Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

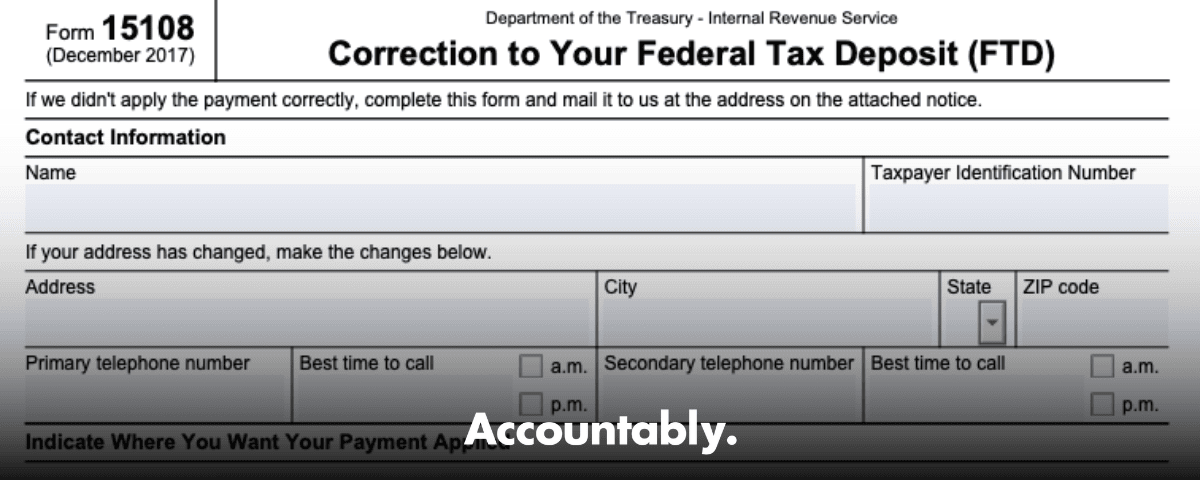

You can do the same. If your notice mentions Form 15108 alongside CP108, the IRS is not saying your money is missing. It is asking you to confirm where the payment belongs and, if needed, to direct a reposting.

Key Takeaways

- Form 15108 shows up with a CP108 when the IRS cannot determine the right form or tax period for your payment. It is about placement, not whether you paid.

- Form 15108 is titled Correction to Your Federal Tax Deposit (FTD), and the IRS lists it on its official forms page.

- Start with your IRS Online Account to verify the posting date, amount, and tax period, then match it to your bank or EFTPS confirmation.

- If the payment was placed in the wrong period or module, call the toll‑free number on your notice or send a brief letter with proof of payment to the address shown on the notice.

- If normal channels stall and you have hardship or repeated delays, contact the Taxpayer Advocate Service at 877‑777‑4778 or file Form 911.

If your CP108 includes Form 15108, you are confirming allocation, not begging for credit. The IRS wants to know exactly where to apply the money.

What Form 15108 Means for Your Tax Account

Form 15108 often rides with CP108. CP108 means the IRS received your money but could not figure out the correct tax form or period to use, so it needs your direction. The Form 15108 attachment is the IRS’s way to collect that direction and fix the posting.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

This combination is common when electronic payments carry the wrong tax type, the wrong period, or a truncated identifier. As of August 27, 2025, the IRS page for CP108 confirms this workflow, and the Internal Revenue Manual notes that CP108 provides Form 15108 to return if the payment posted incorrectly.

If your notice details April 2024 and $2,005.15, treat those as anchor points. Your goal is to show the IRS where that exact payment belongs. If the notice already shows a correct match, you can stand down. If it does not, you will verify, document, and ask the IRS to move it.

Who typically gets CP108 with Form 15108

- Employers that made federal tax deposits with the wrong tax period or type.

- Individuals who paid electronically, selected the wrong year, or used a mismatch in name or TIN.

- Businesses with multiple modules, for example, 941 payroll versus 940 FUTA, where the payment landed on the wrong module.

The IRS guidance is consistent. If the posting is right, do nothing. If it is wrong, call or write, and include proof, so the payment can be re-applied to the correct period or form.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallHow to Verify Where Your Payment Landed

Your first stop is your IRS Online Account. You want three things, the posting date, the amount, and the tax period the system shows. If you are an individual, you can sign in and see up to five years of payment history, including pending items. If you are a business, you will often rely on transcripts and EFTPS records, or you will work with your tax professional to pull the right data. As of September 26, 2025, the IRS says Online Account shows balances, payments, and payment activity, which is exactly what you need for a quick check.

Next, compare your Online Account details to your bank statement or EFTPS confirmation. EFTPS and Direct Pay both give confirmation numbers, and the IRS advises you to keep them. If you used Direct Pay, the IRS notes you can see pending and processed payments and lookup details later with your confirmation number.

Use the table below as your mini audit checklist, then save screenshots to build a tidy paper trail.

Mini Payment Audit Table

| Item | What you should see |

| Amount | $2,005.15 |

| Posting date | IRS transaction date from Online Account or transcript |

| Tax period | April 2024 |

| Module or return | 1040, 941, 940, 1120, or other, as applicable |

| Confirmation | EFTPS or Direct Pay reference number |

Monitor your account for a few weeks until you see the corrected entry or a note from the IRS. If nothing changes and you confirmed a mismatch, move to a phone call or a short letter. The CP108 page explains that you should call the number on your notice or mail your response to the address shown.

Quick note on transcripts

If you need more detail, order an Account Transcript. The IRS confirms that Online Account can access tax records and transcripts, and the Internal Revenue Manual explains how transcripts appear through Online Account after the Get Transcript Online retirement in July 2024.

Fixing a Misapplied Payment Fast

When your payment is in the wrong month or on the wrong form, you have two practical paths, a call or a letter. The notice tells you which number to dial and which address to use. The IRS CP108 page is clear, if the payment was applied incorrectly, let the IRS know where it belongs, by phone or in writing.

Call the IRS, use the notice number

- Call the toll‑free number on the top right of your CP108.

- Say you received CP108 with Form 15108 and you need to review your account.

- Have ready, the amount $2,005.15, the intended period April 2024, the date paid, your SSN or EIN, and your confirmation number.

- Keep a log with the date, time, the rep’s name, and any reference or case number.

- If the notice line is swamped, you can also try 800‑829‑1040 and follow the prompts that route you to personal income tax and payment history. Menus change, so be ready to adapt.

The IRS’s CP108 guidance confirms these basics, including what to say when you call, and that you should have the notice and return in front of you.

Send a short letter if phones are jammed

If you cannot get through, mail a concise correction to the address on your CP108. Include:

- A one-paragraph explanation that your $2,005.15 payment meant for April 2024 posted to the wrong period.

- Your full name, address, SSN or EIN, the CP108 notice number and date.

- Proof of payment, for example, EFTPS or Direct Pay confirmation, or a copy of the canceled check.

- A clear instruction, for example, “Please reapply $2,005.15 to 941 for April 2024.”

- Your signature, date, and a daytime phone.

Send copies, not originals. Use certified mail with tracking. The IRS CP108 page confirms that mailing a response to the address on your notice is an acceptable way to correct a misapplied payment.

What Form 15108 actually is

Form 15108 is titled Correction to Your Federal Tax Deposit (FTD). The IRS forms index lists it, and the Internal Revenue Manual explains that CP108 generates when EFTPS payments cannot be matched to a tax type or period, and that CP108 supplies Form 15108 to return if the payment posted incorrectly. This is your simple tool to tell the IRS where the money goes. As of October 1, 2025, that language appears in IRM 21.7.11.4.1.

Using Your IRS Online Account to Monitor and Request Fixes

Online Account is your dashboard. As of September 26, 2025, the IRS says you can view balances, up to five years of payment history, pending and scheduled payments, and certain digital notices. That means you can confirm when the misapplied payment moves to the correct period.

- Sign in, review Payment Activity, and confirm the posting date and tax period.

- Save screenshots that show the wrong placement and the corrected entry later.

- If your account offers secure messaging or document upload for a payment issue, use it to attach your letter and proof.

- Check weekly for status changes.

If you paid with Direct Pay and only need to look up a single payment, you can use your confirmation number. The IRS explains how to look up Direct Pay payments and confirms that both Direct Pay and EFTPS issue confirmations that you should keep.

Documentation You Should Keep

Strong documentation shortens the fix. Keep:

- Your CP108 and any Form 15108 pages.

- EFTPS or Direct Pay confirmation showing $2,005.15, the date, and your identifier.

- Bank statement showing the withdrawal.

- Filed return pages, for example, 941 for April 2024, or a transcript that supports the intended period.

- A call log with dates, times, rep names, and case numbers.

- Copies of letters you mailed, plus USPS tracking and delivery confirmations.

If you work inside a firm, store this in your client’s permanent file. If you are a business owner handling your own account, save everything in a secure folder. This gives you a clean audit trail if penalties or interest appear later.

What if the IRS removed the payment entirely

Occasionally, if the IRS decides a payment does not belong on your account, you may see a different notice, for example CP260 or CP60. Both involve misapplied or removed payments and the next step is the same, call the number on the notice, have proof ready, and request a review. The IRS pages for CP260 and the TAS guide for CP60 confirm this approach.

Penalties and interest tie back to where the money should have been applied, so thorough proof helps the IRS correct both placement and any downstream charges.

When to Escalate to the Taxpayer Advocate Service

If you have tried normal channels and nothing moves, or if you face real hardship, call the Taxpayer Advocate Service at 877‑777‑4778 or file Form 911. TAS is an independent organization inside the IRS that helps when you have economic harm, repeated failed attempts to resolve a problem, or when a process is not working as it should. As of May 29, 2025, the IRS pages confirm who qualifies and how to request help.

- Gather your CP108, any Form 15108 pages, your proof of payment, and your call log.

- Explain the issue in one paragraph, for example, “Payment of $2,005.15 for April 2024 posted to the wrong period, repeated calls and a letter did not resolve.”

- Ask TAS to coordinate a correction and provide a timeline.

- Keep monitoring your IRS Online Account so you can confirm when the fix posts.

FAQs about CP108 and Form 15108

Is Form 15108 a tax form I file every year?

No. Form 15108 is a correction form that appears with CP108. You use it to tell the IRS where to put a payment when the IRS cannot determine the correct form or period.

How long does it take the IRS to move a misapplied payment?

Phone fixes can be quick if your proof is ready, written requests can take several weeks. Watch your Online Account for the corrected entry and save screenshots. The IRS confirms you can see payment activity and digital notices in your account.

Will interest or penalties be removed once the payment is corrected?

If the IRS placed your payment incorrectly, it can adjust related penalties and interest after reapplication. Call the number on your notice and ask for a review once the payment is moved. The CP108 page instructs you to contact the IRS if the payment was applied incorrectly.

What is the difference between CP108 and CP260?

CP108 is about a payment the IRS cannot match to the right period or form and often includes Form 15108. CP260 tells you a payment was misapplied and removed. In both cases, call or write with proof of payment.

Can I fix a business EFTPS error through my personal Online Account?

Individuals can see their own payment history in Online Account. For business modules, you may rely on EFTPS records, business transcripts, or authorized access by your tax professional. The IRS outlines what Online Account covers and how transcripts are accessed.

What if my payment landed on the wrong EIN or the wrong return type?

Call the number on the notice with proof of payment and the correct EIN or form. If phones fail and you face hardship or repeated delays, contact TAS or file Form 911.

How can I prevent misapplied payments in the future?

Always double check tax type, period, and identification before you submit. Keep the confirmation number and match it to your Online Account within a few days. If you use Direct Pay or EFTPS, the IRS provides confirmation and lookup tools.

A Firm-Level Tip, reduce repeat issues with clean process

If you run a firm, build a simple playbook, a two-minute check of tax type and period before payment, a quick confirmation save, and a same‑week Online Account match. For complex payroll or multi‑entity structures, a standard workpaper and a shared proof folder help your team answer a CP108 in minutes, not hours. If your team is stretched and you need consistent, well-documented execution support inside your own systems and templates, Accountably can integrate trained offshore staff into your workflow so you keep control of process while your team gains time for client strategy. Use this when you want stability and clear accountability, not resume stacks.

Conclusion

You now have a clear path. Verify the posting in your IRS Online Account, match it to your EFTPS or Direct Pay confirmation, and, if needed, call the notice number or send a short letter with proof. Watch for the corrected entry, then save a final screenshot for your records. If progress stalls and you face hardship or ongoing delays, call the Taxpayer Advocate Service or file Form 911 for help.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk