Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

If you are the executor, a CPA, or the reviewer who signs off, you do not have a sales problem here, you have a delivery problem. The fix is a disciplined workflow that makes Schedule D routine, not risky. Below, you will get a practical, step‑by‑step framework to list every policy, decide inclusion, pull the right exhibits, and file on time without late‑night emergencies.

Key Takeaways

- List every life insurance policy on the decedent’s life on Schedule D, even if it looks excludible. Identify the insurer and policy number for each line. Attach Form 712 whenever possible.

- Include the full proceeds if they are payable to the estate or if the decedent held incidents of ownership, for example the power to change beneficiaries, assign, surrender, pledge, borrow, or a reversionary interest over 5 percent.

- Use Form 712 as your primary source for values and rights. If an insurer will not provide it, attach other proof, for example the proceeds check or policy documents, and explain your determination.

- File Form 706 within 9 months of death or obtain an automatic 6‑month extension with Form 4768. Timely filing is required to elect portability of DSUE.

- Mail Form 706 to the IRS in Kansas City, Missouri, or use the Kansas City private delivery address. Form 4768 is mailed to the IRS Estate and Gift unit in Florence, Kentucky. As of 2025, the IRS does not support e‑filing for Forms 706 and 709.

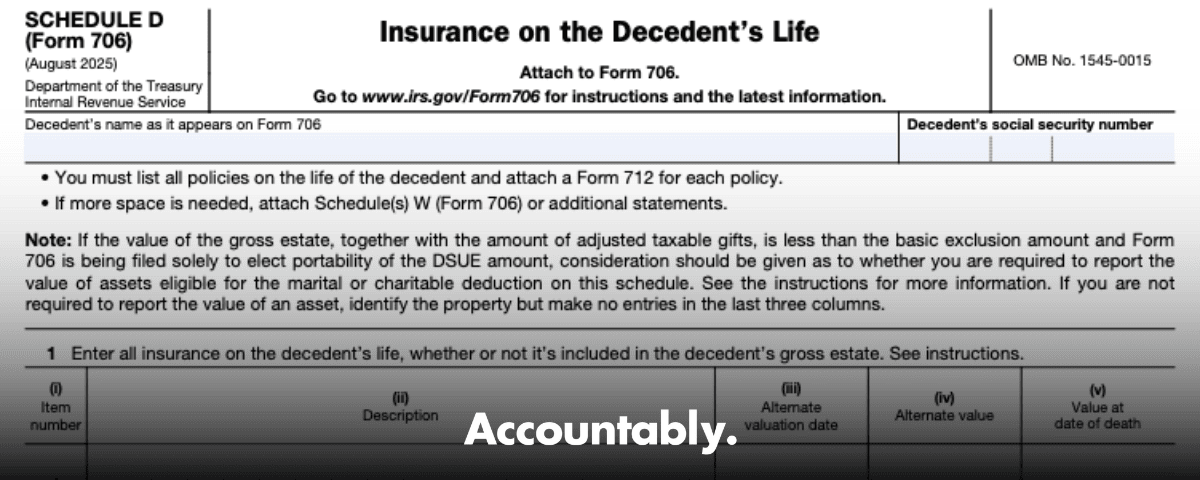

What Schedule D Really Does

Schedule D is where you show the IRS every life insurance policy on the decedent’s life and document why each policy is includible or not. You will:

- List the insurer and policy number for every policy on the decedent’s life.

- Determine inclusion under section 2042 and the incidents‑of‑ownership test.

- Enter value only for includible policies, and explain any exclusions.

- Attach Form 712 for each policy, and use it to support your entries.

The IRS instructions are explicit, list every policy and attach Form 712. If a carrier refuses to issue Form 712, you can submit other documentation, for example riders, assignments, or the proceeds check, and briefly explain your valuation and inclusion call. This simple discipline reduces questions later and protects the return in exam.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Pro tip: treat Form 712 as your anchor. Your description line should name the insurer, show the policy number, and reference the attached Form 712 so your reviewer and any IRS agent can match items in seconds.

The Incidents‑of‑Ownership Test, In Plain English

A policy is includible in the gross estate if the proceeds are payable to, or for the benefit of, the estate, or if the decedent held incidents of ownership at death. Incidents of ownership are any powers that control economic benefits or beneficiaries, including the power to change the beneficiary, assign, revoke an assignment, surrender or cancel, pledge as collateral, or borrow against cash value. A reversionary interest over 5 percent also counts. You test each policy on the date of death and document the result.

What You Must Attach

The IRS expects a death certificate, the certified will if the decedent died testate, and all relevant exhibits, including Form 712. Missing exhibits delay processing and create unnecessary correspondence. Build your packet early, then review it again before shipping.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhich Policies You Must Report

Short answer, all of them. You must list every life insurance policy on the decedent’s life on Schedule D, whether or not you think it is taxable in the estate. Identifying details are not optional, the insurer name and the policy number must appear in the description column.

Use the table below as your quick setup checklist.

| What to list | Where to get it | Why it matters |

| Insurer name | Policy contract or Form 712 | Ties the policy to the issuer for audit clarity |

| Policy number | Policy contract or Form 712 | Lets you match to the insurer exhibit |

| Form 712 attached | Insurer | Establishes proceeds, rights, loans, and ownership |

| Inclusion note | Your incidents‑of‑ownership analysis | Shows why value is entered or left blank |

If a policy is not includible, leave the value column blank and write a short exclusion note tied to incidents of ownership, for example “No incidents of ownership at death, see attached Form 712.” The instructions specifically call for an explanation when proceeds are not included.

When Policies Are Includible In The Gross Estate

Include the full proceeds if they are payable to the estate or obligated for estate liabilities such as taxes or debts. Include the proceeds payable to non‑estate beneficiaries if the decedent held incidents of ownership at death, for example the power to change beneficiaries, assign, surrender, pledge, borrow, or a reversionary interest over 5 percent. Section 2042 and its regulations spell this out and the IRS instructions mirror the rule.

Common examples that trigger inclusion:

- The beneficiary must, by contract, use proceeds to pay estate tax or debts, even if the estate is not named on the policy.

- The decedent could change the beneficiary or borrow against the policy right up to the date of death.

- The decedent held a reversionary interest that exceeded 5 percent immediately before death.

If you do not include proceeds under section 2042, consider whether another Code section would apply to a transferred policy, for example sections 2036, 2037, 2038, or 2035 depending on facts. The IRS notes this possibility in the instructions.

How To Use Form 712 To Complete Schedule D

Form 712, Life Insurance Statement, is your primary exhibit for each listed policy. Request it from the insurer for every policy on the decedent’s life, list the insurer and policy number on Schedule D, and attach the Form 712 behind the schedule. If an insurer refuses to provide a Form 712, attach other reliable proof, for example copies of riders or the proceeds check, and explain your inclusion or exclusion call in the description.

What To Confirm On Each Form 712

- Face amount, policy loans, and cash or surrender value as of date of death.

- Ownership history and who held policy rights on the date of death.

- Settlement terms, payable in a lump sum or a stream, which affects valuation entries.

- Any powers held by the decedent, for example change of beneficiary, assignment, surrender, pledge, or borrowing.

If proceeds are paid in a single sum, the IRS instructions point you to Form 712 line items for what to bring over to Schedule D. If proceeds are not paid in a lump sum, use the value as of date of death from the corresponding Form 712 line. The instruction text provides the exact mapping so your numbers reconcile.

Quick format tip: in your Schedule D description, write “ABC Life, Policy 123456, see Form 712, Exhibit D‑1.” Your reviewer can find the exhibit without hunting, and the IRS agent can do the same.

Nonincludible Policies Still Go On The List

Even when a policy is excludible, you still list it, name the insurer, show the policy number, attach the Form 712, leave the value column blank, and write a short reason. The instructions specifically tell you to explain why proceeds are not included. This approach lowers the chance of a policy‑audit letter and makes beneficiary conversations easier.

Filing Deadlines, Extensions, And Shipping Logistics

You must file Form 706 within 9 months of the date of death. If you need more time, file Form 4768 by the original due date to receive an automatic 6‑month extension. Timely filing is required to elect portability, so do not miss the deadline if the surviving spouse may want the DSUE.

Where to send what in 2025:

- Mail Form 706 to the IRS in Kansas City, Missouri. If you use a private delivery service, ship to the IRS Submission Processing Center on West Pershing Road in Kansas City. Keep the label clean and legible.

- Mail Form 4768 to the Estate and Gift unit in Florence, Kentucky. The instructions list both the USPS and private delivery addresses at the Kentucky Drive location.

- As of 2025, the IRS does not support e‑file for Form 706 or Form 709, so plan for paper filing and tracking.

If your only reason to file is to make the portability election and the estate was not otherwise required to file, the IRS gives you a simplified path. Under Rev. Proc. 2022‑32, you generally have until the fifth anniversary of the decedent’s death to file for portability. The 2025 instructions for Form 706 continue to reference this relief.

Required Attachments You Should Gather Early

- Death certificate.

- Certified copy of the will, or a copy plus a short explanation if certification is not obtainable.

- Form 712 for each policy on the decedent’s life.

- Any additional documents cited in the instructions, for example trust instruments or state death tax certifications.

The IRS lists “death certificate” and “Form 712” specifically in the supplemental documents section and in its pre‑filing checklist.

Step‑By‑Step, From Intake To Filing

Here is a practical flow you can copy into your SOP.

- Create the policy inventory. Ask for all policies on the decedent’s life, including those owned by trusts or third parties. Record insurer, policy number, and any known riders.

- Request Form 712 from each carrier. Submit your requests through the insurer’s portal if available, then follow up with a dated letter or email. Track request dates, contacts, and expected delivery.

- Test inclusion under section 2042. For each policy, decide whether proceeds are payable to or for the benefit of the estate, or whether the decedent held incidents of ownership at death, including a reversionary interest over 5 percent. Document your decision in plain English and link it to the exhibit.

- Fill out Schedule D. Enter descriptions with insurer and policy number. For includible policies, enter value per Form 712 and your analysis. For excludible policies, leave value blank and add a short reason, for example “No incidents of ownership, see Form 712.”

- Assemble exhibits. Place Form 712s in order, label them, and cross‑reference each Schedule D line. Add the death certificate, will copy, and any other required documents.

- Final review. Reconcile totals to Part I liquidity planning and the tax computation, then sign, package, and ship to the correct IRS address. Calendar the 9‑month due date and, if needed, the Form 4768 mailing date.

Advanced Points That Save Reviews And Audits

Even seasoned preparers get tripped up by these scenarios. Use them to tighten your process.

Insurance Payable To Others But Used For Estate Debts

If another beneficiary is legally obligated to use proceeds for estate tax or debts, those proceeds are considered for the benefit of the estate. You include the amount needed to satisfy the obligation, even if the beneficiary is not the estate. The IRS instructions and the regulation both say the form of the policy does not control, the binding obligation does.

Corporate‑Owned Policies

If a corporation owns a policy on a controlling shareholder’s life and pays the proceeds to a third party, attribution rules can pull incidents of ownership back to the decedent for the portion not payable to or for the benefit of the corporation. The regulation gives examples and explains when attribution applies. Document ownership and beneficiaries clearly in your workpapers.

Reversionary Interest Over 5 Percent

A reversionary interest can be hidden in policy terms or by operation of law. If the value of that reversionary interest exceeded 5 percent immediately before death, the policy is includible. Ask carriers specific questions and use Form 712 to confirm. Note your math and cite the policy terms.

When You Cannot Get Form 712

It happens. If the insurer will not provide a Form 712, attach other proof, for example a policy statement, riders, assignments, beneficiary forms, or the proceeds check, and explain how you computed the amount and why you included or excluded it. The instructions acknowledge this fallback.

Sample Schedule D Entries You Can Copy

- “XYZ Life Insurance Co., Policy 987654, Term, see Form 712, Exhibit D‑3. Includible under section 2042, power to change beneficiary held at death, proceeds payable lump sum.”

- “ABC Mutual, Policy 123456, Whole Life, see Form 712, Exhibit D‑5. Not includible, no incidents of ownership at death, value column intentionally blank per instructions.”

- “Guardian Life, Policy 000111, Collateral assignment to lender, see Form 712 and loan agreement, Exhibit D‑7. Proceeds includible to the extent used to satisfy estate debt obligation.”

Keep your language short and factual, then let the exhibit do the heavy lifting.

Quality Control, So Reviews Move Fast

- Use a single naming convention for every file, for example “D‑1 ABC Life 712 Policy 123456.pdf.”

- Put your incidents‑of‑ownership analysis at the top of each policy’s exhibit set.

- Tie each Schedule D line to a Form 712 page reference, not just the exhibit number.

- Run one last “policy discovery” loop with beneficiaries and the decedent’s advisor to catch unreported contracts.

If your firm needs more hands during peak estate season, bring structure first, then add capacity. A disciplined offshore delivery team can request Forms 712, standardize descriptions, build workpapers, and keep reviewers out of loop‑heavy back‑and‑forth. Accountably integrates trained offshore teams into your workflow, follows your templates, and uses a multi‑layer review system to protect partner time and quality. Use this only if you want execution, not resumes.

Frequently Asked Questions

What is Schedule D on Form 706?

It is the schedule where you list every life insurance policy on the decedent’s life, decide inclusion under section 2042, and attach Form 712 to support values and rights. The IRS instructions require complete listing and Form 712 exhibits whenever possible.

Do I have to list policies that are not taxable in the estate?

Yes. List all policies on the decedent’s life with the insurer and policy number. If a policy is not includible, leave the value column blank and explain why, then attach Form 712 or other proof.

What counts as an incident of ownership?

Any right that controls the policy’s economic benefits or beneficiaries, for example the power to change the beneficiary, assign, surrender, pledge, borrow, or a reversionary interest over 5 percent. Test each policy on the date of death.

When is Form 706 due, and can I extend?

Form 706 is due 9 months after the date of death. File Form 4768 by the original due date to receive an automatic 6‑month extension. Timely filing is required to elect portability of DSUE.

Where do I mail Form 706 and Form 4768 in 2025?

Mail Form 706 to the IRS in Kansas City, Missouri, or use the Kansas City private delivery address. Mail Form 4768 to the Estate and Gift unit in Florence, Kentucky.

Can I e‑file Form 706?

No. As of 2025, the IRS does not support e‑filing for Forms 706 and 709, so plan for paper filing and use tracked delivery.

Practical Checklist For Preparing And Filing Schedule D

- Inventory all policies on the decedent’s life, including trust‑owned and third‑party‑owned contracts.

- Request Form 712 from each insurer, track requests, and file the responses in a labeled exhibits folder.

- Apply the incidents‑of‑ownership test and section 2042 to each policy, then write a one‑line reason for inclusion or exclusion.

- Prepare Schedule D, entering insurer and policy number for every policy. Enter value only when includible, leave value blank for excludible policies and explain briefly.

- Attach Form 712 for each listed policy, plus the death certificate and the certified will.

- File Form 706 within 9 months, or file Form 4768 by the original due date for an automatic 6‑month extension. Use the correct 2025 mailing addresses.

Red Flags Reviewers Catch Fast

- A policy listed with no policy number or mismatched insurer name.

- A nonincludible policy with no exclusion note and no Form 712 attached.

- A corporate‑owned policy with proceeds payable to a family member, with no attribution discussion.

- A return filed late without Form 4768 on file, risking the portability election.

If You Manage A Firm, Turn Delivery Into A Strength

You do not need more reminders, you need a clean system. Build SOPs for intake, Form 712 requests, naming conventions, and review notes. If your calendar fills with review loops and deadline pressure during peak season, consider structured help. Accountably embeds trained offshore teams into your workflow, uses standardized workpapers, and runs a multi‑layer review that protects partner time. Use it when you want predictable turnaround, documentation discipline, and control over quality.

Compliance, Sourcing, And A Quick Word On Scope

- The rules that drive inclusion live in section 2042 and the related regulation, which define incidents of ownership and the 5 percent reversionary interest threshold. Use these as your backbone as you analyze each policy.

- The IRS Schedule D instructions tell you to list every policy, identify insurer and policy number, attach Form 712 for each, explain any exclusions, and use alternate documentation if a 712 is unavailable.

- Filing logistics matter. Check the 2025 instructions for addresses before you ship, Kansas City for Form 706, Florence for Form 4768, and remember that e‑file for Form 706 is not supported.

- If your only reason to file is portability and you were not otherwise required to file, Rev. Proc. 2022‑32 gives a five‑year window from date of death to file for that election.

This article is general information for 2025 filings. Always confirm facts with the latest IRS instructions and your legal or tax advisor for the estate’s specific situation.

Conclusion

When you treat Schedule D as a delivery system, not a last‑minute scramble, everything gets easier. Start with a complete policy inventory, anchor your entries to Form 712, apply the incidents‑of‑ownership test, and give the IRS a tidy set of exhibits that tell the story without a single follow‑up letter. File on time, protect portability, and document decisions in plain language. Do that, and your estate return will stand up under review, and your team will have the headspace to focus on strategy instead of rework.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk