Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

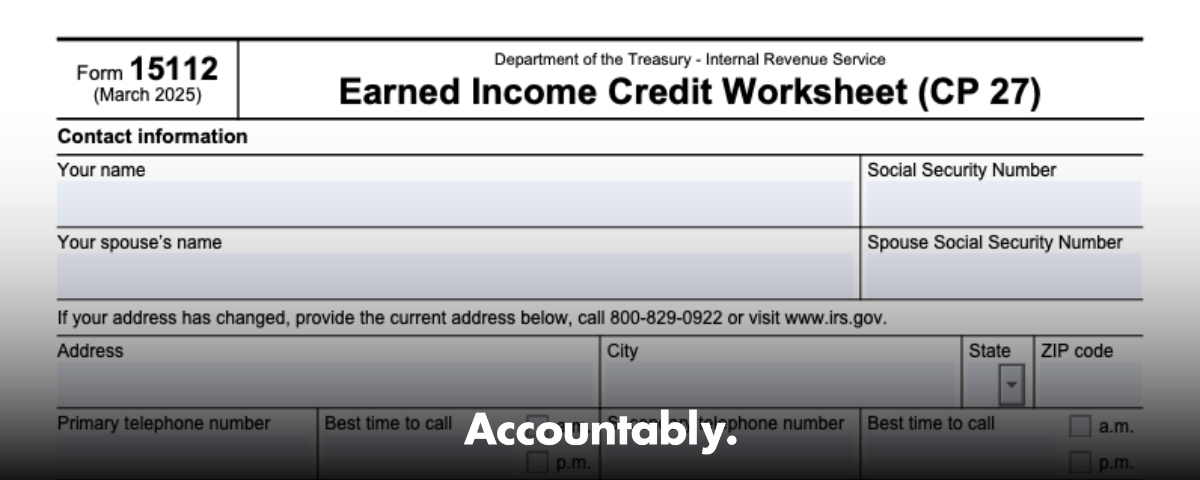

If you received a CP27, the IRS believes you may have qualified for the Earned Income Tax Credit but did not claim it on your filed return. Your next move is simple. Read the notice, complete Form 15112 carefully, sign it, and mail it to the address shown on your CP27. If you qualify and you do not owe other debts, the IRS says refunds generally arrive in about 6 to 8 weeks after they receive your signed form. If week eight comes and goes, call the IRS at 800‑829‑0922.

Key Takeaways

- Use Form 15112 only when you receive a CP27 saying you may have missed the Earned Income Credit, also called EITC or EIC.

- The latest Form 15112 is the Earned Income Credit Worksheet for CP27, last updated in March 2025. Check that your copy matches the current revision.

- Mail your signed form to the regional address printed at the top left of your worksheet, not a general IRS center. Use certified mail and keep a full copy.

- If the IRS approves your claim and no offsets apply, expect your refund in about 6 to 8 weeks. If you hear nothing after 8 weeks, call 800‑829‑0922.

- Not eligible after Step 1? Do not return the form. Review Publication 596 for EITC rules and plan for next year.

What CP27 Means And Why Form 15112 Matters

A CP27 is good news most of the time. It means the IRS flagged that you likely qualified for the Earned Income Credit but did not claim it. Inside the envelope, you will find instructions and Form 15112, which is the EIC eligibility worksheet for CP27. When you complete and sign Form 15112 and send it back, the IRS reviews your information and either issues a refund or sends a letter explaining why you do not qualify. The IRS page for CP27 confirms the mailing steps, the 6 to 8 week timeline, and the status phone number if you do not hear back.

What-How-Wow, In One Minute

- What: Form 15112 is the worksheet you use to confirm EITC eligibility after a CP27.

- How: Verify you are not disqualified in Step 1, enter exact names and SSNs, list any qualifying children, sign, and mail to the address printed on your worksheet.

- Wow: When completed correctly, many taxpayers receive money they legally earned, usually within about 6 to 8 weeks, without filing an amended return.

First Check, Then Act, So You Do Not Lose Time

Start by reading your CP27 end to end. The notice explains exactly why you were identified and how to complete the enclosed Form 15112. If the Step 1 disqualifiers apply to you, you should not return the form. If they do not apply and your SSNs are valid for work, complete and sign the form and send it to the specific regional address listed on the top left of the worksheet. That address routes your response to the right IRS team.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Tip from the trenches: match names and Social Security numbers to your most recent return, down to the middle initial. Small mismatches cause big delays.

Step 1 – Is The Gatekeeper, Treat It That Way

Form 15112 begins with four disqualifying statements. If any of these fit your situation, stop and do not send the form. In plain English, the big ones are: you were a dependent of someone else, you lived outside the United States for more than half the year, you filed a joint return when not allowed, or your Social Security card says Not Valid For Employment. For everyone else, continue with the worksheet. When in doubt about eligibility rules, cross check Publication 596, which the IRS updates each year and which sets the official EITC criteria.

Quick Table, Big Clarity

| Step | What You Do | Where To Look |

| Step 1 | Confirm none of the disqualifiers apply | CP27 and Form 15112 instructions |

| Child section | If claiming children, apply relationship, age, and residency tests | Publication 596, Qualifying Child rules |

| Signatures | Sign and date, both spouses if filing jointly | Form 15112 signature blocks |

| Mailing | Use the return envelope or the regional address at top left of the worksheet | CP27 page and your notice |

The IRS confirms the 6 to 8 week timeline after they receive your signed form, and they instruct you to call if 8 weeks pass without an update.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallEligibility, In Real Terms

You are on the right track if you lived in the United States for more than half the year, you have a valid SSN that is valid for work, you are not someone else’s dependent, and your income fits within EITC limits for the year in question. Publication 596 lays out the exact income limits and investment income cap for each year, including 2024 figures and annual updates. Use it to check child rules and the childless EITC rules if you have no qualifying children.

The IRS CP27 page links directly to Pub 596 and Pub 17. If you are unsure about a rule, open those first. They are the source of truth.

How To Complete Form 15112 Without Slowing Yourself Down

Accuracy beats speed here. Pull your filed return so the names and SSNs on Form 15112 match exactly. If you changed your address after filing that return, update the IRS first or include the current address clearly. Then fill the header fields on Form 15112, complete the Step 1 gatekeeper questions, and enter qualifying child details only if the child meets relationship, age, and residency tests. The current revision of Form 15112 is dated March 2025, so verify your form matches this revision to avoid a back‑and‑forth.

Header Fields Checklist

- Primary filer’s full legal name and SSN, exactly as on your latest return.

- Current mailing address with ZIP.

- Daytime phone that you actually answer.

- If filing jointly, spouse’s name and SSN copied exactly. Both spouses must sign.

Bold move that pays: mail the packet with certified tracking and keep a complete copy. If you ever need to call, you will have everything in front of you.

Qualifying Child Rules, Simplified

A child qualifies only if all four are true, and the child has a valid SSN for the return year by the due date.

- Relationship: your child, stepchild, foster child, sibling, step‑sibling, half‑sibling, or a descendant of any of these.

- Age: under 19 at year end, under 24 if a full time student for at least five months, or any age if permanently and totally disabled.

- Residency: lived with you in the United States for more than half the year, with special rules for temporary absences and active duty.

- Exclusivity: only one person can claim a child for EITC, so tie‑breaker rules apply.

Where And How To Mail It

Mail Form 15112 in the return envelope that came with your CP27 or to the regional address printed at the top left of your worksheet. Do not send it to a generic processing center. If the envelope is missing, use the address on your CP27. If you cannot find it, call the number on your notice or 800‑829‑0922 to confirm. The IRS page for CP27 repeats these steps clearly.

Timing, Plain And Simple

| Event | What Happens | Typical Timing |

| You receive CP27 | You complete and sign Form 15112 | Same day is ideal |

| IRS receives your form | Eligibility review begins | Clock starts on receipt |

| Approved, no offsets | Refund is issued | About 6 to 8 weeks |

| Not eligible | IRS mails an explanation | Varies |

| No update by week 8 | You call 800‑829‑0922 | Week 8 and after |

The IRS Internal Revenue Manual also guides phone agents on what to do once 8 weeks have passed since a CP27 response, which is why the week eight follow up matters.

Common Mistakes That Trigger Delays

- SSNs that do not match the filed return, or using an ITIN for EITC.

- Missing one spouse’s signature on a joint response.

- Checking a Step 1 disqualifier by mistake, especially the dependency question.

- Mailing to the wrong address or skipping certified tracking.

- Claiming a child who fails the residency test, the age test, or does not have a valid SSN by the due date. Publications 596 and 17 are your backstop for these rules.

If 8 weeks pass after the IRS receives your signed form and you have no letter or refund, call the IRS. Do not wait and hope. The CP27 page gives you the correct number.

Smart Prep Now, So Next Year Is Easy

Good EITC records reduce stress. Keep SSN cards handy for you, your spouse, and every child you may claim. Save school, medical, or lease records that show where the child lived and when. Track changes in marital status, residency, and income during the year. Before filing next season, update yourself on income limits and the investment income cap in Publication 596 for the right tax year. Those numbers change, and the publication is the official source.

Quick Prep List For Next Season

- Keep copies of W‑2s, 1099s, and proof of earned income.

- Keep proof of your child’s residency, such as school or medical records.

- Review the latest EITC limits and rules in Pub 596 before filing.

- If you get CP27 again, respond quickly with a signed Form 15112.

What The IRS Will Do After You Mail

Once the IRS receives a correctly completed, signed Form 15112, they review your EITC eligibility against their records. If you qualify and do not owe other federal debts, they issue the refund, usually within 6 to 8 weeks. If they deny your claim, they send a letter explaining the reason. If you hear nothing after 8 weeks, the IRS instructs you to call. This is spelled out on the CP27 page.

The IRS processing page and Internal Revenue Manual show why some cases take longer, especially when offsets or identity checks are involved. If your case is still open after eight weeks, call.

FAQs

What is IRS Form 15112 used for?

Form 15112 is the Earned Income Credit Worksheet the IRS includes with CP27. You use it to confirm that you qualify for EITC for the year tied to the notice, then you sign and mail it to the regional address shown on the form. If you qualify and have no offsets, refunds typically arrive in 6 to 8 weeks from IRS receipt.

Who should not return Form 15112?

Do not send Form 15112 if any Step 1 disqualifier applies or if the SSN on your card is not valid for work. Also do not send it if you are someone else’s dependent. Use Publication 596 to confirm the rules for your situation.

I lost the return envelope. Where do I mail the form?

Mail it to the regional address printed at the top left of the worksheet or the address listed on your CP27. If you cannot locate it, call the number on the notice or 800‑829‑0922 for the correct address.

How long will my refund take?

The IRS says about 6 to 8 weeks from the date they receive your signed form, as long as you do not owe other debts. If you hear nothing after 8 weeks, call the IRS.

Where can I read the official EITC rules?

Start with Publication 596 for the year in question. It covers income limits, qualifying child rules, and the investment income cap.

Do I need to file an amended return to get the EITC from CP27?

No. CP27 with Form 15112 is designed so the IRS can compute and issue the EITC based on your verified answers. If you need to correct your original return for other reasons, that is a separate decision.

A Note For Firms Handling Many CP27 Responses

If you run a CPA, EA, or accounting firm, you already know the operational trap here. CP27 workflows look small, but the review loops, signature capture, and mailing control can overwhelm peak season if you do not have clear SOPs. At Accountably, our role is to help firms add disciplined capacity without adding chaos, which means standardized workpapers, named files, and predictable review steps inside your systems. Use us when you need production stability and quality control at scale. Keep us out when you do not. That balance protects your deadlines and your brand.

Step‑By‑Step Walkthrough You Can Follow Today

- Confirm the notice and the year

- Open CP27 and make sure it is for the tax year you filed.

- Pull the return you filed for that year so names and SSNs match exactly.

- Verify the form revision

- Check the bottom corner for the revision date. The latest Form 15112 shows March 2025. If your copy is older, use the one that came with your notice.

- Run the Step 1 gatekeeper

- Read each disqualifier slowly. If any apply, stop and do not send the form. Review Publication 596 for details.

- Qualifying children, if any

- Enter details only if the child meets relationship, age, and residency tests and has a valid SSN. If there is any doubt, check Pub 596.

- Signatures and dates

- Sign in ink. If you file jointly, both spouses must sign and date. Missing signatures stop processing.

- Mail with tracking

- Use the provided return envelope or the regional address printed at the top left of your worksheet. Mail with certified tracking and keep a copy.

- Calendar your follow up

- Add a reminder for 8 weeks from the day the IRS receives your form. If you do not hear back, call 800‑829‑0922.

What If There Is An Offset Or Delay

Sometimes refunds are delayed or reduced because of other balances the IRS must collect. If this happens, the IRS will send you a notice explaining what they did and why. Processing guidance and timing in IRS manuals show why some cases take longer than the standard window, which is why week‑eight follow up is smart.

Troubleshooting And Edge Cases

- Your SSN card says Not Valid For Employment You cannot use Form 15112 for EITC until the Social Security Administration replaces your card with one valid for work. See Publication 596 for rules that apply to your case.

- You moved after filing Consider filing Form 8822 to update your address, then make sure the address on Form 15112 is current so the refund or letter reaches you. For CP27 submissions, always mail to the address shown on the worksheet.

- No qualifying children You may still qualify for the childless EITC if you meet age, residency, income, and SSN rules. Confirm details in Publication 596.

- You are at week 9 with no update Call the IRS at 800‑829‑0922 and have your copy handy. Agents follow specific steps for CP27 follow up after eight weeks.

Compliance Notes And Sources

- The IRS CP27 page is the definitive guide for what the notice means, what you should do, where to mail, the 6 to 8 week timing, and the status phone number. It was last reviewed on September 18, 2025.

- Form 15112, Earned Income Credit Worksheet for CP27, shows a March 2025 revision on IRS.gov. Always check that your version matches the latest.

- Publication 596 is the official EITC rulebook. Use the version for the year tied to your notice.

Disclaimer: EITC amounts, income thresholds, and processing timeframes change. Always confirm details on IRS.gov for the tax year on your notice.

Final Checklist Before You Mail

- Names and SSNs match your filed return.

- Step 1 shows no disqualifiers.

- Qualifying child rules checked in Pub 596.

- Both signatures present if filing jointly.

- Copies made and stored.

- Certified mail tracking number saved.

- Calendar set for week eight follow up at 800‑829‑0922.

If You Need Human Help

- Call the IRS at 800‑829‑0922, or the number printed on your CP27, for status and mailing questions.

- Use VITA or TCE if you qualify for free tax help, and consider the Taxpayer Advocate Service if your case stalls and you face hardship.

- Firms with seasonal CP27 volume can standardize prep, signatures, and mailing with clear SOPs and documented checklists. If you need disciplined offshore execution that runs inside your systems with quality control and continuity, Accountably can help you build it without losing review control.

You earned the credit. With a careful Form 15112 and a stamped envelope, you can get it paid.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk