Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

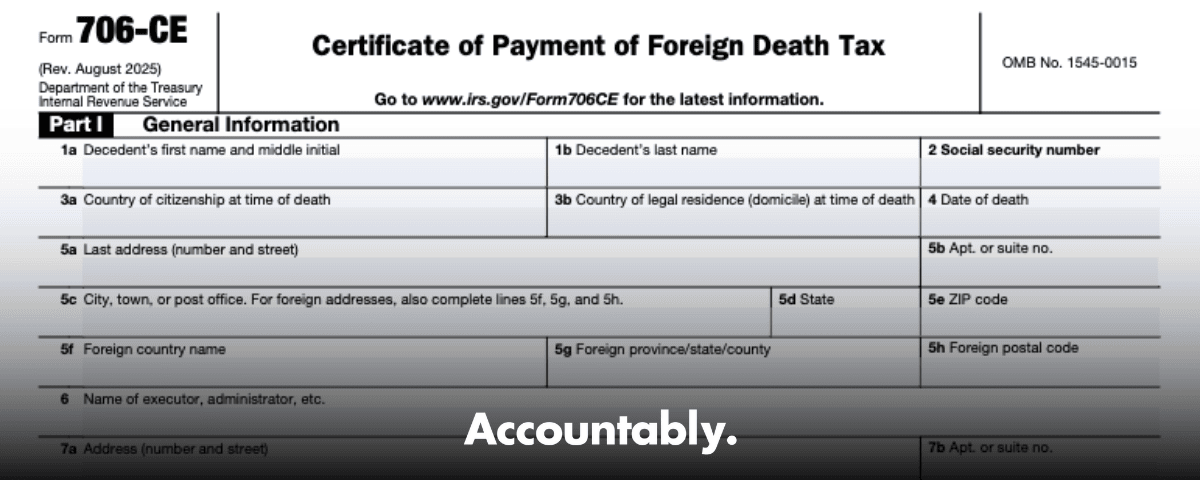

What we did not have was a certified Form 706-CE in the right place at the right time. A small address detail almost cost the estate the credit. You do not need that kind of adrenaline. This guide keeps you on track, start to finish.

Key takeaways

- You use Form 706-CE to certify foreign death taxes that were actually paid, so you can claim the foreign death tax credit on Form 706, Schedule P. Exclude interest and penalties from the amounts you report.

- File a separate 706-CE for each country that imposed death or inheritance tax, and attach 706-CEs to the Form 706 where you claim the credit on Schedule P.

- In 2025, mail original Form 706 returns to the IRS in Kansas City, MO. Mail original or amended Form 706-CE to the IRS Estate and Gift unit in Florence, KY. These addresses are current for calendar year 2025.

- If a foreign authority refuses to certify, you can still file. Attach a signed statement under penalties of perjury, plus the foreign return and proof of payment. Report any foreign tax refunds within 30 days.

- Form 706 is still a paper-filed return, however the IRS accepts electronic or digital signatures on certain paper estate and gift forms, including Form 706.

What Form 706-CE is, and when you actually need it

Form 706-CE is the IRS certificate that proves a foreign death, inheritance, legacy, succession, or similar tax was paid on property included in your U.S. gross estate. The certificate is not a stand‑alone credit. It supports the foreign death tax credit you compute on Schedule P and claim on Form 706. You cannot have the credit allowed without filing 706-CE for each country where tax was paid.

Who files. You, as the executor or administrator, are the filer. The credit is generally available only if the decedent was a U.S. citizen or resident at death, subject to statutory and treaty provisions. If multiple countries taxed the estate, prepare separate 706‑CEs and separate computations on Schedule P.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

What the IRS expects in 2025.

- For the Form 706 return that claims the credit, mail the original return to Kansas City, MO.

- For Form 706-CE itself, send original or amended certificates to the Estate and Gift unit in Florence, KY. These are the current 2025 “Where to file” entries.

Pro tip, do not mix up addresses. Your 706 goes to Kansas City, your 706‑CE goes to the Estate and Gift unit in Florence.

How 706-CE fits into your Form 706 filing

Here is the simple flow that works.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call- Compute the foreign death tax credit on Schedule P, one country at a time. Multiple countries means multiple computations.

- Attach Form 706-CE for each country to support the credit shown on Form 706, Part II, line 13. The credit is not finally allowed until the foreign tax has been paid and evidenced by 706‑CE.

- Convert each foreign tax payment to U.S. dollars using the exchange rate in effect on the date you actually paid the foreign tax.

- Keep an eye on timing. There is a limitation period to claim the credit for taxes actually paid, generally the later of 4 years after filing the estate return, the expiration of any extended time to pay, or 60 days after a final Tax Court decision on a timely deficiency petition.

What to include on each Form 706-CE

You will complete identification details for the decedent and executor, then show the foreign government that imposed tax, the exact death tax amount in the foreign currency, and the dates and amounts actually paid. Do not include interest or penalties in the tax amount. Provide a clear description, location, and value of the taxed property as established by the foreign officials. The latest IRS form text reiterates these points right on the face of the form.

Certification path that avoids delays

- Prepare three copies per country. Keep one for your records.

- Send one to the foreign taxing authority to certify.

- Make sure the certified copy is sent to the IRS Estate and Gift unit in Florence, KY. If the foreign authority prefers to return the certified copy to you, forward it promptly to the IRS address shown below.

Where to mail in 2025

- Form 706 original return, United States Estate Tax: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999.

- Form 706-CE original or amended: Internal Revenue Service Center, Attn: E&G, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042‑2915.

If certification is refused, you still have a path

If the foreign authority refuses to certify, file the uncertified 706‑CE with a signed statement under penalties of perjury that explains the refusal, plus a copy of the foreign death tax return and proof of payment. The IRS accepts this package, and you must also notify the same IRS unit within 30 days if any part of that foreign tax is later refunded.

Heads up, late foreign refunds can create additional U.S. estate tax. The notice within 30 days is not optional.

Who this guide is for and how to use it

You might be a CPA leading an estate engagement, an estate partner juggling busy‑season reviews, or the in‑house tax manager at a law firm keeping executors calm. This guide uses plain language, cites current 2025 IRS sources, and gives you checklists you can hand to staff.

When you want a clean foreign death tax credit on Schedule P, order and documentation do most of the heavy lifting. Here is the workflow I use with teams so nothing slips.

Pre‑filing checklist

- Confirm the decedent’s status. Was the decedent a U.S. citizen or resident at death, and is the foreign tax a true death or inheritance tax, not income tax or VAT.

- Map the countries. List every country that assessed death or inheritance tax, then create a mini file for each one.

- Decide roles. Assign a preparer, a reviewer, and a point person for foreign authority follow up.

- Pull identifiers. Collect the decedent’s name, SSN, date of death, domicile and residence, and the executor’s contact details.

- Lock scope. Tie each country’s tax to the exact property taxed, so you can describe it clearly on the form.

- Calendar the critical dates. Your 706 filing timeline, expected foreign payment date, and any treaty documentation steps.

Prepare 706‑CE for each country, in triplicate

- Complete the identification section. Use consistent names and addresses, matching your Form 706.

- Enter the foreign taxing government, tax type, and the exact tax paid. Exclude interest and penalties.

- Show currency and payment details. List dates and amounts paid as shown on official receipts.

- Describe taxed property. Include a plain description, location, and value as determined by the foreign authority.

- Print three copies. One for your records, one to send for certification, and one that will be the certified copy kept with your U.S. file.

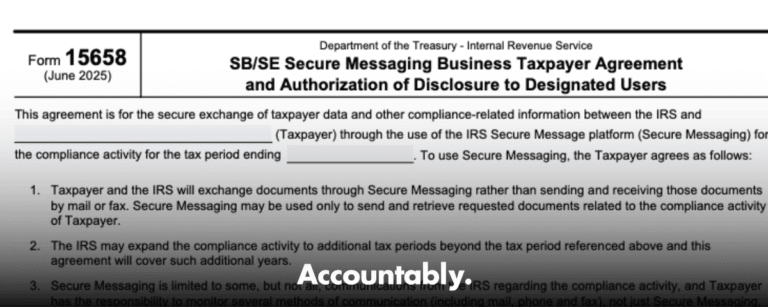

Send for certification, then track it like a deliverable

- Submit the certification copy to the foreign authority. Follow that authority’s stated process, which might include a cover letter, return envelope, or online request.

- Set a reminder for status checks every 10 to 14 days. Keep notes in the file so reviewers can see progress without pinging you.

- When the certified copy returns, scan it, label it consistently, and add it to your Form 706 support packet right away.

Attach to Form 706 and finalize Schedule P

- Complete Schedule P, one computation per country.

- Attach the matching certified 706‑CE for each country.

- Reconcile foreign taxes shown on Schedule P to the certified amounts, in U.S. dollars, using the exchange rate on the date you actually paid the tax.

- Add a one‑page reconciliation memo for your reviewer. This memo saves time, especially when multiple currencies are involved.

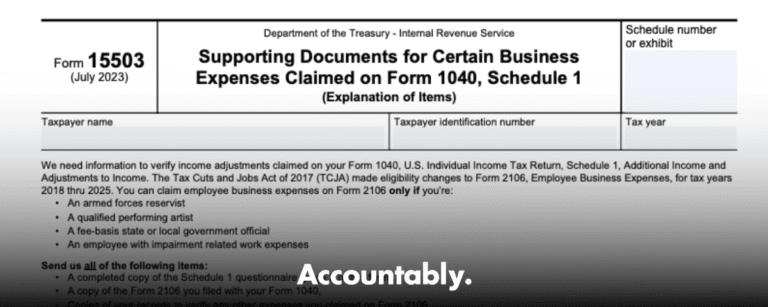

Information and documentation you must have on hand

Gather everything up front, then you can move fast without rework later.

| Data point | Why it matters | Good source |

| Decedent identity, SSN, date of death, domicile | Ties the foreign tax to your 706 facts | Death certificate, 706 draft |

| Executor name and contact | The legal filer of 706‑CE | Letters testamentary, engagement letter |

| Foreign authority’s name and tax type | Confirms this is a death or inheritance tax, not income tax | Foreign assessment or statute citation |

| Tax amount paid, exclude interest and penalties | Only the tax counts toward the credit | Official receipt, bank confirmation |

| Currency and payment date | Drives USD conversion and timing tests | Wire confirmation, bank statement |

| Description, situs, and value of taxed property | Links the foreign tax to the assets in the U.S. gross estate | Foreign valuation, assessment notice |

| Treaty documentation, if applicable | May change how you compute the credit | Treaty text, technical explanation |

| Proof of payment | Required if certification is refused | Receipt, canceled check, bank advice |

Quick reminder, do not include interest or penalties on 706‑CE, only the death or inheritance tax itself.

Currency conversion and valuation, the clean way

You convert the foreign tax to U.S. dollars using the exchange rate in effect on the date the foreign death tax was actually paid. I always freeze the source for that rate in the file. A simple approach is a daily rate from a reputable source, captured as a PDF and labeled with the payment date. If the foreign tax was paid in multiple installments, compute a separate conversion for each date, then add the results in USD. That one detail reduces review questions dramatically.

Property descriptions that pass review

Your property section should read like something a reviewer can approve on first pass. Use clear nouns, not internal codes. For example, write “apartment at 12 Example Street, Paris, held by the decedent individually” instead of “France RE 1.” If the foreign authority valued the property, mirror that value and state that the value is as determined by that authority. You are not trying to re‑appraise in this section, you are documenting what the foreign tax rested on.

Handling joint interests and trusts

If the foreign tax was assessed on joint property or trust interests, state the decedent’s proportionate interest and how the foreign authority treated it. If the foreign authority taxed a trust that is already included in the U.S. gross estate, note the connection. That one sentence helps your Schedule P tie out to your Form 706 asset schedule without extra calls or emails.

What‑How‑Wow summary

- What, Form 706‑CE is the certification you attach so the IRS allows a foreign death tax credit on Schedule P.

- How, prepare one per country, document the exact tax paid, exclude interest and penalties, get the foreign authority to certify, then attach to Form 706 with a clear USD conversion.

- Wow, most delays come from missing proof of payment, fuzzy property descriptions, or slow certification follow up. A simple tracker and a one‑page reconciliation memo often cut review time in half.

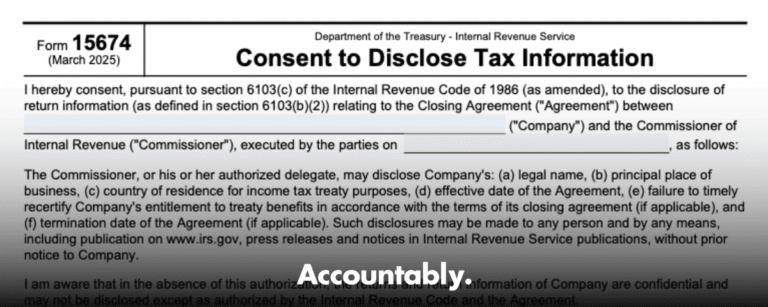

Treaties, combined credits, and edge cases

Estate tax treaties can change how your credit is computed and which country gets first crack at taxing a specific asset. When a treaty applies, read the technical explanation for allocation rules, credits, and tie‑breaker provisions. Then document your treaty position in a short memo and put that memo behind your Schedule P. This is not about writing a law review article, it is about leaving a clear trail for a future reviewer.

One property, two countries, one path

If the same property was taxed by two countries, start with the treaty, if any. If no treaty applies, you can still compute the statutory foreign death tax credit, but you must cap the credit under the Schedule P limitation rules. In practice, that means the allowable credit can be smaller than the tax paid. Spell that out in your reconciliation so the math does not surprise anyone.

Community property and marital transfers

Community regimes and forced heirship rules can create foreign tax on assets that the U.S. return treats differently. If a foreign jurisdiction taxed a portion of community property, explain that treatment in your memo, then mirror the foreign valuation in your 706‑CE property description. When the unlimited marital deduction applies on the U.S. return, you can still have foreign death tax paid. The credit computation may not fully offset it, so set expectations with beneficiaries and counsel early.

Handling adjustments, refunds, and amended filings

Three practical steps keep you compliant and calm.

- Build a refund watch. Note the foreign authority’s appeal or review period. If any refund, rebate, or reduction arrives later, you must notify the IRS promptly and pay any resulting increase in U.S. estate tax.

- Keep the payment trail. Save bank proofs, receipts, and any notices showing how the foreign authority changed the assessment.

- If you need to amend, mirror the original approach. Update the 706‑CE amounts, update Schedule P, and include a short cover explaining what changed and why.

If the foreign authority refuses to certify, you still file. Attach a signed statement, the foreign return, and proof of payment. Keep the tone factual and brief. You are giving the IRS what they need to allow the credit without the foreign stamp.

Common mistakes that stall credits

- Reporting interest and penalties as part of the tax. Only the tax qualifies.

- Vague property descriptions that do not match the assets in the U.S. gross estate.

- Missing currency sources or using the wrong date for conversion.

- Filing one 706‑CE for multiple countries. You need one per country.

- No proof of payment saved in the file. Screenshots disappear, keep a PDF with bank details.

- Waiting too long to chase certification. A simple two‑week cadence keeps this moving.

- Not updating the IRS when a foreign refund arrives. That can turn into correspondence you do not want.

Review protection, how I keep partners out of rework

I have had partners tell me the review took half as long once we started using two simple aids. First, the one‑page reconciliation memo that ties foreign tax paid, currency conversion, and Schedule P limits. Second, a short crosswalk that maps the foreign‑taxed property to the asset numbers on the 706 schedules. When reviewers can tie amounts in seconds, they stop circling the file and start signing it.

Timeline, milestones, and a simple tracker

A light tracker beats a long narrative. Use something like this to keep your team on schedule.

| Milestone | Owner | Target date | Status notes |

| Confirm U.S. citizenship or residency at death | Senior | Week 1 | Death certificate, counsel notes |

| List countries that assessed death or inheritance tax | Preparer | Week 1 | Add links to assessments |

| Draft 706‑CE for each country | Preparer | Week 2 | Triple check currency fields |

| Send 706‑CE for foreign certification | Coordinator | Week 2 | Add contact info and follow up dates |

| Post payment proofs and rate sources | Preparer | Week 3 | Save PDFs for each installment |

| Complete Schedule P computations | Senior | Week 3 | One per country, add memo |

| Attach certified 706‑CE copies to the 706 packet | Coordinator | Week 4 | Scan and label consistently |

| Final review and sign | Partner | Week 4 | Use crosswalk and reconciliation |

| File Form 706 and retain the full packet | Coordinator | Week 4 | Confirm tracking and receipt |

| Monitor for foreign refunds and changes | Coordinator | Ongoing | 30‑day notification rule |

Put this tracker in your workflow tool so everyone can see status without extra emails. Visibility lowers stress during crunch weeks.

Templates you can copy into your file

706‑CE reconciliation memo, one page

- Country and tax type.

- Amount paid in foreign currency, payment date, and exchange rate source.

- USD amount per payment, with math shown.

- Property taxed, short description that matches your 706 schedule.

- Schedule P limitation result and allowable credit.

- Notes on treaty treatment, if any.

- Statement that interest and penalties were excluded.

- Proofs attached, receipts and bank confirmations.

Property crosswalk, short and sweet

- Foreign description, “apartment at 12 Example Street, Paris.”

- U.S. 706 schedule and item number, “Schedule A, item 14.”

- Ownership detail, “held individually, 100 percent.”

- Foreign value and valuation date.

- Any adjustments or differences noted.

FAQs

Do I need a separate 706‑CE for each country

Yes. Prepare one 706‑CE per country that imposed a death or inheritance tax. This mirrors how Schedule P is computed, one country at a time, which keeps the math and documentation clean.

What if the foreign authority does not mail the certified copy to the IRS

You still attach a certified copy to your U.S. file. If they return the certification to you rather than mailing it directly, forward it promptly to the address in the current IRS instructions for 706‑CE. Keep proof of delivery in your file.

Which exchange rate should I use

Use the rate in effect on the date each foreign tax payment was made. If you paid in installments, convert each one by its own date, then add the USD results. Save a PDF of the rate source for your file.

Can I e‑file Form 706 or 706‑CE

Plan on paper filing for Form 706 and related attachments. Follow the current IRS instructions for signatures and assembly, and check for any updated guidance before you mail.

What if we get a partial refund from the foreign country months later

Notify the IRS promptly and pay any resulting increase in U.S. estate tax. Update your file with the refund notice and a short memo explaining the change.

Where Accountably helps, without taking over your file

For CPA and EA firms that want fewer late nights and fewer review loops, structure makes the difference. At Accountably, we do not toss resumes at you. We build a disciplined delivery lane for this exact work, with SOP‑driven prep, structured workpapers, and multi‑layer review that protects partner time. Our teams work in your systems and templates, follow your 706 calendars, and keep certification follow ups moving so Schedule P is ready when you are. Use us to scale capacity during peak season, keep quality consistent, and protect deadlines, while you stay in full control.

Finish strong

If you remember three things, remember these. Prepare one 706‑CE for each country, exclude interest and penalties, and keep tight proofs for payments and currency rates. Add a simple memo and crosswalk so reviewers can approve in minutes, not hours. With that, you claim the foreign death tax credit with confidence, reduce double taxation risk, and give beneficiaries a timely, accurate result.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk