Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

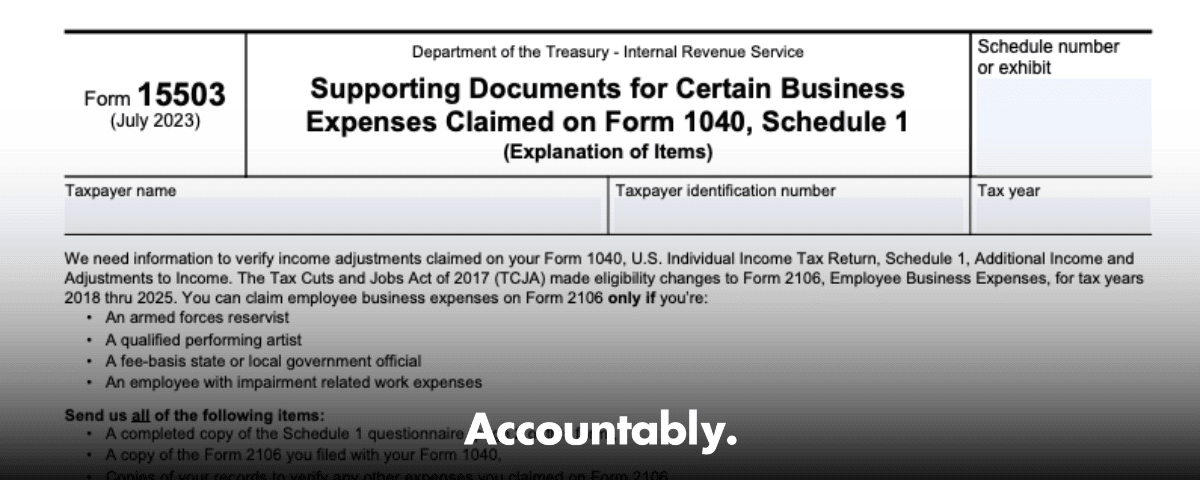

That is the heart of Form 15503. It is a correspondence exam tool the IRS uses to collect facts and documents, especially around employee business expenses that are only deductible for narrow groups under current law. Get the facts right, send a tidy file, and you shorten the back‑and‑forth.

Key Takeaways

- IRS Form 15503 is used to request and transmit supporting documents for certain business expenses reported on Form 1040, Schedule 1. It is not an identity verification form.

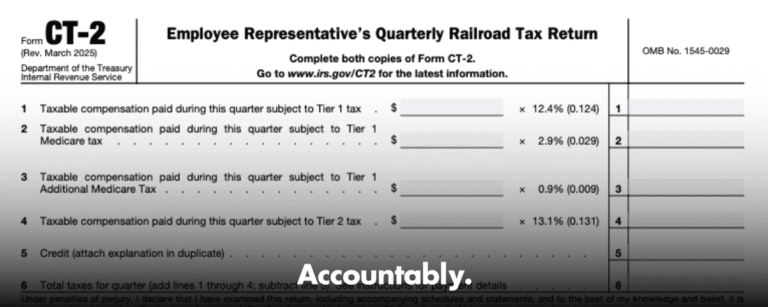

- Since the Tax Cuts and Jobs Act, most unreimbursed employee expenses are not deductible for 2018 through 2025, except for specific groups like Armed Forces reservists, qualified performing artists, fee‑basis state or local officials, and employees with impairment‑related work expenses. The 15503 wizard and IRS publications echo these limits.

- The IRS prefers clean, well‑labeled attachments. The online 15503 flow caps uploads at 10 files, 5 MB each, and points you to the Document Upload Tool if you need to send more. Keep scans readable, organized, and referenced.

- Your deadline is set by the notice that asked for 15503. Many correspondence notices expect a response within about 30 days. If you cannot meet the date, call the number on the letter and request time.

- If your letter is about identity verification, follow the identity verification instructions instead. Most people should not file Form 14039 when they are directed to verify online or by phone.

What Form 15503 Is, In Plain English

Form 15503, Supporting Documents for Certain Business Expenses Claimed on Form 1040, Schedule 1, is a guided web and PDF process the IRS uses to gather proof for adjustments you claimed. The wizard walks you through a short questionnaire, then asks you to upload supporting documents for eligible expense categories. The form exists so examiners can see what you claimed, match it to receipts and logs, and update your case file with a traceable, auditable package.

Why the IRS asks for it. Since 2018, most unreimbursed employee expenses have been suspended for individual filers, with a few exceptions. If you claimed business‑type employee expenses that fall into those exceptions, the IRS often wants documentation, for example mileage logs, travel records, and receipts that tie to your role. The 15503 flow and the related publications outline what proof to send.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Form 15503 is a document request for Schedule 1 adjustments, not an identity theft notice. It is about eligibility and evidence, and it lives inside the correspondence exam workflow.

What Form 15503 Is Not

Many taxpayers confuse any IRS letter with identity theft. That is understandable, given how stressful tax mail can feel. But Form 15503 is not the identity verification process. If your letter directs you to verify identity online or by phone, use the IRS Identity and Tax Return Verification Service. The IRS specifically tells most people not to file Form 14039 in that scenario.

If you truly suspect tax‑related identity theft and you did not receive a verification letter, follow the IRS Identity Theft guidance and consider Form 14039 only when the IRS instructs you or when you cannot use the online verification route. The IRS pages spell out those decision points clearly.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhen Form 15503 Shows Up

You will typically see 15503 after a correspondence examiner flags employee business expenses or other Schedule 1 adjustments that need proof. The letter tells you what year is in scope and what to send. The online 15503 wizard asks which IRS office sent your letter, then walks you through required fields and the upload step. If your packet exceeds the built‑in limits, the page points you to the IRS Document Upload Tool so you can finish the submission without mailing paper.

Correspondence exams run on timetables. Most notices expect a reply in about 30 days, with longer windows for some notices sent abroad. If you cannot make the date, call the number on the notice to request more time, then document who you spoke with and when. The IRS confirms that many notices follow the 30‑day rhythm, and CP2000 materials describe similar timelines.

How To Complete Form 15503, Step By Step

Think of 15503 as a short intake plus an exhibit binder. Your job is to answer every question accurately, then attach proof that is easy to review.

1) Gather the Letter, Return Copy, And Your Records

- The IRS letter that asked for 15503, with the notice or control number visible.

- A copy of your filed return for the tax year, plus Schedule 1 and Form 2106 if used.

- Records that prove each expense, for example receipts, mileage logs, employer reimbursement policy, per diem records, or impairment‑related work expense documentation. Publications 463 and 529 explain what to keep.

2) Work Through The Online Wizard Or PDF

- Pre‑screening questions. Confirm you received an IRS letter that requested 15503 and identify the IRS campus listed on the letter.

- Taxpayer information. Enter names, SSNs or ITINs, contact info, and the tax year.

- Schedule 1 questionnaire. Indicate the expense types you claimed and whether you have documentation.

- Attach files. Upload up to 10 files, each 5 MB or smaller. If you need to send more, submit 15503 with what you can, then use the Document Upload Tool link provided to finish.

Tip, name files so a reviewer can follow the story. For example, 2106_MileageLog_2024.pdf, 2106_Receipts_Travel_Q2Q4.pdf, 2106_EmployerPolicy.pdf. The IRS wants complete, organized, readable proof that directly matches your claim.

3) Review, Submit, And Save Confirmation

- Check totals and dates, fix typos, and confirm whole‑dollar amounts.

- Submit electronically and download the PDF for your records. Keep the confirmation page or email with your client file. If you must mail, include a copy of the notice and never send originals. The IRS repeats these points across its notice and CP2000 guidance.

What Documents To Include

Use this table as a starting point. Always align evidence to the exact expense you claimed.

| Expense Type (Form 2106 category) | What Reviewers Expect To See | Notes |

| Vehicle expenses | Contemporaneous mileage log, dates, purpose, odometer readings, standard mileage calculation or actual expense worksheet, proof of ownership or lease | Keep logs consistent with Publication 463 examples. |

| Travel | Receipts for transportation, lodging, meals, dates, business purpose, trip itinerary, employer reimbursement policy | Per diem rules have limits. Show how you computed amounts. |

| Tools and supplies | Receipts, proof of payment, explanations linking items to your work | Tie each item to your job duties, not personal use. |

| Protective clothing or equipment | Receipts, employer policy, notes on why items are not suitable for everyday wear | Connect to job requirements. |

| Home office for W‑2 employee (rare) | Only if your role qualifies under the limited exceptions, floor plan, exclusive and regular use notes, utility allocations | Most employees cannot deduct this for 2018 to 2025. |

| Impairment‑related work expenses | Medical documentation, receipts, explanation of necessity to perform work | These remain deductible when criteria are met. |

For any expense, include employer reimbursement policy pages. If an employer offered accountable plan reimbursements, unreimbursed amounts can be a red flag unless your role fits the allowed exception groups. Publication 463 and Publication 529 explain recordkeeping standards and who can deduct.

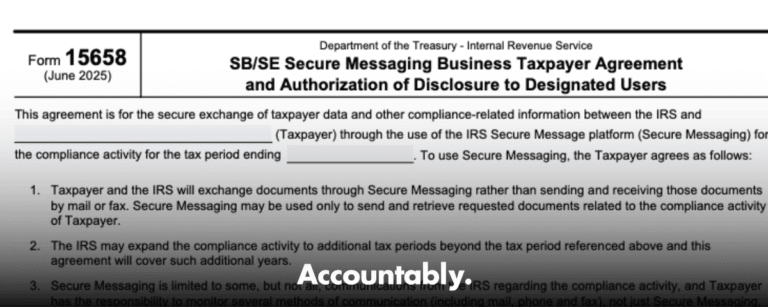

Using The IRS Document Upload Tool

When your packet exceeds the 15503 upload limits, the page directs you to the IRS Document Upload Tool. The DUT accepts scans and photos, gives you a confirmation page, and cuts out mail time. Use the access code or notice number printed on your letter, and keep that confirmation with your files. The IRS has expanded DUT for correspondence responses and describes how it works in public guidance and IRM sections.

Save the DUT confirmation. It is your proof of delivery, complete with a timestamp and the notice reference.

Deadlines, Appeals, And Interest

Always follow the deadline printed on your notice. Many correspondence notices expect a reply in about 30 days. If you miss it, the IRS can move the case forward and may issue a Statutory Notice of Deficiency, which carries a 90‑day Tax Court petition window. If you need more time, call the number on the notice and request an extension, then document the call.

If your notice is a CP2000, the IRS guidance is explicit. Send your response and documentation within 30 days to avoid escalation. If you disagree and miss the response date, watch for CP3219A and the 90‑day petition window. Interest continues to accrue on unpaid balances until assessed amounts are paid or abated.

Common Reasons You Receive Form 15503

- Employee business expenses claimed outside the narrow exception categories.

- Missing or weak records for vehicle mileage or travel.

- Claims that look duplicative with employer reimbursements.

- Totals that do not tie to Schedule 1 or that do not match your Form 2106 worksheet.

- Scans that are unreadable or unlabeled, which leads to requests for more information.

The IRS built the 15503 wizard to standardize what you send. It asks for the campus location from your letter, then walks you to the upload step so examiners can see a complete, traceable package.

How IRS Staff Work Your Submission

Correspondence exam teams process cases in order and rely on digitized case files. When you respond with a complete, organized packet, a phone assistor or examiner can review your exhibits in their system and move the case. The IRM confirms that staff view digitized documents and that the DUT is an accepted route for sending requested proof.

Expected timing. The IRS generally works on a first‑in, first‑out basis for correspondence. Many notices move on a roughly 30‑day communication cycle. If your response cannot be fully processed within that cycle, the IRS aims to send an interim reply. These timeframes appear across IRS correspondence policy and timeliness sections.

Real‑World Checklist You Can Follow Today

- Verify that your letter actually asks for Form 15503, not identity verification. If it is identity verification, use the IRS process in the letter and do not file Form 14039 unless instructed.

- Pull your filed return, Schedule 1, and Form 2106 if used.

- Map each claimed expense to at least one piece of proof, for example a receipt, log, or employer policy page. Publications 463 and 529 explain what counts as proof.

- Label every file so a stranger can follow your story. Use short, descriptive names.

- Keep scans readable, one orientation, and grouped by topic.

- Submit electronically, save the confirmation, and diarize a follow‑up 45 to 60 days later if you have not heard back. The IRS describes that DUT confirmation is available and that cases are worked in order.

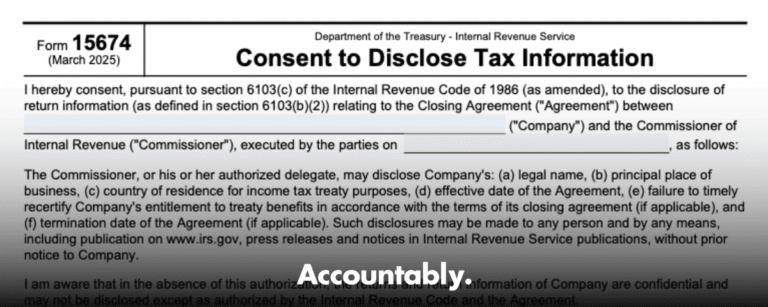

Privacy And Security When You Send Documents

You will upload sensitive personal information. Use the official IRS sites and tools referenced in your letter. The Document Upload Tool lives on IRS.gov and displays a privacy statement before you continue. It is designed for requested correspondence, not for filing original tax returns. The IRS reiterates this in its tool overview and training materials.

If you believe your identity has been compromised, use the IRS Identity Theft Central resources. They explain when to verify identity, when to file Form 14039, and when to request an IP PIN to protect your account.

For CPA, EA, And Firm Teams, How To Keep Reviews Fast

As a reviewer, your job is to cut the examiner’s questions in half. Here is a firm‑ready structure that works.

Reviewer Prep Folder

- 01_Notice, scanned copy of the IRS letter.

- 02_Return_Year, the filed 1040 plus Schedule 1 and 2106.

- 03_Expense_Summaries, one page per category with totals that tie to the return.

- 04_Exhibits, receipts and logs, labeled and grouped, for example Travel_Q2_Receipts.pdf, MileageLog_2024.pdf.

- 05_EmployerPolicy, accountable plan extracts if relevant.

- 06_Cover_Letter, short explanation referencing the notice number and exhibits.

Final Reviewer Checks

- Do totals tie to Schedule 1 and any 2106 worksheet.

- Are logs contemporaneous and complete.

- Are reimbursements excluded or explained.

- Are all files readable and properly named.

- Does the cover letter reference the notice number, tax year, and contact information.

A brief note about Accountably. Many firms ask us to help standardize this exact workflow. Where it adds value, our teams build SOPs, file naming standards, and layered reviews so preparers, seniors, and quality reviewers all handle their step without burying partners in rework. That structure reduces revision loops and speeds correspondence outcomes. Use a similar layered approach even if you run it in house.

FAQs About IRS Form 15503

What is IRS Form 15503 used for?

It is a guided form that helps you submit supporting documents for certain business expenses reported on Form 1040, Schedule 1. The IRS uses it in correspondence exams to review eligibility and evidence, especially for the limited unreimbursed employee expense categories still allowed through 2025.

Is Form 15503 an identity verification form?

No. Identity verification letters direct you to verify online or by phone. Most people should not file Form 14039 if the IRS has already sent an identity verification letter. Follow the instructions on that letter.

What if my files exceed the upload limits?

Submit up to 10 files within the 15503 wizard, then use the IRS Document Upload Tool link shown in the flow to send the rest. Save the confirmation page as proof of delivery.

What is my deadline to respond?

Deadlines are set by the letter. Many correspondence notices expect a response within about 30 days. If you cannot meet your date, call the number on the notice and ask for additional time.

What records prove mileage and travel?

Use a contemporaneous mileage log, receipts for transportation, lodging, and meals, and a short note that explains the business purpose. Publications 463 and 529 show what to keep.

Who can talk to the IRS for me?

You can, or you can authorize a representative by filing Form 2848. If you only want someone to receive information, use Form 8821. The IRS explains both options in detail.

Avoid The Most Common Pitfalls

- Submitting without the notice or control number.

- Totals that do not match your return or 2106 worksheet.

- Missing employer policy pages when reimbursements exist.

- Unreadable scans or mixed orientations that slow review.

- Sending originals by mail. The IRS repeatedly says not to do that.

Review everything once, then once again as a stranger would. If the story is obvious, your examiner’s job is easier and the case moves faster.

What To Do If You Disagree After You Respond

If you disagree with the next IRS letter, you usually have a fresh response window. For CP2000 flows, that is typically 30 days, and if the IRS later issues a Statutory Notice of Deficiency, you have 90 days to petition the Tax Court. Track every date, keep mail proofs, and keep your file organized.

For Firm Leaders, Make This Repeatable

- Build an SOP for 15503 responses.

- Standardize file naming, for example Notice_Year, Exhibits_Vehicle, Exhibits_Travel.

- Use a layered review, preparer to senior to quality, then ship.

- Keep a response log with notice numbers, dates, and confirmation receipts.

- Where helpful, bring in a disciplined delivery partner. Accountably integrates trained offshore teams into your existing workflow, uses your systems, and applies structured workpapers and SLAs so you can scale correspondence work without drowning reviewers. Use this only where it truly helps your clients and team.

Closing Thought

You do not need a heroic strategy for Form 15503. You need a clean story. Match each claimed expense to clear proof, label it well, and send it on time using the IRS tools the letter points to. If you stay organized, you protect your refund, reduce questions, and avoid unnecessary delays.

Sources And Further Reading

- IRS Form 15503 wizard and instructions.

- IRS Publication 463, Travel, Gift, and Car Expenses.

- IRS Publication 529, Miscellaneous Deductions.

- IRS Identity Theft Central and Identity and Tax Return Verification Service.

- IRS guidance on notice timelines, CP2000, and correspondence responses.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk