, Site Review Sheet | Complements 6729‑C when you need a wider review of site processes |

If you run reviewer trainings, print this table and keep it at the front of your binder. It reminds everyone that 6729‑C is part of a larger quality system, not a standalone sheet.

Practical Tips For Speed And Accuracy

- Read the return once without touching anything, then review with the checklist.

- Work from facts first, intake answers and documents, then confirm entries on the return.

- Use two monitors or split screen so you can see intake and the return side by side.

- Write one‑line notes for every correction, include what changed and why.

- Re‑key withholding and direct deposit routing numbers with a second set of eyes.

- If something feels off, slow down for one minute. Ask one more question.

- End every review with a clear decision, accurate or not accurate, then sign and date.

FAQs

Does Form 6729‑C get filed with a tax return?

No. Form 6729‑C is a quality review sheet. It helps you verify accuracy and document findings. Keep it with site quality records based on your partner’s retention policy.

How long should we retain a completed 6729‑C?

Follow your site’s retention policy and privacy rules. Many partners keep quality records for multiple seasons so they can track trends and improve training. When in doubt, ask your site coordinator before you purge any records.

Do I have to report Form 1095‑C on a return?

You do not file Form 1095‑C with a return. Keep it for your records. If the taxpayer had marketplace coverage with a premium tax credit, you reconcile that on Form 8962 using the 1095‑A, not the 1095‑C.

Who needs Schedule C?

File Schedule C when a taxpayer has self employment income from a sole proprietorship or a single member LLC. If the activity is a hobby, report income on Schedule 1 and do not claim business deductions. Good records matter, even for a small side business.

Is a Schedule C loss a red flag?

Repeated losses can draw attention, especially when records are thin or deductions look high. Keep receipts, logs, and a simple note on business purpose. Show a real intent to make a profit and keep estimates conservative.

What taxes are deductible on Schedule C?

You can deduct state and local business taxes, real estate taxes tied to business property, personal property taxes on business equipment, and the employer share of payroll taxes. You cannot deduct federal income tax. Also track meals, home office, depreciation, and cost of goods sold when they apply.

Do we need special steps for foreign income items during review?

Yes, confirm the document source, the currency treatment, and any exclusion or credit worksheets. Keep copies of foreign statements and note how you supported the entry on the return. If the scenario is out of scope for your site, mark it and refer per policy.

A Short Example You Can Reuse In Training

A married taxpayer files jointly and claims two children. Intake says both kids lived with the parents all year. On review, you spot a 1099‑INT on the intake that is missing from the return. You add the $36, update Schedule B, and write a one‑line note, “Added 1099‑INT FirstBank $36, Schedule B updated, refund changed by $5.” You re‑check Child Tax Credit eligibility, confirm withholding, and then answer the final accuracy question on 6729‑C as accurate. The coordinator reads your notes and approves in under a minute because everything is clear.

That is the goal, a review anyone on your team could pick up and understand in seconds.

Conclusion And Next Step

You now have a working playbook for Form 6729‑C. Use it to check facts, line up entries, and make a clear accuracy decision every time. Train your team on a single routine, pair the checklist with 13614‑C, and keep notes short and specific. If you want the same discipline inside an accounting firm environment, where workpapers are clean and reviews move fast, Accountably can help by building the structure that keeps quality high while partners focus on clients.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk