Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

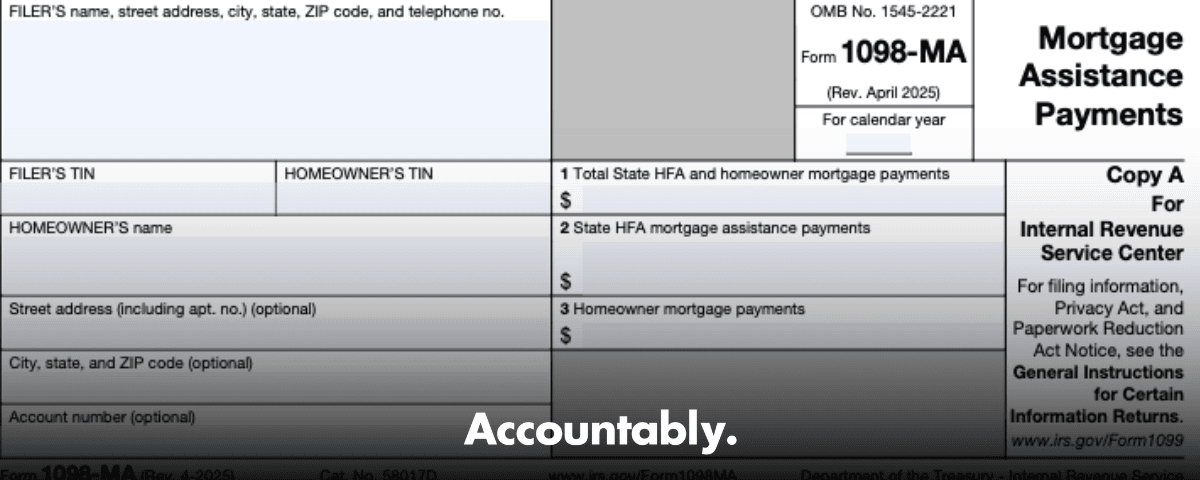

” You might have had the same thought. Here is the calm, step‑by‑step answer. Form 1098‑MA tells you about mortgage help that was paid on your behalf. You do not file it with your return, and those assistance payments are not taxable income. You keep it to make sure your mortgage interest deduction is accurate and not inflated.

Key takeaways

- You receive Form 1098‑MA when a state housing finance agency reports assistance paid on your mortgage, often under the Hardest Hit Fund, and it is mainly for your records. Do not attach it to your tax return.

- Assistance listed on 1098‑MA is not taxable income. Keep the form with your files to support your mortgage interest deduction.

- Boxes matter. Box 1 is the total sent to your lender, Box 2 is program‑paid assistance, Box 3 is what you personally paid through the program.

- When you figure deductions, Form 1098 from your lender sets the ceiling. Under the IRS safe harbor, your deduction cannot exceed Form 1098 Box 1 for mortgage interest, plus any deductible MIP in Box 5, plus real estate taxes reported in Box 10.

- Timing note, as of October 28, 2025. The IRS shows the current 1098‑MA as a Rev. April 2025 accessible PDF and lists “Recent developments, none.” Use the current form and rules.

Keep 1098‑MA with your tax records. It protects you from double‑counting interest that was actually paid with assistance.

What 1098‑MA is, why you received it, and when

- What it is: An information statement from a state housing finance agency reporting both assistance they sent to your lender and any payments you made through the program.

- Why you received it: You took part in an eligible state HFA program, commonly the Hardest Hit Fund.

- When it arrives: Agencies furnish Copy B to homeowners by January 31 of the year after payments were made. They also report to the IRS. This timing rule is rooted in the IRS reporting framework that covers 1098‑series statements, including specific guidance for 1098‑MA.

What you should do first

- Put 1098‑MA next to your lender’s Form 1098. You will use both.

- Confirm Box 1 on 1098‑MA equals the total that reached the lender via the program, combining agency help and your payments.

- Note Box 2, agency assistance, and Box 3, your payments. These will help you avoid taking a deduction for amounts you did not personally pay, unless you qualify for the safe harbor.

- If amounts look off, ask the issuing HFA for a corrected statement before you file.

The IRS safe harbor, in plain English

The IRS gives you an optional safe harbor for main‑home deductions if you were in a qualifying Hardest Hit Fund program that could pay interest, and if you otherwise qualify to deduct all your mortgage interest, all real estate taxes, and, where allowed, mortgage insurance premiums. If you meet both conditions, you may treat what you actually paid during the year, including amounts you sent to the HFA, as deductible, but never more than the total shown on your Form 1098 for interest in Box 1, plus any deductible MIP in Box 5, plus real estate taxes reported in Box 10. The IRS has used “safe harbor” in current materials and “special method” in earlier notices.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Why this matters for your tax return

If a program paid some or all of your mortgage, you could accidentally overstate your deduction by claiming interest you did not pay. 1098‑MA prevents that. It also confirms when you can use the safe harbor to include your own payments made through the HFA, within the cap set by your regular Form 1098. Assistance itself is excluded from income under long‑standing IRS guidance.

- About Form 1098‑MA shows “Recent developments, none” and a page update on January 29, 2025. The accessible PDF is Rev. April 2025.

- The safe‑harbor cap language appears on the 2025 form itself.

- Earlier IRS notices created and extended the approach often called the “special method,” now reflected as a safe harbor.

Tax disclosure: This guide is for general education, not tax advice. For your exact facts, talk with a qualified tax professional.

What 1098‑MA reports, box by box

The three boxes that drive your calculation

- Box 1, total payments to your lender, combines agency assistance and your payments made through the program. It does not split principal, interest, taxes, or insurance.

- Box 2, agency assistance only, shows what the HFA paid on your behalf. You do not deduct these amounts under the regular rules.

- Box 3, your payments to the HFA, shows what you personally paid into the program. Under the safe harbor, these amounts can count toward your deduction, subject to the Form 1098 cap.

Quick reference table

| Item on 1098‑MA | What it means | How you use it |

| Box 1: Total State HFA and homeowner mortgage payments | Combined amount sent to your servicer | Starting context, not a deduction by itself |

| Box 2: State HFA assistance | Program‑paid dollars | Reduce what you deduct unless the safe harbor applies |

| Box 3: Homeowner payments | What you paid to the HFA | Can be included under the safe harbor, within the cap |

Tip, keep your monthly servicer statements and escrow summaries. You will need them to separate interest, principal, taxes, and insurance when you reconcile to Form 1098.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallHow 1098‑MA interacts with your lender’s Form 1098

Think of Form 1098 as the ceiling. It shows mortgage interest in Box 1, mortgage insurance premiums in Box 5 when applicable, and “other” items such as real estate taxes in Box 10. Under the IRS safe harbor, your total deduction for interest, eligible MIP, and real estate taxes cannot be more than those amounts, even if you made payments through the HFA.

- Form 1098 Box 1 caps interest you can claim.

- Form 1098 Box 5 may add deductible MIP, if Congress has extended it for the year in question.

- Form 1098 Box 10 covers “other” reportables, often real estate taxes the servicer paid from escrow.

If the HFA paid the interest and you did not use the safe harbor, you generally cannot deduct that interest because you did not pay it. The safe harbor is what allows certain homeowner payments through the HFA to be treated as if you paid them directly, still within the 1098 cap.

The safe harbor versus the regular method

- Regular method, you deduct only what you personally paid and that meets the normal rules. Assistance reduces what you can claim. Your total still cannot exceed the applicable Form 1098 amounts.

- Safe harbor, if you were in a qualifying Hardest Hit Fund program that could pay interest, and you otherwise qualify to deduct all interest and real estate taxes on your main home, then you can deduct the sum of what you actually paid during the year to the servicer or the HFA, subject to the 1098 cap.

Older IRS notices called this the “special method” and extended it through the Hardest Hit Fund years, including coordination with the state and local tax cap. Today, the 2025 form itself describes the safe‑harbor computation you can use.

SALT cap interaction, the “why” behind the safe harbor

The IRS created and later expanded the safe harbor so eligible HHF participants would not lose deductions just because payments flowed through a program. It coordinates with limits that apply elsewhere, like the state and local tax cap under section 164. Translation, the safe harbor is designed to be fair but not to inflate deductions above what Form 1098 supports.

Who issues 1098‑MA and how it is filed

State housing finance agencies and certain program administrators furnish Copy B to homeowners and provide information to the IRS. The IRS guidance for 1098‑MA sets the furnish‑by date as January 31 for homeowners and provides IRS filing logistics for program filers. Keep Copy B for your records.

Current status check. The IRS “About Form 1098‑MA” page shows no new developments as of January 29, 2025, and the accessible PDF is a Rev. April 2025 version. Keep using the current instructions.

Eligibility, in two clear tests

You can use the IRS safe harbor only if both are true:

- You were in a qualifying Hardest Hit Fund program where program dollars could pay mortgage interest on your main home.

- You otherwise qualify to deduct all of your home mortgage interest and all of your real estate taxes on your main home under the regular rules. If MIP is deductible for that year, it factors in as well.

A note on older programs, the IRS also issued guidance for the HUD Emergency Homeowners’ Loan Program and similar state programs, including exclusion of assistance from income and a safe‑harbor style deduction method for past years. If you are reconciling older tax years, that history may matter. For current filings, rely on the safe‑harbor language built into the 2025 1098‑MA and check a pro if you had EHLP‑era payments.

Regular method vs. safe harbor, side by side

| Method | When it applies | What you can deduct | Important limit |

| Regular | You choose not to use safe harbor or you do not meet both tests | Only amounts you personally paid that meet normal rules | Cannot exceed relevant amounts on Form 1098 |

| Safe harbor | You meet both tests above | Total you actually paid to the servicer or HFA, including Box 3, for interest, eligible MIP, and real estate taxes | Cannot exceed 1098 Box 1 + any deductible Box 5 + Box 10 |

A worked example you can copy

Assume your lender’s Form 1098 shows:

- Box 1, mortgage interest received: 7,800

- Box 5, MIP, assume not deductible for the year, so treat as 0

- Box 10, real estate taxes paid from escrow: 3,000

Your 1098‑MA shows:

- Box 2, State HFA assistance: 6,000

- Box 3, your payments to the HFA: 3,200

Your own records show that, of the 3,200 you paid to the HFA, 2,900 was applied to interest and 300 to escrowed taxes.

- Regular method, you deduct what you paid, so up to 2,900 interest and, if eligible under your state and local tax limit, the 300 of real estate taxes. You cannot claim the 6,000 of program‑paid interest. Your total must still sit within the Form 1098 amounts.

- Safe harbor, if you qualify, you may deduct the total you actually paid to the servicer or HFA for the year, up to the cap. Here, your paid amount for interest and taxes is 3,200. The cap is 7,800 + 0 + 3,000 = 10,800, so 3,200 is fully within the cap. You still cannot claim program‑paid amounts above what you personally paid.

Do not force the numbers. The cap always wins, and assistance is still not income. The safe harbor simply allows qualifying homeowners to count their own payments made through the HFA.

Common errors to avoid

- Swapping Boxes 2 and 3. Box 2 is assistance, Box 3 is your cash. Get those wrong and you overstate your deduction.

- Ignoring the cap. Even under the safe harbor, you cannot deduct more than 1098 Box 1, plus any deductible MIP in Box 5, plus real estate taxes reported in Box 10.

- Treating assistance as taxable income. IRS guidance excludes these payments from income.

- Forgetting SALT rules. Real estate taxes still interact with your state and local tax limit. The safe harbor does not override those limits.

Step‑by‑step, how to use 1098‑MA in tax prep

- Gather documents, your lender’s Form 1098, 1098‑MA, monthly statements, escrow summaries, and any HFA correspondence.

- Reconcile totals, confirm 1098‑MA Box 1 matches what reached the servicer through the program, then separate assistance in Box 2 and your payments in Box 3.

- Decide your method, if you meet both safe‑harbor tests, consider using it, otherwise use the regular method.

- Apply the cap, never exceed Form 1098 Box 1 for interest, plus any deductible Box 5 MIP, plus Box 10 for real estate taxes.

- Document everything, keep statements that show how much of your payments were interest versus taxes. This is what makes you audit‑ready.

What to do if numbers look wrong

- Ask the issuer for a corrected 1098‑MA and keep the email trail or letter. Correct early, not after you file.

- If your lender’s Form 1098 looks off, contact the servicer. Remember, mortgage interest statements follow their own IRS instruction set and can include notes about third‑party or governmental program payments.

Recordkeeping checklist

- Keep 1098‑MA together with your lender’s 1098, escrow summaries, and bank proofs for at least three years.

- Save both paper and encrypted PDF copies, and label files by tax year, property address, and issuing agency.

- If you receive a corrected copy, replace the original and archive the correction notice.

Deadlines and logistics you should know

- Homeowner copies, due to be furnished by January 31 for the prior year’s payments.

- Program filers, the IRS has specific filing logistics for 1098‑MA, and the form itself is available as a Rev. April 2025 accessible PDF.

- “Recent developments” check, the IRS page for 1098‑MA shows none at this time as of January 29, 2025.

Quick decisions for CPAs and controllers

- Use 1098‑MA as a control document to prevent double‑counting.

- Build a simple workpaper that bridges 1098‑MA Boxes 1–3 to Form 1098 Boxes 1, 5, and 10.

- For historical EHLP cases, consult prior‑year IRS notices if you are amending old returns.

For firms that manage spikes in 1098‑MA season

If your team handles many homeowner files at once, discipline wins. Standardize workpapers, name files consistently, and institute a second‑person check on the 1098‑MA to 1098 reconciliation. That is exactly the kind of operational control Accountably helps U.S. firms put in place, with SOP‑driven execution and layered review so partners spend less time untangling documentation and more time advising clients. Use this only if it serves your workflow, not as a sales shortcut.

FAQs

What is Form 1098‑MA, in one sentence?

It is an information statement, not a form you file, that reports state HFA assistance paid on your mortgage and any payments you made through the program, so you can compute a correct deduction without counting assistance you did not pay.

Is the assistance taxable?

No. IRS guidance excludes these payments from income. Keep the form for your records and focus on properly limiting your mortgage interest and related deductions.

When do I get it?

Agencies furnish homeowner copies by January 31 for the prior calendar year. If it has not arrived by early February, contact the issuer and confirm your address or email on file.

How do I know whether to use the safe harbor?

Check two things, that your HHF program could pay interest and that you otherwise qualify to deduct all mortgage interest and real estate taxes on your main home. If yes, you can use the safe harbor, but your total still cannot exceed the amounts shown on your Form 1098.

What exactly is the cap under the safe harbor?

Form 1098 sets it, the sum of Box 1 mortgage interest, plus any deductible MIP in Box 5, plus real estate taxes reported in Box 10. Your deduction under the safe harbor cannot exceed that total.

Do EHLP payments get the same basic tax treatment?

Earlier IRS notices addressed EHLP and substantially similar programs, confirming assistance is not income and providing a safe‑harbor type method for those years. If you are fixing older filings that involved EHLP, consult those notices or a pro.

A quick homeowner checklist

- I have both forms in front of me, 1098‑MA and my lender’s 1098.

- I matched 1098‑MA Boxes 1–3 to my statements, and I know what I personally paid.

- I chose regular or safe harbor and applied the Form 1098 cap correctly.

- I kept all records and, if needed, requested corrections before filing.

Sources and freshness

- IRS “About Form 1098‑MA,” page last reviewed or updated January 29, 2025, lists “Recent developments, none.”

- Form 1098‑MA, Rev. April 2025 accessible PDF, includes homeowner instructions and the safe‑harbor cap language.

- Instructions for Form 1098 discuss treatment of program payments and point to the 1098‑MA framework.

- IRS notices establish exclusion from income and the safe‑harbor approach for HHF and related programs.

Final word and next step

You can do this. Put 1098‑MA beside your lender’s 1098, pick the right method, and apply the cap with confidence. If you run a firm and need airtight workpapers for dozens or hundreds of these files, standardize your reconciliation and review process. That is where a disciplined offshore delivery model, the kind Accountably sets up for U.S. CPA and EA firms, can help maintain quality without burning out your team.

Tax disclosure: Information here is educational, not advice for your exact situation. Rules can change. This article reflects IRS pages reviewed as of October 28, 2025.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk